The electrical equipment company I review in this report has emerged as a key player in the Artificial Intelligence (AI) energy boom (thanks to its solid oxide fuel cell technology, which provides efficient, low-emission, power solutions to hyperscalers). This report reviews the business, growth trajectory, valuation and risks, and then concludes with my strong opinion on investing.

Bloom Energy Corporation (BE):

Bloom Energy provides efficient, lower-emission, electricity by converting natural gas or hydrogen (through its specialized solid oxide fuel cell technology, upon which it holds multiple patents). Bloom’s systems also enable rapid deployment (often in 90 days) thereby making them ideal for mission-critical data centers and AI applications.

Key customers include Southern Company (historically 43-53% of revenue), Korea Energy, Oracle, Equinix (over 100MW capacity), and CoreWeave; and they validate Bloom’s competitive edge over gas turbines (in terms of speed, cost, and permitting, for example).

And for perspective, Bloom went public in July, 2018 (it raised ~$270 million for expansion, to fund operations, and to enhance its market presence). Prior to that, it raised over $1.7 billion in venture capital. And more recently, it raised $230 million in debt in 2020 (to help refinance obligations and stabilize its balance sheet). Essentially, Bloom is still a fairly new company and it is growing rapidly.

Growth Trajectory:

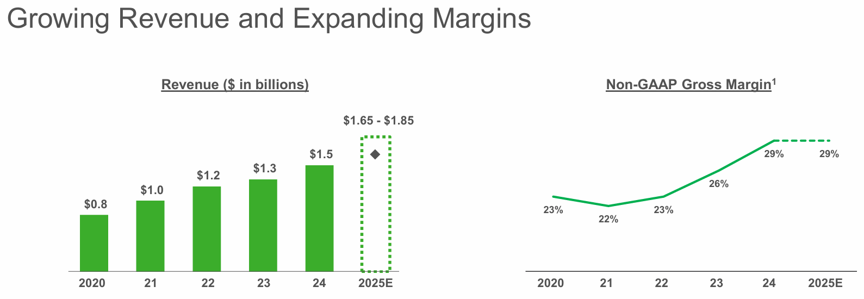

As you can see below, Bloom’s revenue is on a high-growth trajectory, fueled in large part by the ongoing proliferation of AI in datacenters (huge energy demands) which require efficient sources of energy (e.g. Bloom).

AI infrastructure demands are expected to consume 8-12% of U.S. electricity by 2030 (this is huge!) thereby creating a 35GW power gap that onsite solutions like Bloom address. And along these lines, Bloom plans to double its factory capacity to 2GW by 2026 with a $100 million investment, supported by a robust pipeline from hyperscalers.

For example, partnerships with Oracle and AEP (for AWS and Coralogix) highlight Bloom’s role in powering AI data centers, with its rapid 90-day deployments demonstrating its ability to meet urgent, high-scale power needs.

In particular, Bloom’s modular, low-emission fuel cells offer faster deployment, lower operating costs, and easier permitting compared to gas turbines and thereby position it as a preferred solution for data centers.

Also critically important, the company has tax credit support. For example, the recent reinstatement of ITC (investment tax credit) through 2032 (with safe harbor ensuring 2025 benefits) supports customer adoption and mitigates order pushout risks. And according to the recent JP Morgan note:

“We believe the tax credit should provide pricing power for BE in conversations with data centers, while also increasing demand from more price sensitive (non-data center) customers,” the note said, adding that rising gas turbine prices and long lead times could push hesitant buyers to commit.”

Further, the broader “$1.2 trillion clean energy transition and decarbonization” theme positions Bloom for ongoing expansion.

Also worth mentioning, recent deals with Oracle (for AI data centers) and AEP (for AWS) underscore strong demand (recent Q1 2025 revenue was up 39% year-over-year).

Valuation:

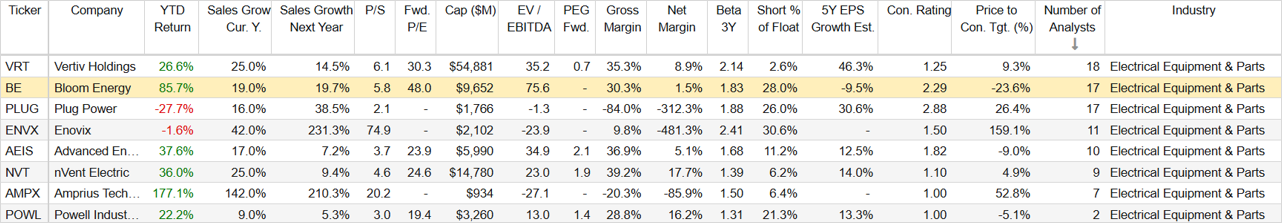

From a valuation standpoint, Bloom Energy is not inexpensive, and the investment thesis relies on the potential disruptive growth ahead (from data centers and tax credits) which may not be adequately captured in current Wall Street estiamtes.

For example, tax credits may improve margins and encourage customers to commit, thereby leading to better growth than the market is expecting. Trading at 5.8x sales is not particularly inexpensive, however it can go significantly higher if/when the market adpopts a high growth and profits narrative related to AI and tax credts. At only a $9 billion market cap (it’s a mid cap stock), Bloom is still a bit under the radar for many investors.

Risks:

Bloom faces a variety of risks. For example:

Rapid expansion risks: Bloom faces the risks of cash burn (from expansion), execution risks (in scaling production), and margin pressures. However, this is also a “high class” risk, as growing pains can be par for the course.

Policy shifts also pose a risk. ITC (tax credit) was included (unexpectedly) as part of the recent “Big Beautiful Bill,” but any changes could deter adoption of Bloom’s solutions. However, it does appear smooth sailing in this regard for now.

Revenue concentration is a risk, considering a few customers comprise a significant portion of revenue (as mentioned earlier) and thereby heightening dependency risks. For example, key customers include Southern Company (historically 43-53% of revenue), Korea Energy, Oracle, Equinix (over 100MW capacity), and CoreWeave.

Competition also poses a risk, as there are much bigger competitors with large economies of scale (although they don’t benefit from the same technologies or tax credits as Bloom).

Macroeconomic risks are also a factor. Any slowdown to the AI megatrend (which seems unlikely) or changes in interest rates (for example) could hinder the company’s increasing forward growth trajectory.

The Bottom Line:

The AI and data center megatrend position Bloom Energy for significant growth, especially considering its unique power technologies (clean, efficient and quick deployment), combined with the recent tax credit (ITC) included in the “Big Beautiful Bill” give it noteworthy competitive advantages. Further, the company’s significant expansion plans demonstrate it has confidence in its high-growth trajectory.

However, the current valuation is not particularly compelling (although top opportunities are rarely ever cheap, and these shares (and valuation) can still go much higher).

I am putting Bloom Energy high on my watch list for now (no current position), and may add shares in the near future (based on any new information and/or sigificant share price pullack).

As always, disciplined, goal-focused, long-term investing continues to be a winning strategy. Be smart people—do what is right for you.