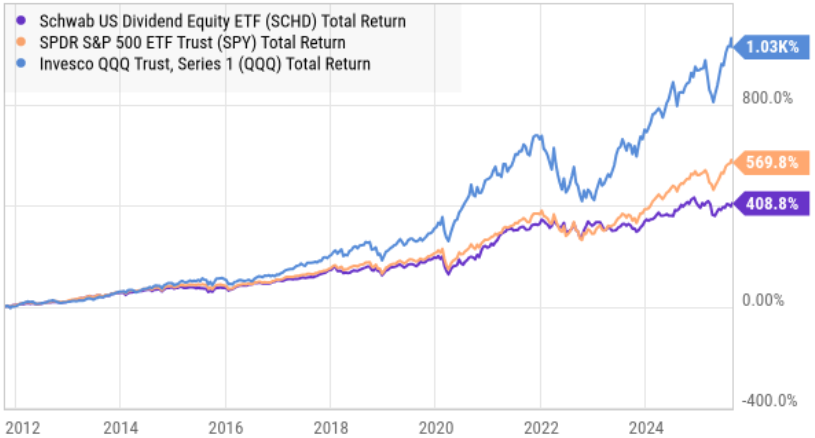

The Schwab US Dividend Equity ETF (SCHD) is increasingly popular (total assets have zoomed to over $70 billion), yet it has significantly underperformed the market (SPY) and especially the tech-heavy Nasdaq 100 (QQQ). This report reviews the SCHD strategy, including its attractive qualities and big risks, and then concludes with my strong opinion on investing.

About SCHD (Attractive Qualities):

Lower-volatility blue-chip safety and attractive dividend growth is what comes to my mind when I think of SCHD. In particular, while the market has flocked to high-growth and technology stocks (which continue to signficantly outperform) SCHD presents the type of old school high-quality strategy that has worked for many decades. And with certain popular zero-dividend growth stock corners of the market now trading at nose-bleed valuations, SCHD makes more and more sense to a lot of investors. Particularly those who have built up significant nest eggs over the years and don’t feel like risking it all on popular AI “flash mobs” like Palantir and Tesla, to name a couple.

According to the Schwab website, the objective of SCHD is to track the total return of the Dow Jones U.S. Dividend 100™ Index, which is designed to basically:

“measure the performance of high-dividend-yielding stocks in the U.S. with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios.”

So basically, SCHD owns “quality” high-dividend stocks, which is essentially the holy grail for many (but certaintly not all) investors.

And to add some additional color, here are a few of the attractive qualities of this ETF that are compelling to many investors:

3.7% dividend yield: SCHD’s dividend yield is nearly double the 1.9% of the S&P 500, and to a lot of investors this is an indication of safety as the companies within SCHD actually have the free cash flow to support payments (and that’s more than you can say for a lot of high-growth stocks currently paying zero dividends because they are speculatively pouring everying back into their businesses just to support their very high current valuations).

Low Beta and Low Volatility are two more attractive qualities. The S&P 500 has a beta of 1.0 (by definition) and securities with betas below one (such as SCHD’s 3-year beta of 0.78 is an indication of safetfy and low volatility.

Outperforms when the market sells off: You can also see in the earlier price performance chart that when the market sells off hard, SCHD tends to sell of less hard (i.e. keep more of what you’ve got) especially as compared to the S&P 500 and the Nasdaq 100.

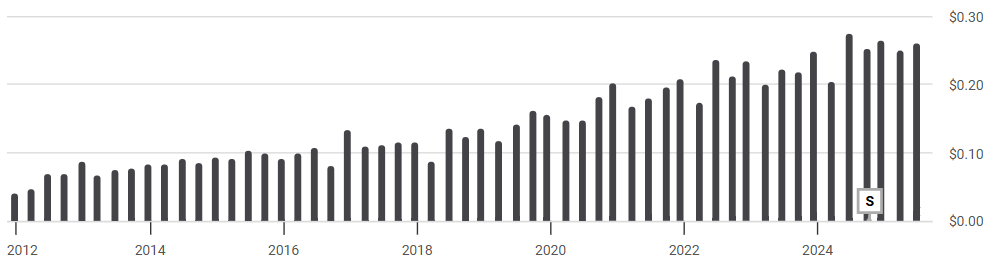

Dividend Growth is another indication of financial strength, and as you can see in the chart below, SCHD has been doing very well in this category (as the blue chip companies it owns continue to deliver).

