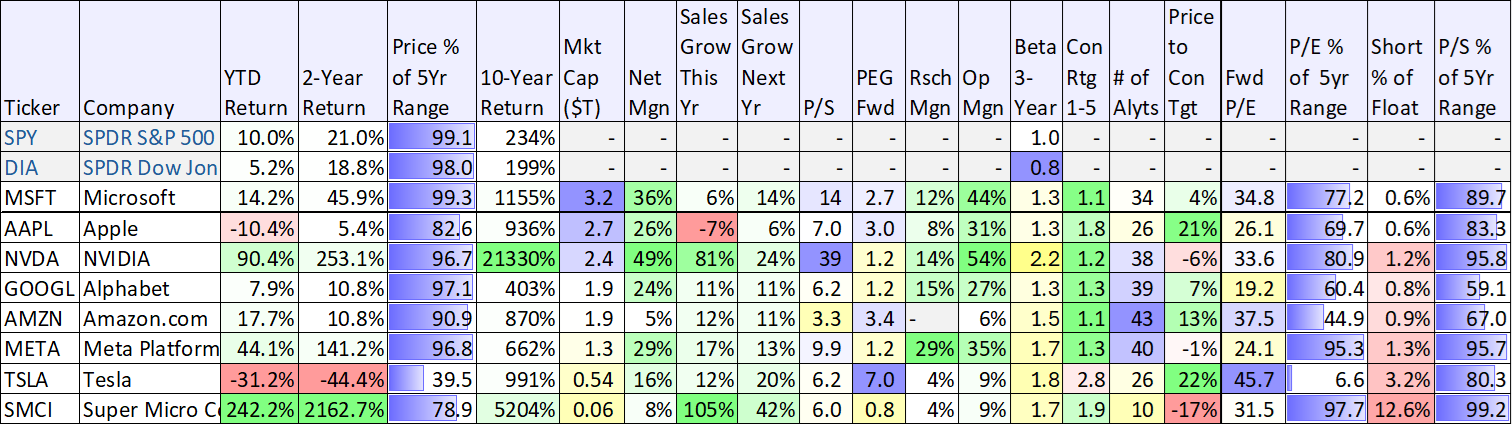

Alphabet (GOOGL) shares are up a measly 7.9% this year, and up 10.8% over the last two-years. That may not sound too bad, but compared to other mega-caps like Microsoft (MSFT) (+14.2% ytd, +45.9% 2yr) and Meta Platforms (META) (+44.1% ytd +141.2% 2yr), Alphabet has been lackluster (and some investors worry it’s increasingly going the way of Apple (AAPL) (-10.4% ytd). In this report, we review Alphabet’s business, its big risks (e.g. AI threats, challenges from being enormous, high spending) and its current valuation. We conclude with our strong opinion on investing.

About Alphabet:

What started as an internet search company (Google), has expanded into a vast ecosystem (Alphabet) of complementary products and platforms, including YouTube, Gmail, Workspace, Android, Cloud and others. Alphabet has some of the largest user-bases in the world, and with a market capitalization near $2 trillion, it’s a major part of the global economy.

Data as of Friday’s close 3/22/24, source: StockRover

Not surprisingly, a company this large, with an ecosystem this wide, has a lot of targets on its back. We’ll review some of the major risks Google faces in the following sections.

The “AI” Risk (from Bing and Others)

Microsoft CEO, Satya Nadella, said in a 2023 statement about Artificial Intelligence and his company’s Bing search engine:

“Google is the 800-pound gorilla in search. I want people to know that we made them dance.”

This statement coming from the company (Microsoft) partnering with the leader in AI language models (Chat GPT), along with a few Google missteps (such as a botched AI rollout), has left a lot of people believing Google is being badly beaten in the AI arms race (part of the reason Google’s share price has recently lagged other mega-caps). However, it’s not exactly true.

According to a recent Sequoia fund letter:

“Google Search remains a trusted source of information and links to source material, while the world has learned to regard the answers of AI chatbots with skepticism.”

