Trading at an attractive 1.4x book value, the BDC I review in this report prints money when it issues new shares (which it does frequently). And the big 11.4% dividend yield is now paid monthly (previously it was quarterly). After reviewing the business, valuation, dividend safety and risks, I conclude with my strong opinion on investing.

About: Capital Southwest Corp (CSWC)

Based in Dallas, Texas, and with 31 employees, Capital Southwest is a Business Development Company (“BDC”) providing capital (mainly loans) to support the acquisition and growth of companies across a variety of industries.

It has total balance sheet assets of $1.9 billion, and operates Capital Southwest SBIC I, LP and Capital Southwest SBIC II, LP as wholly-owned subsidiaries. It also has 7.75% Notes due 2028 (CSWCZ).

CSWC is internally managed (this is good for aligning the interests of management and investors, not to mention it generally keeps costs lower). And it has an investment grade credit rating (Baa3 from Moody's and BBB- from Fitch), which is an indication of financial strength.

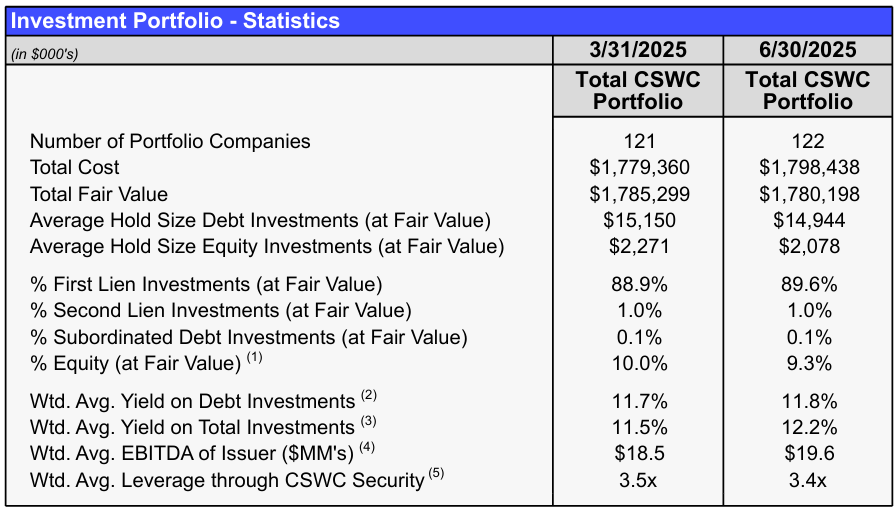

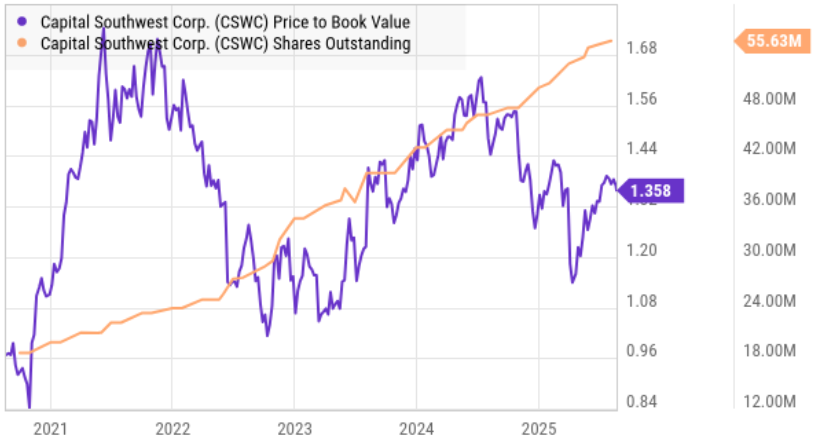

Capital Southwest invests in 122 portfolio companies (see table below), and the average yield on its debt investments is 11.8%, which helps support its big dividend yield (more on the dividend later).

Valuation (printing money at a premium):

