As a follow up to “part I” in this series, this “part II” article highlights more attractive healthy-dividend companies. We’re sticking with the theme that investors should NOT blindly chase after the highest yielding securities, but rather focus on those with the healthiest yields. We highlight a handful of healthy yielders including one that we own in our Blue Harbinger Disciplined Growth portfolio.

Our 28 Favorite Stocks: July Performance Review & Outlook

In this week’s Blue Harbinger Weekly, we provide a brief performance review and outlook for each of the 28 holdings across our Blue Harbinger strategies. We also provide access to a members-only report on our “Top 3 Covered Call Stocks.” Lastly, you’ll notice we’ve updated performance though the end of July, and all three Blue Harbinger strategies continue to significantly outperform.

Will Oil Drag the Market Lower Again?

The market followed oil lower last week as crude inventories exceeded expectations. Important economic releases this upcoming week include crude inventories on Wednesday (2/10) and retail sales on Friday (2/12). In this week’s Weekly we review the Blue Harbinger stocks that announced earnings last week (they were better than expected) and the ones that announce this upcoming week. We also share a top contrarian idea we’ve been working on to profit from “low for longer” oil prices.

Automatic Data Processing (ADP) - Thesis

Automatic Data Processing (ADP) – Thesis

Rating: BUY

Current Price: $78.13

Price Target: $114

Thesis:

Automatic Data Processing (ADP) is an attractive stock to own. It’s a stable, highly profitable, human capital management (HCM) company with a large and growing dividend. Additionally, ADP is developing and growing its cloud-based HCM solution to meet customer needs and to keep ADP an attractive and relevant investment for years to come.

ADP is stable, highly profitable, and offers an attractive dividend.

If you’re not familiar, ADP provides a range of software and services to help companies recruit, staff, pay, manage and retain employees. And as the following chart shows, ADP’s revenues and profits are very large and fairly stable:

A big reason for the stability is the high customer retention rate. For example, ADP’s worldwide client revenue retention was 91.4% in fiscal 2015 (Annual Report, p.26). This steady stream of business helps reduce the company’s volatility, and it also helps the company pay a healthy dividend (i.e. ADP has an above average 2.5% dividend yield).

Additionally, ADP’s stable business generates lots of free cash flow so it can continue to increase the dividend as well as repurchase shares. The following chart shows ADP’s free cash flow over the last several years:

Specifically, in fiscal 2015 ADP paid dividends of $927.6 million and returned $1,557.2 million in cash through their share buyback program (ADP Annual Report, p.20). The company also has a track record of increasing the quarterly dividend for 40 consecutive years.

ADP is able to increase the amount of cash retuned to shareholders because it is growing at only a moderate pace. Sources of growth for ADP include economic growth (ADP generally grows as the economy grows), international growth (the company is working to expand outside the US), and rising interest rates (management estimates that a change in both short- and intermediate-term interest rates of 25 basis would result in approximately a $12 million impact to earnings from continuing operations) (Annual Report, p.33). However, ADP would not be returning any cash at all to shareholders if they had the same aggressive growth opportunities as some of their smaller competitors (more on this later).

Valuation:

A basic discounted free cash flow model suggest the market is expecting ADP to grow at an annual rate of about 4.4% (we divided fiscal 2015 FCF by the WACC [8.4%] minus the growth rate to back into the current share price). A 4.4% growth rate is not unrealistic given the company’s growth opportunities. And realistically, ADP will likely achieve a higher growth rate given its current trajectory. For example, analysts surveyed by Yahoo Finance expect earnings to grow at an annual rate of 10.4% over the next 5 years, and management has already provided guidance for 7-8% revenue growth in 2016 (ADP Earnings Release). For example, if ADP grows at 8% for the next five years, and then reverts to a lower 4% growth rate thereafter, the stock is worth $114 per share.

ADP’s Competition:

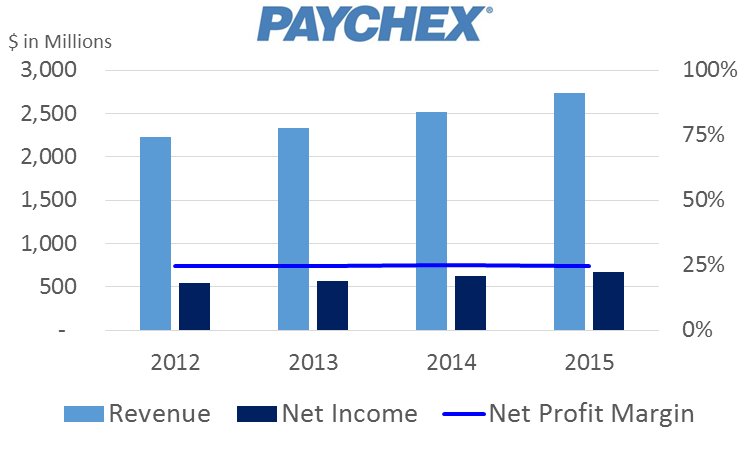

Like ADP, Paychex (PAYX) is an HCM company with large and fairly stable profits. And while Paychex market capitalization is smaller than ADP’s ($19B vs $39B), the following chart shows Paychex’s profit margin is higher:

Like ADP, Paychex also generates an impressive stream of FCF that can be used to grow the business or return to shareholders (i.e. share repurchases and dividends).

For example, Paychex used it’s FCF to repurchase shares ($182.4 million in FY 2015) and pay dividends ($551.8 in FY 2015). And specifically, PAYX dividend payments amount to an impressive 3.2% dividend yield (significantly higher than ADP).

However, Paychex doesn’t have great organic growth opportunities, and they are reverting to inorganic growth instead. Inorganic is generally less profitable and less desirable than organic growth. Regardless, Paychex explains that it seeks inorganic “growth through strategic acquisitions” (GoogleFinance description). This is in contrast to ADP’s strategic goal to grow organically (one of ADP’s three strategic pillars is to “grow a complete suite of cloud-based HCM solutions, Annual Report, p.3). Paychex’ interest in strategic acquisitions may include aggressive growth cloud-based competitors Paycom (PAYC) and Ultimate Software (ULTI), but more on these companies later.

A basic discounted free cash flow model suggest the market is expecting PAYX to grow at an annual rate of about 4.9% (we divided fiscal 2015 FCF by the WACC [9.1%] minus the growth rate to back into the current share price). A 4.9% growth rate is not unrealistic given the company’s growth opportunities. Somewhat similar to ADP, Paychex growth opportunities include economic growth, aggressive sales initiatives, strategic acquisitions (Paychex, not ADP), and rising interest rates. And realistically, Paychex may achieve a higher growth rate given its current trajectory. For example, analysts surveyed by Yahoo Finance expect earnings to grow at a rate of 9.5% over the next 5 years, and management has already provided revenue and earnings growth guidance of 7-8% and 8-9%, respectively, for fiscal year 2016 (Q1’16 Earnings Release, p.3). However, we believe Paychex does not offer a risk/reward profile that is as attractive as ADP, and for this reason we do NOT own Paychex.

If you like more risk, ADP’s cloud competition may offer a more reward.

ADP and Paychex are experiencing increased HCM competition from cloud-based software companies such as Paycom (PAYC), Paylocity (PCTY) and Ultimate Software (ULTI). These cloud based companies offer solutions that are often better suited for smaller companies. Unlike ADP, the cloud-based software competitor solutions require no customization and are maintained in a single database for all HCM functions. This is particularly attractive to newer (and usually smaller) companies because they’re not bogged down by legacy systems and databases that they must maintain. However, for larger companies they cannot offer the same level of sophistication as ADP.

However, if you do like a higher risk/reward profile with no dividend, we do own Paylocity (PCTY) in our “Dividend Growth” strategy. Like Paycom and Ultimate Software, Paylocity is spending heavily to grow its business and will likely experience much higher volatility than steady ADP. Paylocity is not a good fit for our lower risk, higher dividend “Income Equity” strategy.

Conclusion:

We like ADP. It’s a steady growth business, it has significant price appreciation potential, and it offers an above average dividend. Also, we believe Human Capital Management is a steady growth industry that will benefit from a secular trend towards cloud based solutions. Additionally, because of the amount of client payroll cash on ADP’s books, a rising interest rate environment will be a helpful tailwind. Even though we believe some of ADP’s cloud competitors (for example Paylocity) offer higher risk-reward profiles, we also know they are not a good fit for “Income Equity” investors (they’re high risk and they don’t offer a dividend). ADP’s above average dividend is very safe, and the stock offers continued steady capital appreciation as well.

Terrific Stock-Specific Opportunities, Despite Broader Market Red Lights

With all of last week's macro-volatility, and the Fed set to begin raising rates this upcoming week, it's a great time to point out two important things: (1) Diversified long-term investors don’t need to make a single change to their investment strategy, and (2) Many terrific stock-specific investment opportunities remain for those willing to do their homework. For example, this week’s Weekly highlights several specific stocks related to cloud-based human capital management that are set to climb from an accelerating secular trend.