Here is a look at recent performance data for 40+ big-yield business development companies (or BDCs). As you can see, the prices are down this year, more so than the S&P 500, and the price-to-book values (a common BDC valuation metric) are down too. Let’s consider why, whether there is more pain to come, and if you should be hitting the eject button, holding tight or buying more.

As you can see in the table above (sorted by market cap), BDCs offer much bigger yields than the S&P 500 (SPY), investment grade bonds (BND) and high-yield bonds (HYG).

What is a BDC?

A Business Development Company (BDC) is a type of publicly traded company in the U.S. that invests in small, growing, or financially distressed businesses, providing them with capital through loans, equity investments, or a combination of both. BDCs are regulated under the Investment Company Act of 1940 and are designed to give retail investors access to private market investments typically reserved for institutional investors.

Importantly, BDCs avoid corporate income tax by passing income directly to shareholders, who then pay taxes on dividends. Also, BDCs often use borrowed funds (leverage) to enhance returns, which can increase both potential gains and risks. Furthermore, they must adhere to strict regulatory requirements, such as diversification rules and limits on leverage (typically up to 2:1 debt-to-equity ratio).

Also worth mentioning, BDCs were created by an act of Congress to provide support for small businesses (i.e. they provide critical capital to underserved companies).

High-Level Risks:

From a risk standpoint, BDCs face Credit Risk (investments in smaller or distressed companies can lead to defaults or losses); Interest Rate Sensitivity (rising rates can increase borrowing costs and affect dividend sustainability); Market Volatility (BDC stock prices can be volatile due to economic cycles or leverage) and Management Fees (BDCs often charge high fees, which can reduce returns)

Why are BDCs down this year

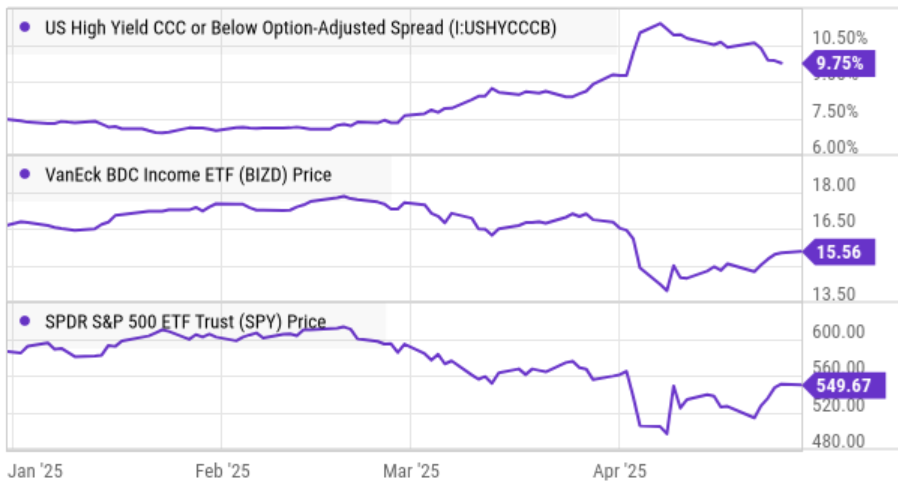

No surprise, BDCs are down (along with the overall market) as tariff fears have gripped the entire market. For a little perspective, here is a look at year-to-date BDC performance (as measured by BDC ETF (BIZD)) as compared to credit spreads.

Credit spreads (a measure of credit risk, as described earlier) widen when perceived market risk increases. It may appear (above) that BDCs have performed just like the overall stock market, but when we zoom out (see below) we can see that unlike the broader market (S&P 500), BDC prices remain relatively flat over time (they don’t go up like other stocks) because BDCs pay out most of their gains as dividends (so their is less capital for them to reinvest and grow, all else equal, as by design).

Also, as you can see in our earlier table, BDCs have lower market betas (less market risk) and therefor BDC prices are generally not as volatile relative to the S&P 500 (a good thing for income-focused investors that prefer lower volatility).

Further still, as you can see in our earlier table, BDCs have low leverage (debt-to-equity) as compared to the 2.0x regulatory limit—which means they still have a lot of financial wherewithal (dry powder) to handle any additional market volatility and economic weakness that may (or may not) be ahead.

Is now a good time to buy BDCs?

The answer to that question depends on your personal situation and goals, but if you are an income-focused investor then now is a great time to consider owning BDCs (and if you do own BDCs, don’t “panic sell” just because they’re down).

Specifically, BDCs trade at relatively attractive prices compared to book values, and they have plenty of leverage dry powder to weather any increasing economic challenges as well as to deploy capital for additional investments as demand may grow (good for BDCs) as economic distress may pick up for the type of small, higher-risk, businesses BDCs invest in by providing capital to them.

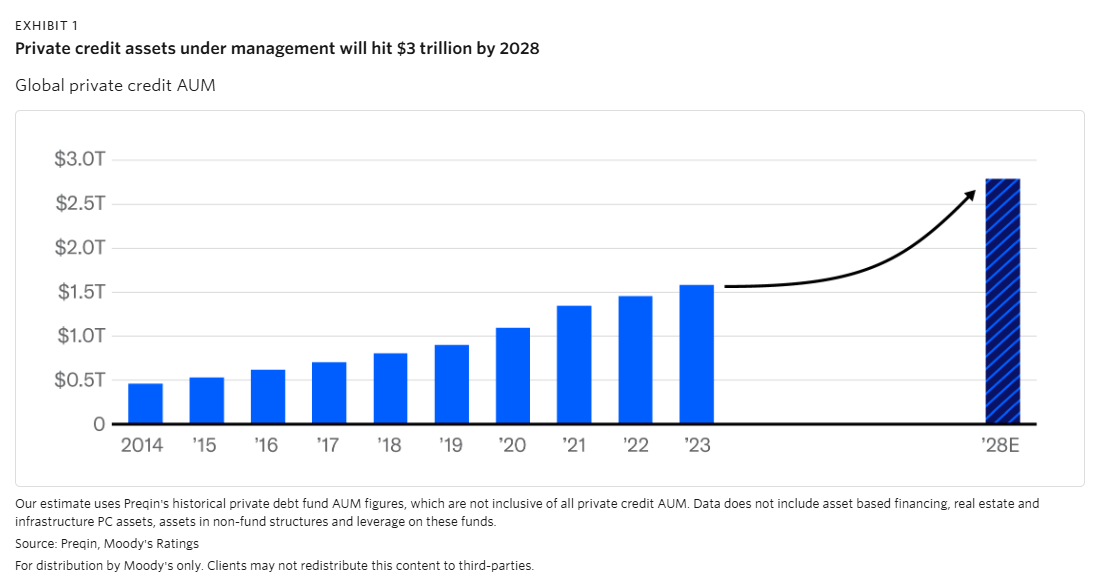

And to provide a little more color, Moody’s estimates that demand for private market credit (essentially exactly what BDCs do) may grow significantly in the short years ahead (a good thing for BDCs) as you can see in the chart below.

The Bottom Line

The saying is “buy low” (not the other way around), and unless you think the world is actually going to blow up and end, BDCs have plenty of financial strength to weather the storm and take advantage of additional opportunities as they arise.

We are long shares of Ares Capital, Oaktree, Main Street and Blue Owl as part of a prudent allocation to BDCs within our High Income NOW portfolio. We have no intention of selling at this time and look forward to more big dividends and opportunistic price gains ahead.