Astera Labs’ is growing rapidly because it solves datacenter bottlenecks created by the AI megatrend. It also has several competitive advantages and strategic partnerships (e.g. Nvidia, Amazon) allowing it to capture a significant share of a large and growing market (cloud data and AI). This report reviews the business, the high growth, total addressable market, current valuation and risks, and then concludes with my strong opinion on investing.

About Astera Labs (ALAB)

Founded in 2017, Atera Labs began trading publicly (in March 2024) at a time when few other companies were going public—a positive nod to its disruptive growth (revenue grew 45% year-over-year in 2023) and high demand for AI solutions.

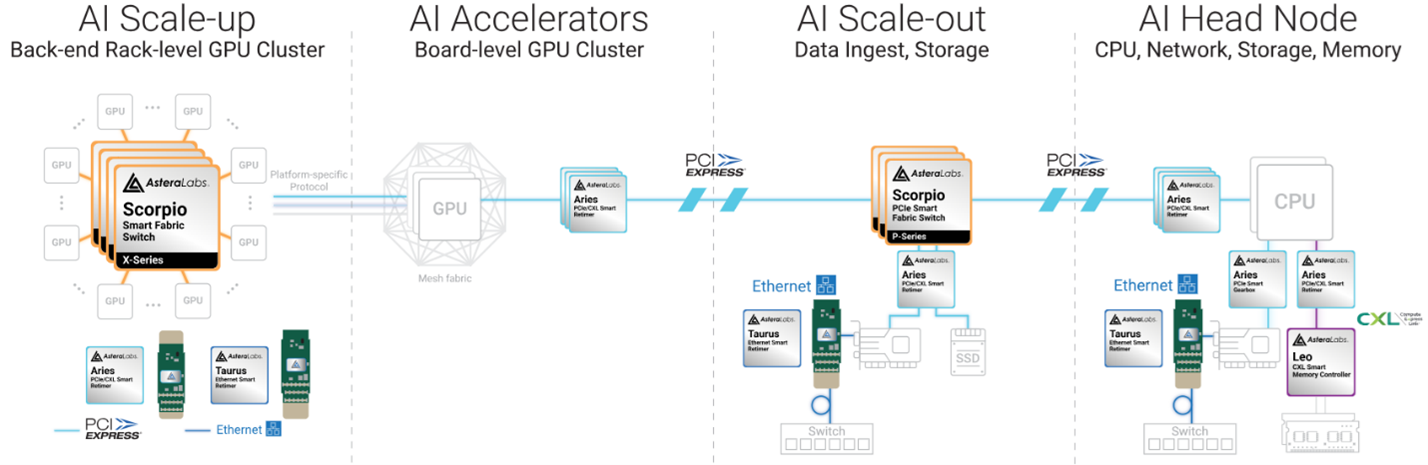

Based in Santa Clara, California (a semiconductor hotbed), Astera Labs is a fabless semiconductor company that specializes in high-speed connectivity solutions for cloud and AI infrastructure. Specifically, the company addresses performance bottlenecks in data-centric systems, enabling efficient, low-latency data transfers critical for AI and cloud computing workloads.

For example, according to co-founder and CEO, Jitendra Mohan:

“AI workloads have shattered the traditional unit of compute, ushering in what we call “AI Infrastructure 2.0”—where all the servers in an entire rack function as unified computing platform rather than collections of individual servers. The continued exponential leap in computational requirements has pushed us beyond what traditional server architecture can handle.”

That’s basically the problem Astera Labs is solving, and for some perspective:

“The numbers tell the story of an industry hitting the limits of traditional architecture. Google’s PaLM demanded 6,144 chips in early 2022, already a massive scale by historical standards. Yet just months later, OpenAI’s GPT-4 training run required approximately 25,000 A100 GPUs, a 4x increase that shattered previous assumptions. Meta’s infrastructure evolution illustrates the acceleration: their Research SuperCluster started with 16,000 A100 GPUs in 2022, but by March 2024, they were operating clusters with 24,576 H100 GPUs each for training Llama 3. The pace has only intensified. xAI brought online a 100,000 H100 GPU system in September 2024, representing a 16x increase in cluster size in just two years.”

High Growth and Large TAM:

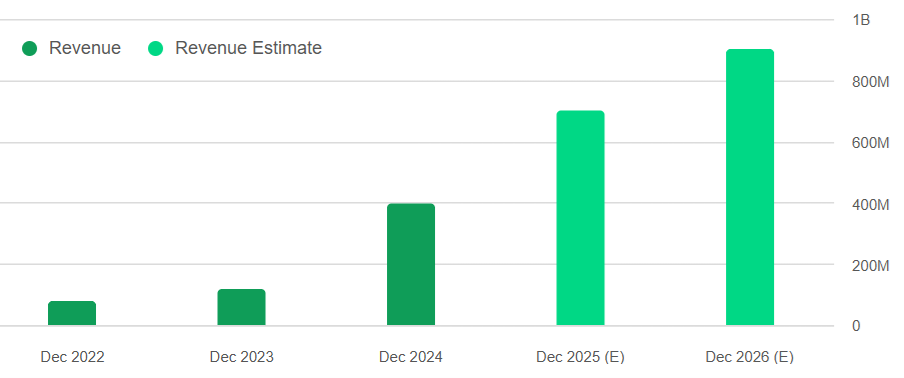

As mentioned, Astera Labs revenue grew 45% in 2023 (right before its IPO), but then grew 242% in 2024, over 144% (to $159.4 million) in Q1 2025 (year over year), and analysts are projecting revenue over $1.9 billion by 2029. This high growth is being fueled by the AI megatrend.

