Most people recognize Amazon as the global leader in in e-commerce, but it’s also a huge cloud company with massive advertising revenue growth. Further, Amazon is spending heavily on Artificial Intelligence (“AI”) and other innovation, while simultaneously strengthening profitability under CEO Andy Jassy. And despite big risks (such as tariffs, massive scale—which makes growth challenging, and competition), the shares are attractively valued (especially considering its strategic focus on large-TAM megatrends). I review the details in this report and then conclude with my opinion on investing.

About Amazon

Amazon’s business spans multiple sectors collectively achieving $165.7 billion in revenue in the first quarter of this year (up 10% year-over-year, excluding FX impacts), and $650.31 billion in total revenue over the last 12 months (this is A LOT of revenue).

For perspective, here is a high-level breakdown of Amazon’s businesses:

Amazon Stores: This is the e-commerce platform, including retail and third-party seller services. And it remains Amazon’s largest segment in terms of revenues, generating approximately $61.4 billion in Q1 2025, or ~39% of total revenue. Further, online store sales grew 7% year-over-year.

Amazon Web Services (AWS): This is the cloud business, and it is Amazon’s main profit engine. AWS contributed $29.3 billion in Q1 2025 revenue (up 19% YoY, and ~19% of total revenue). And importantly, AWS accounted for ~63% of operating income (due to its 35%+ operating margins).

Amazon Prime: This is the subscription service (including Prime Video) and it contributes significantly to Amazon’s recurring revenue. Amazon doesn’t isolate Prime figures exactly, but we do know that Prime-related subscriptions generated ~$10 billion in Q1 2025 revenue (roughly 6% of total revenue).

Amazon Ads: This is the advertising unit, driven by sponsored products and Prime Video ads. It generated $13.92 billion in Q1 2025 (+19% YoY, or ~9% of total revenue). It’s a relatively new and high-margin business for Amazon.

Amazon’s AI Business: Amazon’s AI initiatives (e.g. Nova AI models and Bedrock platform), are being integrated into AWS and e-commerce. AI financials are not reported separately, but CEO Andy Jassy noted AI as a “once-in-a-lifetime opportunity,” with AWS investing $100 billion in 2025 for AI infrastructure.

Other Businesses: Amazon’s logistics, Kuiper (satellite broadband), and Zoox (self-driving cars) are emerging bets. These are pre-revenue or low-revenue businesses, but align with long-term growth in connectivity and automation, and represent potentially large future market opportunities.

Growth:

Amazon’s revenues continue to grow significantly, and earnings per share is growing even faster. Specifically, Amazon’s revenue grew 8.6% YoY (to $155.7 billion in Q1 2025), with TTM revenue up nearly 10.1% (to $650.31 billion). And more impressively, earnings per share (EPS) grew 62% YoY (to $1.59 in Q1), due to cost discipline and high-margin AWS growth. Analysts forecast revenue growth of 8.7% annually and EPS growth of 20% over the next three years, driven by AWS and advertising.

Total Addressable Market (TAM) Size:

Amazon’s total addressable market (TAM) opportunities are huge. For example, global e-commerce is expected to reach $7 trillion by 2027, cloud computing $1.6 trillion by 2030, and digital advertising ~$1 trillion by 2027. These opportunities are supported by megatrend growth including AI adopoption and the ongoing digital revolution. CEO Andy Jassy recently said, “What you’ve seen just in the last few months is really the explosion of coding agents,” highlighting AWS’s AI-driven growth.

Valuation

From a valuation standpoint, Amazon is attractive and positioned to outperform the market. Not just because the shares are down this year, but also because EPS is expected to grow 30.9%, on average, each year for the next 5 years (this is a lot!), driven by operational efficiency and megatrend tailwinds.

And with a forward P/E of 28.2 (well below its five-year average) and a forward PEG ratio of 1.1x, these shares can continue to outpace the market.

Capital Allocation:

Amazon does not pay a dividend because it prioritizes reinvesting in its own business (a good thing considering the large growth opportunities), but it does repurchase shares (in 2022, the board authorized a $10 billion buyback program, a sign of confidence in the value of the business).

