In this report, we review a small cap company that specializes in providing semiconductor and software solutions for Advanced Driver Assistance Systems (ADAS), including light detection and ranging (LiDAR), connected cars, user experience, and electrification applications. The company's technologies serve as the foundational elements for both electric and autonomous vehicles, with a focus on enhancing in-cabin experiences and seamless connectivity to mobile platforms. In this report, we analyze the company’s business model, its market opportunity, financials, valuation, risks, and then finally conclude with our opinion on whether investing offers an attractive balance between risks and rewards.

Key Takeaways:

Cutting-edge product portfolio within a market with significant entry barriers.

Large secular growth automotive semiconductor market.

Solid top-line growth on the back of growing backlog and sustained improvement in profitability.

Attractive investment opportunity considering robust revenue growth, expanding backlog, promising industry prospects and notable competitive advantages.

View a PDF copy of this report here.

Overview: Indie Semiconductor (INDI):

indie was founded in 2007 by Donald McClymont, Ichiro Aoki, Scott Kee, and David Kang, with the goal to extend the advantages of custom design to microcontrollers, mixed-signal SoC, and software users. Today, it ranks among the fastest-growing semiconductor companies, focused on developing advanced silicon solutions for evolving vehicle designs.

In modern automobiles, semiconductors play a crucial role, handling various functions like sensing, data processing, information storage, and control across multiple electronic components. Semiconductor architectures vary based on their specific functions, integration level, customization, programmability, and manufacturing process technology. Recent technological advancements have significantly enhanced semiconductor features, functionality, and performance, leading to improved user interfaces, reduced power consumption, smaller footprints, and lower costs. This innovation has opened up substantial growth opportunities across diverse end markets and applications.

indie’s technological expertise, state-of-the-art design capabilities and strong customer relationships has facilitated the cumulative shipments of over 200M semiconductor chips since its inception. Its products consistently meet or exceed the stringent quality standards of over 25 global automotive manufacturers currently utilizing its devices. indie is headquartered in Aliso Viejo, California and has design and application centers across North and South America, the Middle East, Asia, and Europe.

