If you are an income-focused investor, there are a lot of opportunities and pitfalls, especially considering the current macroeconomic environment. In this report, we share data on over 100 big-yield opportunities (including CEFs, BDCs, REITs and MLPs), and then rank our top 10 big-yielders, counting down from #10 and finishing with our top ideas.

Interest Rate Volatility

Before getting into the countdown it’s worth considering the macroeconomic environment. The market has been volatile and dynamic following the onset of the pandemic. And in case you haven’t noticed, interest rates have been particularly volatile over this time period too (as the fed first cut to 0% to spur growth, and then raised aggressively to fight inflation). This has created some unique risks and opportunities for investors to watch out for. For example, as interest rates rise, bond prices fall, as you can see in the following chart.

In fact, the recent interest rate volatility has created some of the worst annual bond price performance (by historical standards) as you can see in this next chart (check out how ugly 2022 was).

This type of interest rate volatility not only impacts bond prices (such as some of the bond CEFs we review in this report), but it also impacts stocks too (particularly stocks that lend money—such as the BDCs we review in this report) and especially because rising rates increases the cost of borrowing and slows the growth of many businesses from across the economy.

Yield Traps

Aside from a challenging macroeconomic backdrop, investors also need to watch out for yield traps. Specifically, the internet is in no short supply of cheerleaders rooting on any investment opportunity that offers a large yield. However, and unfortunately, when an investment offers a high yield that is often an indication of risk. For example, the company may be in distress and future investment results may be ugly. As such, careful consideration should be given to high yield opportunities with regards to investment safety and suitability.

However and importantly, there are certain categories of investments that consistently offer bigger yields, such as REITs and BDCs (which receive tax benefits for paying out big dividends), CEFs (which are often designed to deliver steady high income) and other companies which are naturally suited to pay out big steady income (such as midstream energy companies that benefit from steady fee-based revenues). We’ll explain with specific examples as we countdown our top 10.

Top 10 Big Yields:

With that backdrop in mind, let’s get into the top 10. The rankings are sorted by category because of important nuances and considerations associated with each group. We begin with REITs.

Real Estate Investment Trusts (“REITs”):

