It’s a cloud-AI world, and the companies capitalizing on this will dominate in market performance for years to come. What’s more, tariff fear has created more attractive buying opportunities as this turmoil too shall pass and stocks are eventually going higher (some of them much higher). This report ranks our top 10 growth stocks, starting with #10 and counting down to our very top ideas. Five years from now, people will wish they had been buying more stocks in 2025, and this report highlights a few very top ideas for you to consider.

*Honorable Mention: Palantir (PLTR)

Before getting into the official top 10 rankings, we’d be remiss to not at least mention dominant fast-growing AI juggernaut Palantir Technologies—a company that has been growing like wildfire with tons of room too keep growing—fast!

If there was a poster-child for the AI megatrend it would be Palantir—with a 30% revenue growth rate and a colorful CEO, Alex Karp, who knows precisely how to push buttons and fire up his troops of retail investors.

Wall Street, however, HATES Palantir because its valuation is so much ahead of it business, now trading at 99x sales (honestly, this is way too high for any stock, unless it can grow at over 30% for the next 10 years, and even that doesn’t leave much room for price upside).

Nonetheless, the business is an amazing AI beneficiary. We have owned this one in the past (and enjoyed a run in price from $14 per share to over $100, but it’s simply too expensive for us now—even if we do absolutely love the businesses.

So let’s get into the official top 10 ranking and countdown.

10. Microsoft (MSFT)

Simply put, Microsoft is one of the greatest (or perhaps the greatest) stock in the world. It does NOT get the attention of flashier names like Nvidia, Meta Platforms or Tesla, but Microsoft provides something else—an amazing high-growth cloud-and-AI megatrend beneficiary with fortress financial strength (AAA credit rating), an amazing CEO and safety in down markets plus massive upside in bull markets.

Microsoft is a leader in cloud computing and AI software, has a double-digit sales growth rate, and recently beat earnings expectations again (a signal that the cloud and AI megatrends are alive and well). We’d rank this one higher on our list, but it’s up over 23% in the last few weeks, and there are better near-term margin of safety stocks worth considering.

Either way, Microsoft is arguably the best single long-term, publicly-traded business in the world (but we don’t invest in single stocks alone—we invest in a portfolio of them, and Microsoft is a signficant positon in ours).

9. Meta (META)

I don’t care what anyone says, Meta CEO, Mark Zuckerberg, is an all-time creepy geek, and for better or worse—he is solidly monetizing people’s social addictions. I have been long these shares since 2012, and watched Zuck (who originally created Facebook to creep on college girls at Harvard) expand his original platform to more users and then to mobile, and then grew to Instagram and WhatsApp (which, by the way, records all your calls and plugs them into AI) and recently spend massively on Nvidia servers to stay ahead of his peers in the AI arms race. Again, this CEO creeps me out, but he is really smart and appears just as determined to make Meta a bigger, better and an even more dominant company.

With ongoing double-digit revenue growth, a “strong buy” rating from Wall Street and a compelling 1.2x forward PEG ratio (price-to-earnings vs growth) Meta remains a very attractive long-term growth stock (it also pays a small growing dividend now too) set to continue benefiting from AI and its highly determined creepy CEO.

Not to mention, Meta beat earnings this quarter and provided guidance in line with street expectations (i.e. more healthy double-digit growth ahead). Long Meta.

