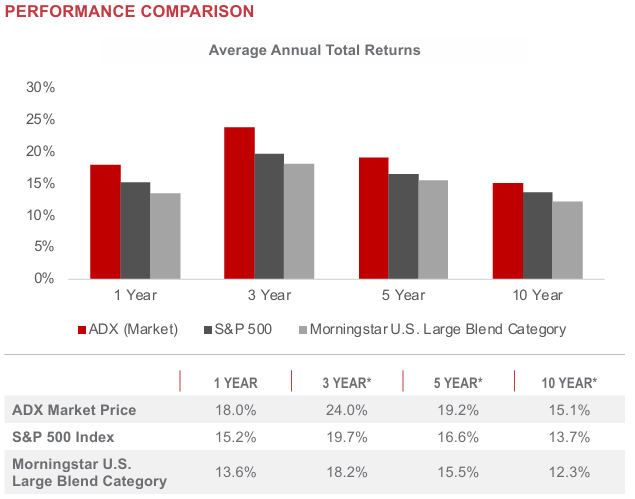

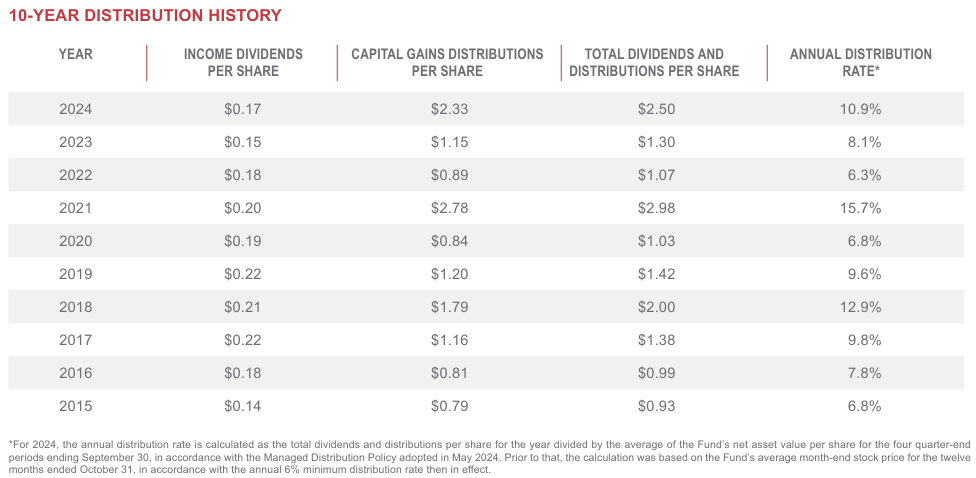

The Adams Diversified Equity Fund (ADX) is a compelling stock market closed-end fund (“CEF”) thanks to its long history (85+ years) of paying big distributions (guaranteed yield is 8%, and 2024 was 10.9%) and outperformance versus the S&P 500 (see chart below). However before investing, it’s important to understand how this fund is constructed (what are its goals) and why do many investors absolutely hate it (they generally have different goals and don’t care to understand the mechanics of ADX). After reviewing the details, I conclude with my strong opinion on who may, and who may not, want to invest in ADX, and why. Enjoy!

The Adams Diversified Equity Fund (ADX):

According to the fund’s website, the goal of ADX is:

“Adams Diversified Equity Fund, the Adams Express™ closed-end fund, seeks to deliver superior returns over time by investing in a broadly-diversified equity portfolio. The Fund invests in a blend of high-quality, large-cap companies. The Fund seeks to generate returns that exceed its benchmark as well as consistently distribute dividend income and capital gains to shareholders.”

And as you can see in the tables (above and below), ADX has been delivering on both total return (above) and distribution yield (below).

