Omega Healthcare Investors (OHI) pays a big growing dividend (7.2%), and it has recently underperformed many of its healthcare REIT peers. And while some investors are quick to sing its praises as a “value play,” it is most certainly exposed to very real risks. Specifically, the evolving skilled nursing facilities industry calls into question the source of Omega’s future revenues particularly with regards to entitlement reform. This article provides our views on Omega, and addresses the all-important question: Is Omega worth the risk?

Overview:

Within the constructs of a diversified income-focused investment portfolio, we believe Omega Healthcare is well-worth the risk. It just raised its already big dividend (7.2%) and its valuation has become increasingly attractive this year as the stock has underperformed the rest of the market. The company clearly faces risks related to the changing skilled nursing facilities industry, however we believe the market has significantly over-reacted to these risk thereby making Omega Healthcare a very attractive investment opportunity.

Omega has a lot of good things going for it…

Omega Healthcare Investors is a triple-net, equity REIT that supports the goals of Skilled Nursing Facility (SNF) and Assisted Living Facility (ALF) operators with financing and capital. And considering the shifting demographics of the US population, Omega has a big tailwind at its back that will help it going forward as shown in the following charts.

And the following map provides information on the well-diversified locations of Omegas’s properties.

This next table provides additional information on the diversified nature of Omega’s investments by dollars, geographic location and occupancy.

And worth noting, Omega maintains healthy investment grade credit ratings (as shown in the following table).

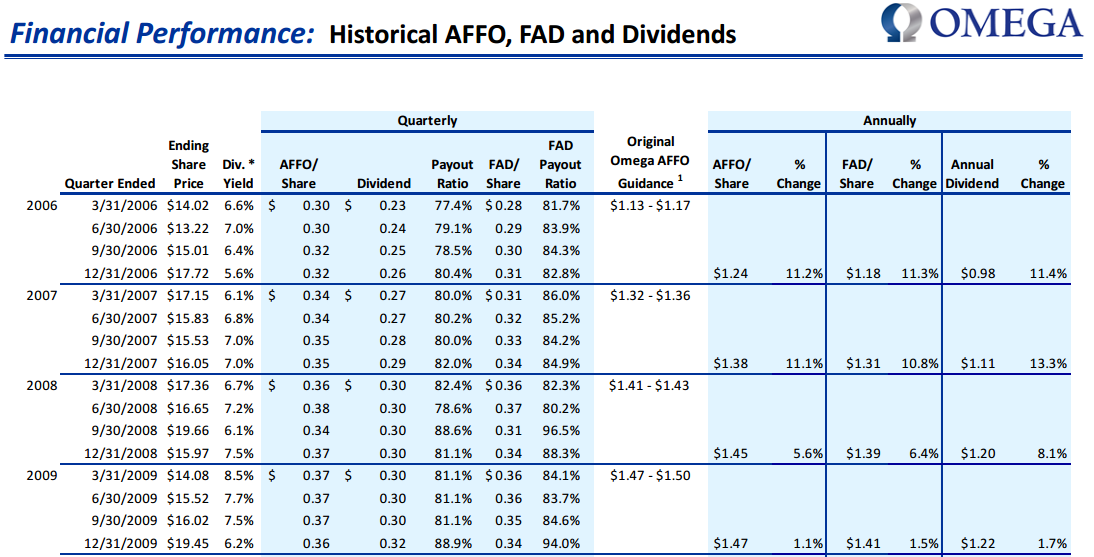

And Omega generates lots of adjusted funds from operations (AFFO) and maintains a very healthy and consistent dividend payout ratio as shown in the following table:

So considering all the positive things Omega has going for it, why has the stock underperformed this year?...

Why has Omega Underperformed?

Unlike many of its healthcare REIT peers, Omega is a pure-play Skilled Nursing Facilities (SNF) operator, and this is a risky business to be in because of its continuing evolution as shown in the following chart.

Specifically, the percentage of Omega’s revenues coming from government influenced groups (such as Medicare and “Accountable Care Organizations”) is increasing, and this subjects the company to massive legislative risk exposures. Said differently, if the government cuts back on entitlement spending, this could have a significantly negative affect on Omega’s profitability.

For example, the following excerpt from Omega’s most recent 10K describes the risk:

Changes in the reimbursement rate or methods of payment from third-party payors, including the Medicare and Medicaid programs, or the implementation of other measures to reduce reimbursements for services provided by our operators has in the past, and could in the future, result in a substantial reduction in our operators’ revenues and operating margins… which could cause the revenues of our operators to decline and negatively impact their ability to meet their obligations to us.

As a specific example, on January 3, 2013 the American Taxpayer Relief Act cut future payments to SNF’s by approximately $600 million (10K, p.22). As another specific example, earlier this year Kindred/Rehab Care agreed to pay the US Government $125 million for causing an SNF customer to bill for unreasonable and unnecessary rehabilitation therapy. The point is that Skilled Nursing Facilities is risky business to be in, and this is Omega’s main business.

Omega’s Valuation:

For some perspective, the following chart shows Omega’s recent price-to-FFO versus several of its healthcare industry peers.