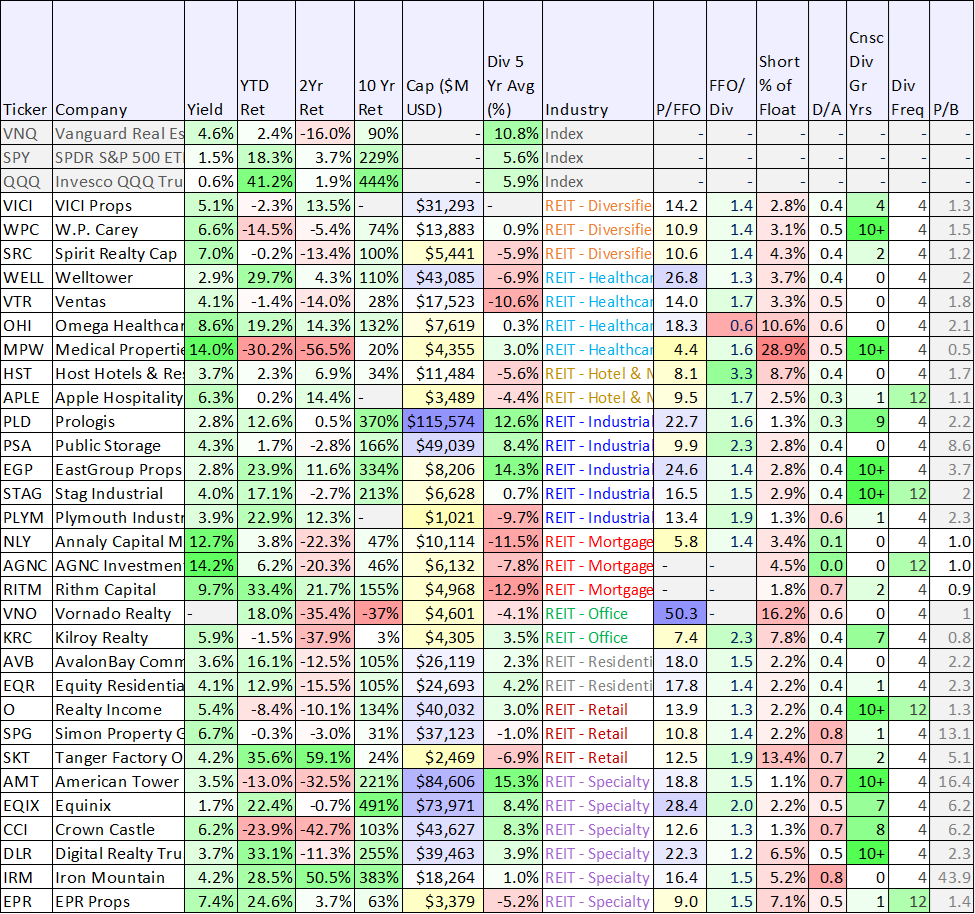

REITs are companies that own, sometimes operate, and/or finance income-generating real estate properties. And REITs come in a wide variety of shapes and sizes, as you can see in the following table.

Source: StockRover, data of 29-Aug-23

A few things you’ll notice about the data in the table above. For one, office REITs have been absolutely terrible over the last two years (because so many people work from home now, especially following the pandemic). Also, mortgage REITs stand out for offering particularly high yields, but you’ll also notice they don’t have particularly long track records of maintaining and growing their dividends (because they are forced to reduce them relatively frequently). Additionally, Industrial REITs have been relatively strong, and we continue to like that group going forward because it is still needed (and growing) despite increases to online shopping habits (unlike many retail REITs, which have struggled).

10. W.P. Carey (WPC), Yield: 6.7%

Coming in at #10 on our countdown, W.P. Carey is a large-cap, blue-chip diversified REIT, specializing largely in industrial properties (as well as retail and office properties, to a lessor extent). The company has a long history of growing its dividend (thanks in part to rent escalators) and it is well positioned to benefit going forward (considering its relatively strong financial position and very solid real estate portfolio). Further, it presents an increasingly attractive contrarian opportunity considering REIT prices (WPC in particular) continue to be weak this year. We recently wrote this one up in detail in a report titled “WPC: 10 Good Things, 5 Risks, 1 Conclusion,” and you can access the report using the following link:

Master Limited Partnerships (MLPs), Midstream Energy

Switching gears, MLPs and midstream energy companies are generally involved in the transportation, storage and processing of oil and natural gas. And they are often another income-investor favorite (because of their very high yields). However, before investing, there are a few things you should know.