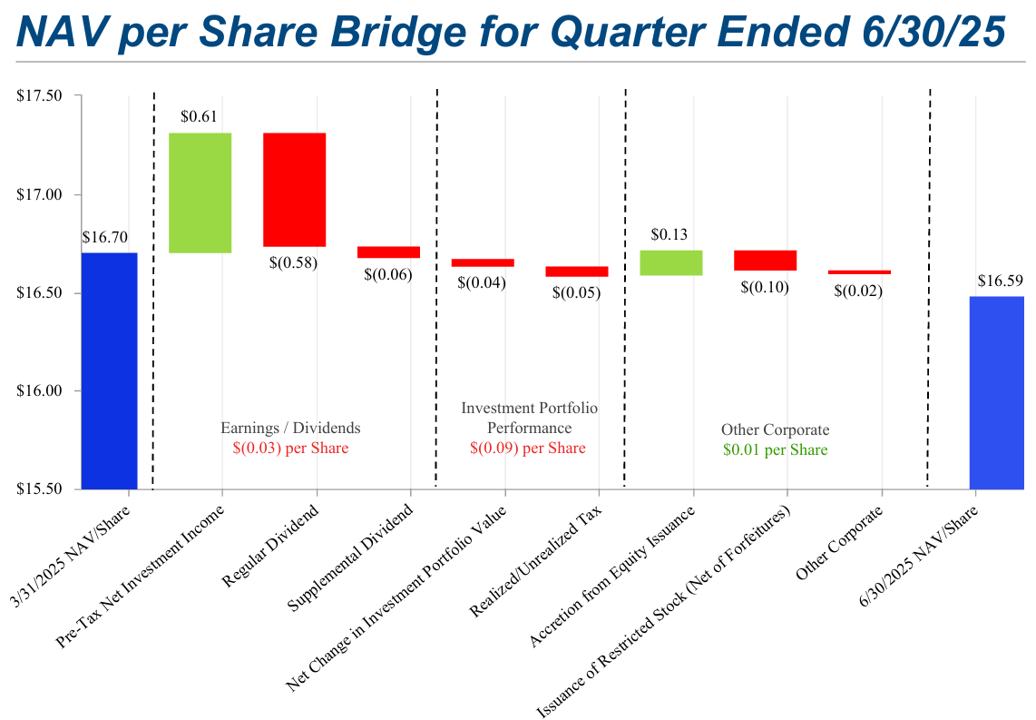

A basic BDC valuation metric is price-to-book value (“P/B”), and as you can see in the table below CSWC currently trades at a 1.4x premium to book value (also known as “net asset value” or “NAV”).

Some investors argue this premium is a negative thing (they only like to buy at a discount), but in reality the premium allows CSWC to issue new shares that are accretive to NAV (a very good thing for shareholders), as you can see in the following table.

CSWC basically prints money every time it issues shares, and as you can see in this next chart, CSWC has been issuing shares consistently over time (and thereby making good use of the opportunity created by the premium share price versus book value, plus it’s an indication of business growth in this case).

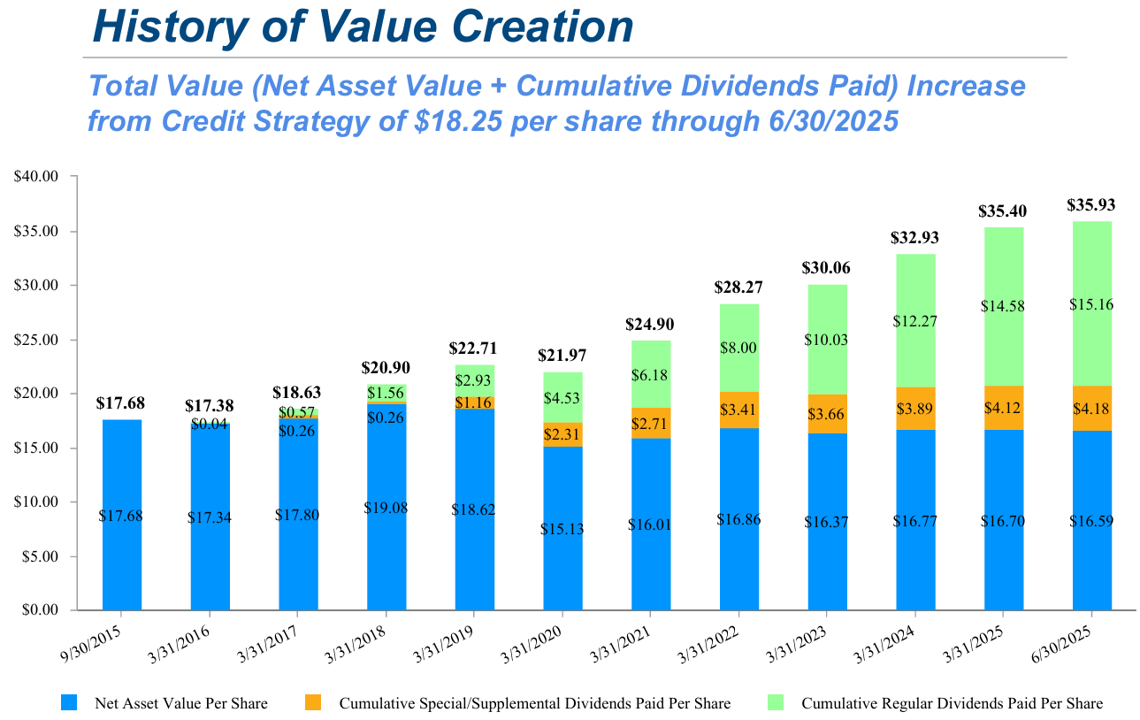

And for more perspective, you can see how CSWC has a long history of creating value for shareholders (in terms ov NAV plus dividends) in the following graphic.