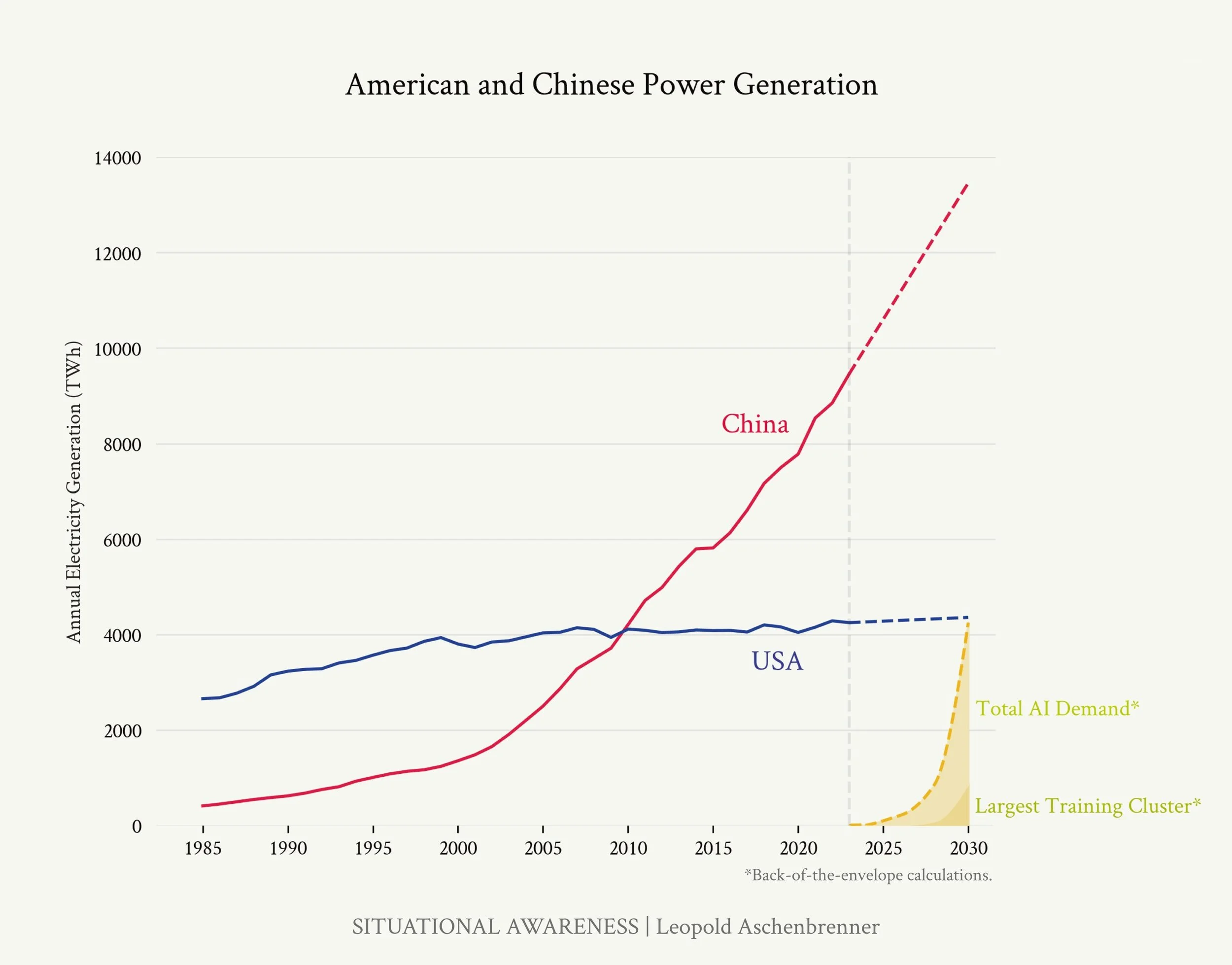

8. Constellation Energy (CEG)

This one chart basically says it all when it comes to the demand for energy that will be created by power-hungry AI data centers, of which Constellation Energy is a supplier (it generates clean energy with a 34.2 GW carbon-free portfolio, attractive for AI data center demand and nuclear growth).

In a nutshell, Constellation Energy will continue to benefit from rising clean energy demand as industries shift toward sustainability. It trades at just over 20x P/E ratio, which is slightly rich for a utility sector stock, but not when you consider this sector is overdue for strong performance and considering the CEG has such strong demand (Wall Street rates is a strong buy and assigns it an impressive 14.6% 5-year earnings per share growth estimate). Long CEG.

7. Adobe (ADBE)

Adobe may not have the hypergrowth of some headline-grabbing disruptors, but it is still growing revenues at almost 10% annually, and the shares have gotten really cheap (attractive!). Trading at only 16.7x forward earnings, this very high-margin (+30% net) creative software business (Firefly AI drives growth) is also attractive for its very strong subscription model and its impressive 14.3% 5-year EPS growth estimates. This business is a stalwart of the digital creative industry, and it is not going away (it’s only getting bigger and better), and it is a buy. Long Adobe.

6. Nvidia (NVDA)

Nvidia is ground zero for the AI megatrend. The company’s GPU are the dominant leader in AI, and demand greatly exceeds supply. The backlog is extensive and the AI megatrend is still just getting started.

The recent tariff turmoil is mpacting Nvidia significantly, particularly as certain GPU chip sales to China are not allowed (and the company has plans for American-made AI supercomputers—which of course will take time). But the real story remains dominant demand and revenue growth and a valuation that remains relatively low (forward P/E is still only 20x and forward P/E to Growth is only 1.1x—both highly attractive and compelling).

Nvidia is the quintessential AI play, and if you are not picking up shares on this selloff (the industry has always been cyclical) you are making a mistake. Long Nvidia.

5. CoreWeave (CRWV)

CoreWeave is a Generative-AI cloud platform on the frontlines of the AI infrastructure megatrend. As a new IPO (March 28, 2025), the company basically helps hyper-scalers get up and running fast with early access to leading Nvidia GPUs optimized for AI. Microsoft is their biggest customer at 62% of revenues, but OpenAI signed a big deal in March that should make the future revenue split about 45% OpenAI and 23% Microsoft.