MLPs are publicly-traded partnerships (i.e. you can buy and sell them on a public exchange, much like a stock) with unique tax advantages and challenges. Specifically, MLPs don’t pay taxes at the entity level, but instead the investors (e.g. limited partners like you) are on the hook for any tax consequences (i.e. MLPs are passthrough securities).

The MLP partnership structure can create challenges at tax time. For example, you’ll receive a K-1 statement (instead of a 1099) at tax time (this can slow down the filing of your annual taxes). Further, some brokerages simply don’t allow you to own MLPs in retirement accounts (such as an IRA) because they can trigger tax consequences in otherwise non-taxable accounts (i.e. more headaches for investors).

If you can handle the MLP structure, then MLPs can offer some extremely attractive high-income opportunities. However, there are also some non-MLP midstream companies that also offer attractive high yields, as you can see in the following table.

Source: StockRover, data of 29-Aug-23

The table includes a mix of MLPs (K-1’s) and non-MLP midstream companies (no K-1’s). You likely recognize a few of your favorites on this list, as well as a few that may have frustrated you with large tax bills when they converted from MLPs to corporations.

9. Energy Transfer (ET), Yield: 9.5%

Coming in at #9 on our ranking, Energy Transfer is an MLP that owns and operates nearly 125,000 miles of pipeline and associated infrastructure in 41 states (and with a strategic footprint in all major U.S. production basins). And if you are an income-focused investor, it offers a very tempting 9.5% yield. Especially considering the stable fee-based income, the healthy distribution coverage ratio and the ongoing volume growth trajectory. In the following report, we provide the details on why we believe ET offers such an attractive balance of risks versus rewards.