Cutting-Edge Product Portfolio within a Market with Significant Entry Barriers

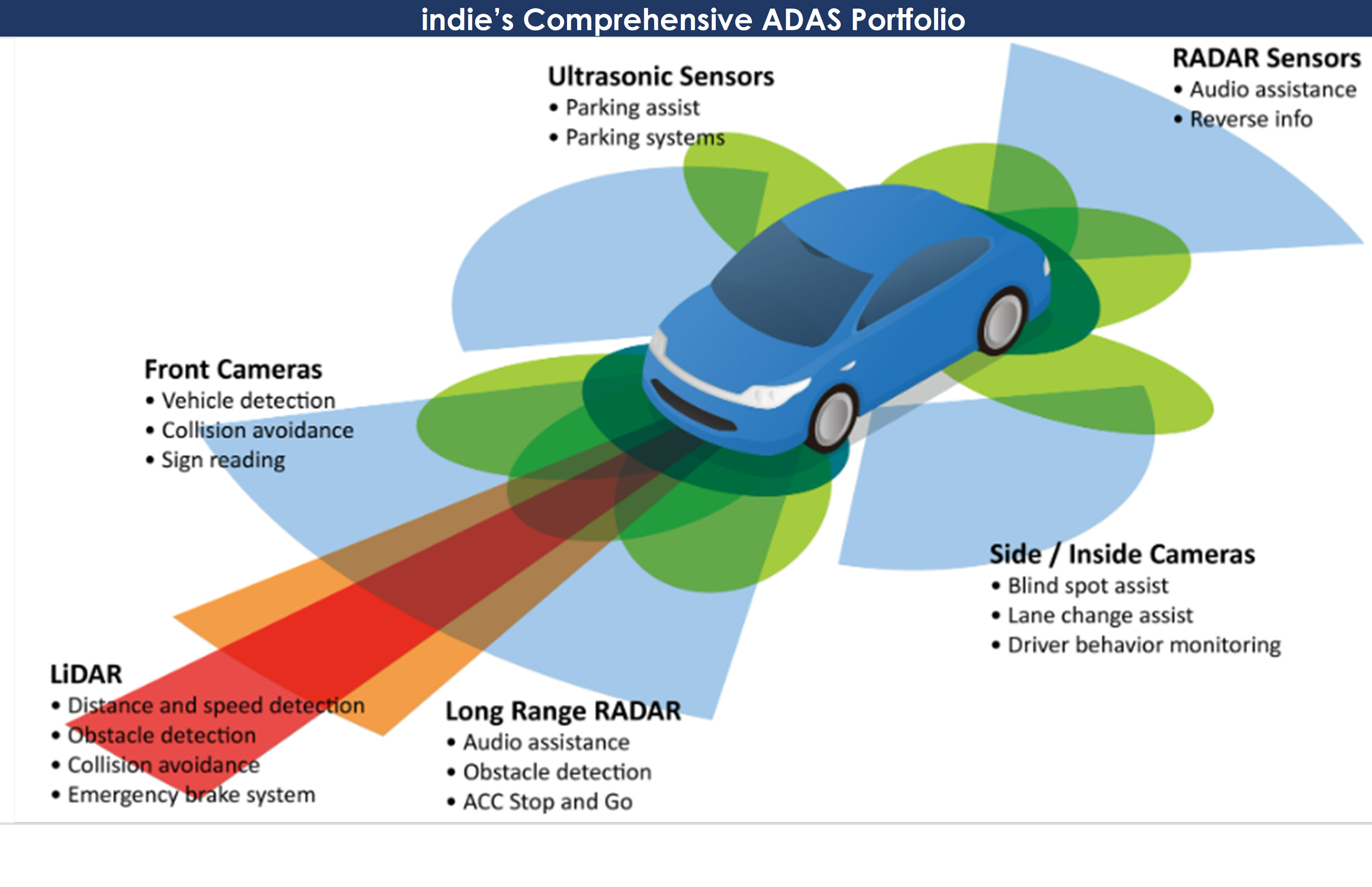

The current product spectrum of indie encompasses a diverse array of automotive devices, addressing various applications critical to the automotive industry. These include ultrasound solutions designed for parking assistance, in-cabin wireless charging, USB power delivery, seamless device interfacing through Apple CarPlay and Android Auto, and advanced LED lighting controllers catering to both interior and exterior applications. Furthermore, the company is actively engaged in the development of innovative products, including LiDAR, radar, and vision solutions specifically tailored for Advanced Driver Assistance Systems (ADAS). It is also working on charging controllers tailored for electric vehicles, innovative smart car access solutions, and cybersecurity microcontrollers.

Within the ADAS portfolio, indie is strategically positioned to offer comprehensive system-level solutions, intending to support all key sensor modalities. This strategic positioning underscores the company's dedication to providing holistic solutions that meet the evolving needs of the automotive market.

Source: Company 10-K

Navigating the auto-tech supply business can be a challenging journey characterized by prolonged project timelines, rigorous testing processes, and multiple iterations before product launch. The extended time to market, often spanning 5-7 years, poses a significant barrier to entry. indie's ability to meet these stringent quality standards serves as a testament to its strength and sustainability in the market. The company's product wins result in sustainable recurring revenues, employing a land and expand strategy akin to Software as a Service (SaaS), where customers frequently purchase multiple products.

