It’s a bit of a turnoff to see a 30-year-old stock marketing itself as an Artificial Intelligence play (considering that’s a megatrend that only just started to ramp within the last 2-years). Nonetheless, Innodata (INOD), a data engineering company, is finding its niche (capitalizing on the surging demand for high-quality AI training data) and hitting its stride (5 “Mag 7” clients) with a lot of room to run (massive TAM) and a reasonable valuation (8x sales). This report reviews all of that, plus risks, and then concludes with a strong opinion on investing.

About Innodata:

Founded in 1988 and headquartered in Ridgefield Park, New Jersey, Innodata operates through three business segments (1. Digital Data Solutions (DDS), 2. Synodex, and 3. Agility), but the DDS segment is the primary revenue driver (it provides AI data preparation and model training services). INOD serves many market sectors and currently has contracts with 5 of the Mag 7.

Regarding, the other two business segments, Synodex digitizes medical records, and Agility supports marketing and PR with content distribution platforms.

Growth:

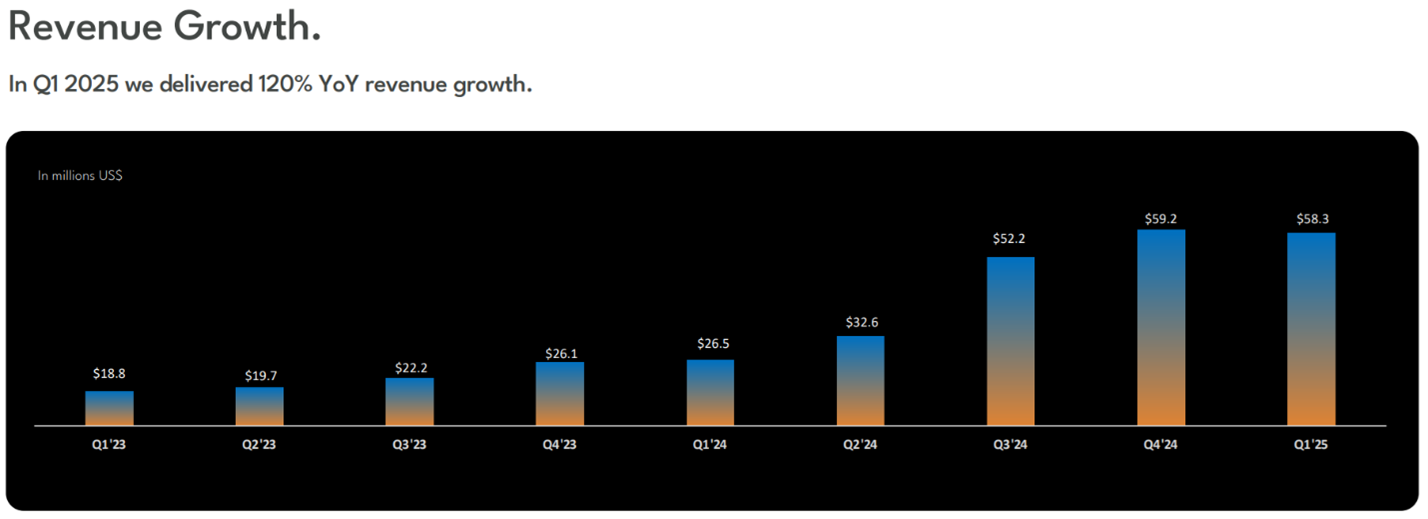

Innodata is growing rapidly courtesy of the AI megatrend (and the need for quality data, in particular). Revenue grew 120% in Q1 (year-over-year), and INOD estimates 40%+ growth for 2025 (again, driven by expanding AI data services, new customer wins, and account expansions, specifically in generative AI, agentic AI, and trust & safety solutions).

Furthermore, the total addressable market (“TAM”) opportunity is huge. For example, Morgan Stanley estimates $300 billion in 2025 capex from tech giants on generative AI. And INOD estimates at 40% compound annual growth rates in their TAM through 2032.

Valuation:

From a valuation standpoint, INOD trades at 8.3x sales, expensive, but not really when you consider revenue is to grow by +40% this year, and more next year.

The company is also profitable (more than you can say for a lot of other high-growth companies), and the 4 Wall Street analysts covering this small cap stock currently rate it a “strong buy” (1.25 on a scale of 1 to 5).

Risks:

Innodata shares face plenty of risks, considering it’s a small cap stock with a significant portion of revenue coming from just a few clients. Although the company doesn’t disclose clients, they did just disclose they have contracts with 5 of the Magnificent 7 companies, and the largest client accounts for $135 million (run rate) of the company’s total ~$238 2025 revenue estimate (so one client account for nearly 57% of revenue).

Another risks is simply that it is a volatile high-beta stock tied strongly to the economy and the AI megatrend in particular. Any bad news or near-term earnings weakness could drive these volatile shares lower in a hurry.

The Bottom Line:

If you are looking for a picks-and-shovel play on the AI megatrend, Innodata is carving a high-growth niche in preparing training data for big tech and others. It’s a market area that is growing fast with a large TAM. Obviously, there are big risks, as described, but within the constructs of a prudently-concentrated high-growth portfolio, owning shares could be worth considering. I have no position at this time, but may add shares in the near future.