Business Development Companies (“BDCs”)

Before getting into the details on specific BDC opportunities, a quick review of BDCs is warranted. For some high-level background, here is what we wrote about BDCs in our previous BDC report:

Business Development Companies (“BDCs”) were created by Congress in the 1980s as a way to help small businesses (middle-market sized) get access to capital. BDCs invest in businesses by providing them debt and sometimes taking an equity position. BDCs can generally avoid paying corporate taxes by paying out most of their income as dividends (you generally still have to pay taxes on the dividends you receive from BDCs—if you own them in a taxable account).

BDCs are subject to a variety of other stipulations. For example, they are regulated by the SEC under the Investment Company Act of 1940, their leverage is limited to approximately 2:1 debt/equity (unless an SEC exemptive order exists to exclude SBA debt) and investments are required to be carried at fair value. The majority of the board of directors must be independent, they offer managerial assistance to portfolio companies and they are subject to comprehensive disclosure requirements under the 1934 Act.

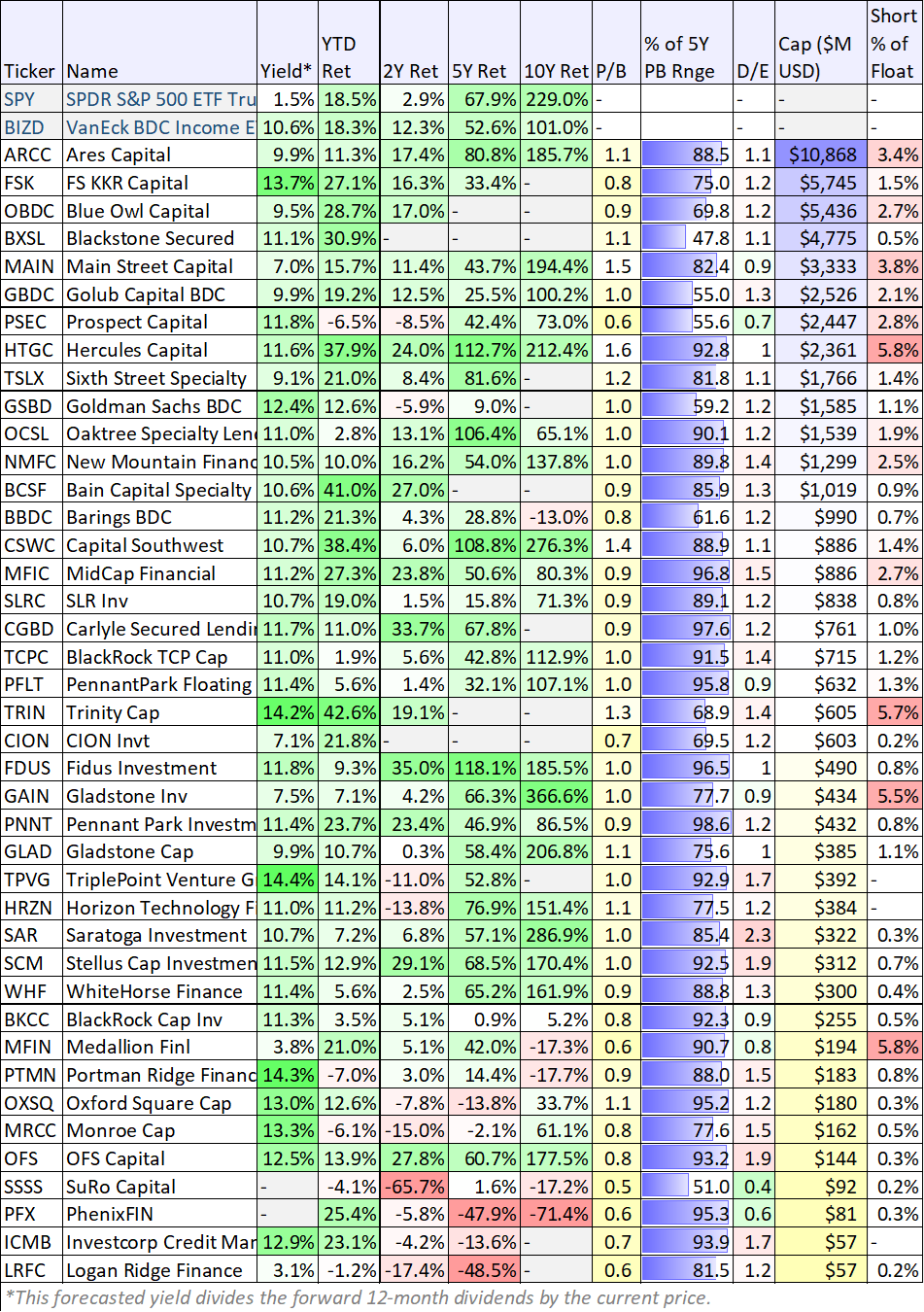

BDCs can come in a wide variety of shapes and sizes, often focusing on different market sectors, geographies and types of financing arrangements. And of course, BDCs are often an income-investor favorite because of their often big steady dividend payments.

Source: StockRover, data of 30-Aug-23

You’ll notice most BDCs have price-to-book ratios that are in the upper half of their historical range, and few have significantly high short interest too. Performance has been relatively strong this year (after a weaker 2022), and there could be additional share price rebounding ahead.

8. Hercules Capital (HTGC), Yield: 9.4%

Hercules is a big-dividend BDC (9.4% yield, not counting supplemental dividends) that we purchased in March and that has now experienced significant share price gains since the whole Silicon Valley Bank panic at that time (Hercules provides financing in the same high-growth / venture-backed lending space).

Hercules is unique because it is the largest BDC focused on high-growth and venture-backed businesses. It is also internally managed (this can help reduce expensive conflicts of interest, as compared to externally-managed BDCs).

Hercules does have a relatively high price-to-book value ratio (as compared to peers and its own history), however the business continues to grow and has significantly more long-term upside prospects in the years ahead. We currently own shares of Hercules, and we recently wrote it up here.

Closed-End Funds (CEFs):

