Fads come and go. Megatrends (such as urbanization and the internet) change the world. Certainly, megatrends can get ahead of themselves (there was an internet bubble in the early 2000s, and more recently China built entire cities expecting rapid pockets of urbanization that never happened). Some investors wonder if Artificial Intelligence (“AI”) is a fad, a megatend that has gotten ahead of itself, or still in its infancy. In this report, we address this question with a variety of data points (including comparative data on 20+ top AI stocks) and a special focus on big-data AI stock Snowflake (SNOW) (including its business, growth opportunity, valuation and risks). We conclude with our strong opinion on AI as a theme and Snowflake as an investment opportunity.

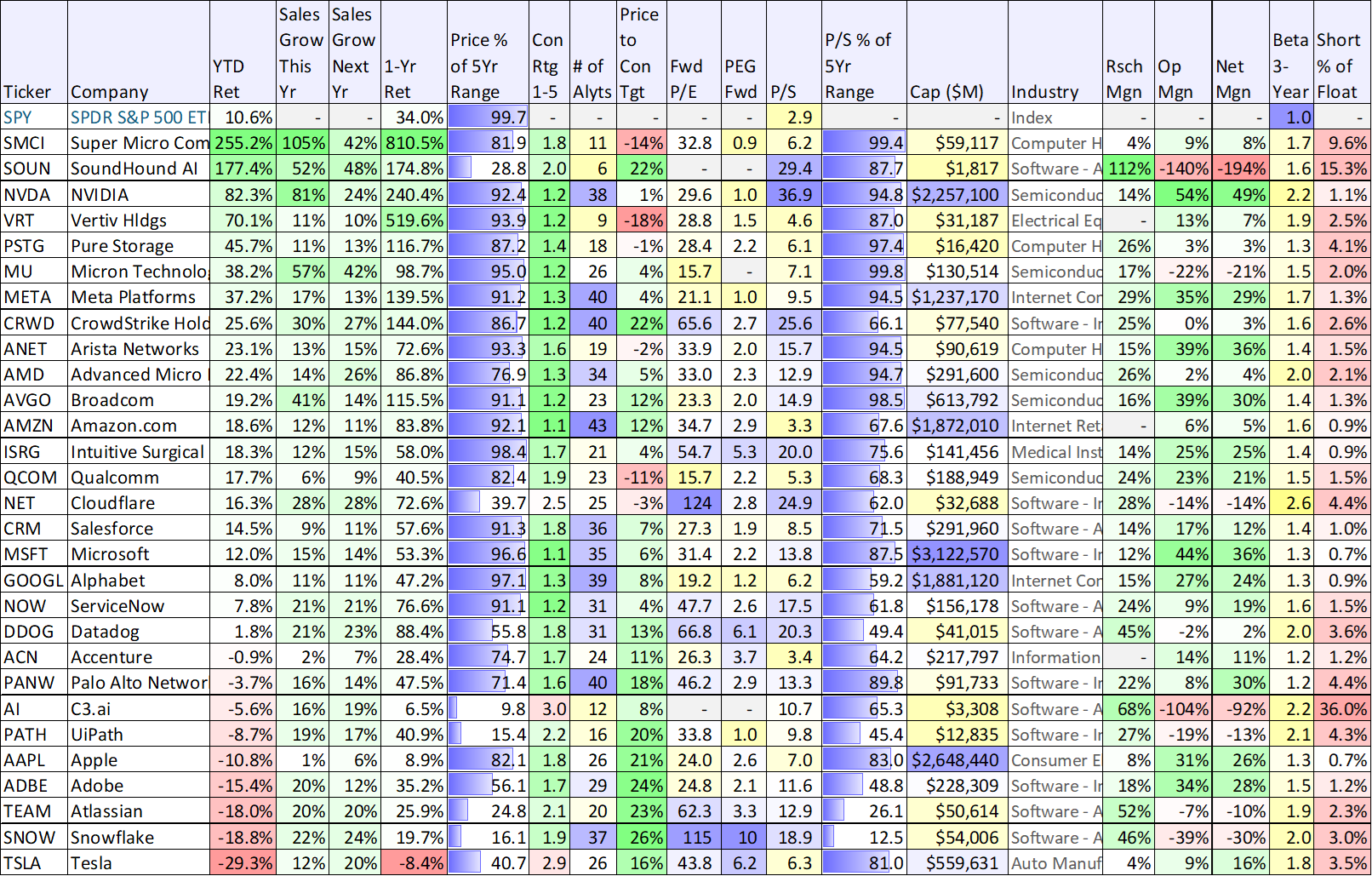

20+ Top AI Stocks, Ranked

The following table includes comparative data on 20+ top AI stocks (you likely recognize many of your favorites). The companies are ranked by year-to-date performance, but you can also compare them on expected revenue growth rates (for this fiscal year and next), profit margins, valuation, research & development spending, analyst ratings and more.

data as of market close: 3/28/24, source: StockRover

You may want to use the above data points as a starting point for more research of your own (we dig deeper into one name from the list, Snowflake, momentarily), but here are a few more high-level data points for you to stir into the pot (on whether AI is a fad, and overextended megatrend, or just getting started).

