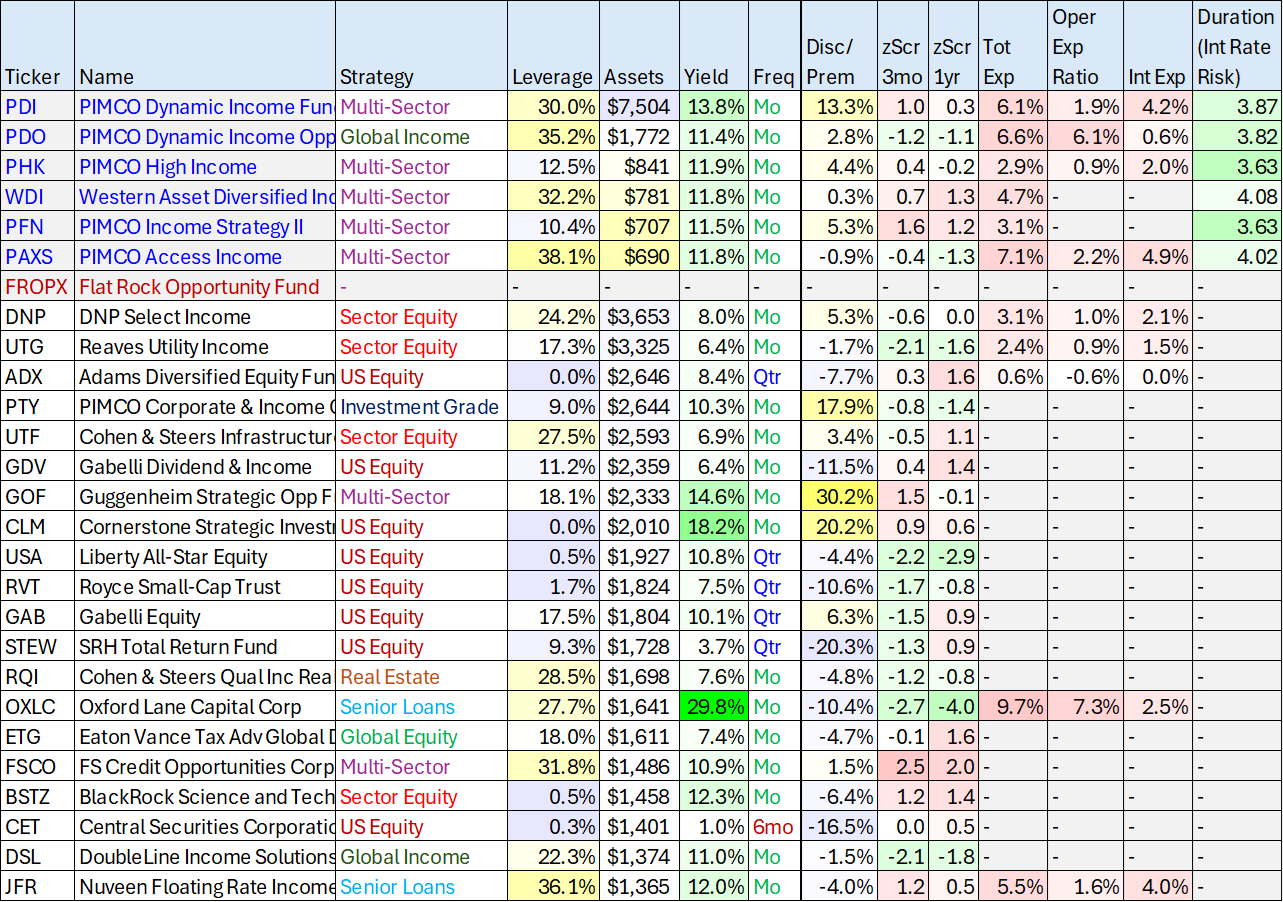

Just like inflation is a hidden tax on your money, so is return of capital (“ROC”) on your big-yield closed-end fund (“CEF”). For example, PIMCO’s CEFs are particularly impressive and attractive, just not as much so as many people seem to think considering not a single one actually covered its distribution over the last year (see table below). This report shares high-level data on PIMCO’s popular big-yield CEFs, with a special focus on the Dynamic Income Fund (PDI), and then draws a critical conclusion based on the risks and rewards.

Why PDI?