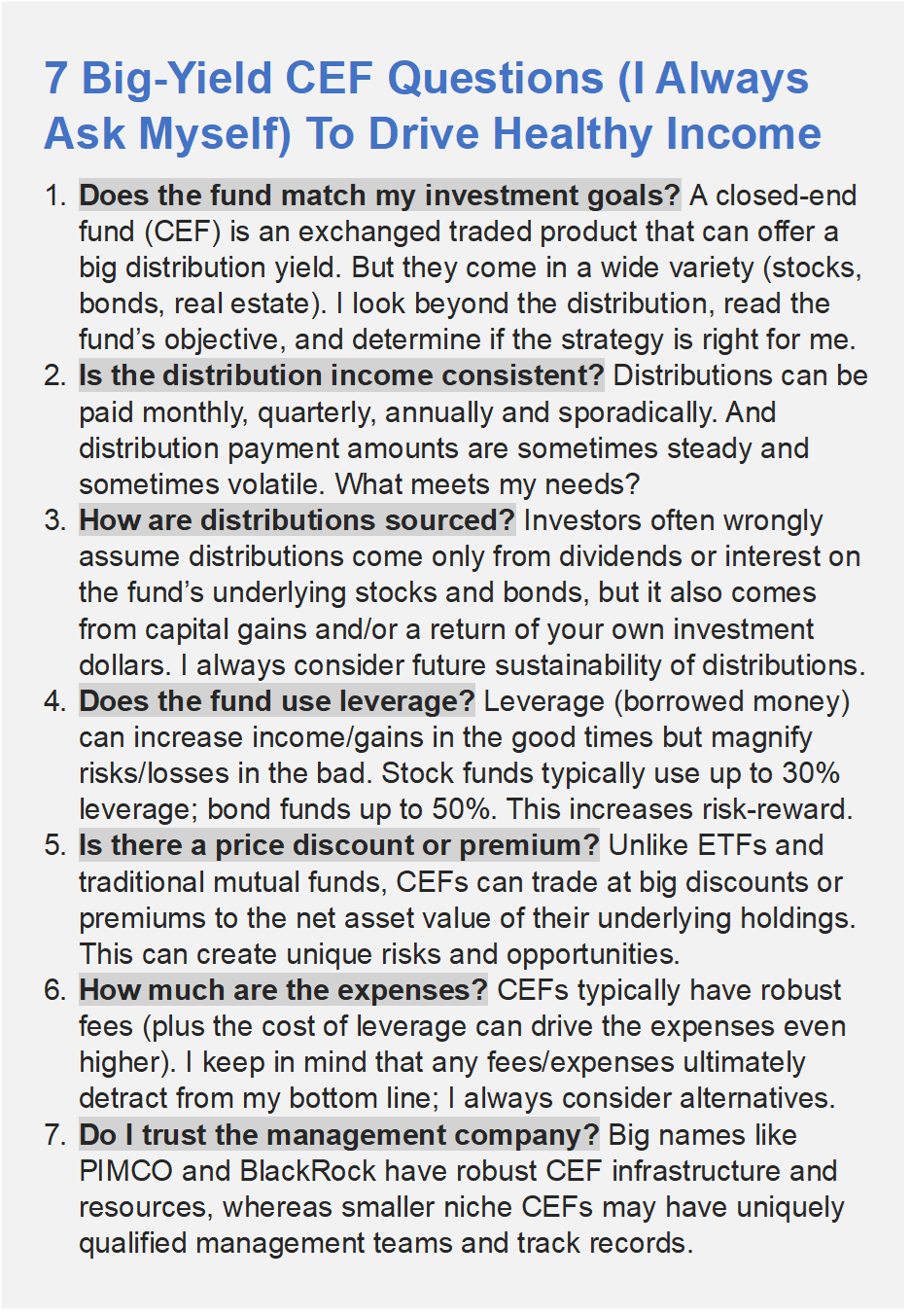

CEFs are another income-investor favorite because they can offer some big steady income payments, often paid monthly. However, there are a few important CEF nuances that investors should be aware of. For example, similar to other mutual funds and exchange-traded funds, CEFs own a basket of individual securities (such as stocks or bonds, depending on the strategy) and thereby offer some instant diversification benefits. However, unlike other mutual funds and exchange traded funds, CEFs can often trade at wide discounts or premiums (compared to the aggregate value of their underlying holdings) and thereby creating some unique risks and opportunities. For a little more perspective, the following graphic explains 7 things we always consider before investing in any close-end fund.

