“Dogs of the Dow” is a contrarian blue-chip dividend value strategy, and UnitedHealth Group (UNH) is one “dog” that stands out as attractive. It’s a leading diversified healthcare company that has navigated a challenging 2025 (marked by medical cost pressures, regulatory scrutiny, and market volatility). Yet, despite the headwinds (and a 28% year-to-date share price decline), UNH has demonstrated resilience through healthy revenue growth and strategic expansion. Despite the risks (as will be discussed), UNH is currently attractive thanks to its powerful growth trajectory, compelling valuation, and healthy 2.5% dividend yield.

Dogs of the Dow:

Before getting into UnitedHealth Group, it’s worth first considering the “Dogs of The Dow” strategy (because UNH is currently an attractive “dog”).

*Note: click the image above to open a higher-resolution PDF to improve clarity and “zoom-in-ability”.

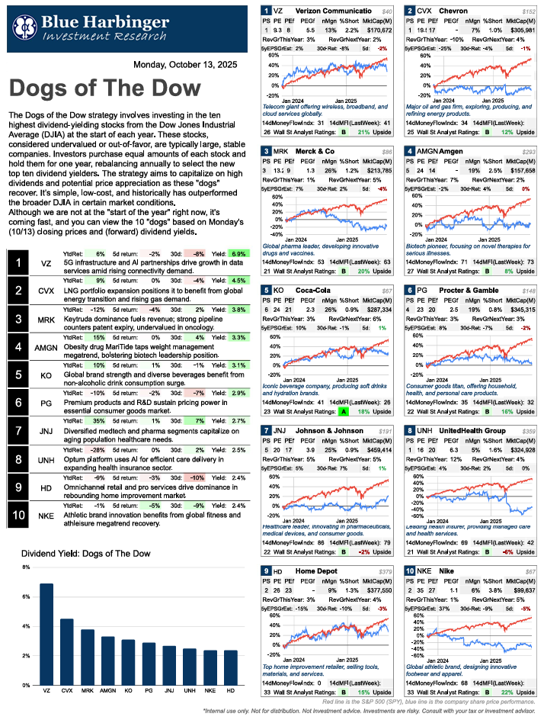

The Dogs of the Dow strategy involves investing in the ten highest dividend-yielding stocks from the Dow Jones Industrial Average (DJIA) at the start of each year. These stocks, considered undervalued or out-of-favor, are typically large, stable companies. Investors purchase equal amounts of each stock and hold them for one year, rebalancing annually to select the new top ten dividend yielders. The strategy aims to capitalize on high dividends and potential price appreciation as these "dogs" recover. It’s simple, low-cost, and historically has outperformed the broader DJIA in certain market conditions.

Although we are not at the "start of the year" right now, it's coming fast, and you can view the 10 "dogs" based on Monday's (10/13) closing prices and (forward) dividend yields in the graphic above (including UnitedHealth Group).

Overview: UnitedHealth Group (UNH), Yield: 2.5%

UnitedHealth Group operates through two primary platforms: (1) UnitedHealthcare which provides health benefits to individuals, employers, and government programs (and it focuses on Medicare Advantage, Medicaid, and commercial plans), and (2) Optum which delivers health services, analytics, pharmacy benefits, and technology solutions (it emphasizes value-based care and data-driven insights).

As one of the largest healthcare companies globally, UNH serves over 50 million members in the U.S. and internationally, with a market cap of over $300 billion.

Growth Opportunities:

UNH's growth trajectory remains promising, driven by demographic trends and strategic initiatives. For example, Wall street expects revenue to grow 12% this year (a lot for a megacap bluechip), reflecting expansions in Medicare Advantage (amid an aging U.S. population projected to boost demand for senior-focused plans). Further, Optum is expanding through acquisitions and tech integrations (targeting 7–9% margins by 2027 despite near-term pressures). And broader industry tailwinds, including the booming group health insurance market (expected to grow through 2032) positions UNH to benefit from rising premiums and value-based care models.

Valuation:

Trading at only 16x earnings, and with continuing revenue growth, UNH shares are attractive, especially considering so much negativity is already baked in. For example, the shares are down 28% this year following an earnings miss on rising medical costs, a CEO resignation and fraud allegations and regulatory scrutiny. Also notable, Warren Buffett's Berkshire Hathaway initiated a significant new position in UNH (~$1.6 billion) in the second quarter (following the share price declines).

Dividend Safety:

The UNH dividend is also particularly attractive. The forward annual yield is currently 2.5%, and it’s backed by a low payout ratio of only 36.8% (particularly healthy). Also UNH has increased the dividend for 15 consecutive years (another indication of health). And considering the share price is down this year, the yield has also increased significantly (as share price falls, dividend yield mathematically increases). This has pushed UNH into the “Dogs of The Dow” category—attractive in my view.

Risks:

While appealing, UNH does faces notable risks. For example, persistent medical cost inflation (above 7.5%) could erode margins. Further, regulatory pressures (including a DOJ probe and potential Medicare Advantage reforms) pose threats to profitability. Also, competition from peers (like CVS Health) add to pressures. Further, macroeconomics (e.g. rising consumer debt) could indirectly impact enrollment. Also noteworthy, cybersecurity incidents (like the earlier 2025 breach) remain a concern for operational disruptions.

Conclusion:

If you are worried about pure-growth stocks overheating, UnitedHealth is an attractive contrarian dividend-value stock that has recently entered into “Dog of The Dow” status—something a lot of investors find attractive. I am currenlty long shares of UNH in my Blue Harbinger Disciplined Growth Portfolio (and look forward to healthy income and share-price appreciation potenital ahead).