Is it still safe to own Prospect Capital? This big 12.4% yielder has rallied significantly since we bought it on May 6th (+15.6%), and it’s up even more since it bottomed in February of this year at $5.21 per share (it’s now $8.10 per share). No one has a working crystal ball, but we believe Prospect remains a safe investment (we continue to own it) for income-focused investors for the following reasons:

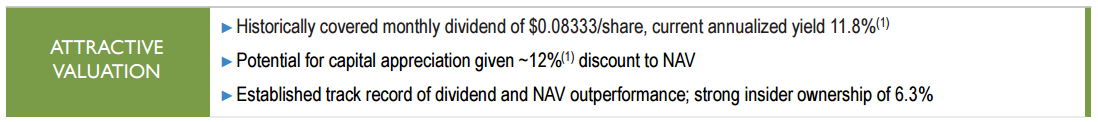

PSEC still trades at a nice discount to its NAV.

At the end of August PSEC traded at a 12% discount to its Net Asset Value, and the share price has come down further since then thus making the price more attractive in our view. This discount suggests there is still more room for price appreciation.

PSEC still has a healthy dividend coverage ratio.

As the following chart shows, Prospect is still covering its dividend payments with a health margin to spare. PSEC is particularly attractive relative to other Business Development Companies (BDCs).

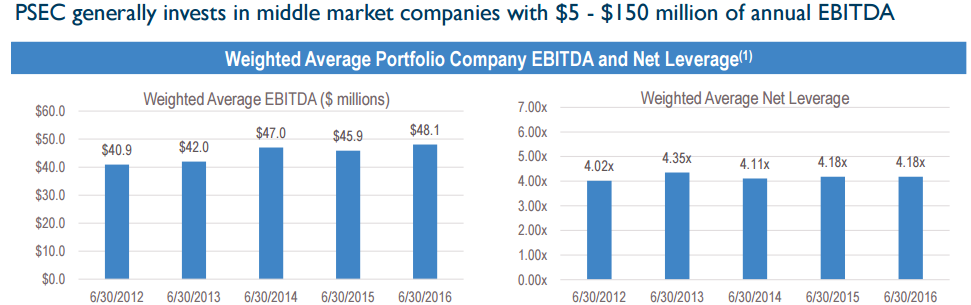

Business is still doing well.

As the following chart shows, Prospect continues to generate healthy EBITDA (Earnings Before Interest Taxes Depreciation and Amortization- a more pure measure of a company’s earnings power), and maintains relatively consistent weighted average net leverage (These are both signs of health).

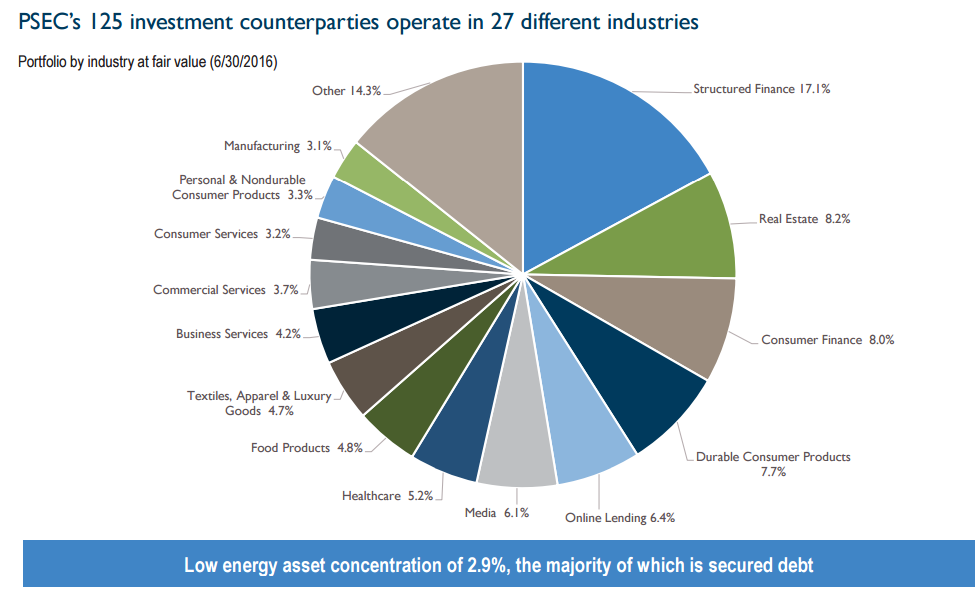

Plus, Prospect’s business is well diversified thereby reducing its risk exposures (more on risks later) as shown in the following charts.

It also has access to a wide range of deal flow opportunities as shown in the following graphic…

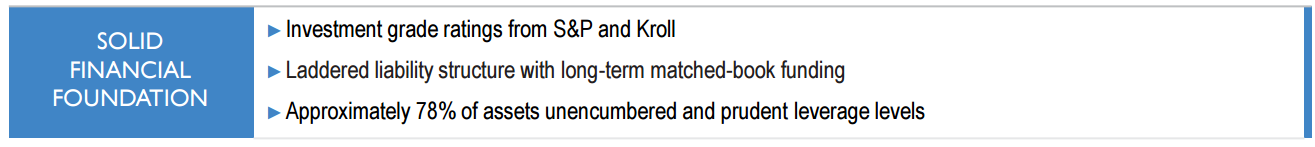

PSEC continues to maintain strong investment grade credit ratings.

The following graphic shows Prospect’s strong credit ratings, as well as its laddered liability structure (a good thing for a dynamic market environment).

What are the Risks?

The biggest risk for Prospect is that the market turns south quickly. For example, we saw PSEC’s price decline rapidly in the first two month of this year as the market declined. If market conditions deteriorate dramatically it could cause PSEC’s portfolio investments to default on their debts to Prospect.

Worth noting, a small increase in interest rates is not a huge risk to PSEC because, according to their most recent earnings release:

"Our balance sheet as of June 30, 2016 consisted of 91% floating interest earning assets and 99% fixed rate liabilities, positioning us to benefit from potentially significant increases in short-term interest rates."

Also worth noting, it seems unlikely the Fed will implement the type of dramatic interest rate increase that would cause PSEC’s portfolio investments to default (the Fed seems intent on raising interest rates very slowly).

Further, it is encouraging to see inside ownership by PSEC’s management suggesting they have faith in the company as shown in the following chart.

Conclusion

We believe PSEC is remains an attractive investment for income-focused investors because of its big dividend yield (12.4%), strong credit rating, strong pipeline of opportunities, healthy balance sheet, ample dividend coverage, inside ownership, and the unlikelihood of a rapid interest rate increase (that could cause portfolio investments to default), and the unlikelihood of a rapid and dramatic market-wide decline (which would also create problems for Prospect’s investments). We continue to own Prospect Capital in our Blue Harbinger Income Equity portfolio.

For your reference, you can review our earlier report on Prospect Capital here.