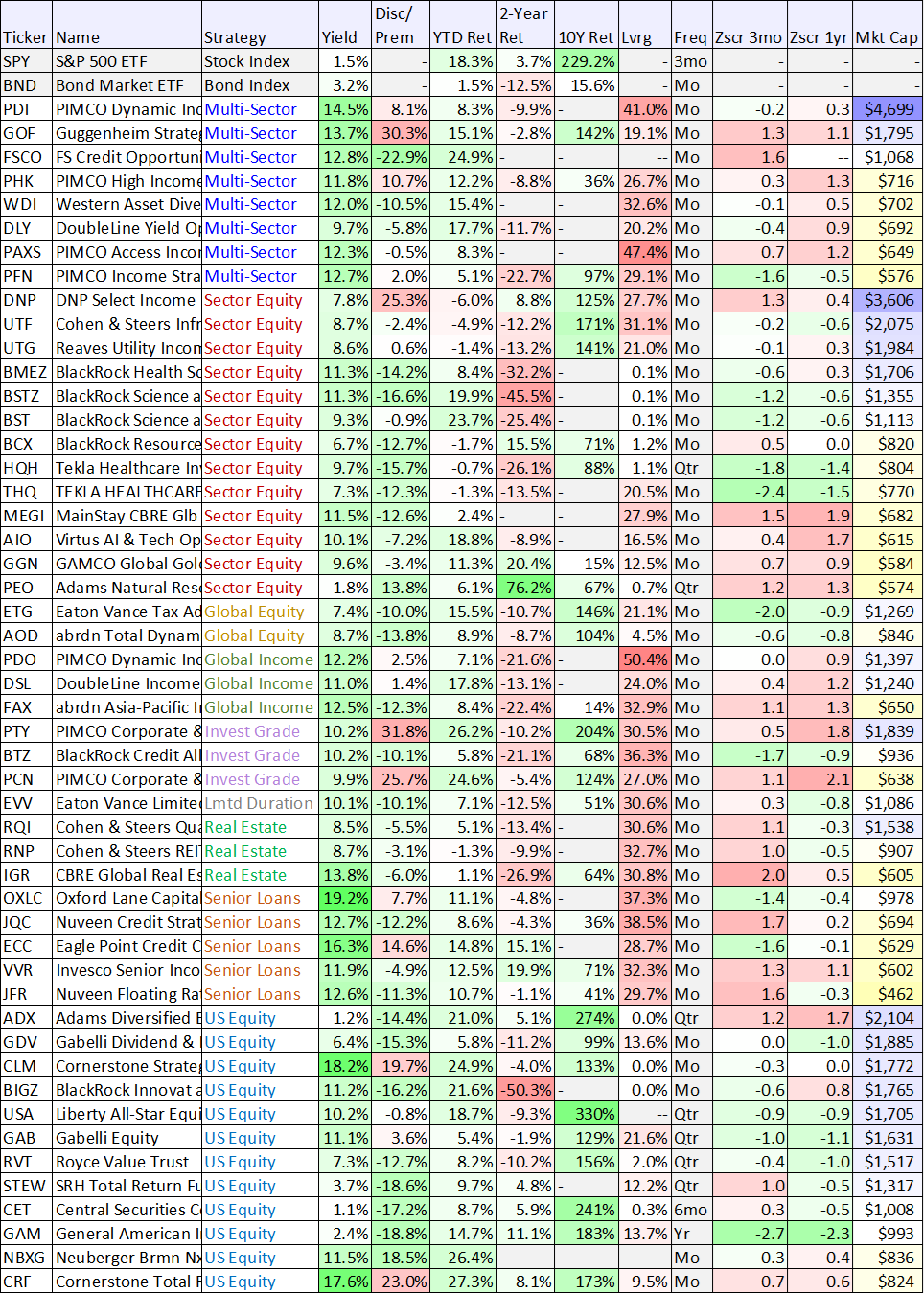

And for more perspective on the group, the following table shares data on a variety of big-yield closed-end funds.

Source: StockRover, data of 29-Aug-23

As you can see in the table above, CEFs vary widely. And one CEF that we consider particularly interesting is described below.

7. PIMCO Dynamic Income Fund (PDI), Yield: 14.4%

PIMCO’s Dynamic Income Fund (PDI) is a popular CEF among income-focused investors, and it should be. It offers big monthly distribution payments (that have increased over time), and it occasionally pays additional special dividends too. Plus, interest rates may be stabilizing, and the fund is managed by a world-class company, PIMCO. In the following report, we weight the strategy’s costs versus benefits, and then conclude with our strong opinion on investing.

6. Cohen & Steers Infrastructure (UTF), Yield: 8.7%

The Cohen & Steers Infrastructure Fund has been around since March 27, 2004 (inception date) and has ~$3.2 billion in managed assets (including assets purchased with leverage), large by CEF standards. The fund’s objective is total return with an emphasis on high current income by investing in infrastructure securities (both stocks and bonds) including utilities, pipelines, toll roads, airports, railroads, marine ports, telecoms and other infrastructure companies. UTF recently held 240 individual positions, including some popular midstream energy companies (such as Enbridge (ENB)) and does not issue a K-1 statement. You can access our previous full report on UTF here:

5. Tekla Healthcare Investors (HQH), Yield: 9.5%

Healthcare stocks have been weak this year (as compared to the rest of the market) and the group is increasingly attractive from a contrarian standpoint. And one particularly interesting way to play the group is through Tekla Healthcare Investors CEF (HQH). This particular fund invests in healthcare stocks from across the globe, including names like Amgen (AMGN), United HealthGroup (UNH) and AbbVie (ABV). And not only has the sector lagged this year, but the fund’s discount to NAV is attractively large (recently -15.1%), and its z-scores are compelling (recently negative at 3, 6 and 12 months, see earlier table). Plus the fund uses almost zero leverage. We currently own multiple Tekla healthcare CEFs in our High Income NOW portfolio, as you can see in the holdings using the link below.