Income-focused investors are drawn to this fund because it offers a very large distribution yield (recently 13.8%) and it is managed by the premier bond fund manager, PIMCO. And if you have worked hard all your life, and built and saved a substantial nest egg, the idea of parking your money in something that will pay you a big monthly distribution (with an annualized rate in the double-digits) is very hard to ignore. Actually, for a lot of people it is the dream: park your money “worry free” and collect a big monthly paycheck for doing “nothing.” But not so fast…

7 Big-Yield CEF Questions

Before I invest in any CEF, here are 7 important questions I always ask myself.

I’ll review these questions throughout this report.

About PDI

According to PIMCO’s website, PDI offers:

“access to PIMCO’s best income-generating ideas across multiple global fixed income sectors” and it “seeks current income as a primary objective and capital appreciation as a secondary objective.”

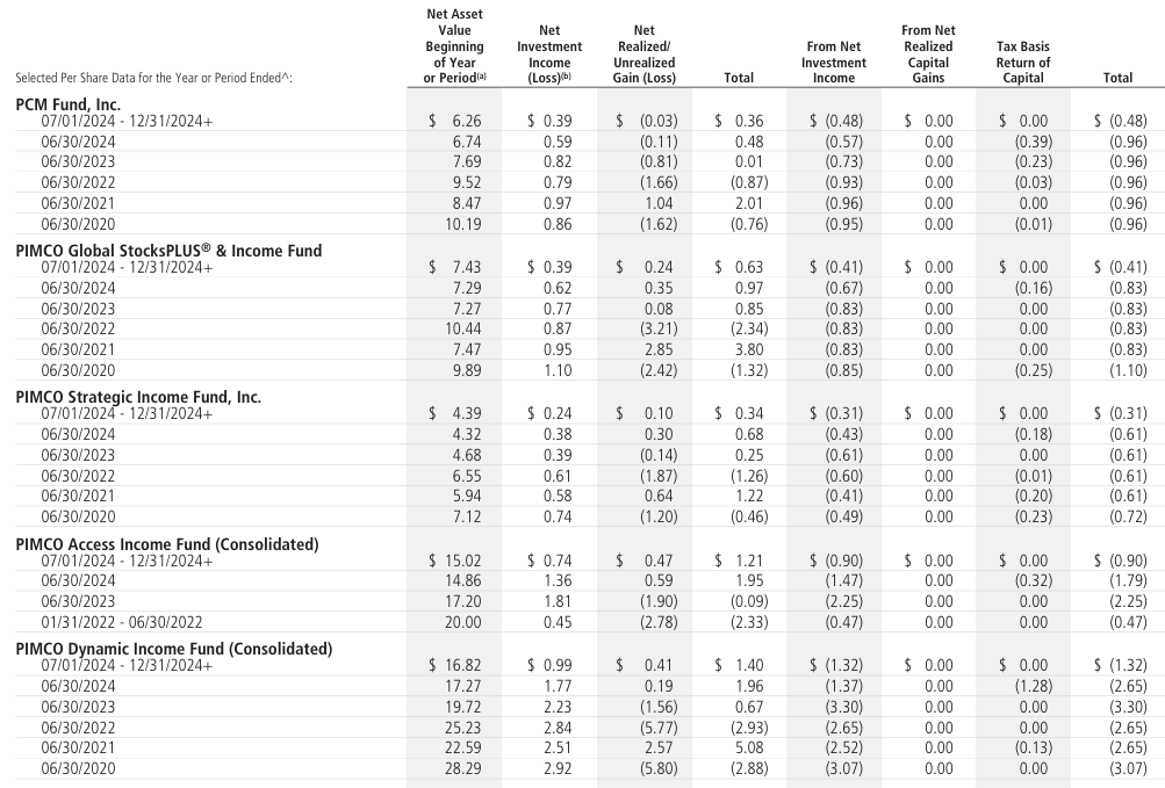

This all sounds great, and PIMCO has done a great job of paying investors big monthly distributions since its inception. But the problem is it hasn’t actually succeeded with the “capital appreciation” part of its objective, because its price keeps declining (see chart later in this report), and according to its own reporting, it is NOT covering its own distributions (see earlier distribution coverage ratio table).

How are the Distributions Sourced?

One of the key considerations in the earlier 7-CEF-questions graphic is how are the distributions sourced? And in PIMCO’s case there is a fitting saying “you don’t want to see how the sausage is made” (implying the big yield may look tasty, but once you realize how it is manufactured you might actually get a little sick to your stomach).

