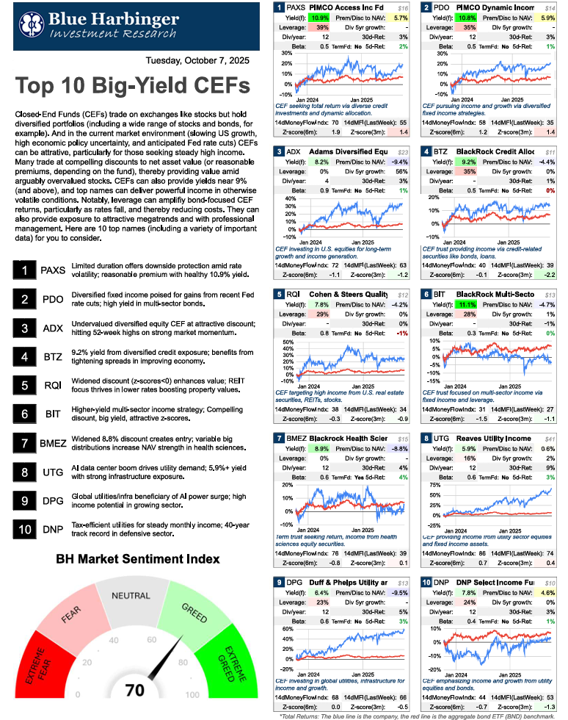

This report shares updated data on 10 top big-yield closed-end funds (CEFs), including bonds, stocks and a couple utility-sector specific funds. They all offer attractive big yields, but one BlackRock fund stands out for a particularly compelling opportunity right now.

For starters, here is a look at the latest data (for you to compare, contrast and consider):

And here are the 7 big-yield CEF questions I always ask myself before investing.

However, one fund in particular stands out as worth considering…

BlackRock Multi-Sector Income Trust (BIT): 11.1% Yield

Specifically, BIT (a multi-sector income CEF) has experienced a modest price pullback in recent weeks, currently trading in the low $13’s (down from $14.50 recently).

This sell-off (amid broader fixed-income volatility), has pushed its discount to NAV wider—to -4.7% from a 52-week average premium of +0.06%. The key driver has been the fund's over-subscribed rights offering, completed September 9, which issued up to 14.3 million new shares at $13.01 (90% of NAV). This increased shares outstanding, creating dilution and temporary selling pressure and thereby exacerbating the discount.

However, despite this, BIT's NAV remains a resilient at $14.06, up 7.3% YTD, and is supported by its 11.1% distribution yield and diversified credit exposure benefiting from expected Fed rate cuts.

The current discount presents a potential entry for income seekers, though near-term volatility persists. I am currently long shares of BIT in my high-income portolio, and I believe they are worth considering for new investment (depending, of course, on your personal situation).

Disciplined goal-focused long-term investing continues to be a winning strategy.