Large Secular Growth Automotive Semiconductor Market

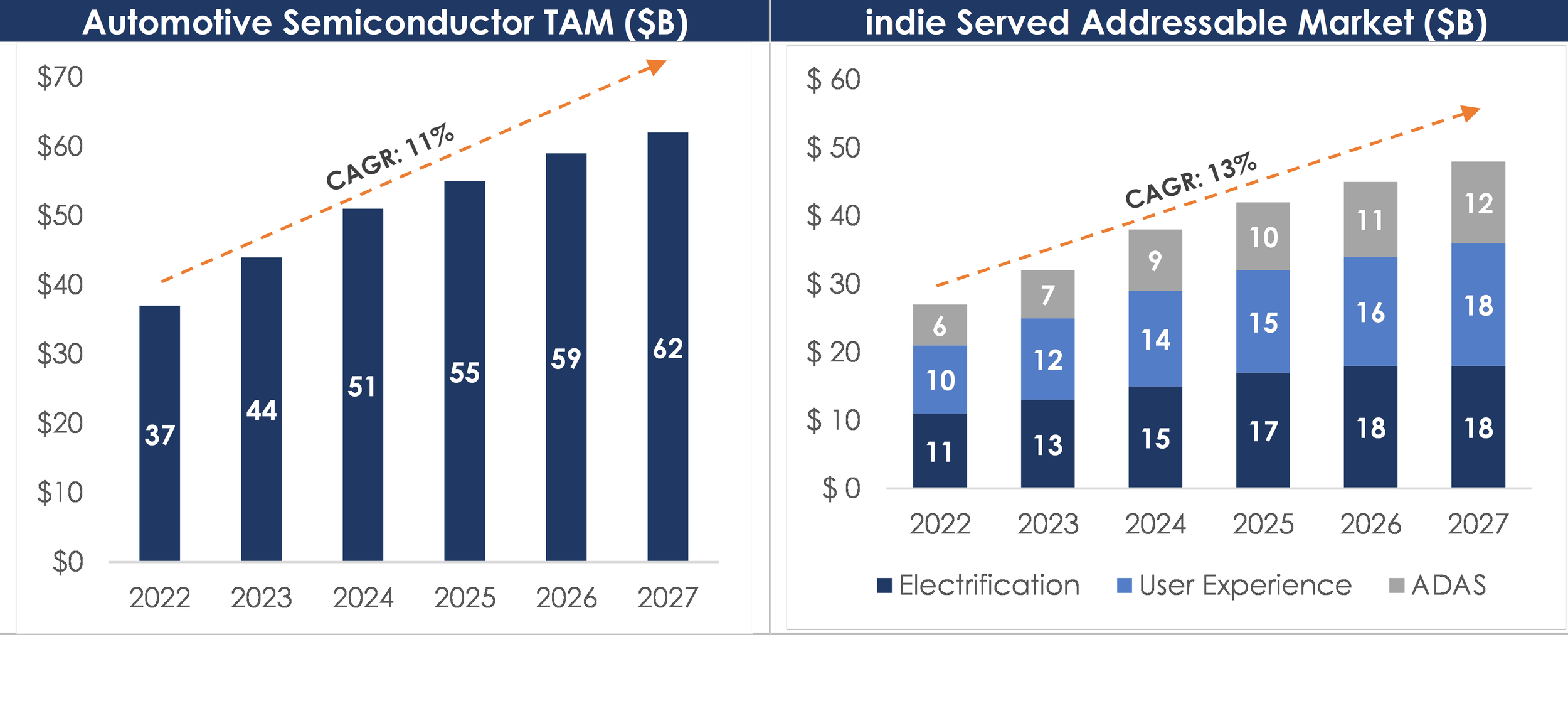

The automotive semiconductor market is driven by three overarching megatrends, spurred by: (i) the escalating electrification of vehicle drivetrains, contributing to the widespread adoption of electric vehicles (EVs); (ii) the embrace of advanced driver assistance systems (ADAS) and driving automation functionalities, aimed at enhancing road safety and achieving higher levels of vehicle automation; and (iii) consumer preferences for engaging, connected, and convenient in-cabin user experiences (UX). indie has strategically positioned itself in high growth areas, with S&P Global projecting a 13% CAGR in safety systems, user experience, and electrification applications over the next 5 years.

Source: Investor Presentation

The automotive semiconductor market is competitive, although recent industry consolidation has diminished the pool of viable competitors. This evolving landscape has, however, created favorable design opportunities for indie. Key rivals in this domain include other semiconductor companies with a focus on automotive applications, notably Infineon, Monolithic Power Systems, NXP, Renesas, and ST Microelectronics. While certain competitors boast greater financial resources, others exhibit a more diversified product portfolio and cater to varied end markets. That said, according to Morgan Stanley, indie Semiconductor has outpaced 224 other semiconductor companies in growth over the past two years, as CEO Don McClymont highlighted in the latest earnings call. Driving this growth is indie’s innovative product roadmap and a scalable supply chain. While the company continues to incur losses, it has made considerable progress towards profitability and expects to achieve non-GAAP EBITDA breakeven in Q4 2023.

