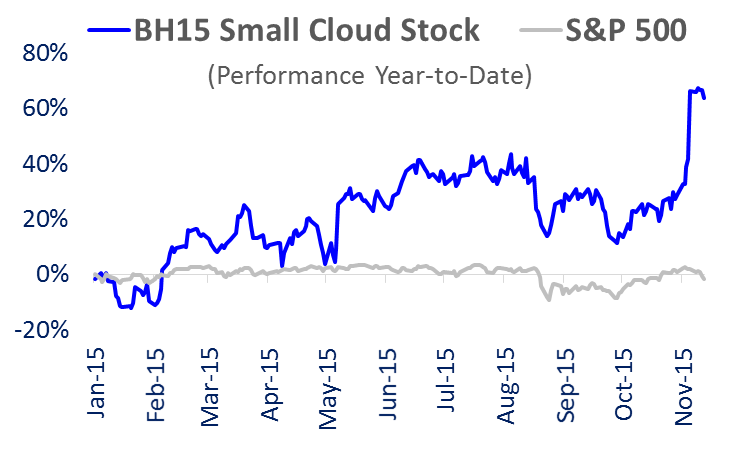

Our favorite cloud-based small cap holding is up 31% in the last month, and it beat the market again this week despite the broad sell off we are experiencing. If you are a diversified long-term investor, there is no reason to change your strategy just because volatility has picked up. Buying and holding quality stocks is a proven winning strategy.

Our last two free “Stock of the Week” reports (one on Coke and one on AT&T) highlight how a particular stock that is good for some may not be good for others. Both Coca-Cola and AT&T are great dividend stocks that offer attractive income for retirees and less volatility than most other stocks. However, the tradeoff is that both of these stocks have lower long-term return expectations, in our view. And if you don’t need the income then you’ll likely be better off in the long run holding stocks with a little more risk because they’ll likely provide a little more total return. Even a small 1% annual return improvement can add up to very big money over the long-term. It’s also important to remember that a diversified portfolio of slightly more risky stocks is usually still far less risky that holding only one or two very low risk stocks like AT&T and Coca-Cola.

Regarding our favorite cloud-based small cap holding… it’s Paylocity (PCTY). As a reminder, Paylocity is a cloud-based provider of payroll and human capital management software solutions for medium-sized organizations. The company recently beat earnings expectations and raised its future revenue guidance. As a result, we updated our price target and you can read more about our new views and target here.

Lastly, if the market sell off continues into next week don’t forget your goals and remember to stick to your strategy. We’re likely to see continued heightened volatility as the Fed gets closer to raising rates. The volatility may be magnified by the fact that the Eurozone is still years behind the US in the recovery and their monetary policies are still more accommodative. Regardless of what happens, stick to your strategy and don’t do anything rash.