AI In Perspective

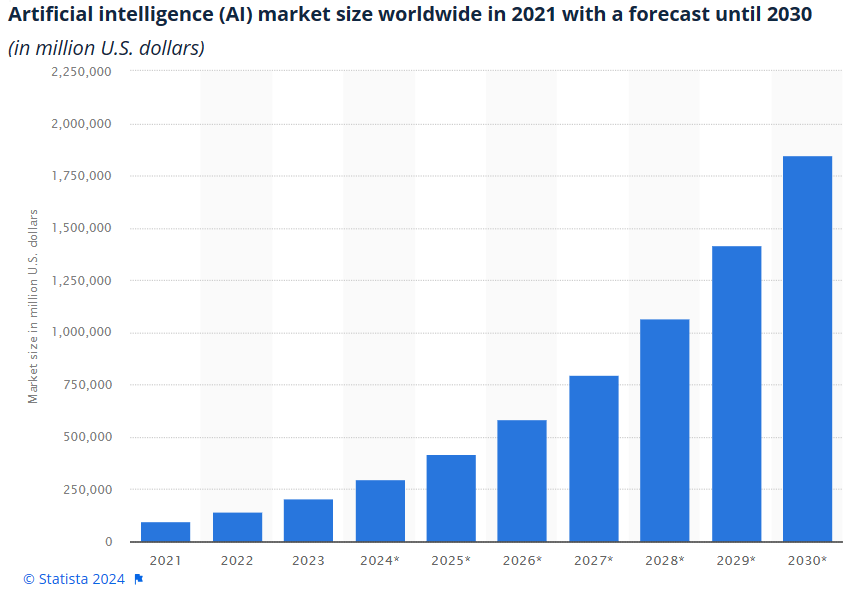

For starters, you can see an estimate (below) of just how large the AI market is expected to grow by the end of the decade.