And, according to a new note from analysts led by Scott Devitt at Wedbush:

“We believe the perceived structural risks to Google Search are overstated and continue to view Alphabet as a net beneficiary of generative AI."

Importantly, Google has its own set of AI capabilities. The earlier referenced Sequoia letter goes on to say:

“the company has been building world-class capabilities in artificial intelligence for over a decade. It built two of the leading AI research organizations in the world, Google Brain and DeepMind, and in April of 2023 merged them in order to accelerate the development of a new state-of-the-art model. This model, Gemini, saw a limited release at the end of 2023 and should see full availability in 2024.”

"Alphabet’s competitive advantages are multifaceted, the company has an unmatched breadth of data to develop and train AI models across text, images, and video, a massive user base spanning Google Search, YouTube, Android, and other Google applications, AI-optimized compute infrastructure supported by custom silicon (TPUs), access to leading engineering talent, and a proven track record of effective monetization.

Basically, Google (Alphabet) is bringing its own world-class AI to its own world-class products. And, in a potentially very big win, Google is bringing AI to sister mega cap company Apple (the two companies are reportedly in negotiations to integrate Gemini in the upcoming iPhone software updates).

The Apple DOJ Risk:

It was just recently announced that the US Department of Justice (“DOJ”) is suing Apple on antitrust grounds for

Not only is this a bad headline for Apple (its shares were down on the news) and for its partnership with Google, but it also highlights another important risk factor for Google. Considering Alphabet’s large size and wide-ranging ecosystem, it could also become the subject of new DOJ antitrust lawsuits. It’s already clearly in the sights of European lawmakers too.

However, such a lawsuits will likely be more of a speedbump than an existential threat to Alphabet’s ongoing high-growth trajectory, considering the US government likely doesn’t want to completely destroy Google because it is such a large and important part of the economy (not to mention, Google’s political views tend to align closely with those of Washington DC anyway).

However, such DOJ threats highlight another challenge—Alphabet’s massive size. Generally speaking, it can be dramatically more difficult for a very large company (like Alphabet) to continue to grow at such a high rate (because it’s already so big).

Nonetheless, Alphabet is expected to continue growing at a healthy clip, as we will cover in the later section of this report on growth and valuation.

Alphabet’s “Meta-Like” Spending:

As Alphabet feels the pressure to grow (in the face of AI threats and its already massive size), it runs the risk of spending too heavily and sacrificing profits. This is the ugly mistake Meta Platforms made in 2022 when it sacrificed profits by going all-in on “metaverse” spending, and as a result Meta shares plummeted to dramatic multiyear lows that had many investors jumping ship (boy were they wrong—hindsight is 2020—we’ve stayed long Meta since 2012). And one of Alphabet CEO Sundar Pichao’s main points on the latest quarterly call was on the company’s:

“investments and focus to meet the growth opportunities ahead.”

As you can see in our earlier table, Alphabet’s research margin (i.e. the percent of its revenues it spends on “research & development”) is very large (15%), especially considering the company’s revenues are so large. However, management seems committed to growing profits in step with high revenue growth, potetially side-stepping the ugly mistake Meta made two years ago.

Noteworthy, to reassure investors of its newfound discipline on spending, Meta recently initiated a dividend (something some investors expect Google may soon feel obligated to do too).

Alphabet’s Growth Trajectory:

As you can see in our earlier table, Google’s growth trajectory remains robust (with an expectation for 11% growth this fiscal year and next). According to CEO Sundar Pichai on the latest quarterly call, the compay is focused on four areas of growth:

