This particular closed-end fund (CEF) offers an attractive 7.6% yield, an amazing track record of top-notch management, and currently trades at an exceptionally attractive discount to its net asset value (NAV). We are also very comfortable with its holdings, particularly its sector exposures, and believe it’s poised to deliver very strong future returns.

Adams Diversified Equity Fund

(ticker: ADX, Yield 7.6%)

The Adams Diversified Equity Fund (ADX) is an internally managed, closed-end fund that is focused on generating long-term capital appreciation and committed to paying at least 6% in annual distributions (paid quarterly). It also provides exposure to a diversified portfolio of large cap equities, and pays close attention to risk management. Oh, and its successful, long-term, track record dates back to 1929!

Sources of Income:

Considering this fund invests in large-cap stocks that generally pay dividends of around 2.5%, you may be wondering how the fund is able to consistently pay out at least 6% every year (distributions are paid quarterly). The answer is a combination of dividend income, long-term capital gains, short-term capital gains, and in rare cases a return of capital. The management team’s track record of efficiently making these large distributions available to investors has enabled many investors to sleep well at night for many many years.

Track Record:

The inception date for this fund is 1929. And that’s not a typo. This fund has been paying distributions for over 80 years! The current management team, however, has not been in place that long, but they are continuing the track record of efficient distributing cash to investors.

(more information on the fund’s management)

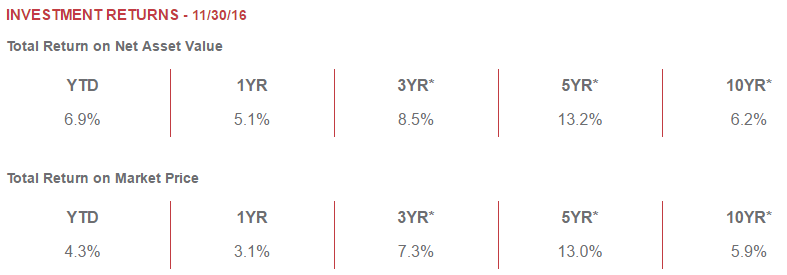

And for reference, the following table shows the more recent performance of the fund.

Discount to NAV:

Important to note, the difference be NAV return and Market Price return (in the above chart) has to do with the discount/premium of closed-end funds, and it helps explain one of the reasons this fund (ADX) is attractive right now. Specifically, over the last 1-, 3- and 5-years, the NAV return has become increasingly better than the market price return in terms of the spread or difference between the two. This is because the discount at which this fund trades in the market versus its NAV has been increasing as shown in the following chart.

Unlike open-end funds, ADX is a closed-end fund, and this means “creation units” are not used by the management team to keep the market price close to the NAV and therefore big distributions and premiums may occur based on supply and demand. In the case of ADX, it trades at a big discount (bigger than usual) and in our opinion this creates an even more attractive buying opportunity.

The discount likely exists because investors have unwisely (in our view) been chasing more glamorous funds that offer higher distribution yields and pay monthly (instead of quarterly like ADX), and instead been shunning ADX (remember closed-end funds trade largely on supply and demand). However, in order to achieve the higher yield, the other funds are taking on higher risk through the use of leverage, and by generating a high percentage of the distribution with return of capital (i.e. when the market goes south they’re often forced to sell holdings at discounted prices just to maintain their big yields). ADX has a 0% 1940 Act Leverage Ratio (note: they do borrow very small amounts for operating purposes, but not to magnify returns like many other funds do), and this is a big part of the reason the fund has been successful since 1929.

For reference, as the following table shows, ADX distributions are sourced from dividends and capital gains, NOT a return of capital.

For comparison purposes, here is the same information from another popular large-cap CEF, The Gabelli Dividend & Income Trust (GDV), however this CEF uses leverage, and has often used a return of capital to support the dividend instead of sourcing it from dividends and capital gains like ADX.

For further, consideration, Gabelli returned a lot of capital to support the dividend during the 2008-2009 financial crisis (i.e. they were being forced to sell things at distressed prices, NOT good).

On the other hand ADX, in much more conservatively and prudently managed in our view, which has helped it deliver such a long history of healthy returns.

Holdings:

We are also attracted to the holding of ADX from both a style and sector weight stand point. For reference the following style box shows the fund holdings tilt slightly towards growth.