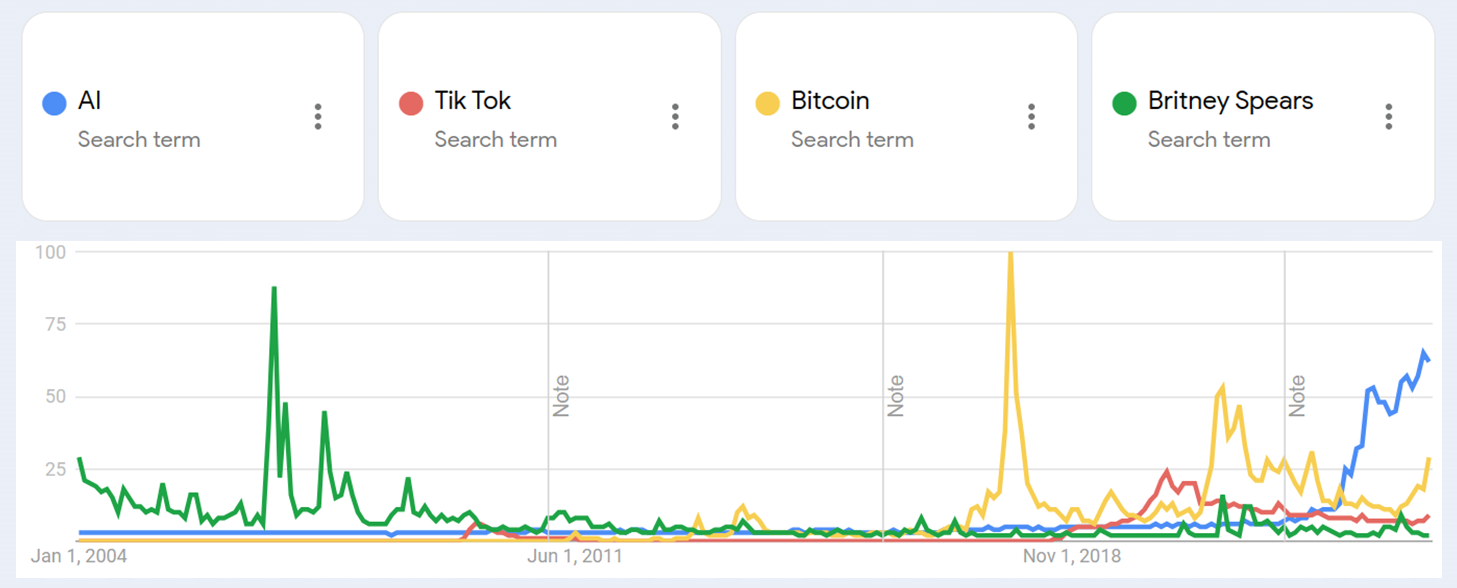

For a little more perspective, here is a look at how the term “AI” has been climbing recently among Google searches (and as compared to a few historical search terms)

In our view, AI is a much bigger deal than the other comparative search terms in the chart above.

And here is what Nvidia (NVDA) CEO Jensen Huang had to say about it at a Microsoft (MSFT) Ignite conference in November 2023:

“Generative AI is the single most significant platform transition in computing history… In the last 40 years, nothing has been this big. It’s bigger than PC, it’s bigger than mobile, and it’s gonna be bigger than the internet, by far.”

So with that backdrop in mind, let’s get into the details on one very big player in the AI race, Snowflake.

Snowflake:

Snowflake is a “big data” company, and without big data the explosive growth in AI (that the market has been experiencing) would not be possible.

However, for all the hype surrounding this big-data cloud company, the shares have been a bust. Revenues continue to scream higher (see our table above), but profits scream lower and CEO Frank Slootman has just “stepped aside” (he’s now Chairman) to allow relative company newcomer (and AI expert) Sridhar Ramaswamy to take the reigns as the new CEO. The big question is whether Snowflake is a victim of unachievably high expectations or a disruptive megatrend beneficiary trading at an increasingly compelling price?

Overview:

Snowflake pioneered the data cloud where organizations unite their siloed data to achieve better and faster results. And with the explosion in data (courtesy of the digital revolution, and now ramping even faster thanks to AI) Snowflake addresses very real challenges and its sales are growing rapidly.

However, as mentioned, profits are non-existent at this stage as the company focuses instead on its long-term growth vision.

Concerning Forward Guidance:

Snowflake recently delivered healthy quarterly results, but provided forward guidance significantly lower than expectations thereby causing the shares to fall sharply (and this comes on top of disappointing performance over the last year as the share price has dramatically underperformed (see data table above).

As a result, CEO Frank Slootman has been replaced (he is now the Chairmen) in favor of new CEO Sridhar Ramaswamy (who joined Snowflake in 2023 in connection with the company’s acquisition of Neeva, the world’s first AI-powered search engine, where he was co-Founder and CEO).

On one hand, it’s very disappointing to see Snowflake shares dramatically underperform peers over the last year (especially as so many companies related to AI have soared), but on the other hand it is good to see the company proactively addressing the issues before they get worse.

New CEO Sridhar Ramaswamy:

On the most recent quarterly call, new CEO Ramaswamy described Snowflake as a “once in a generation company” and explained:

“There's no AI strategy without a data strategy. And this has opened a massive opportunity for Snowflake to address."

This is encouraging as Ramaswamy has a history of success at Neeva and prior to that at Google, according to Snowflake’s website:

“prior to founding Neeva, Sridhar led Google’s Advertising business, which he helped grow from $1.5 billion to over $100 billion. During his 15 years at Google, he was responsible for all advertising and commerce products – search, display and video advertising, analytics, shopping, payments, and travel.”

It’s also encouraging because the company is making changes to address the massive market opportunities ahead (in data, especially related to AI), and Ramaswamy will hit the ground running (with his already strong history of introducing new products to address customer demands).

Financially Speaking:

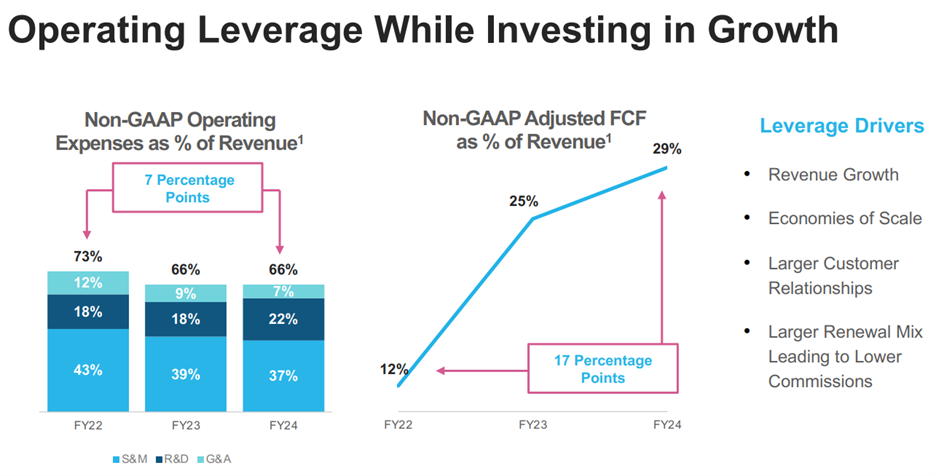

Snowflake is not profitable. In fact, its losses are growing. The company has a stated goal focused on revenue growth, not profits (to capitalize on the market opportunity), but at some point Snowflake needs to move towards profitability.

And considering the company just guided for fiscal 2025 growth of around 22% versus consensus estimates of almost 30%, the company needs to start innovating value for customers faster.

Snowflake is making small gains in margin improvements and cash flow generation, but it’s not enough as revenue growth slows and the valuation remains high (see the PEG ratio above (price/earnings to growth)). This is where new CEO Ramaswamy’s product innovation history will hopefully prove invaluable in reaccelerating Snowflake, especially considering the research margin (i.e. spending on research as a percent of revenues) is extremely high (see table above).

Basically, Snowflake needs to start creating more value for customers through innovation and they need to do it faster (we’ll see if Ramaswamy can deliver).

Massive Market Opportunity:

As a reminder, Snowflake’s market opportunity is truly enormous. According to its website, the company’s vision is for its platform to be:

“the engine that powers and provides access to the Data Cloud, creating a solution for applications, collaboration, cybersecurity, data engineering, data lake, data science, data warehousing, and unistore. Snowflake’s vision is a world with unlimited access to governed data, so every organization can tackle the challenges and opportunities of today and reveal the possibilities of tomorrow.”

The amount of data in the world is enormous because everything is being digitized and moved to the cloud, and now artificial intelligence is driving even more data creation that can be used to develop solutions. AI needs a data solution, and Snowflake has a huge opportunity here. The are positioned better than almost everyone else to succeed in this area (based on what the company has accomplished already, see customer examples below).

image source: Quarterly Investor Presentation

AI, and the great cloud migration, are a market megatrend that will last for many years, and now Snowflake needs to do a better job of capitalizing on it (they’ve been doing a good job, just not as good as expectations).

Valuation:

As mentioned, Snowflake is growing revenues rapidly, but so are the companies net losses. For example, the price-to-sales ratio has come down from insanely high levels during the pandemic to around 18.9x now (still very high, but not as compared to where it was). And the companies PEG ratio (price/earnings to growth) is the highest of any company in our earlier table (10x).

Ecouragingly, Wall Street analysts continue to rate the shares a “buy” and believe they have 26% upside from here (more than many other AI stocks). Overally Snowflake’s share price and valuation have come down, but they are still not “cheap” due to continuing high expectations for the business opportunity.

Risks:

One of the biggest risks that Snowflake faces is data security. The company basically has access to everyone’s data. Of course, Snowflake claims their platform allows users to share data securely and in a governed fashion, but any data breaches could create huge legal, financial and reputational challenges.

Competition is another risk. Here is a look at revenue growth for Snowflake versus private company competitor, Databricks.

(source: X (@techfund1))

Innovation is also a risk, as mentioned. The new CEO needs to deliver more value-adding products and faster.

The Bottom Line

There have been plenty of highly successful companies that were first unprofitable for many years (Amazon is a great example). Snowflake is currently very unprofitable, but it’s also growing revenues fast. Unfortunately, the company is not growing revenues as fast as Wall Street expects and the shares are down big.

And despite recent declines, the shares are still not “cheap” on a valuation basis. This makes sense because the opportunities that lie ahead (big data, cloud, AI) are so great (and the company is still relatively young in its “j-curve” journey). At this point, it just comes down to execution.

We appreciate the company proactively inserted Ramaswamy as the new CEO instead of sticking with the wrong guy for the job for too many years (Slootman seems great, it’s just he doesn’t have the strong AI development background that Ramaswamy does). And the company’s latest revenue growth guide (which came in well below Street expectations) may have set the bar low making it easier for the new CEO to excel. Time will tell if Ramaswamy is able to accelerate the company’s value execution.

As disciplined long-term investors, we’re willing to take the risk. The opportunity presented by the digital revolution, the cloud and now AI is truly enormous, and patient long-term Snowflake shareholders stand to benefit, perhaps handsomely, over the long-term. Time will tell. Long Snowflake.