Overview:

Low interest rates, improved bank reserve requirements, and quantitative easing have done such a great job restoring faith in the markets following the financial crisis, that the S&P 500 continues to reach new highs and fear (as measured by the VIX) has practically evaporated altogether. But valuations are starting to get stretched.

Market Valuation Metrics:

Here is a look at the Stock Market “Fear Index” (The VIX) versus the S&P 500 (SPY since the depths of the financial crisis in 2009. The market has “gone up” essentially non-stop, and fear has almost disappeared.

To put this dramatic market increase into some perspective, here is a look at the historical forward price to earnings ratio (“PE ratio”) of the S&P 500 (P/E is a basic, yet common, starting point for valuing an investment).

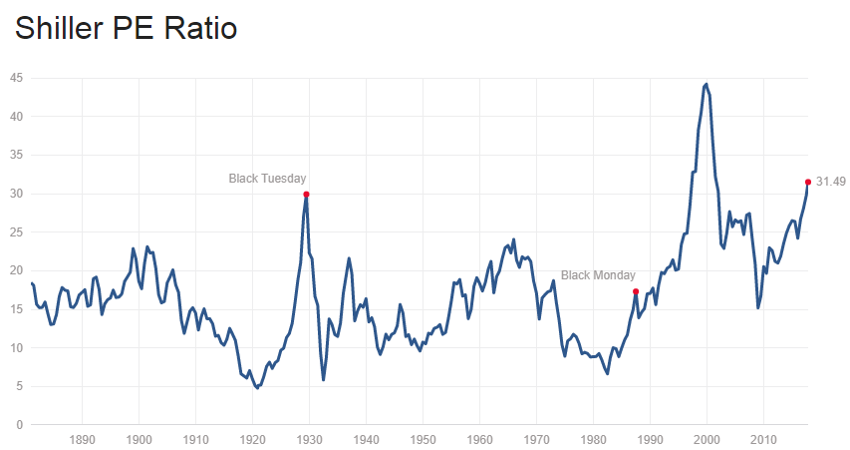

On this measure (forward PE ratio), the market’s valuation is high, but not “tech bubble” high (see the valuation during late 1999 into early 2000). However, there are other ways to gauge the market’s valuation, such as the Shiller PE ratio (which attempts to adjust earnings for inflation) as shown in the following chart.

And after adjusting earnings for inflation (see above), the market appears a little more expensive, but still not “tech bubble” expensive.

For even more perspective, this next chart (known as the Warren Buffett Indicator) compares the overall equity value of the market to GDP.

Market Cap to GDP (above) is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett. Back in 2001 he remarked in a Fortune Magazine interview that "it is probably the best single measure of where valuations stand at any given moment." And according to the Warren Buffett Indicator, the market is starting to get close to “tech bubble” valuation levels.

Perhaps making investors even more nervous, is the non-stop record prices and market capitalizations being set by aggressive large cap growth and “FANG” stocks, like Facebook, Amazon, Netflix, Google and Microsoft, as shown in the following charts.

Are You Afraid of High Valuations?

If you are scared valuations have gotten too high, and you’re afraid we’re due for a market pullback, here are 3 very important things you can do.

1. Know Your Investment Time Frame:

If you’re going to need to “cash in” some of your investments in the near future, then you probably shouldn’t have that money in the stock market. One of Warren Buffett’s many great quotes is:

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

Despite the low VIX (as described above), the market is fickle and it could pull back significantly at any time (no one has a working crystal ball to tell you exactly when). Make sure you have access to liquidity to meet your needs, so if the market pulls back significantly in the short-term, you aren’t forced to sell at a low price. Think of all the people that had their cash tied up in the market and needed to liquidate in 2009 at the bottom of the financial crisis… Yuck!

2. Acknowledge the Market Can Still Go Much Higher (and it probably will over the long-term!)

Despite the fact that valuations have been climbing (as shown earlier), acknowledge the market can still go much higher. Whether it be through higher than expected corporate earnings growth, further earnings multiple expansion, or simply long-term GDP growth, the market probably will go much much higher in the long-term. For some perspective, interest rates (as set by the fed) remain very low (the fed funds target is still only 1.00% to 1.25), and according to the CME FedWatch tool, rates are not expected to increase following the Fed’s meeting this upcoming week.

The market is expecting a rate increase to 1.25% to 1.50% in December, but thisis still very low, and low rates are very pro-growth for the economy.

And the market is expecting only the possibility of very small rate increases through September 2018 as shown in the following chart.

Worth mentioning, President Trump is expected to announce a new Fed Chair (to replace Janet Yellen) this week, and that could change interest rate expectations, but remember this President is very pro-growth.

3. Diversify

Diversification sounds completely boring, but it is critically important to not pull all your eggs in the same stupid basket. That means consider owning some aggressive growth stocks like the FANG stocks we described earlier because they can still go much higher (for example, we own Facebook (FB) in our Blue Harbinger Disciplined Growth Portfolio). Also, consider owning some attractive contrarian investments too. For example, we recently purchased some General Electric (GE) despite its absolutely terrible recent performance. Also, for your reference, here is a look at the very non-FANG 30 stocks of the Dow Jones, and many of them currently offer attractive contrarian income opportunities (we like to buy things that are out of favor).

Sticking with the diversification theme, we also own several allocations to diversified funds, such as the very high-yield attractive closed-end fund: Adams Diversified Equity Fund (as we wrote about here). Further, we’ve taken up some contrarian small cap value opportunities in the Royce Small and Micro Cap Funds (RVT) and (RMT) both of which offer very large yields as well as attractive contrarian opportunities (small value stocks are due for some mean reversion, as described in this article). Even also consider Energy stocks, which have been performing terrible as a whole. However, for example, we own Phillips 66 (PSX) which just announced outstanding earnings on Friday.

At Blue Harbinger, we’ve been putting together an outstanding track record of market beating performance across our strategies by owning top quality investments diversified across industries and market caps. You can view our current holdings here.

Conclusion:

Despite what people tell you, no one has a working crystal ball. Yes, market valuations are on the high side, but over the long-term the market is likely going much, much, higher. And in the immediate-term, it’s very important to own quality individual investments that can perform well throughout any market cycle. Our track record of market-beating performance continues to grow, and you can check out all of our current holdings here.