ROC vs Paid in Surplus

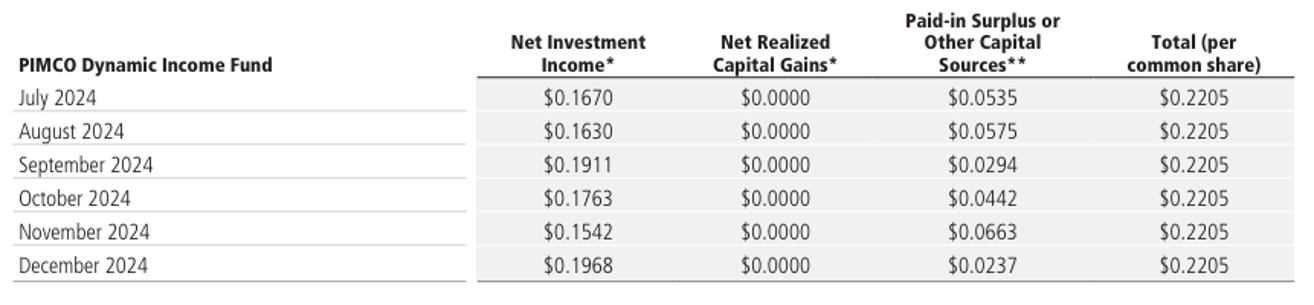

We already saw in the earlier table that none of PIMCO’s taxable CEFs (including PDI) actually covered their distribution payments over the last year (PDI only covered 68.8% of its distribution over the last fiscal year—yuck!?).

But if you look into the fund’s prospectus, annual reports and sections 19 notices (i.e. check to see how the sausage is actually made) you’ll see that rather than reporting this distribution shortfall as ROC (something many investors loathe) it is being temporarily classified (via accounting practice) as something called “Paid-in Surplus or Other Capital Sources” because the interest rate swaps (derivatives) the funds are using effectively delays the official recognition of ROC until the second leg of the interest rate swap expires in the future (at which time the fund may retroactively recognize ROC, as it has done in the past, or it may actually be able to cancel out the ROC if the swap closes appropriately “in the money”).

It’s a bit messy and complex, and a lot of investors just ignore it (because they are simply focused on the big monthly distributions instead of the “total returns”), but I wrote about it in more detail here.

Total Return Considerations

According to Investopedia:

“Total return, when measuring performance, is the actual rate of return of an investment or a pool of investments over a given evaluation period. Total return includes interest, capital gains, dividends, and distributions realized over a period. Total return accounts for two categories of return: income including interest paid by fixed-income investments, distributions, or dividends and capital appreciation, representing the change in the market price of an asset.”

