If you like big-yield opportunities, trading at discounted prices, the healthcare sector CEF I review in this report is worth considering. It currently offers a 14% yield (paid monthly) and trades at a big contrarian discount (its top holdings are down big, and it trades at a 9% discount to net asset value). This report takes a closer look at what is happening here (in terms of fund strategy, valuation and risks) and then concludes with my strong opinion on who might want to invest.

About THQ:

According to the Aberdeen website, THQ: “seeks current income and long-term capital appreciation,” and it does so by owning primarily healthcare stocks (recently ~74%) as well as corporate bonds in the healthcare sector (recently ~14%) and small allocations to healthcare REITs, venture capital and derivatives (~5%, ~5% and ~2%, respectively).

And it achieves these allocations with the help of leverage (or borrowed money) which can magnify returns and income in the good times, but magnify risks in the bad times (more on this later).

And speaking of “bad times,” the fund has recently performed terribly as nearly all of its top holdings are underperforming the S&P 500 (some of them by a lot) as you can see in the following chart.

Worth mentioning, the THQ leverage ratio was recently 30.5% (a lot for a primarily equity fund, but still reasonable considering the healthcare sector is historically less volatile, and with a lower “beta,” than the S&P 500, and say technology stocks in particular, and the fund has a significant allocation to bonds too—also lower volatility).

What is a Closed-End Fund (CEF)

Before getting into more details on THQ, it’s worth briefly reviewing what a CEF is (because that’s what THQ is). A closed-end fund is a basket of investments (THQ recently had 115 individual positions) thereby providing some instant diversification; and unlike open-end mutual funds and exchange-traded funds, CEFs typically start with a fixed number of shares and trade based on supply and demand (i.e. there is no mechanism in place to ensure the market price stays close to the net asset value (NAV) of the underlying holdings, as is the case for open-end mutual funds and ETFs) and thereby CEFs can trade at wide discounts and premiums to NAV thereby creating significant risks and opportunities (more on this later).

For reference, here is a look at 7 big-yield closed-end fund questions I always ask myself before investing, and I will refer to this graphic throughout this report.

Why has THQ performance been so bad?