If you are an investor, CoreWeave offers a high-risk, high-reward proposition. Its alignment with the AI megatrend, explosive growth, and reasonable valuation make it a compelling buy if you are a long-term investor betting on AI.

4. Tesla (TSLA)

I cannot believe I am saying this here, but Tesla is a buy. Wall Street HATES Tesla (they are too backward looking), Main Street HATES Tesla (they are too politically motivated), automobile industry analysts HATE Tesla (they are not recognizing what the company actually is).

Tesla is about to rip higher over the next 1-year+ thanks to its Full Self Driving (“FSD”) technologies—which could be worth over $1 TRILLION dollars alone thanks to the massive robotaxi market. For example, Google CEO Sundar Pichai gave a HUGE nod to Tesla shares on the Alphabet earnings call. Discussing Waymo (Google’s self-driving technologies), he explained:

"The car is very expensive, made in low volume. Teslas are probably cost 25% or 20% of what a Waymo costs and made in very high volume."

Tesla has a huge market opportunity ahead, and the market is not appreciating it whatsoever. Elon Musk has done it many times before, and if/when Tesla FSD makes it a leader in FSD these shares will again be trading dramatically higher.

3. Vertiv (VRT)

Vertiv is in the right place, at the right time, as it is positioned for massive growth thanks to the AI megatrend. Specifically, Vertiv provides critical AI data center infrastructure (for example it has a strong partnership with Nvidia) and is expected to grow earnings rapidly over the next five years. The shares have also sold off hard due to the tariff crisis (it does rely heavily on overseas partners), but nothing is going to stop the AI megatrend, the tariff woes will absolutely be worked out at some point (hopefully sooner than later) and these shares are eventually going much higher.

Still trading at only a 0.8x forward PEG, and with earnings per share expected to grow at over 30%, on average, for the next five years, these shares are an obvious buy. Vertiv shares have a lot of room to run to get back to recent (pre-tariff) all time highs (they likely will) and they have the clear potential to go even much higher in the years ahead. Long Vertiv.

2. Super Micro Computer (SMCI)

It may sound counterintuitive, but when a good business is hated—that is a good thing. Super Micro sits smack dab in the middle of the AI megatrend, they are growing like crazy, have the ability to raise prices anytime they want and they won’t lose customers (i.e. they have pricing power because demand greatly exceeds supply) and they trade at a tremendously compelling valuation (for example, a forward PEG ratio of only 0.5x—extremely attractive!).

Super Micro provides AI server solutions, and is growing faster (and at scale) than just about any other company thanks to its ties to Nvidia and fueling of the AI infrastructure megatrend.

However, Super Micro is hated because it had bad accounting controls (the old auditor resigned over this and had to replaced), and some customers diversified away from Super Micro (as best they could) while investors dumped shares hand-over-fist.

Nonetheless, Super Micro continues to grow rapidly, and trades at a very compelling valuation. It’s a buy. Long Super Micro Computer.

1. Alphabet (GOOGL)

With double-digit sales growth, a huge +30% net margin, impressive earnings growth, and only a 16x forward P/E and 1.2x forward PEG—Alphabet is a strong buy. The company dominates in search (Google and YouTube ads are a massive source of revenue), and the company is also a clear and growing leader in the cloud services megatrend. Not to mention, Alphabet is increasingly incorporating AI into its ecosystem (CEO Sundar Pichai recognizes the huge opportunity and the importance of not getting left behind in AI).

Regulatory concerns (antitrust) and the overall Mag-7 selloff so far this year has brought the share price down, thereby creating an attractive buying opportunity in one of the world’s leading companies. Five years from now, people will be kicking themselves for not buying more Alphabet in 2025. Long Alphabet.

The Bottom Line: Fear Creates Opportunity

The recent market declines have been driven by fearful investors dumping shares on tariff concerns (not to mention, the market was due for a bit of a healthy selloff following extremely strong performace in 2023 and 2024). Unquestionably, the tariffs will have real (negative) impacts on the near and mid-term economy, especially depending on how draconian they are and how long they last before being modified.

However, this too shall pass. And the global AI megatrend is going to move forward. So is the total US (and global) economy for that matter, and stocks are eventually going higher.

Rather than panicking and selling, investors should use this year’s fear to take advantage of top opportunities (such as those described in this report) so they can benefit from the eventual rebound (the idea is to buy low) followed by continuing ongoing financial strength for the US economy and the stocks described in this report in particular.

Long US stocks.