The Big-Dividends Report

Keep tabs on high-income opportunities from across the markets.

How to use this report:

The articles below include tables filled with big-yield and high-dividend opportunities, sorted into various categories, such as REITs, BDCs, CEFs and more. New reports are added periodically. The idea is to share comparative data on big-dividend investments to help you identify exceptional opportunities.

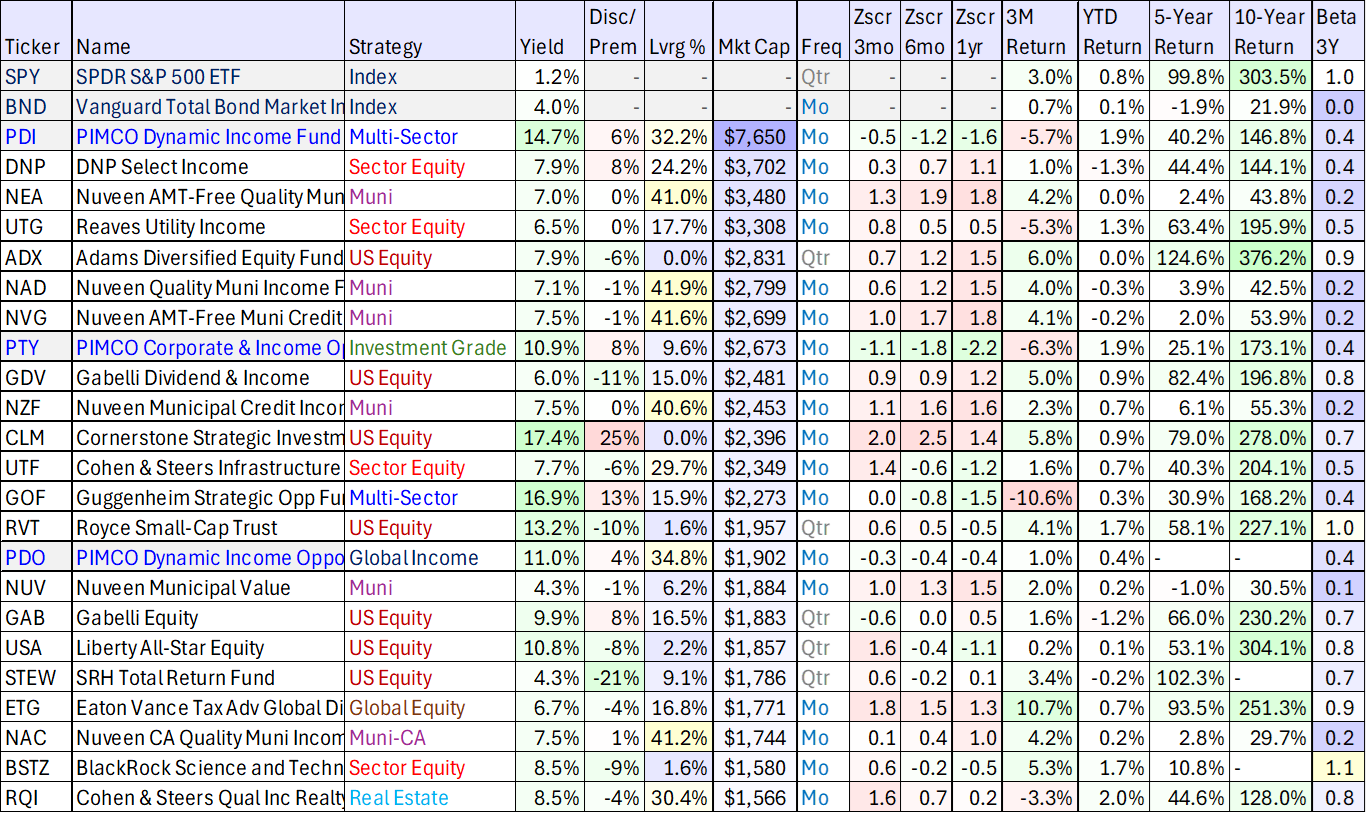

This report shares updated data on 50+ of the biggest big-yield Closed-End Funds (CEFs, by market cap), including current yield, discounts and premiums, leverage, beta, long-term performance and more! Interestingly, a few very popular PIMCO CEFs have recently come down in price (relative to NAV) which makes for some unusually attractive entry points on some premier double-digit yields (paid monthly). Muni bonds look good too (if you are in a high bracket and invest via your taxable account). Enjoy!

This report shares updated data on 10 top big-yield closed-end funds (CEFs), including bonds, stocks and a couple utility-sector specific funds. They all offer attractive big yields, but one BlackRock fund stands out for a particularly compelling opportunity right now.

Business Development Companies (BDCs) continue to provide big steady yields (income) to investors despite a challenging BDC environment, including interest rate volatility, increasing competition and economic uncertainty. Although BDC strategies are varied, they generally provide loans to riskier private business where traditional bank lending is less suitable, and then reduce aggregate risks by doing so through a diversified portfolio (within their areas of expertise). Many are facing selling pressure (see 14-day money flow index) and some trade below book value (generally an indication of fear, depending the the particular BDC strategy). Increasingly compelling contrarian yield opportunities in an otherwise greedy market environment.

Just like inflation is a hidden tax on your money, so is return of capital (“ROC”) on your big-yield closed-end fund (“CEF”). For example, PIMCO’s CEFs are particularly impressive and attractive, just not as much so as many people seem to think considering not a single one actually covered its distribution over the last year (see table below). This report shares high-level data on PIMCO’s popular big-yield CEFs, with a special focus on the Dynamic Income Fund (PDI), and then draws a critical conclusion based on the risks and rewards.

There is a new #1 position in the “High Income NOW” Portfolio (it’s an 11.9% yield monthly-pay security trading at a discount). There are also a handful of new buys, sells and position '“right-sizings.” The aggregate yield is 9.9% and that consists of 25 individual positions (including BDCs, a variety of stock and bond CEFs, individual stocks and more). If you like your investments to pay big steady income, you’re going to want to check out this top-idea report, including the usual caveats and specific exceptional investment opportunities worth considering right now.

Here is a look at recent performance data for 40+ big-yield business development companies (or BDCs). As you can see, the prices are down this year, more so than the S&P 500, and the price-to-book values (a common BDC valuation metric) are down too. Let’s consider why, whether there is more pain to come, and if you should be hitting the eject button, holding tight or buying more.