And the company estimated its total addressable market (TAM) opportunity at over $17 billion, including data center interconnects. The market is expanding rapidly due to the ongoing proliferation of AI, cloud computing, and high-performance computing applications. Furthermore, the open standard for AI connectivity positions Astera to capture significant market share from hyperscalers (e.g. Amazon, Alphabet, Microsoft) as they transition to scale up their AI architectures (thereby requiring thousands of interconnected GPUs).

Competitive Advantages and Strategic Partnerships

Astera Labs’ focus on emerging standards (e.g. CXL and PCIe 6.x) makes it most relevant for next-generation AI infrastructure. And its open standard “plug-and-play” interoperability has been rigorously tested with the main GPU and memory vendors thereby reducing integration risks for clients.

Atera’s strategic partnerships with hyperscalers (e.g. Amazon, Meta and Google) and its leadership role in the UALink Consortium, enhance its ecosystem influence. Further, the company’s ability to offer comprehensive connectivity solutions (from signal conditioning to smart fabric switches) sets it apart from competitors like Broadcom and even Nvidia’s Mellanox division.

Valuation:

From a valuation standpoint, Astera Labs may appear expensive (recently trading at over 31x sales), but after taking into consideration the extraordinarily high sales growth trajectory (77% this year and 28% next year), combined with the large TAM, competitive advantages and growing AI megatrend, these shares are arguably much more reasonably priced (and potentially significantly undervalued relative to what lies ahead). In fact, the 14 Wall Street analysts covering the shares rate them a “strong buy.”

Furthermore, you can see in the table above that upward EPS earnings revisions (green bars in the table above) have been significantly positive (for this quarter, next quarter, this year and next year, respectively) often an indication of short-sighted analysts underappreciating the high-growth trajectory (i.e. good for shareholders). Astera Labs is also already significantly profitable (see net margin, +8.4%, above) another good indication of financial health.

Risks:

Nvidia Partnership: Astera’s partnership with Nvidia poses a significant risk. For example, Astera solutions are deployed within Nvidia Hopper and Blackwell platforms, which drives dramatic revenue, but also poses a risk if Nvidia were to face setbacks or diversify suppliers away from Astera. As mentioned, Astera has competitive advantages (such as its more comprehensive solutions), but its reliance on Nvidia poses a significant risk (even though it’s a huge advantage right now).

Customer Concentration is also a risk worth considering. Even though Astera doesn’t publicly disclose revenue per customer, it seems Amazon is likely big partner (based on disclosure of Amazon having warrants to purchase more Astera shares). Nvidia is also a big customer (as described). And Microsoft and Alphabet are also disclosed customers and likely big ones considering they are among the main hyperscalers fueling AI and datacenter growth. Further, Intel was historically a large customer, but that relationship has been shrinking, relatively speaking, as Astera works to diversify customer concentration risk.

Competition is another risk. For example, Astera is currently around a $15 billion market cap company—a large cap stock—but still small in comparison to established players like Nvidia, AMD and Intel—who have dramatically superior financial wherewithal if they were to choose to build out internal solutions instead of Astera’s. Although the chance of this seems low at the moment (because the industry is currently so focused on simply keeping up with demand) as the cycle changes, so could the competition.

Industry Cyclicality is another risk. It seems the AI megatrend is still in its early innings based on a wide variety of market reports and hyperscaler disclosures. However, given the high customer concentration and historically cyclical semiconductor industry, Astera could face significant risks from any market wide slowdowns (business cycle, tariff driven or otherwise).

Conclusion:

Astera Labs presents a compelling investment opportunity thanks to its important role in the AI megatrend (it solves connectivity bottlenecks), combined with its dramatic growth trajectory. And contrary to initial sticker shock, its valuation metrics are arguably very compelling as compared to its tremendous ongoing growth rate (Wall street rates it a “strong buy” and the shares can easily 2x considering growth is set to more than 2x in the coming years while profit margins will expand for this already profitable young business, and the long-term TAM is even dramatically larger still).

However, Astera Labs is not without significant risks (including customer concentration, competitive threats and overall semiconductor industry dynamics and swings), and for this reason the shares should only be considered within the constructs of a prudently concentrated high-growth portfolio. I have no position at this time, but Astera Labs is high on my watchlist and I may add shares in the near future.