Futures are lower this morning, as the market seems set to take a breather from its sharp move higher in recent session, especially for higher-risk growth stocks. But as we review some of the stocks that have been performing extremely well, its worth asking the question “does the fed have too much power over the stock market?”

50 Big-Dividend REITs, Compared

Realty Income: 50 Big-Dividend REITs Compared

Realty Income (known as the monthly dividend company) has been a safe haven this year as markets have declined sharply but Realty Income’s share price has remained roughly flat. However, some investors are left wondering if Realty Income still offers an attractive valuation or if it’s time to shift new investment dollars elsewhere. We offer our opinion on the relative attractiveness of the shares, including a discussion of business strategy, the risks and the current valuation as compared to 50 other big-dividend REITs.

Is This Dead Cat Bounce Different?

With futures pointing higher, the market is set to rise for a third day in a row. And some investors are starting to think these gains are different than the dead cat bounces we’ve repeatedly experienced this year because this time commodity prices are down, the dollar is strengthening and the fed may finally be ahead of inflation.

The Fed Is Fearful, Time to Get Greedy?

The minutes from the Fed’s June meeting were released today, and they show a continued laser-focus on inflation (i.e. the fed is scared). Yet interestingly, Energy stocks and 10-year treasury rates keep declining in what may be a case of the market being a few steps ahead of the minutes from a meeting that took place in the past. For example, here is a look at the one month performance of energy stocks, and it has been ugly!

Signs of Slowing Inflation

S&P futures are hovering around flat to slightly negative so far this morning, as we head into a day where the upcoming release of last week’s fed meeting minutes may already be outdated. Both treasuries and commodity prices have been trending lower, a sign that the fed’s inflation fight may be less dire than last week’s minutes convey. Markets tend to recover long before recessions end. This report shares data on past recessions, chip stock valuations (e.g. Nvidia, AMD, Micron and Intel) and an update on the market’s technical position.

Energy Stocks: Ugly 1-Month, Still Up Big YTD

Positve Signals: Growth Stocks Up, Commodities Down

BH THINKER: The Worst First Half for Stocks in 50 Years

Meta Platforms: Fervently Hated, Money-Printing Value Stock

Other than a Super Bowl watch party, most people hate commercials and advertisements of any kind. They are disruptive, often offensive and increasingly violate privacy. Nonetheless, Meta Platforms (formerly Facebook) continues to print and store massive piles of money it derives from advertising across its platforms, including Facebook, Instagram, Messenger, WhatsApp and others. And despite the fact that growth in traditional markets may be slowing, and its pivot to the Metaverse is wildly unproven, the low valuation (of this once growth now value stock) is hard to ignore. This report reviews the business, valuation, risks and concludes with our opinion on investing.

10-Day Market Reversal

Lead of Value Over Growth

10-Year Treasury vs Growth Stocks

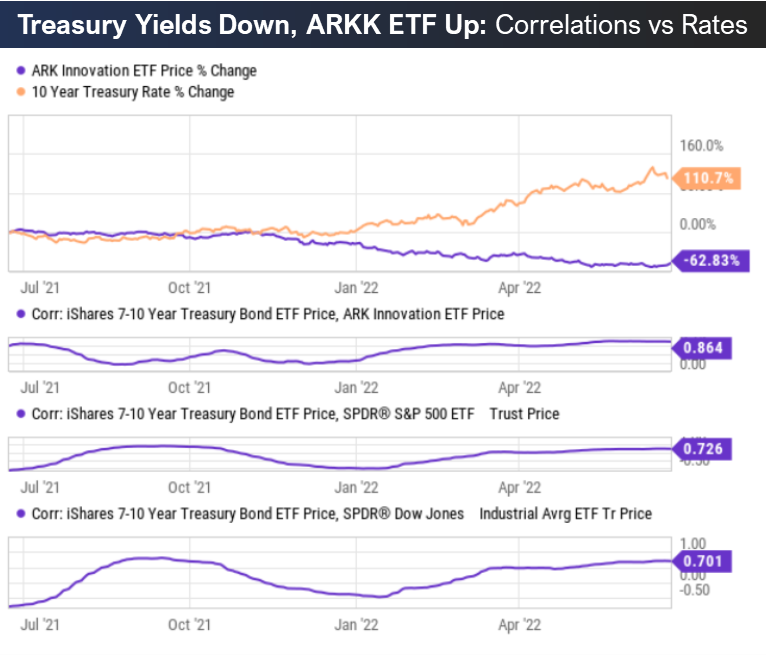

As you can see in the following chart, there has been a high correlation between high-growth stocks (as measured by the Ark Innovation ETF (ARKK)) and the 10-year treasury rate. More so than for the S&P 500 or the Dow.

The reason is because as the fed raises rates to fight inflation, they slow down the economy as a side affect, and the most growth-oriented names are the most negatively affected.

Considering we just had the largest drop in 10-year treasury rates this week since Covid, it was off-to-the-races for ARKK and high-growth stocks in general.

Honeywell: Growth-Value Debate, Big Dividend Growth

In the “olden days,” it was widely accepted that value stocks outperform growth stocks over the long-term. But as central bankers have gotten increasingly involved in the last few batches of market cycles, growth stocks (supported by easy money) have been dominating—until this year. And if the US Fed’s now increasing interest rate trajectory is any indication, value stocks may again return to extended periods of outperformance. Shares of diversified industrial company, Honeywell (HON), fall into the value stock category, and may be worth considering. This report reviews Honeywell’s business, its valuation and risks, and then concludes with our opinion on investing.

Top Sales Growth: 20 Worst Performers

Shopify: Meme Stock, New Market Paradigm

We first purchased Shopify at ~$143 per share in August of 2018. It now trades at ~$333 per share. Not a bad return—until you realize the shares have fallen over 80% in the last 6 months! This report compares Shopify’s business fundamentals (including its business strategy, ongoing revenue growth and margins) to its current valuation, and then examines the question of whether Shopify CEO, Tobias Lütke, continues to imprudently push an easy-money, high-growth business strategy in an increasingly sober new market paradigm—now characterized by higher costs of capital and a starkly less friendly meme stock environment (yes—Shopify is a meme stock). We conclude with our opinion on who might want to invest—or if it’s simply time to sell and move on.

Top 10 Big Dividends: REITs, BDCs, Bond CEFs, Energy and More (4-10% Yields)

When it comes to income investing, investors have a lot of choices. And considering the current macroeconomic environment (inflation, the fed, market declines, recession risks) many investors are left flummoxed concerning their next move. In this report, we share our top 10 big-dividend opportunities, including two ideas from each of the following five categories: REITs, BDCs, Bond CEFs, dividend-growth stocks and energy investments. The yields range from 4% to over 9%, and we share some high-level macroeconomic perspective before we get into the countdown.

The Big-Dividend Report

Verizon: 5.2% Yield, 4 Risks Worth Considering

The share price of steady dividend-growth stock, Verizon, is still down more than 11% following its latest earnings release. And the 5.2% dividend yield is increasingly tempting for many income-focused investors (especially in our current volatile market). But the outsized dividend doesn’t come without risks. In this report, we review Verizon’s business, its dividend safety, the current valuation and four big risks the company currently faces. We conclude with our opinion on who might want to consider investing.