Strong Revenue Growth on the back of Growing Backlog and Sustained Improvement in Profitability

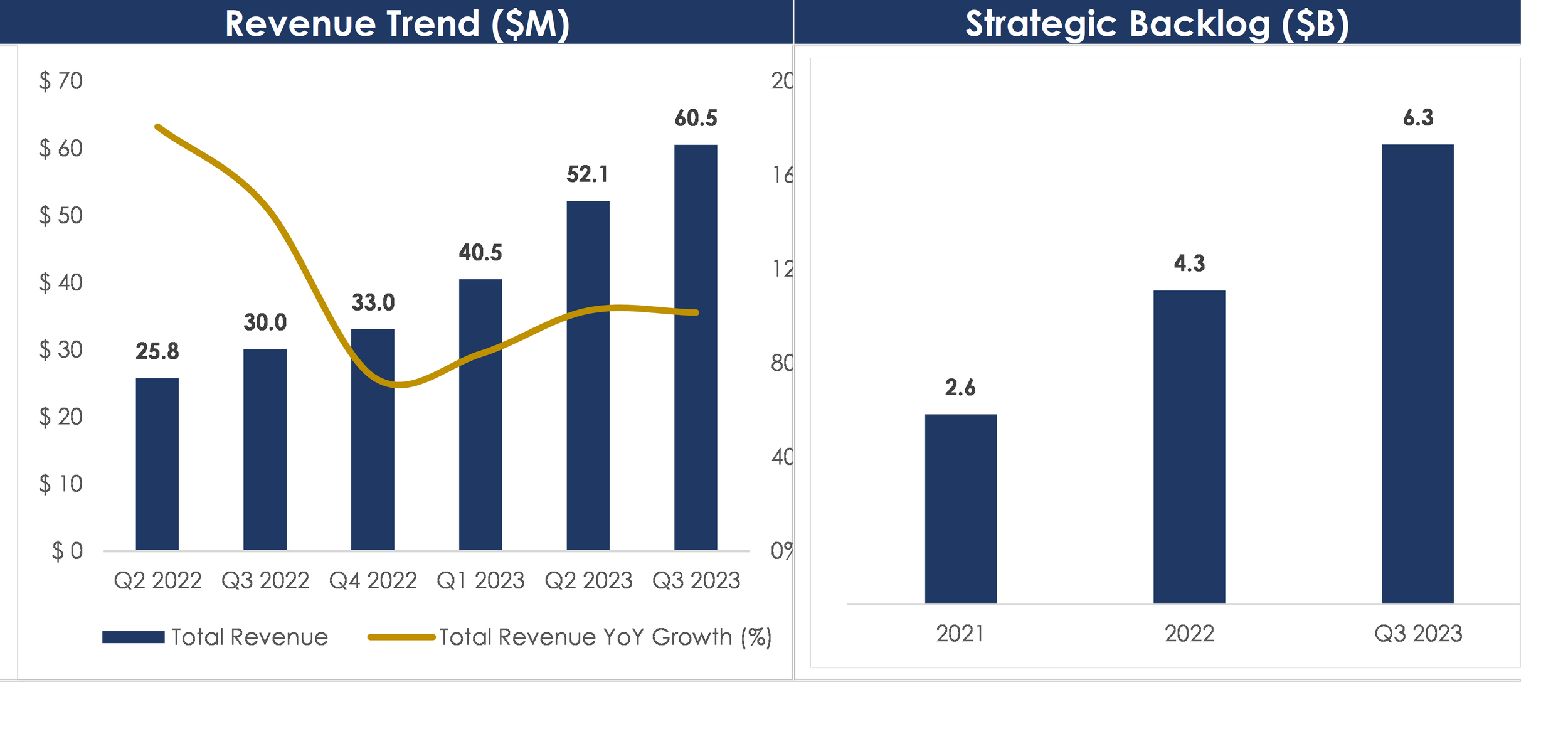

In Q3 2023, total revenue increased 101% YoY to $60.5M, driven by increasing demand for the company’s differentiated Autotech solutions, once again exceeding top-line guidance. Notably, this marks indie’s 10th consecutive quarter of consistently exceeding or meeting these targets since its IPO.

indie reported a significant increase in its strategic backlog, rising from $4.3B in 2022 to $6.3B in Q3 2023. The $2B surge was primarily driven by the Computer Vision segment, following the acquisition of GEO Semiconductor earlier in 2023. Post-integration successes, such as the Bosch win, played a significant role, bringing in a leading North American OEM and Toyota into the backlog. The ADAS segment of the company contributes over 70%, or ~$4.6B, to the strategic backlog, underscoring the strength of its ADAS offering. Management has emphasized that indie is well-positioned to achieve revenues exceeding $1B by 2028 with its strong strategic backlog.