Not an AI Flash Mob: Artificial Intelligence (“AI”) is the most popular theme in the market today, considered a long-term mega trend by many. However, as we have seen over and over throughout history, many of the most popular stocks of the days can climb rapidly (in “flash mob” type fashion) and then fall rapidly. We certainly saw this during covid (where work-from-home stocks like Zoom and Teladoc did very well very quckly, and then gave back all their gains very quickly too). Currently, some people believe AI stocks like Palantir and Nebius fall into this category (and SCHD has no position in any of these zero-dividend names).

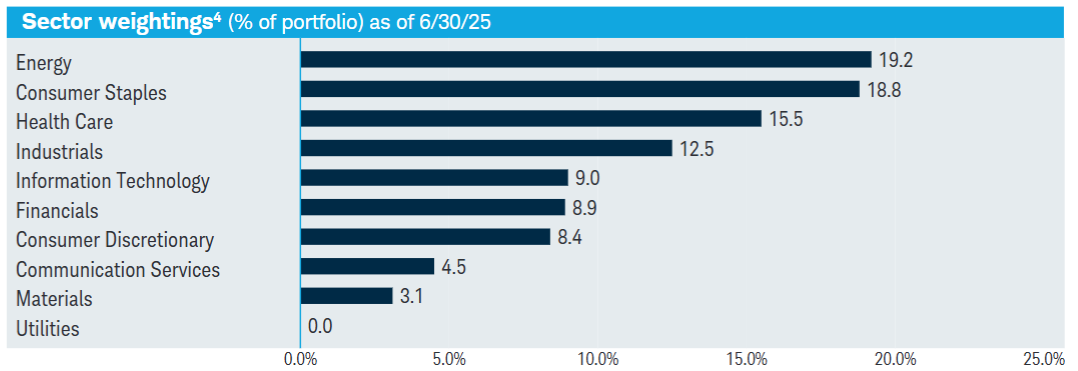

Instant Diversification: with just over 100 positions, SCHD provides investors some instant diversification. Rather than racking your brain constantly worrying about what to buy or sell, SCHD does all the work for you and stays fully invested too (to help those big growing dividends keep rolling in, while the share price is also positioned to keep climbing over the long term).

Qualified Dividends are another attractive SCHD quality. Specifically, the stocks SCHD holds typically qualify for the lower dividend taxation rate (0%, 15% or 20%, depending on your tax bracket). This helps boost your after tax return, something REITs, BDCs and CEFs are typically not able to do (their distributions tend to often be taxed at your ordinary tax rate—which is typically higher and thereby reduces your after tax returns if you own them in a taxable account).

No Gimmicky Leverage or ROC: Additionally, SCHD doesn’t source distributions from return of capital (“ROC”) something that can create problems for CEFs, for example. Further still, SCHD doesn’t layer on additional layers of leverage (or borrowed money) to juice the returns like some strategies do.

No Unnecessary Credit Risk: As mentioned, SCHD invests in high quality businesses, and this is a good thing at a time when credit spreads are near historic lows (meaning investors may not currently be appropriately compensated for taking on additional risks). For example, BDCs and CEFs add a little extra yield by adding a lot of additional risk as compared to what SCHD does. SCHD’s high-quality blue chip investments are attractive.

Who Might Want to Invest:

SCHD is for winners. In particular, if you have already built up a significant nestegg, you may not need to take on the same high level of risk as younger investors who still have a lot of time to make up for losses if something goes wrong.

Further, there is never any good reason to take on additional risks just to keep up with the Joneses (something SCHD does not do). For a lot of investors, they simply just don’t need to be chasing speculative zero-profit growth stocks at this point in the cycle and at this point in their lives.

Rather, if you are looking for steady growing income and some healthy long-term capital appreciation, SCHD may be right for you.

Risks:

Of course there are risks to investing in SCHD that investors need to be aware of.

Opportunity Cost: Perhaps, the largest risk is opportunity cost. Specifically, by omitting speculative high-growth stocks, SCHD has delivered lower returns over the long-term. This is a trend that might reverse, but it might also continue to work against SCHD investors.

Market risk is another SCHD risk. SCHD can lose value (and it has over certain periods of time, although the long-term trend remains signficiantly to the upside). However, the fund’s outsized dividends help pad any near-term market declines (both psychologically and from a lower price-volatility standpoint too).

Conclusion:

SCHD is absolutely NOT for everyone. For example, if you are a young buck with many decades before you retire, avoiding SCHD (and instead investing in the complete S&P 500 or Nasdaq 100 stocks) may be the right strategy for you.

However, if you are at a point in life where you’ve already built up a signficant nestegg, SCHD may be exactly right for you in terms of steady growing qualified dividend income and long-term price appreciation (to help keep you ahead of inflation, and then some).

At the end of the day, you need to do what is right for you. Everyone’s individual situation is different. And disciplined goal-focused long-term investing continues to be a winning strategy. Be smart people.