There is a new #1 position in the “High Income NOW” Portfolio (it’s an 11.9% yield monthly-pay security trading at a discount). There are also a handful of new buys, sells and position '“right-sizings.” The aggregate yield is 9.9% and that consists of 25 individual positions (including BDCs, a variety of stock and bond CEFs, individual stocks and more). If you like your investments to pay big steady income, you’re going to want to check out this top-idea report, including the usual caveats and specific exceptional investment opportunities worth considering right now.

The Portfolio:

For starters, you can access the portfolio here:

As per usual, the holdings are sorted by weight (with top positions at the top), and you can also view current yields, recent price performance, ratings (based on “buy under” prices) and more.

Also, new buys are highlighted in green, complete sales are highlighted in red, and position size increases in green text, and position size decreases in red text.

The New #1 Position: A Bond Closed-End Fund

1. PIMCO Access Income Fund (PAXS), Yield; 11.9%

To get right to it, the PIMCO Access Income Fund is now the top holding, comprising a 7% weight in the aggregate portfolio and offering an 11.9% yield (paid monthly). This relatively new PIMCO (the leader in bond funds) Bond CEF doesn’t carry all the legacy derivatives baggage as other top PIMCO CEFs, and it also trades at a discount to NAV (as compared to premiums for many other popular PIMCO bond funds). It gives you access to a diversified portfolio of many individual bonds (that you couldn’t access on your own) as well as prudent leverage and a strong management team. If you like big steady income, PAXS is attractive.

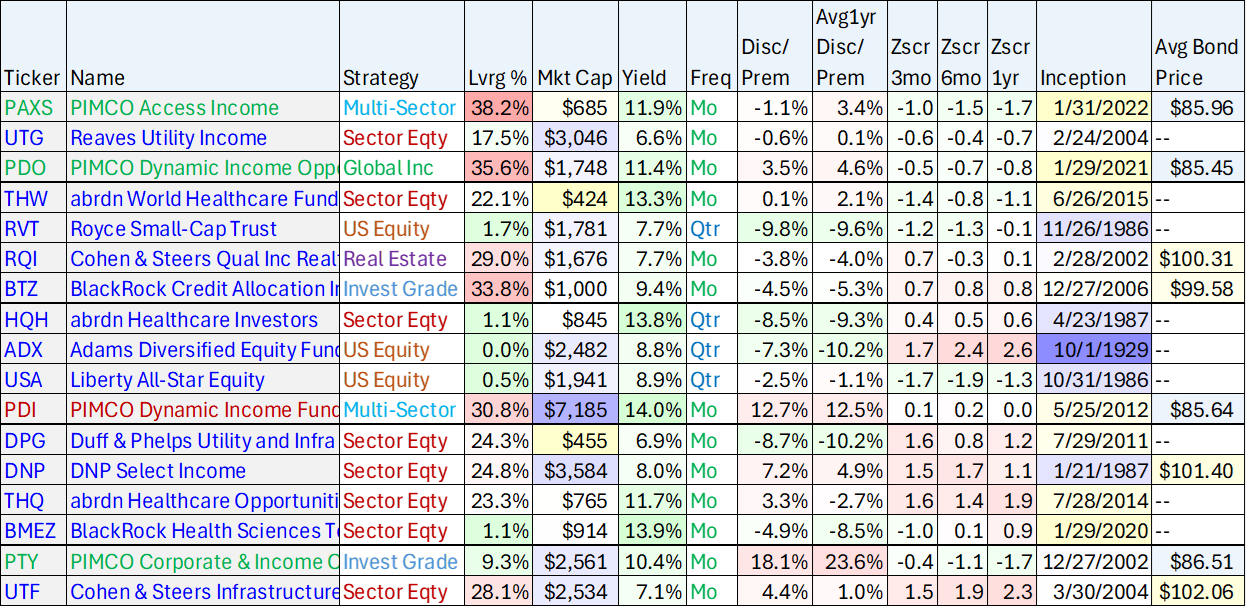

And as you scroll through the portfolio (link above), you can see more top PIMCO funds (and weights) currently held in the portfolio. For your reference, here is a list of many top Closed-End Funds (“CEFs”), including important data on premiums/discounts (versus NAV), yields, strategies and more.