Source: Company Filings

On the profitability front, indie reported Non-GAAP gross margin of 52.7% in Q3 2023, an improvement of 226 basis points YoY. The company has exhibited an impressive progression in its gross margin over the past years thanks to the strategic shift towards ADAS, which has higher margins. As the product mix continues to improve and leans more towards ADAS, the company is poised to achieve its long-term target gross margin of 60%.

Increased revenue, improved gross margin, and effective operating expense leverage led to a continued reduction in operating losses. indie reported a Non-GAAP operating loss of $13M in Q3 2023 as compared to $16M in Q3 2022. Operating margin improved 3100 basis points YoY to -22%. The company aims to achieve breakeven for the first time in its history in the upcoming Q4 results and has set a long-term operating margin target of 30%.

Source: Company Earnings Press Releases

Balance Sheet highlights Dilution Risks

indie ended Q3 2023 with $161M in cash and cash equivalents and $156M in long-term debt. It continues to experience cash outflow, reporting a negative FCF of $17M in the third quarter of 2023.

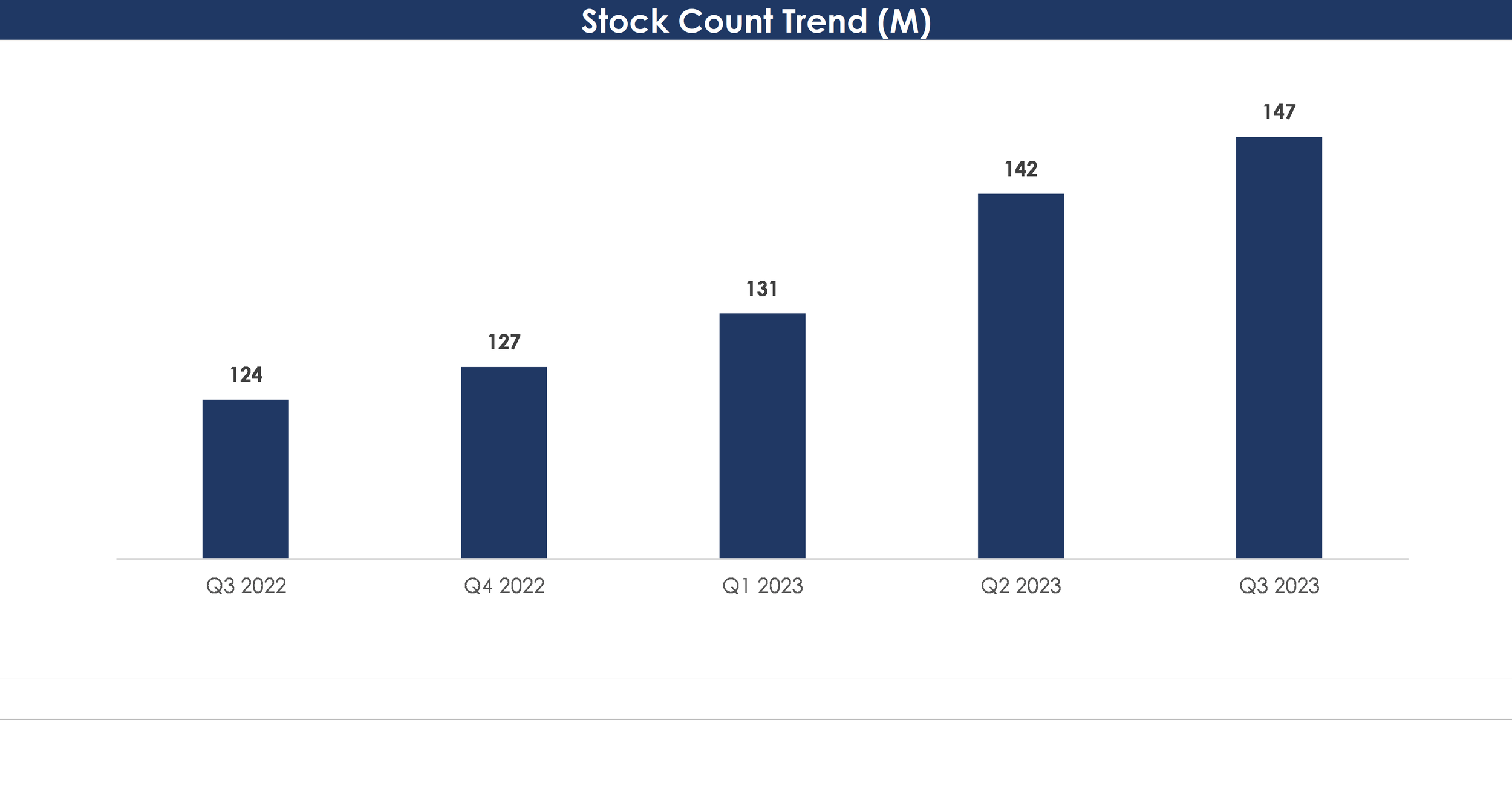

Source: Company Filings

The company has witnessed a substantial rise in its stock count, escalating from 70M in 2021 to 147M at the end of Q3 2023. This has been mainly due to the numerous acquisitions paid for by the issuance of new stock. indie issued ~16M shares for three acquisitions within the initial 9 months of 2023. While these acquisitions are pivotal for strategic growth, notably contributing to the $2B strategic backlog expansion this year, the cumulative impact of this stock-centric strategy also raises prospects of dilution. Management appears cognizant of this, and the recent announcement of the successful completion of the warrant exchange tender offer is a step in the right direction.

“In fact, given our bullishness, we are pleased to announce the recent completion of our warrant exchange tender offer, which effectively retired potentially 27.4 million shares, which is 7.7 million shares. In this way, we substantially reduced potential future dilution, removed the shareholder overhang and simplified our capital structure.” - Tom Schiller, CFO, Q3 2023 Earnings Conference Call

Source: Company Earnings Releases

Valuation

indie went public in 2021 and the stock price has experienced a persistent decline, down ~50% from its all time high. While its business performance has been relatively strong, the market has responded by penalizing the company's stock due to its reliance on stock-driven funding for acquisitions and the perceived risk of potential dilutive events in the future.