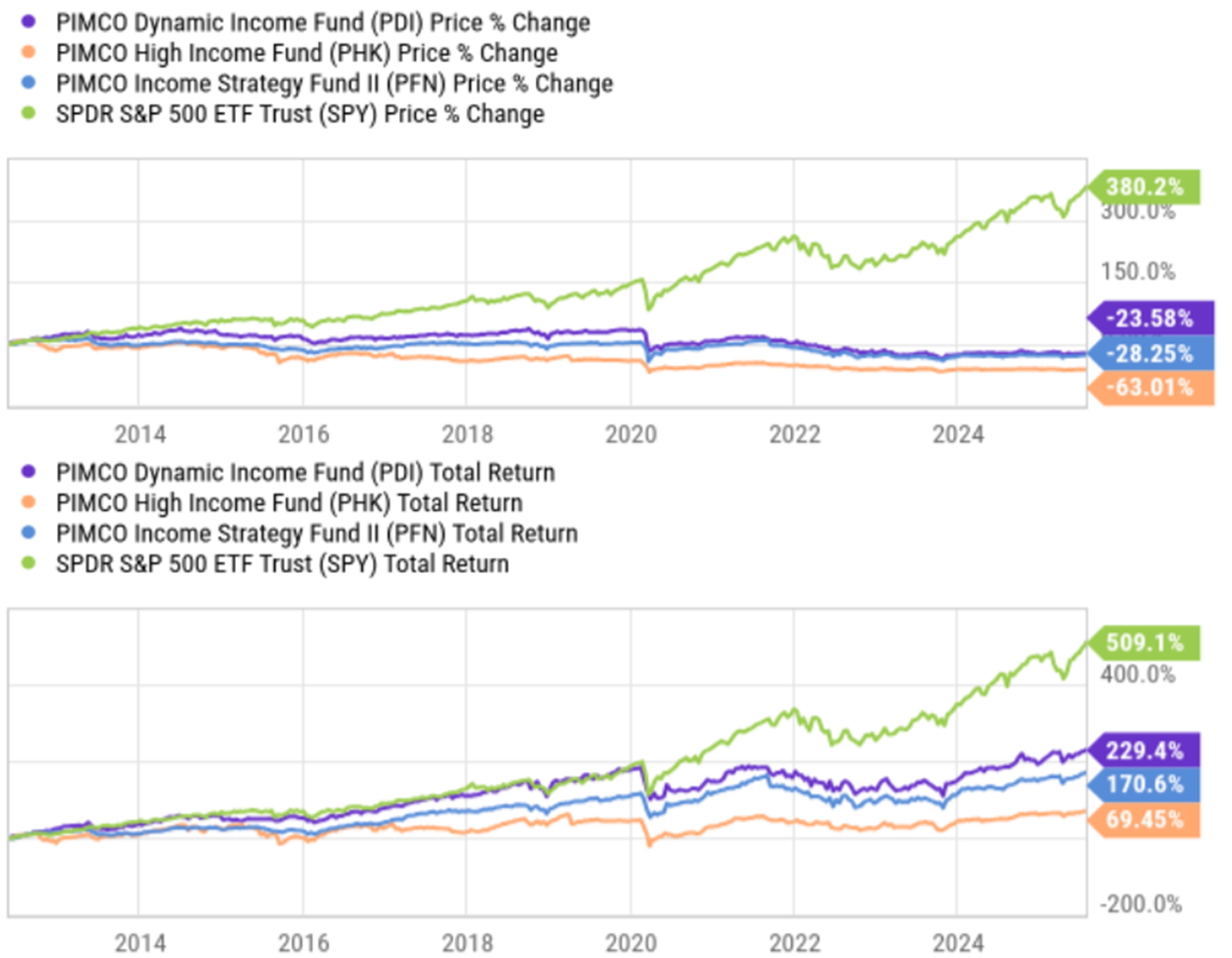

And for perspective, here is a look at the total return (versus price gains) of PDI (and a couple other popular PIMCO CEFs) versus the S&P 500.

As you can see above, even though PDI keeps paying big distributions to investors every month, its price has also been declining, so its total return is LOWER than the distributions it has been paying (due to the negative price returns). And whether we attribute this to ROC or “paid in surplus” the price declines are like a hidden tax on your income.

Additional Risks

Based on the earlier graphic (7 Big-Yield CEF Questions), there are additional risks to investing in PDI (besides just a declining share price, ROC and “paid in surplus”) that investors need to consider. For example, duration (or interest rate risk) which is reasonable at just under four years for PDI, is a risk that investors need to keep on their radar (because when interest rates rise, the value of PDI will decrease, and vice-versa). Also, these funds use significant leverage (or borrowed money) which can magnify returns and income (and PIMCO is very good at managing this), but it can also magnify losses in the bad times.

Further, total expenses for PDI (and other CEFs) is a significant factor investors need to consider because it detracts directly from their bottom line. For example, the cost of leverage (or borrowing) can be a significant expense for these funds (especially as interest rates—the cost of borrowing—is volatile). Further still, PIMCO funds often trade at a premium to NAV which means when you purchase shares you are paying more than the underlying holdings are actually worth. All else equal, I’d rather purchase shares of an attractive CEF at a discount (not a premium), but at least the premium allows PIMCO to issue more shares (which they occasionally do) at an attractive premium price. And the z-scores in the table above show how the current premium or discount compares to recent history (perhaps suggesting which funds are particularly expensive (red) or relatively less expensive (green) right now with regards to premiums and discounts versus net asset values).

Conclusion

It’s easy to write an article about how great PIMCO CEFs are (such as PDI) just because they offer such big monthly income. But in real life, when you are dealing with your hard-earned nest egg, you may want to look beyond simply the yield, including also the risks, such as the declining share price (which is essentially a tax on your income).

At the end of the day, I like PIMCO CEFs, including PDI, but I do not think they are as great as some people believe. And considering the risks mentioned above, and the dangers of longer-term inflation (which bond CEFs may not be as good at protecting against as long-term stocks are), I think PDI can be an important part of a prudently-diversified, long-term goal-focused investment portfolio. And when it comes to bond CEFs—PIMCO is the best in the industry.

Bottom line: You ultimately need to do what is right for you, based on your own individual situation. Disciplined, goal-focused, long-term investing continues to be a winning strategy.