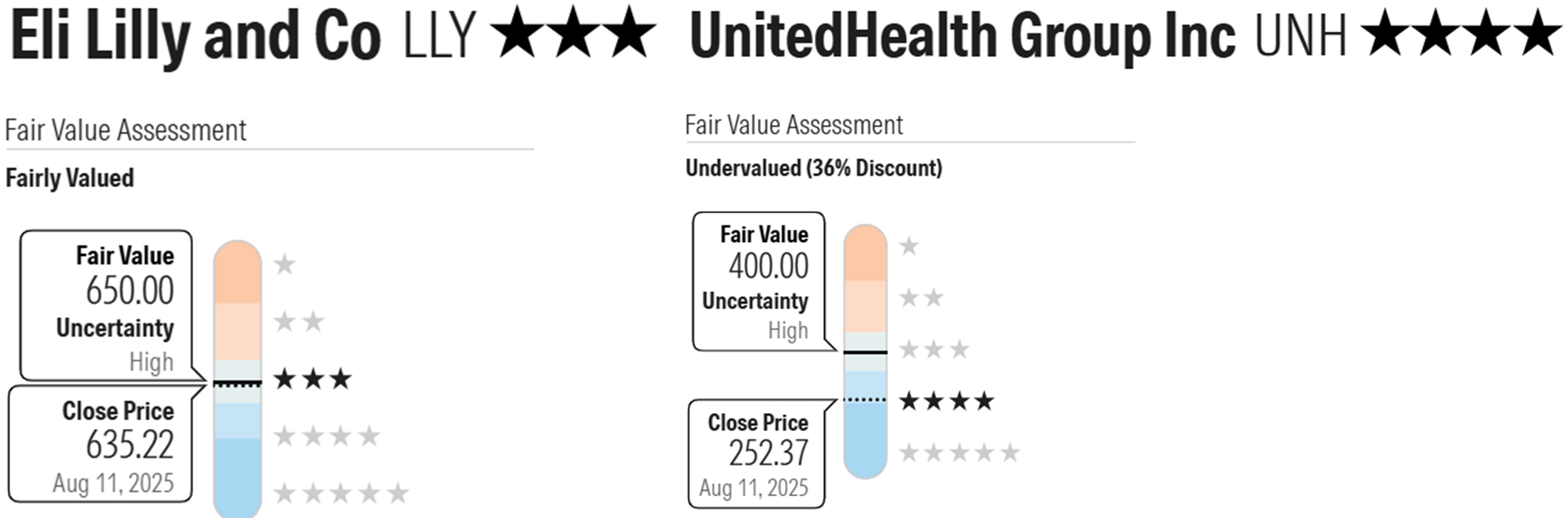

As you can see in the earlier chart, THQ performance has been weak over the last year (down -18%) as compared to the S&P 500 (up +21%), and the main reason is because the big healthcare stocks it owns (e.g. Eli Lilly (LLY) and United Healthgroup (UNH), the largest holdings) have been terrible (and the whole healthcare sector is down too).

Additionally, THQ is trading at an increased discount to NAV (which has been an additional drag on price performance) as “fearful investors” have put selling pressure on the shares (particularly in recent trading sessions, see chart below).

Further still, the fund’s unique custom benchmark (80% S&PComposite 1500 Healthcare Index, 15% S&P 500 HealthCare Corporate Bond Index, 5% S&P Composite 1500 HealthCare REITS Index) has also been relatively weak. In a nutshell, the healthcare sector has NOT done well recently.

Is THQ an attractive contrarian opportunity?

The answer to this question depends on your pesonal goals, however it is notable that healthcare stocks can be a bit of a defensive play versus the more volatile S&P 500, and many investors believe the top holdings (such as Lilly and UNH) are attractive (Morning star rates them 3 and 4 stars, respectively, and suggests they have 2.3% and 36% immediate upside, respectively).

Further still, the discounted price versus NAV (from fearful selling pressure) aruguably makes the shares significantly more attractive than they were. However, it still depends on your personal situation, goals and investment philosophy (more on this in the conclusion).

Risks Factors:

Of course THQ faces a variety of risk factors investors need to consider. For example:

Leverage: As mentioned, THQ uses leverage (borrowed money) to magnify returns and income, but this also magnifies risks in the bad times (when it sells off, it can sell off hard, like it just did).

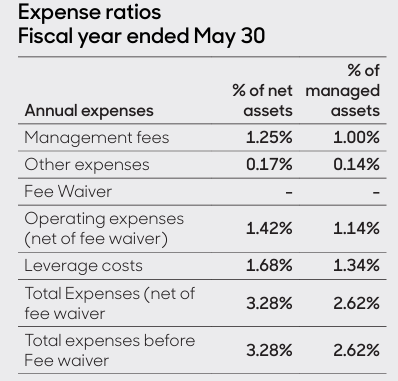

Fees and expenses are another risk. For example, the interest rate on borrowed money (leverage) adds to the fund’s total expense ratio (as you can see in the graphic below), and the overall expense ratio (recently 3.28%) is very expensive compared to just owning individual stocks on your own (basically free) or just buying a healthcare sector ETF (XLV) which has an expense ratio of only 0.08%, and then creating your own distributions (by selling some of your shares).