4. Oaktree Specialty Lending (OCSL), Yield: 11.2%

Oaktree Specialty Lending is a big-dividend BDC that currently presents an attractive opportunity for income-focused investors. Specifically, the big dividend is well covered, the balance sheet is strong and the company has been helped by rising interest rates (thanks to floating rate loans). It also trades at a reasonable valuation and has opportunities for growth. You can access our full report on OCSL using the link below.

3a. Adams Diversified Equity Fund (ADX), Yield: +6.0%

Income-focused investor often end up owning a lot more bonds and financing companies (such as BDCs, for example) than typical stocks, and when they do invest in stocks they are usually overweight sectors known for dividends (such as utilities, financials and consumer defensive stocks). However, one way to get exposure to stocks (to help maintain a healthy level of diversification in your investment portfolio) is by owning big-yield equity closed-end funds, such as the Adams Diversified Equity Fund (ADX). In particular, ADX has a significant amount of exposure to “growthier” sectors of the market (such as technology and consumer discretionary) yet still maintains a large distribution.

ADX has been paying distributions for over 80 years, and it guarantees a distribution of at least 6% per year, and often pays more (depending on market conditions). Of course, like other CEFs, ADX sources a significant portion of its big distribution from long-term capital gains. One big caveat, ADX pays three smaller distributions in quarters one, two and three each year, followed by a larger fourth quarter distribution (that brings the annual distribution rate to 6.0% or more).

Importantly, ADX doesn’t use leverage, it has a long track record of very strong total returns, and it currently trades at a very healthy discount to NAV (recently more than 14%). The fund has posted strong gains this year as the equity market has recovered, but the market pullback in recent weeks provides an increasingly compelling entry point for long-term investors. We currently own shares of ADX

3b. Central Securities Corp (CET), Yield: +6.0%

Another very interesting equity CEF is Central Securities Corp. It has been around since 1929 and also has a long history of paying very large distributions. This fund has a highly attractive long-term strategy, but does hold a one large less liquid investment (interest in a private insurance company) and therefore trades at an even larger discount to NAV than its currently disclosed 18.9% discount (the NAV is written down to account for an illiquidity discount on the private insurance company stake). We wrote this one up in detail earlier this year (see link below). Also keep in mind, the distribution on CET is paid semiannually.

2. Ares Capital (ARCC), Yield: 10.0%

Ares is the largest publicly-traded BDC in the US, and it has a well-diversified portfolio of investments (mainly loans to businesses in need) across market sectors and industries. The business is helped by an attractive mix of floating rate loans (it makes more revenue as interest rates have risen) and fixed rate debt (interest on its balance sheet debt is largely fixed rate). We recently wrote this one up in detail (see link below), we currently own shares in our High Income NOW portfolio, and if you are an income-focused investor it is absolutely worth considering for investment.

1a. BlackRock Credit Allocation (BTZ), Yield: 10.2%

1b. PIMCO Access Income Fund (PAXS), Yield: 12.6%

We’re adding two big-yield bond funds at #1 because both are particularly attractive in our view. For starters, they both offer double-digit yields and they are both managed by top tier managers. Some argue that PIMCO is a much better investment manager than BlackRock, and that helps explain why the PAXS price discount versus NAV is only around -2.7%, whereas for BTZ the discount is larger (-10.2%). Discounts on BlackRock funds are generally attractive and not unusual, but it is a bit unusual for a PIMCO fund (PAXS is relatively new versus a lot of other PIMCO funds). However, it’s noteworthy that the BTZ z-scores are significantly negative thereby creating a particularly attractive entry point in our view.

Both funds have interest rate risk (as rates rise, bond prices fall), and the BlackRock fund has a bit more interest rate risk, as measured by duration (6.18 years) versus PAXS (3.8 years). However, with rates (hopefully stabilizing) both positions are positioned much better for stronger returns going forward. You can read more about BTZ on the BlackRock website here, and more about PAXS here. We currently own significant positions in both funds in our High Income NOW Portfolio.

The Bottom Line:

If you are an income-focused investor, there are many opportunities (ranging from REITs to BDCs and more) and pitfalls (including potential “yield traps” and volatile interest rates). And depending on your personal goals and situation, we believe the opportunities highlighted in this report can be an important part of a prudently-diversified high-income portfolio. And for reference, you can access the complete list of holdings in our High Income NOW Portfolio by clicking here: