This week’s Weekly highlights five attractive long-term investment opportunities. Specifically, we review market sector ETFs, geographic regions, and individual stocks, and then point out five that are flashing buy signals. As Ben Graham says, the market is a voting machine in the short-term, but a weighing machine over the long-run.

This first table shows the performance of various market sector ETFs over the last three months and year-to-date. A few things stand out. First, REITs have performed horribly as a group over the last three months, and we view this as an opportunity to buy some big yielding stocks at discounted prices.

1. REIT Funds

Two REIT funds that we consider attractive are the two worst performers over the last three months in the above table. As a group, REITs offer big dividends and they were performing well in the first part of the year leading up to the recent launch of a new real estate GICs sector. However, as the sector was created, the hype died down, and REITs underperformed. We believe now is an attractive time to pick up some attractive yield with low volatility by purchasing the Vanguard REIT Index Fund (VNQ) and/or the REIT sector ETF (XLRE). They’re both very low cost and provide broadly diversified exposure to a higher yielding sector that we believe will perform better going forward because investors care about yield.

2. Specific REITs

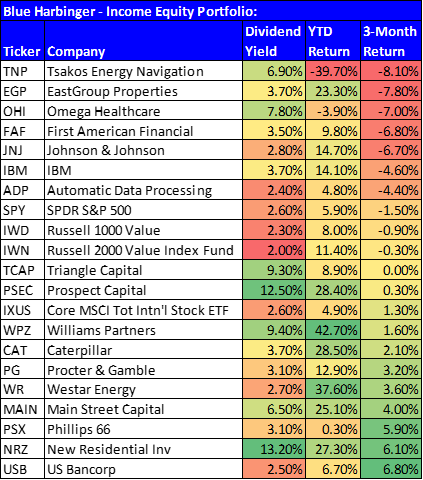

If you don’t like investing in broadly diversified low-cost funds, then we also like a couple specific REITs. Specifically, we like the 2nd and 3rd worst performers over the last three months in the following table (and yes, we do own both of them in our outperforming Blue Harbinger Income Equity portfolio).

EastGroup Properties (EGP) is an attractive long-term industrials REIT, and the market is offering an opportunity to “buy low.” You can read our recent write-up on EGP here...

Omega Healthcare (OHI) is big-dividend healthcare REIT that has been overly beat up by the market due to entitlement (healthcare) reform. We consider it an attractive buying opportunity, and you can review our recent write-up here...

3. Johnson & Johnson (JNJ)

Johnson & Johnson has had a great run this year (it’s up 14.7%), but it has pulled back 6.7% over the last quarter. As we saw in an earlier table, the healthcare sector (XLV) has pulled back significantly over the last three months (it’s down 9.3%) as the Affordable Care Act is starting to show signs of collapsing under its own weight (i.e. premiums are increasing dramatically to cover costs, and this will result in more people dropping coverage because they simply cannot afford all the expensive bells, whistles and subsidies that are required under the new system).

However, we believe Johnson & Johnson should remain strong because of its diversified business (e.g. its main segments are diversified including Consumer, Pharmaceutical and Medical Devices). It also offers an attractive 2.8% dividend yield which we believe will help prevent it from collapsing like some other healthcare companies will if someone doesn’t start to plug the Affordable Care Act dam.

4. Utilities Stocks (XLU)

Utilities is another big-dividend sector that performed great during the beginning of this year, but has underperformed over the last three months. We believe these low volatility big-dividend stocks won’t stay down for long because they can be such a great source of income in our low interest rate environment (even if the Fed does raise rates another 25 basis points in the relatively near future). The Utilities ETF (XLU) is a great low-cost way to achieve broadly diversified exposure to this attractive sector of the market.

5. Emerson Electric (EMR)

Emerson Electric offers a big 3.8% dividend yield, and its shares are currently on sale. As the following table shows its price has declined 9.5% over the last three months.

We purchase shares in August after they declined sharply, and we believe the share price has become even more attractive since then. Emerson offers technology and engineering solutions for customers in industrial, commercial, and consumer markets around the world. And you can read our full Emerson write-up here...

As a side note, and for your consideration, this next table provides information on the performance of various geographic region ETFs this year and over the last three months

Also worth mentioning, this week’s members-only investment idea is Triangle Capital. Triangle is a huge-dividend BDC that we own in our Income Equity strategy, and you can read that write-up here...