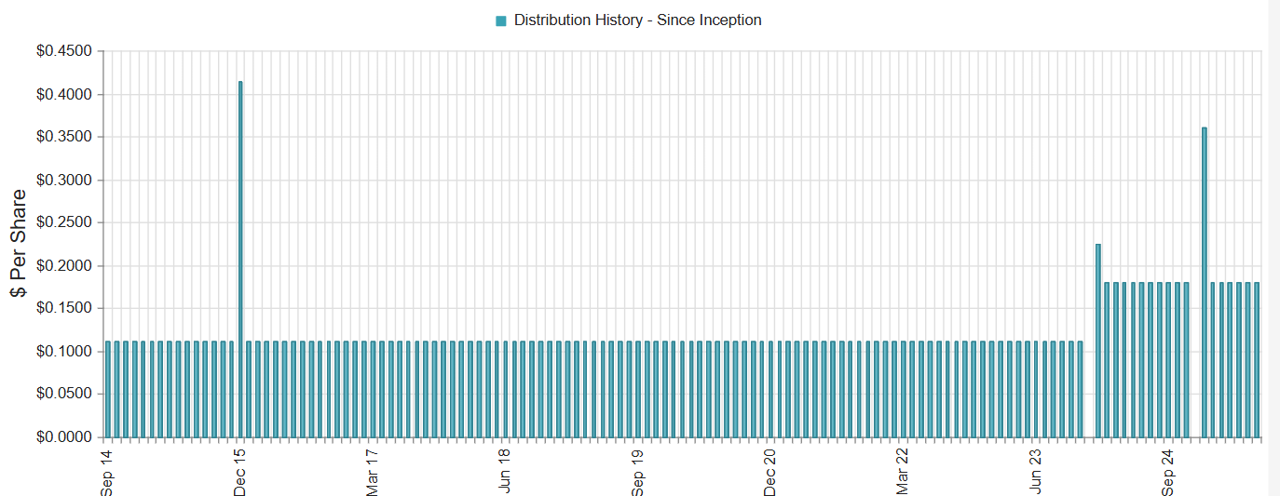

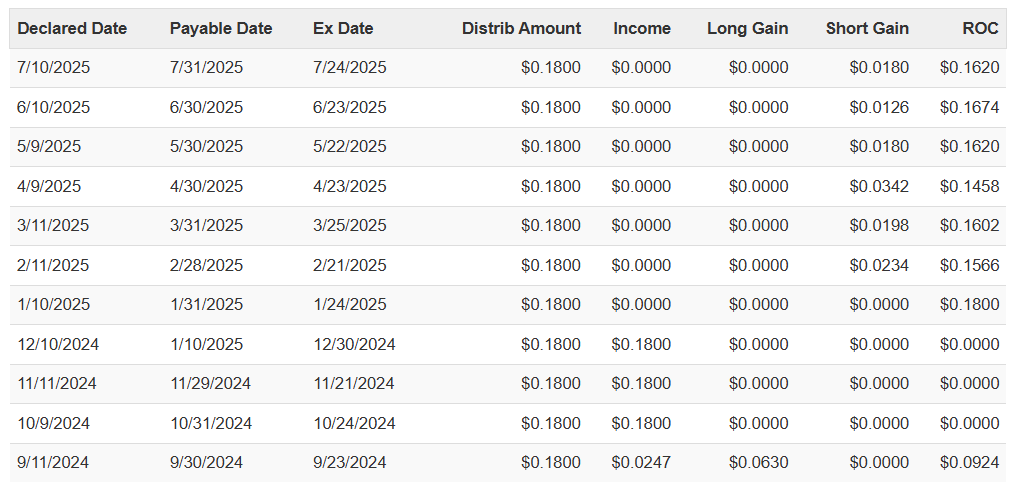

New Management: Aberdeen (now abrdn) took over management of THQ from Tekla in October of 2023, and the transition creates some risk. For example, the new management company was quick to raise the distribution after the acquisition (see chart below), but this also increases the risks.

Is the distribution sustainable? The increased distribution calls into question whether the distribution is sustainable over the long-term. For example, as you can see in the table below, THQ has been using some ROC (return of capital) to support the distribution recently. A little ROC is fine from time to time, but if it is continued for the long term it eats away at the net asset value, reduces the future earnings power (and income power) of the fund and makes the distribution increasingly at risk of requiring a reduction. However, even if abrdn is forced to reduce the distribution, it will still likely be quite large and this will also increase the future health of the fund.

Also noteworthy, short-term capital gains have been used recently to help support the distribution, and these short-term gains may be taxed at a higher rate for you than long-term gains (depending on your tax bracket, and whether you own THQ in a taxable account or non-taxable retirement account).

The discount can get bigger. We’ve already considered the recently increased THQ share price discount versus NAV to be attractive (all else equal, I prefer to purchase attractive CEFs at a discount to NAV, not a premium). However, that doesn’t mean the discount cannot still get bigger (which would hurt the value of your position), considering it has been bigger throughout history as you can see in the earlier “Premium/Discount” chart.

Is the healthcare sector right for you? Rather than concentrating your investments in the healthcare sector (like THQ does) some investors prefer to invest more broadly across all sectors (such as an S&P 500 ETF). However, others prefer the perceived safetfy (and historical safety) of the healthcare sector (especially when it has been underperforming and presents a contrarian opportunity) particularly when combined with THQ’s big steady monthly distribution payments to invesors (i.e. put it on “autopilot” and just let the distribution cash roll in).

The Bottom Line

THQ is absolutely NOT for everyone, However, if you are an income-focused investor that likes to pruchase big distributions when they trade at a discounted price (i.e. the discount to NAV has just increased based on fearful selling, and the healthcare sector may be due for a bit of a contrarian rebound), THQ is worth considering. I currently own shares in my High Income NOW portfolio.