Also worth mentioning, Amazon is working to stabilize free cash flow (down 48% to $25.9 billion TTM due to capex) and optimizing rural delivery costs. Andy Jassy recently emphasized, “We’re maniacally focused on keeping retail prices low,” (perhaps underscoring efforts to maintain margins despite tariff pressures and risks).

Risks:

Of course Amazon faces risks that investors should consider. For example:

Tariffs: President Trump has been creating big headaches for Amazon recently announcing, then partially delaying, 145% tariffs on Chinese imports (which could cause $5–10 billion in annual profit erosion, mainly from Amazon’s retail and e-commerce business). Tariffs could cause sellers to increase prices, and thereby negatively impacting demand.

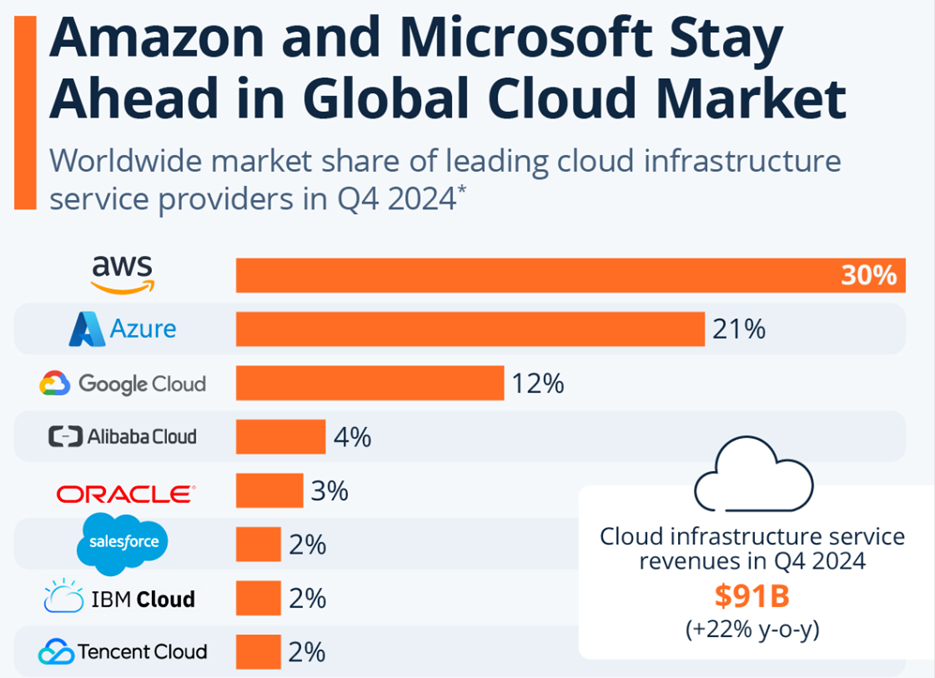

Cloud Competition: AWS remains the leading cloud company, but faces intensifying competition from faster growing Microsoft Azure (+31% YoY) and Google Cloud (+30% YoY); AWS’s revenue grew 17% in Q1 2025. Additionally, Amazon has faced some margin erosion, but it still remains extremely profitable (36.9% in Q4 2024).

Regulatory Risks: The expansion of antitrust lawsuits and data privacy regulations are a constant threat to Amazon.

Macroeconomic Risks: Inflation and recessionary concerns could clearly impact consumer spending, negatively affecting e-commerce growth in particular.

Execution Risks: Amazon is spending massively on innovation. For example, heavy capex (~$100 billion in 2025) for AI, Kuiper, and Zoox poses a significant risk and strain on free cash flow if returns don’t materialize at some point.

The Bottom Line:

Amazon shares are down this year (as big tech has sold off particularly hard), and the company faces significant risks (from tariffs, growing cloud competition and large capex that is yet to bear significant fruit).

However, the valuation is increasingly attractive considering massive megatrend tailwinds (e.g. the ongoing digital revolution and AI) and the company’s high EPS growth trajectory (thanks to financial discipline and leadership from Andy Jassy).

Overall, and despite the risks, Amazon appears positioned for continuing long-term market outperformance. It’s worth considering for a spot in your disciplined, long-term, growth-focused portfolio.

*(long Amazon).