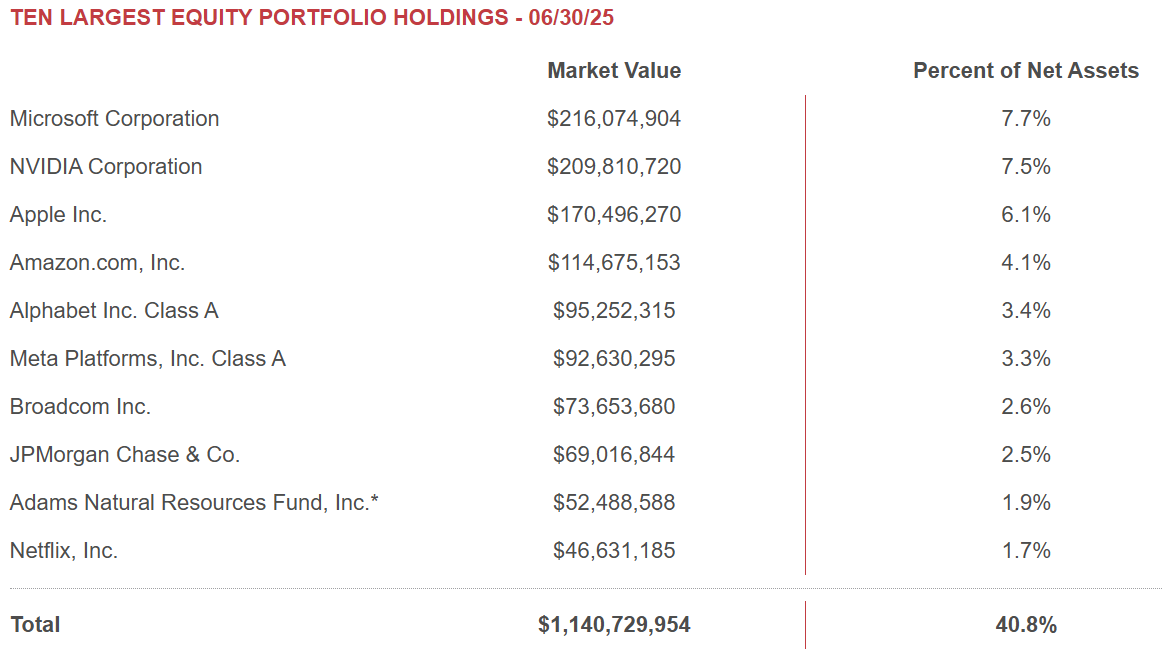

Also important, ADX is internally managed (this helps reduce conflicts of interest and better align investor and management goals), and is broadly diversified and sector neutral (as you can see in the sector and top 10 holdings graphics below).

Note: Technology is ~33% of the S&P 500.

And regarding the distribution, ADX is committed to a quarterly distribution of at least 2% of average net asset value (more on this later).

What is a Closed-End Fund:

Before getting into more details on ADX, it’s important to understand that it is a closed-end fund (“CEF”) and what that means. A CEF is a basket of investments (for example, ADX owns many individual stocks) that trades on an exchange. However, unlike open-ended funds (such as ETFs and mutual funds), the price of a closed-end fund often trades at a wide discount or premium to the net asset value (“NAV”) of its underlying holdings (which can create unique opportunities and risks). For example, ADX typically trades at a wide discount (more on this later).

For perspective (and to help me make disciplined investment decisions), here are seven important CEF questions I always ask myself before investing:

I’ll refer back to the 7 questions in the above graphic throughout this report.

Some Investors Hate ADX

Before describing more of the attractive details of ADX, it’s important to at least acknowledge the big reasons why some investors absolutely hate it.

Fees: For one, ADX has an annual expense ratio of around 0.59%. And while this is low by CEF and mutual fund standards, it is still higher than some index ETFs and higher than just picking your own individual stocks (instead of letting ADX do it for you). However, this fee becomes less detracting when you consider ADX fairly consistently trades at a discount to NAV (which means you get access to all of the earnigns and dividend power of the underlying holdings, but you get them at a discounted price—even if the discount never goes away).

Distribution Source: Another reason some investors “hate” ADX is because they realize a signficant portion of the big quarterly distribution is NOT generated from dividends on the underlying holdings, but rather it is sourced from long-term capital gains (i.e. the fund will sell some of its winners to fund the big quarterly distrubions to investors). For example, you can see in the earlier 10-year distribution history chart that capital gains have been a significant funding source for the quarterly distribution (which is fine and good considering the dividends on the underlying stock holdings are not enough, and long-term gains are the main driver of value for stock market investors).