INDI is currently valued at a forward Price to Sales ratio of 5.1x, and we believe this risk-reward profile is favorable at this valuation, given indie’s robust revenue gowth, expanding backlog, promising industry prospects and notable competitive advantages.

Source: Seeking Alpha

Risks

Intense competition: The semiconductor market is highly competitive, marked by continuous and swift technological advancements, brief product lifecycles, notable price erosion, and dynamic quality standards. indie’s primary competitors include other automotive-focused semiconductor companies, including Infineon, Monolithic Power Systems, NXP, Renesas and ST Microelectronics. Several competitors possess greater financial resources while others boast a more diversified range of products and end markets. Ineffectiveness in competing or losing in bid selection processes could have adverse impacts on indie's business.

Cyclicality: indie, by virtue of its industry, faces a notable cyclicality risk. The semiconductor sector is prone to significant downturns influenced by factors like technological shifts, product obsolescence, price erosion, and market fluctuations. Events like the 2020 COVID-19 pandemic and geopolitical tensions serve as examples of downturns, resulting in reduced demand, production overcapacity, and inventory challenges. Conversely, upturns in the industry introduce challenges such as meeting heightened demand, increased competition for resources, and the necessity for rapid expansion. These cyclicality dynamics pose potential impacts on the company’s operations and financial health.

Conclusion

Amidst the challenging landscape of the auto-tech supply business, where prolonged project timelines, rigorous testing, and iterative processes are the norm, indie’s extensive product portfolio and deep customer relationships serve as a testament to its strength and sustainability in the market. The company’s adept execution is reflected in its robust top-line growth, gross margin expansion and operating expense leverage.

Despite these positive indicators, the market appears to be emphasizing the company’s stock-driven funding for acquisitions, resulting in lacklustre stock price performance since its Nasdaq listing. While acknowledging the dilution risk for shareholders, we believe these acquisitions play a crucial role in addressing product gaps, acquiring valuable intellectual property, and positioning the company for long-term growth.

Considering the current risk and reward dynamics, we view INDI as an attractive opportunity for patient, long-term investors aiming to leverage the growth narrative in the automotive semiconductor sector.

We do not currently own shares, but we are considering INDI for a spot in our Disciplined Growth Portfolio.