CrowdStrike founder and CEO, George Kurtz, has founded and led multiple successful cybersecurity businesses, and he knows the drill. Specifically, CrowdStrike is a high-margin Software-as-a-Service company with highly attractive recurring revenues that continue to grow rapidly in a large (and expanding) total addressable market (cybersecurity). What’s more, despite the continuing rapid growth, the valuation has come down, thereby making the shares even more compelling to some investors. In this report we share our opinion on whether CrowdStrike is worth considering for investment at these levels (valuation), or if it’s just another overhyped growth stock that is being valued too much on a euphoric narrative and not enough on its underlying fundamentals.

High Growth Stocks - with Room to Run

These are potentially “rocket fuel” stocks in the coming months, IF inflation has peaked and the Fed becomes less hawkish. It also doesn’t hurt that China has decided to lighten up on its crack down on tech. The “% of 52-Week Price Range” shows how much more upside these stocks could have relatively to where they sit between their 52-week highs and lows.

Owl Rock’s 9.1% Yield: Credit Spread Risks, Rewards

Business Development Companies, or BDCs, make the loans that big banks generally will not (or cannot, due to regulatory rules). However, like big banks, BDC bottom lines usually come down to simply net interest margins (i.e. the margin between the rate they borrow at and the rate they lend at), assuming they can survive any macroeconomic turmoil, considering they have much higher sensitivity than do the big banks. Interest rates are trending sharply higher (as the Fed fights inflation), and this can be very good (or very bad) for big-dividend BDCs (like Owl Rock). In this report, we share our opinion on whether Owl Rock’s big 9.1% dividend yield is attractive and worth considering, or whether the risks are simply too great and if investors should avoid the shares.

The Tech Bubble Took Over 2.5 Years to Fully Burst

The Tech Bubble (QQQ) peaked on 3/10/2000 and it took more than 2.5 years for it to fully burst. We are in a different environment today (i.e. low rates rising, massive revenue also rising for top growth stocks), but here is sector performance when the bubble burst (the first year and peak to bottom). Cathie Wood’s ARKK ETF peaked in June 2021 and the Nasdaq (QQQ) peaked in late 2021.

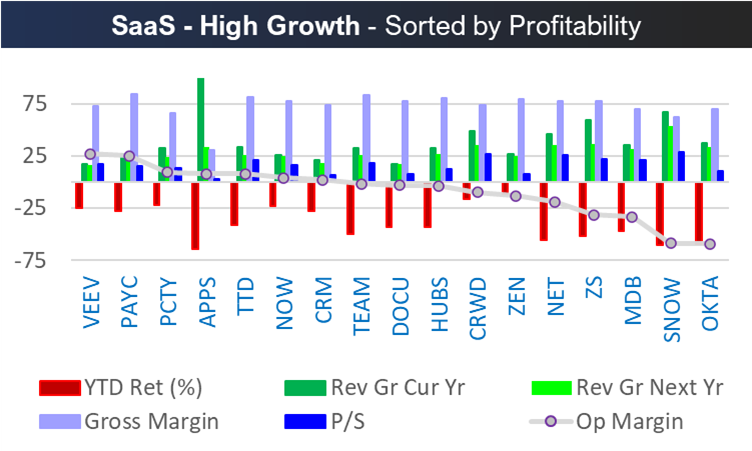

SaaS - High Growth - Sorted by Profitability

Growth Stocks (1-Day vs YTD)

Disruptive Finance Stocks (sorted by Growth)

This Steady Growth Juggernaut is a Gift from the Market

There is a lot to like about the highly-profitable business we review in this report, including its high margins, powerful revenue growth, large total addressable market opportunity, impressive history of dividend growth (10+ years) and its compelling valuation. The company helps consumers and small businesses make short work of their financial responsibilities and challenges. And the shares have absurdly lost nearly 50% of their value since November as they’ve gotten caught up in the recent market-wide high-growth selloff. Yet, yesterday’s earnings announcement makes clear this business is still quite healthy (they again exceeded expectations) and on track to do even better (perhaps dramatically so) in the years ahead.

Attractive 7.1% Yield BDC: Monthly Dividend, Compelling Valuation

The well-managed, blue-chip, Business Development Company (“BDC”) we review in this report currently trades at a compelling price, it offers a healthy dividend, and it sits at an attractive spot in the current business cycle. But is it worth investing? This report reviews all the details and then concludes with our opinion on investing.