Generally speaking, we prefer value stocks at Blue Harbinger over growth stocks, but in this case the exposure is acceptable for a variety of reasons. First, it’s not deep growth, it’s actually close to the middle (core-growth). Second, the growth vs value long-term performance difference is historically not as strong in the large-cap space as it is in the small-cap space (over the long-term, +10-years, value stocks tend to outperform growth stocks, but this difference is more pronounced in the small-cap space, not the large-cap space). Additionally, value just had a strong finish to 2016, which makes growth more compelling from a contrarian standpoint. And finally, we expect the unusually large discount to NAV on ADX will likely shrink in 2017 back to more normal levels (however there is no guarantee) which makes this investment particularly attractive.

From a sector standpoint, we appreciate the broad diversification of ADX as shown in the following chart.

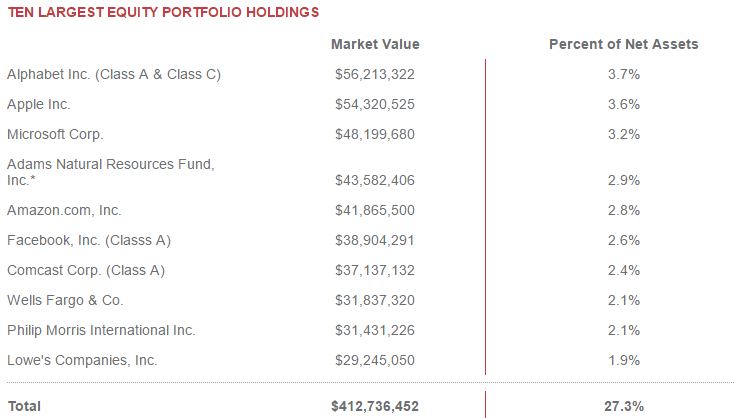

And for further reference, here are the recent top ten holdings of the fund.

From a risk management standpoint, we appreciate the diversified holdings. And we also appreciate this fund’s long-term track record of actively selecting stocks. For further reference, the Gabelli fund we mentioned earlier, which does have some attractive qualities, misses out on some sector exposures (for example, that management team has boldly decided to have very little exposure to technology stocks) which is part of the reason we prefer ADX.

Risks:

The Adams Diversified Equity Fund does face risks that should be considered.

Equity market exposure: For starters, ADX is an equity fund, which means it will suffer many of the same ups and downs as the general equity market. However, because of the big distribution payments from this fund, market volatility should be somewhat muted, and it should be easier for investors to handle because they’ll most likely continue to receive big distribution checks every quarter.

Leverage: Another important consideration is leverage. Many CEF’s use up to 33% leverage to magnify their returns, but of course leverage introduces more risk. For example, if you are levered when the market declines you could be forced to sell holdings at distressed prices just to meet the distribution payments. However, in the case of ADX, the only leverage is a very small amount (1.17%) to help manage operating expenses (so the fund can stay more fully invested in the market so as to avoid missing out on long-term capital gains) but the fund currently does not use speculative leverage like many of its peers, and this reduced the possibility for very big gains, but also prudently reduces the possibility for very big losses.

Management Fees: Management fees are another risk for closed-end funds. At Blue Harbinger, we generally despise paying management fees, and work hard to help investors avoid them as much as possible. However, in the case of closed-end funds, the higher fees may be acceptable for some investors. Specifically, if you are a mature retired (or semi-retired) investor then paying the management fee for access to a closed-end fund may be prudent if you specifically need the big distribution payments and you’re comfortable paying someone else to manage the investments (in this case Adams) so you can sleep well at night. Importantly, this fund charges extremely low management fees relative to other closed-end funds. Specifically, it’s not uncommon for a closed-end fund to charge 1.5% to 2.0% in management fees, but the Adams Diversified Equity Fund (ADX) only charges 0.61% which is extremely attractive if you need the big distributions that this fund generates.

Conclusion:

Overall, the Adams Diversified Equity Fund (ADX) may be an attractive investment for mature retired (or semi-retired) investors that need the big, safe, steady, long-term distribution payments. However, it’s probably NOT prudent for a young investor still saving for retirement (i.e. they likely don’t yet need the big distribution payments, so they’re likely better off in a very low-cost diversified ETF that pays a lower yield). However, we especially like ADX for income-focused investors because of its discount to NAV, attractive market exposure, and attractive long-term management track record. If you are an income-focused investor, this fund is worth considering for an allocation within your diversified long-term portfolio.