New BDCs:

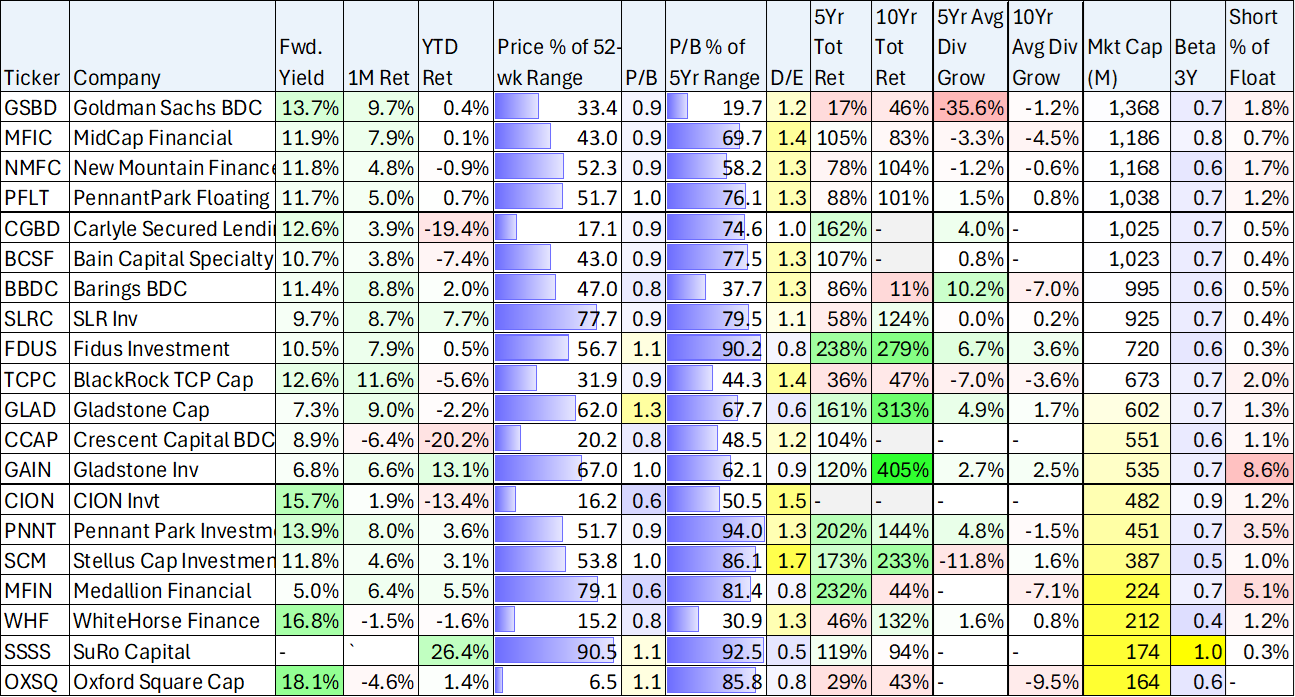

Business Development Companies (“BDCs”) provide financing (most higher-yielding loans) to middle-market sized companies, and this is how they support the big dividends they offer to investors (see table below). You can see in the latest “High Income NOW” Portfolio link, we currently own multiple BDCs.

BDCs have been a bit volatile over the last month, as tariffs caused market-wide fear, which can be particularly impactful to the higher-yielding loan types that BDCs make (in a negative, price-decline, kind of way). We used this volatility to make some changes, including re-weightings and a couple new big-yield BDC purchases too.

Here is a look (above) at important data on many BDCs (including price-to-book values versus history, recent performance, yields and more). And you can see how we adjusted our BDCs holdings in the High Income NOW Portfolio using the link provided earlier in this report. In particular, we slightly reduced our position size in Ares Capital (ARCC), increased Blue Owl (OBDC), and added new starter positions in Hercules (HTGC) and Trinity (TRIN) (a couple market-sensitive BDCs offering “buy low” opportunities.

Cigarette (Tobacco) Stocks:

Considering they are great recession-proof businesses (people are addicted to the product), but also hated by many people (smoking stinks and it’s bad for you), top tobacco stocks, Altria Group (MO) and British American Tobacco (BTI) have long traded at low prices and offered outsized dividend yields (currently 6.9% and 6.3%, respectively).

However, given the recent tariff-induced market fear and volatility this year, a lot of people have flocked to tobacco stocks, and now the shares are trading a bit richer than they have been throughout recent history. As such, we have reduced out position size (in The “High Income NOW” Portfolio) in both of these names, and now hold only a smaller position-size in each.

Real Estate Investment Trusts (REITs)

REITs have been a challenging space in recent years as interest rates rose rapidly following the pandemic (creating challenges for REITs) and because the real estate market continues to change so dramatically (for example, people shop online instead of at the mall, and people work from home instead of in the office).

We just sold our position in single REIT WP Carey (WPC) after some nice recent price gains, and now maintain exposure to REITs through CEF RQI (Cohen & Steers Quality Income Realty Fund).

More Portfolio Changes:

As noted, you can view additional changes to the High Income NOW Portfolio (using the link above), including position right-sizes (i.e. re-weightings for risk management and market opportunities) as well as buy-under prices and real-time weightings.

The Bottom Line:

Income-focused investing is not for everyone, but it can be absolutely fantastic for those focused on earning big steady income payments to pay the bills and to sleep well at night. And while some investors prefer the high-risk high-reward of extraordinarily volatile growth stocks (that pay zero dividends), for a lot of people—earning “High Income NOW” is just what the doctor ordered.

At the end of the day, you need to do what is right for you. Disciplined goal-focused long-term investing continues to be a winning strategy.