CEF Rover: Bond CEFs Are Ugly--Could Get Uglier

This quick note shares data on over 100 big-yield (7% to 14%+) bond Closed-End Funds (“CEFs”), including discounts/premiums, recent returns, amount of leverage, and more. Returns have been ugly this year (as interest rates have risen), and they could get uglier considering the Fed is set to keep raising, losses will be magnified by the use of leverage, and forced “fire sales” could make matters worse as the funds mathematically bump up against regulatory leverage limits. Caveat Emptor.

Disciplined Growth Portfolio: 6 New Buys!

I don’t trade often (because I believe in long-term investing), but recent market dislocation has created some very attractive buying opportunities. Year-to-date, growth stocks have been hammered, and as counterintuitive as that may seem—that can often be the best time to buy. In this report, we review the new buys, the new “buy under” prices, and the aggregate portfolio details. has all the details.

Albemarle to Benefit from Inflation, EV Lithium Demand

The basic materials stock we review in this report has increased its dividend for 28-years in a row. It also has newfound growth opportunities related to dramatically increasing lithium demand and pricing (courtesy of exploding demand for lithium-based batteries in electric vehicles, for example). Not to mention, the basic materials sector can continue to be a highly attractive inflation hedge. In this report, we review the details and then conclude with our opinion on investing.

Micron: 25 Growth Stocks To Rip Higher

To the satisfaction of many prognosticators, hoards of “pandemic darling” stocks have now fallen more than 30%, 50% and even 70%. However, it’s worth noting that some of them actually have impressive businesses and now trade at dramatically more compelling valuation multiples—even after taking into consideration the risks created by the fed’s aggressive interest rate hike trajectory (to battle inflation) which could drive us into recession and decisively warrant discounted valuation multiples being assigned to these businesses still on track to achieve significantly higher future earnings. In this report, we highlight 25 examples, including a special focus on Micron (MU).

Income Equity Portfolio: MANY New Buys!

I don’t trade often (because I believe in long-term investing), but recent market dislocation has created some very attractive buying opportunities. Year-to-date, the Blue Harbinger Income Equity Portfolio has significantly outperformed the S&P 500 (this has been due to its large overweight to very high-income securities, in particular). However, going forward, the strategy is focused more heavily on steady dividend/income growth—through compelling blue-chip capital appreciation opportunities. This report has all the details.

A Special Note on Market Volatility

This Steady Dividend Growth Stock Is Attractive

If you are into wide-moat, blue-chip, dividend-growth stocks, you might want to consider the impressive industrial stock in this report. It’s not a high-flying growth stock, nor does it offer a massive dividend yield, but it does have a healthy growing dividend (2.0% yield), ongoing share repurchases, strong operating margins and a business that is virtually impossible for competitors to replicate. It’s also a high book value business (which can be valuable in times of inflation). We will review this attractive business in detail in this report (including valuation and risks), and then conclude with our opinion on investing (we currently own shares in our income portfolio).

8.7% Yield Bond CEF: Max Interest Rate Pain, Taper Tantrum Looms

As the Fed continues on its path of aggressive interest rate increases (to tame inflation), infamous growth stock investor, Cathie Wood, says “equities and bonds seem to be warning the Fed that its policy measures could cause an economic and/or financial crisis.” Both stock and bond markets are down sharply this year (largely in response to the Fed), but there are reasons to believe things could be about to change (for example, high inflation rates could still prove somewhat transitory thereby making the Fed more receptive to the market’s growing taper tantrum), and now may be an attractive time to consider investing in select high-yield bond CEFs. In this report, we review one in particular that is increasingly attractive.

This Stock: 360 Degrees of Attractiveness

If you are looking for an investment opportunity that is attractive in every direction, you might want to consider this professional services consulting company. It’s classified in the information technology sector, but benefits handsomely from the massive opportunities that exist across the many compelling industries it serves. In this report, we review the company’s healthy growing dividend, share repurchases, massive cash flow, strong balance sheet, powerful earnings and revenue growth trajectories, and the attractive valuation for this very impressive business model.

This Attractive, High-Growth, Blue-Chip Stock Is On Sale

Now trading at only 6.4 times sales (down from over 12x in late 2021), but with an ongoing sales growth trajectory of nearly 20%, this CRM (customer relationship management) technology company has a lot of room to run (large total addressable market) and a highly defensible moat to its business. In this report, we review the business details and the risks, and then conclude with our opinion on investing (we currently own shares).

Attractively Valued 4.5% Yield Consumer Staples Stock

Short-term headwinds have dragged the share price lower, but this steady, blue-chip consumer staples company has a wide moat, significant competitive advantages and the stock is currently trading at an attractive price. In this report, we review the business, the challenges (both short-term and long-term risks), the valuation, opportunities and finally our opinion on who might want to invest.