Long-term investors should not forget the risk-reward tradeoff. For example, if you were diversified into investment-grade bonds over the last year then your account balance probably hasn’t suffered as much as if you’d invested entirely in stocks. However, over the long-term, we expect stocks to significantly outperform less-risky bonds. This week’s Weekly highlights some extremely attractive stock-specific opportunities that have been created by 2016’s recent market volatility.

Risk-Off Environment So Far in 2016:

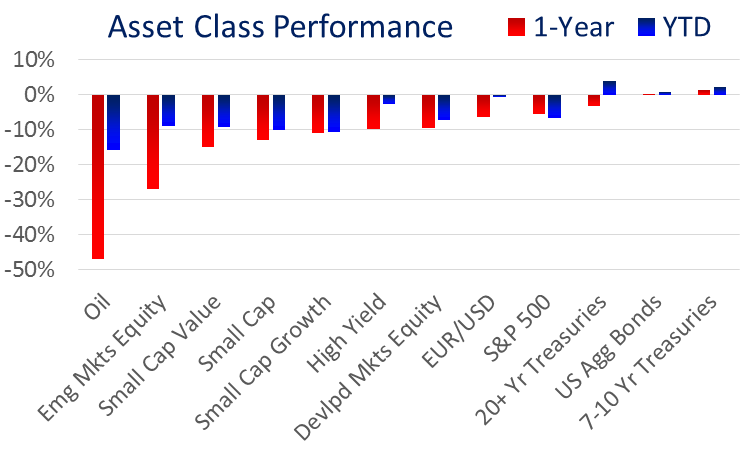

So far, 2016 has been a “risk-off” environment. Investors have sold high-risk investments (like small cap stocks) and they’ve purchased lower-risk investments (like investment-grade bonds). This explains the rally in investment grade bonds. It also explains, in part, why several Blue Harbinger holdings have outperformed the market so far in 2016. For example, McDonald’s (+0.2%), Procter & Gamble (-1.7%), Westar Energy (-1.8%) and Phillips 66 (-2.2%) have all outperformed the S&P 500 (-6.6%) this year because they are considered “less risky” when compared to other stocks. All four of the stocks provide above average dividends which is a sign of safety and security for many investors. You can read our completed thesis and updates for each of these stocks here: MCD, PG, WR, and PSX.

Buy Low:

The declines we have experience in 2016 have been more severe for some stocks in particular. For example, Industrials stock Caterpillar (CAT) has declined 9.1% this year. CAT is particularly sensitive to global economic growth as the heavy machinery it produces is used for construction and to produce and transport energy (oil and gas). Despite slower economic growth across the globe, Caterpillar products continue to be used for industrial production. And the company’s recent declines are due not only to slower growth, but also because dealers have let inventory levels fall low, and eventually they will “stock up” causing Caterpillar demand to rise. You can read our recent Caterpillar updates here.

Paylocity is another stock that has declined sharply this year (-17.9%). Worth noting, Paylocity had a fantastic 2015. However, it is a highly volatile stock with more perceived risk than other stocks because it is a newer company, it is a small cap stock, and its valuation depends heavily on future growth. We believe this year’s sharp decline has created an outstanding buying opportunity because this is a stock that will continue to grow. You can read our most recent Paylocity updates here.

American Express (AXP) is another company that has gotten hammered this year (-20.5%). In this case however, the decline is due to a variety of stock specific factors as well as the broad market decline. For example, the company announced earnings last week, and they missed estimates and lowered future expectations. The stock has also been beaten up because they lost an exclusivity deal with Costco in 2015. American Express also lost a federal lawsuit which now allows merchants to discriminate against AXP for its higher processing fees. However, we believe AXP is an exceptional brand name that has been overly beat up. You can read our recent updates and thesis on AXP here.

At the End of the Day...

If your investment horizon is intermediate or short-term, then it likely makes sense to hold fewer risky stocks, and to diversify into other asset classes such as investment grade bonds. This strategy will reduce the wild ups and downs in the value of your investment account, and still allow you to participate in the market’s intermediate- and long-term upside. Many investors make the mistake of believing buying a lot of different stocks makes them appropriately diversified and protects them from the stock market’s wild swings. In reality, many of these “diversified” investors are not appropriately diversified, and they should be investing in other asset classes besides simply stocks.

However, if you’re a long-term investor, 2016’s market volatility has created some outstanding stock specific investment opportunities. And if you can stomach the ups and downs, now is a great time to buy stocks.