Dividend Safety

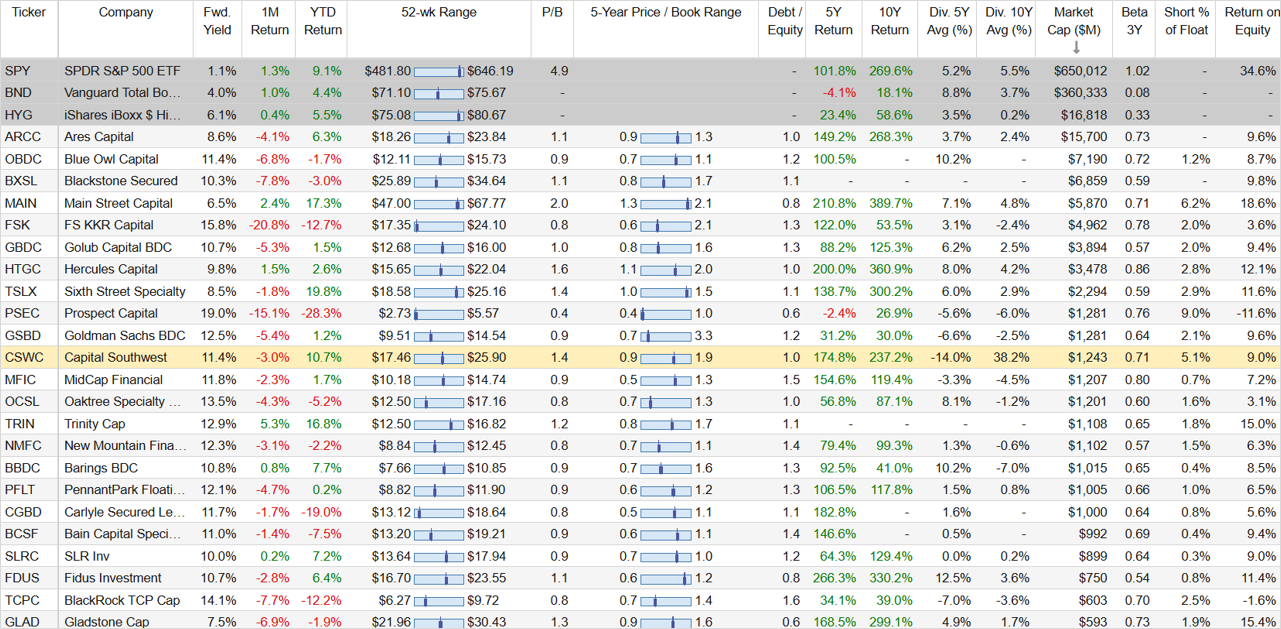

You can also see in the earlier “NAV per share Bridge…” graphic that CSWC net investment income (“NII”) per share covered the dividend in the most recent quarter (a good thing), and you can see in the chart below, CSWC has a long history of growing the dividend and paying supplemental (and special) dividends too (a great thing if you like big steady income).

Also worth mentioning, CSWC recently switched from paying dividends quarterly to paying them monthly (also a good thing for many income-focused investors), and will pay an additional supplemental dividend of $0.06 on September 30th (to shareholders of record as of Septembe 15th).

Additionally, CSWC’s net investment income (per share) has exceeded the regular dividend in three of the last four quarters, and on average it has exceeded the dividend for all four quarters (as you can see in the table below).

And keep in mind, BDCs are required to pay out the majority of net investment income as dividends to avoid corporate taxation, and for this reason the “dividend cushion” is always going to be small. Further, CSWC maintains an investment grade credit rating (a sign of financial strength).

Plus, as another indication of financial health, CSWC continues to find attractive new investment opportunities, as you an see in this next graphic.

Risks

There are risks investors should consider before investing in CSWC. For example:

Leverage: BDCs can use leverage (or borrowed money) to magnify their returns and income payments. The current regulatory leverage limit for BDCs in 2x debt to equity. However, CSWC currently only sits at 1.0x (as you can see in the earlier BDC comparison table), and it is actually even lower when you factor in the BDCs small business loans (which have regulatory protections). Specifically, CSWC just recently received final approval from the SBA for its second SBIC license, allowing access to up to $175 million in additional SBA debentures over time.

Interest Rates are another risk. As you can see in the graphic below, nearly 100% of CSWC’s loans are floating rate, which means as interest rates come down, CSWC earns less income (and vice versa). You can see specific interest rate movement sensitivity estimates below.

Tariffs and government policies also present uncertainty, particularly related to health care and government services (which are somewhat significant as you can see in the earlier industry concentration graph).

Credit Spreads are another risk. Specifically, spreads are currently very low meaning the market is not pricing in much extra compensation for taking on risk (i.e. spreads could widen if the market gets shakey, which would in term hurt the value of CSCW loans which are predominantly higher risk—even though collectively the BDC’s credit rating is investment grade).

Competitive Pressures also continue to build as banks are becoming increasingly competitive (as post financial crisis regulations fall further in the rear view mirror, and as competition among BDCs continues to increase).

Conclusion:

At the end of the day, if you like big steady monthly income (generated from a growing business with a healthy net asset value) Capital Southwest is absolutely worth considering. It provides somewhat of a reprieve from stock market risks (its beta is only 0.71, as you can see in the earlier BDC comparison table), and can be an important part of a prudently-diversified income-focused investment portfolio. I currently own shares in my Blue Harbinger “High Income NOW” portfolio.