(Note: this data is as of 8/11/16).

The important takeaway from this chart is that Omega is very cheap because of its skilled nursing facilities exposure. Specifically, Omega is the only pure-play SNF REIT in the group, whereas Ventas (VTR) already spun off its skilled nursing, and Welltower (HCN) and HCP still have some exposure to skilled nursing. The valuations follow this pattern closely (i.e. SNF are risky, and the market assigns a lower valuation because of the risk).

For added perspective, this next chart shows OHI’s price-to-FFO (TTM) versus its own history.

And what stands out about this chart again, is that Omega is very cheap. We believe this is largely because the market is overly nervous about exposure to skilled nursing facilities, and the narrative has become too negative. Yes, there are clearly risk, but within the constructs of a diversified portfolio (i.e. don’t put all your eggs in one basket) we believe this is a risk worth taking.

Risks:

Aside from the general exposure to skilled nursing facilities, Omega does face other risks. We have highlighted some of the more significant risks noted in Omega’s annual report below:

Government Regulation and Reimbursement

The healthcare industry is heavily regulated. Our operators are subject to extensive and complex federal, state and local healthcare laws and regulations. These laws and regulations are subject to frequent and substantial changes resulting from the adoption of new legislation, rules and regulations, and administrative and judicial interpretations of existing law. The ultimate timing or effect of these changes, 14 which may be applied retroactively, cannot be predicted. Changes in laws and regulations impacting our operators, in addition to regulatory non-compliance by our operators, can have a significant effect on the operations and financial condition of our operators, which in turn may adversely impact us. The following is a discussion of certain laws and regulations generally applicable to our operators, and in certain cases, to us.

Healthcare Reform:

A substantial amount of rules and regulations have been issued under the Patient Protection and Affordable Care Act, as amended by the Health Care and Education and Reconciliation Act of 2010 (collectively referred to as the “Healthcare Reform Law”). We expect additional rules, regulations and interpretations under the Healthcare Reform Law to be issued that may materially affect our operators’ financial condition and operations.

Reimbursement Generally:

A significant portion of our operators’ revenue is derived from governmentally-funded reimbursement programs, consisting primarily of Medicare and Medicaid. As federal and state governments focus on healthcare reform initiatives, and as the federal government and many states face significant current and future budget deficits, efforts to reduce costs by government payors will likely continue, which may result in reductions in reimbursement at both the federal and state levels. These cost-cutting measures could result in a significant reduction of reimbursement rates to our operators under both the Medicare and Medicaid programs. Additionally, new and evolving payor and provider programs, including but not limited to Medicare Advantage, dual eligible, accountable care organizations, and bundled payments could adversely impact our tenants’ and operators’ liquidity, financial condition or results of operations. We currently believe that our operator coverage ratios are adequate and that our operators can absorb moderate reimbursement rate reductions and still meet their obligations to us. However, significant limits on the scopes of services reimbursed and/or reductions of reimbursement rates could have a material adverse effect on our operators’ results of operations and financial condition, which could adversely affect our operators’ ability to meet their obligations to us

Medicaid:

State budgetary concerns, coupled with the implementation of rules under the Healthcare Reform Law, may result in significant changes in healthcare spending at the state level. Many states are currently focusing on the reduction of expenditures under their state Medicaid programs, which may result in a reduction in reimbursement rates for our operators. The need to control Medicaid expenditures may be exacerbated by the potential for increased enrollment in Medicaid due to unemployment and declines in 15 family incomes. Since our operators’ profit margins on Medicaid patients are generally relatively low, more than modest reductions in Medicaid reimbursement or an increase in the number of Medicaid patients could adversely affect our operators’ results of operations and financial condition, which in turn could negatively impact us.

Medicare:

On April 1, 2014, President Obama signed the “Protecting Access to Medicare Act of 2014” which calls for the United States Department of Health and Human Services (“HHS”) to develop a value based purchasing program for SNFs aimed at lowering readmission rates beginning on October 1, 2018.

General and Professional Liability:

Although arbitration agreements have been effective in limiting general and professional liabilities for SNF and long term care providers, there have been numerous lawsuits challenging the validity of arbitration agreements in long term care settings. On July 16, 2015, CMS issued a proposed rule on, Reform of Requirements for Long-Term Care Facilities, which would require SNFs to explain binding arbitration agreements to residents and their families before they sign them. The rule would also prohibit requiring arbitration agreements as a condition of admission. While a final rule has not been promulgated, if this rule is finalized as proposed, there would likely be an increase in liabilities for SNF and long term care providers.

Conclusion:

In our opinion, Omega is risky, but it’s not that risky. It seems its valuation has been overly beat up over fears related to entitlement reform. And despite the stock's low valuation, it still generates lots of funds from operations and continues to cover its big growing dividend payments. We’d be slightly more nervous if this was the only stock we owned, but within the constructs of a diversified investment portfolio we believe Omega Healthcare currently presents and outstanding investment opportunity. We own Omega in our Blue Harbinger Income Equity portfolio.