The Fed hiked rates, the FDIC continued to bail out depositors and select big-yield opportunities became decidedly more interesting. Specifically, many big-dividend REITs and BDCs are down big this year; and some of them are actually attractive. In this report, we share updated data on over 100 big-yield REITs and BDCs, and then conclude with information about our top 27 favorite big yielders, ranked.

Without further ado, let’s get into some data…

Big-Dividend BDCs:

For starters, you can see (in the table below) that many big-dividend BDCs have fallen hard this year, especially over the last month. In particular, since the Silicon Valley Bank failure in early March, a lot of BDCs have paid the price (considering they’re similar to banks, only riskier).

Data as of Fri Mar 24th. Download spreadsheet here.

The four BDCs highlighted in yellow are focused heavily in the venture capital space (i.e. the same focus area as Silicon Valley Bank). And as we wrote about in this report, they are facing unique challenges and creating unique opportunities. Further still, Ares Capital is the largest big-dividend BDC in our table, and it’s one we like (considering its well-diversified business and considerable financial wherewithal). And despite the risks of a struggling economy and rising rates (which can help interest income, but also increase default risk) we like Ares—especially as it now trades at a price below its book value, as we wrote about in this report.

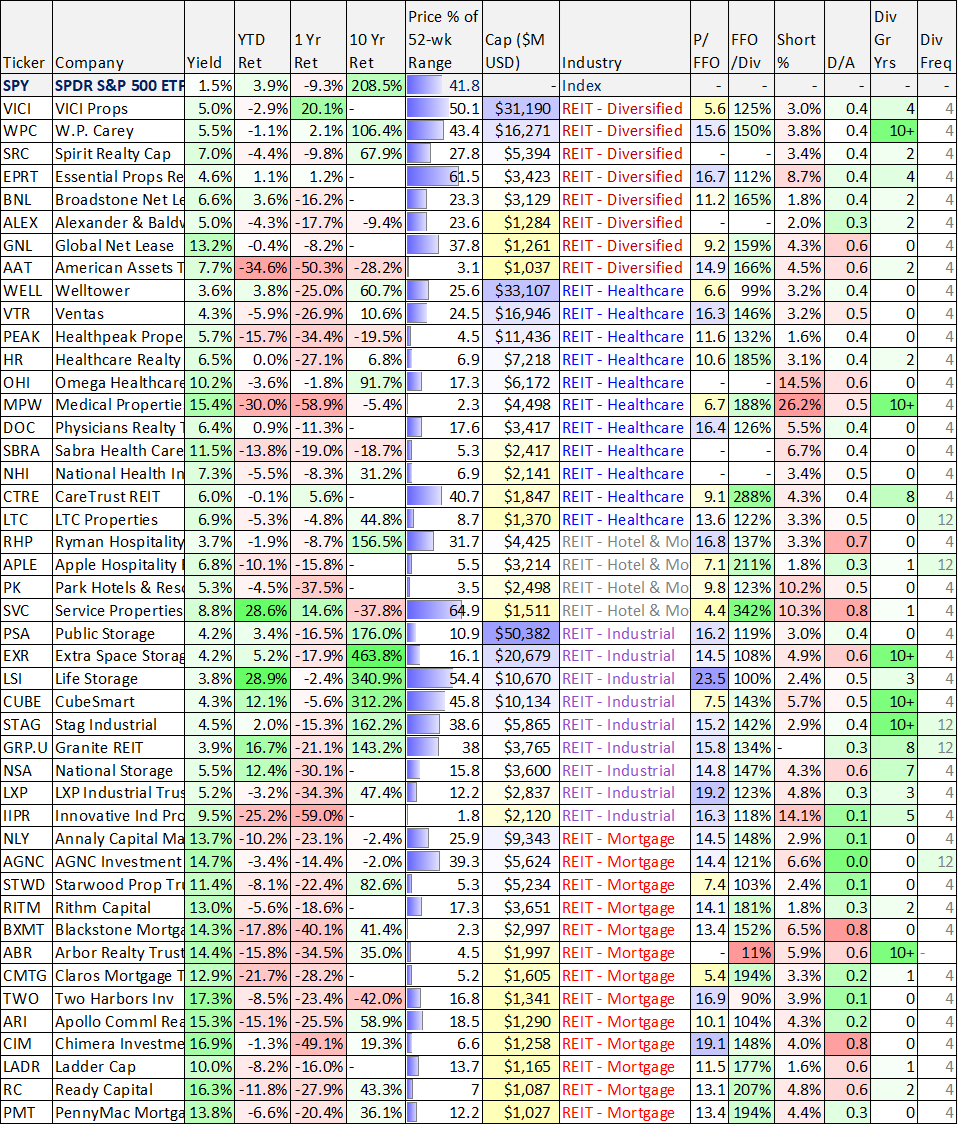

Big-Dividend REITs:

Big-dividend REITs have been ugly. And some REIT sub-industries have been even uglier. For example, check out the brutal “price as a percent of 52-week range” column for Office and Residential REITs in the following table.

Data as of Fri Mar 24th. Download spreadsheet here.

Data as of Fri Mar 24th. Download spreadsheet here.

And while some bottom-fishers may be tempted to invest in these REIT sub-industries (Office and Residential) from a purely blind contrarian standpoint, we are staying the heck away. Office is permanently damaged by post-covid work-from-home initiatives (which may never fully go away) and residential REITs are just the vehicle the “Blackstones” of the world used to dump the real estate they bought for cents on the dollar after the last housing crisis in 2008-2009.

In the REIT space, we like (and own) select industrial REITs (a sub-industry that cannot easily be “Amazon-ed” or “work-from-home-ed” away).

More Big-Yield Opportunities

Of course REITs and BDCs are not the only big-dividend corners of the market. For example, we recently shared a new report on an attractively-priced dividend-growth stock (it currently yields 7.7%, and the annual dividend has increased every year for decades straight without interruption).

Further still, this year’s market declines (combined with the apparent slowing—and possible end—to Fed interest rate hikes) has created some very compelling big-yield closed-end fund (“CEF”) opportunities, as we wrote about here, here and here.

The Bottom Line:

There are currently lots of attractive big yield opportunities spread out across REITs, BDCs, CEFs, dividend-growth stocks, and more. But you need to be selective. Just because the share price is down and the yield is high—that does NOT mean it’s a good investment. We share our 27 favorite, hand-selected, big-yield investments in our new “High Income NOW” portfolio.

But at the end of the day, you need to select investments that are right for you, based on your own personal situation. We believe prudently-diversified, goal-focused, long-term investing will continue to be a winning strategy.