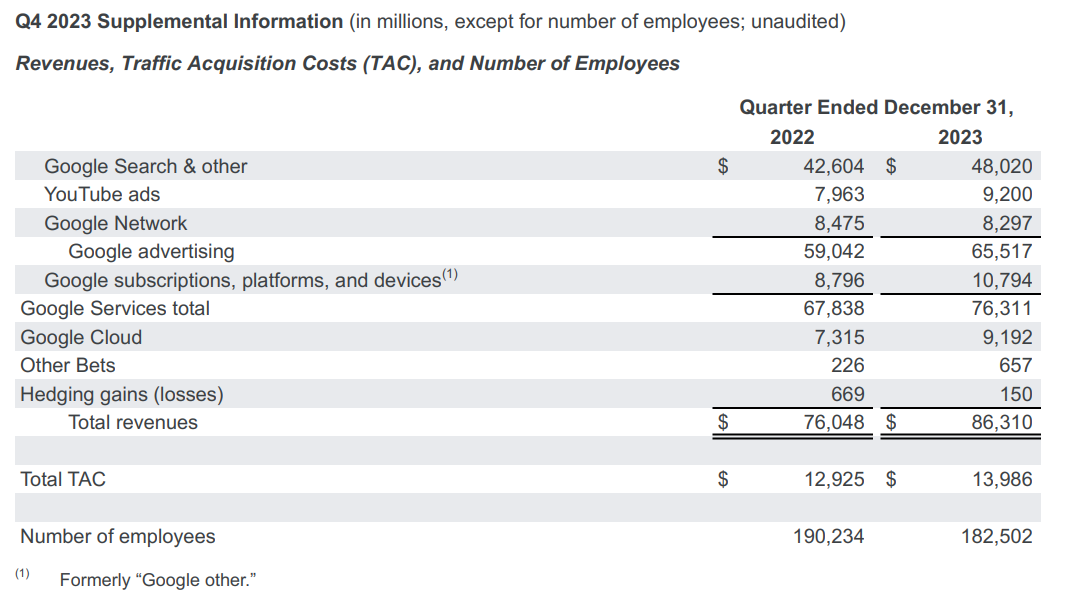

“One, our investments in AI, including how it's helping search. Two, subscriptions which reached $15 billion in annual revenue, up 5x since 2019. Subscriptions is growing strongly, powered by YouTube Premium and Music, YouTube TV and Google One. Three, Cloud which crossed $9 billion in revenues this quarter and saw accelerated growth driven by our Gen AI and product leadership. And four, our investments and focus to meet the growth opportunities ahead.”

Notably, most of Alphabet’s revenue (and essentially almost all of its operating income) still comes from advertising.

Encouragingly, Google Search and YouTube advertising continued to grow last year (YouTube subscriptions enjoyed a bump last fall from the NFL making its platform the exclusive home of NFL Sunday Ticket in a deal that goes through 2030).

And importantly, in the first quarter of 2023 (and for the full year), fast-growing Google Cloud achieved profitability for the first time (see above). Amazon Web Services (AMZN) is still the leader is cloud services, but 2nd and 3rd place Microsoft and Google are catching up as they grow faster.

Valuation:

From a valuation standpoint, Alphabet remains compelling as compared to its healthy growth trajectory. For example, it trades at a forward P/E of only 19.2x (better than most mega cap peers) and it also has an attractively low PEG ratio (P/E over growth) of 1.3x (also compelling compared to its already impressive peer group). Wall Street Analysts rate the shares a strong buy (1.3 average rating, see earlier table). And considering the company’s dominant competitive advantages from its vast ecosystem, large size (spending budget) and economies of scale, Google looks to have many years of profitable growth (and share price appreciation) ahead.

The Bottom Line:

Google is one of our largest holdings (in our Disciplined Growth Portfolio), and we expect it will remain that way for a long time. Alphabet will continue to benefit from secular trends, including Artificial Intelligence (despite media stories that it is behind) and the overall digitial revolution and migration to the cloud (through Google Cloud and its vast ecosystem). And despite all the positives, the shares still trade at a compelling valuation. Considering Alphabet is such a large part of the S&P 500 and the overall economy, there is now way we’re not investing in it. We remain long this high-growth, wide-moat, undervalued, mega-cap juggernaut.