DIY Investors: Many investors realize they can just buy an ETF or a basket of stocks on their own, and then use some of the long-term gains to fund whatever quarterly (or even monthly) distributions they want (instead of relying on ADX to do it for them). For this reason they don’t like the fund (or its reasonable 0.59% expense ratio), whereas others are happy (and prefer) to let ADX manage this activity for them.

Why ADX Has Been Successful for so Long

Big Yield (10.9% in 2024): ADX has been paying distributions for over 85 consecutive years (that’s a long time!). The fund’s “managed distribution policy” was adopted in May 2024 and commits to an annual distribution rate of at least 8% of the average NAV (calculated based on the four quarter-end periods ending September 30) (note: the guaranteed yield was only 6% prior to this time). This high yield (it was 10.9% in 2024), combined with consistent payouts for over many decades, positions ADX as a loved income-focused investment for many.

Long-Term Price Discount: As mentioned earlier, the fact that ADX has traded at a discount for so long (see chart below) allows investors to buy into all the earnings, dividends and capital appreciation potential of the holdings at a discounted price. This is attractive even if the discount never dissipates.

Dividend Reinvestment Plan: ADX offers a compelling Dividend Reinvestment Plan (DRIP). Specifically, if you elect to reinvest the distributions, then the reinvestment price is determined by the lower of NAV or market price on the valuation date. This can provide an attractive cost advantage. For example, if ADX’s NAV is $22.93 and the market price is $21.15, shares are issued at $21.15, offering a slight discount relative to NAV (a good thing).

Internally Managed: As mentioned, the internal management of the fund helps align investors and management interests (another good thing).

Performance: As we saw in the early chart, ADX has a healthy hisory of outperforming the market.

Risks:

Of course, there are a variety of risks that should be considered before investing in ADX. For example:

Stock Market Exposure is a big risk for this fund because as the market goes up and down (sometimes a lot) so too does the price of this fund. However, this is also an attractive quality for many income-focused investors looking to complement their mostly bond-focused portfolios with some less correlated (and higher long-term gains potential) stock market exposure (i.e. ADX). Plus the big quarterly distributions help make the short term (and mid term) price volatility more tolerable for many.

Activist Investors: In 2024 some activist investors became interested in ADX because they wanted to see the price discount (versus NAV) shrink (or they wanted to take a position on the ADX board, which could have driven all kinds of short-term shenanigas and conflicts of interest). As a result, ADX announced a tendor offer to purchase shares at 98% of NAV (to shrink the discount and to appease the activists). The offer worked (it was over-subscribed) and that’s why the price discount (versus NAV) shrunk (see the earlier price discount chart). Nonetheless, activist investor interest remains a risk.

Investor Misunderstanding is another risk. For example, a lot of investors may not fully realize (or appreciate) that if they take the distrubtions (as cash) instead of reinvesting in the fund, this will have a dramatic impact on long-term performance (i.e. the price of ADX has not, and will not, rise much over the longer term).

The Bottom Line

If you are an income-focused investor, and you greatly appreciate big steady quarterly distributions (with the potential for an even larger fourth-quarter annual distribution) ADX is worth considering. In addition to the big distributions, it also gives income-focused investors exposure to the stock market (something many of them are missing because they are often so overly concentrated in bond funds, such as those from PIMCO).

Additionally, the fund’s long-term discount helps offset the reasonable CEF fee. And the fund’s use of 0% leverage (no borrowed money) helps keep the stock market risks in check (versus bond funds which often use 30-40% leverage). Further still, ADX has been accomplishing its objectives (pay distributions for over 85 years straight) for a very long time!

If you are prone to do things yourself (like sell some of your winners periodically to generate regular income), or if you don’t care so much about the big distributions at all—then ADX may not be right for you.

But if you are a disciplined, long-term, income-focused investor, ADX is absolutely worth considerig for a spot in your portfolio. *Long ADX.