This week’s Weekly provides data (total returns) for 39 market sectors and industries (YTD, 1-Year, and 5-Year), and then provides an overview of several key investment themes opportunities with regards to oil prices, heath care companies, and financials.

For starters, here are the total returns (dividends plus price appreciation) across sectors and industries.

1. Oil Prices:

The first key theme and investment opportunity is related to oil prices. Oil prices have been decimated since mid-2014, and it’s caused a lot of industry distress, bankruptcies, and opportunities. And as the above total returns chart shows, the energy sector has been the worst performing sector so far in 2017. We believe this provides a relatively attractive short-term entry point into some attractive long-term investment opportunities. Our latest investment idea focuses on the shipping industry which has been hit particularly hard by oversupply and low commodity prices, particularly oil. We’re not trying to predict where oil prices will be tomorrow, but we are saying we’d rather purchase things low instead of high, and the near-term oil price declines provide a relatively more attractive entry point. The report is available here…

2. HealthCare:

The next theme and investment opportunity is related to healthcare. As the chart shows, healthcare has been a top performer over the last five years as the industry benefitted from strong demographic trends (mainly an aging population) and new mandated health insurance purchases under the Affordable Care Act (ACA). However, with the ACA in jeopardy under the newly elected administration, the sector has pulled back hard over the last year. Despite the pullback, the demographics remain on the sector's side (the aging population still as unprecedented wealth, and needs health care), and we believe attractive “buy low” opportunities exist. You can view our comprehensive list of current holdings, including healthcare stocks, here…

3. Financials:

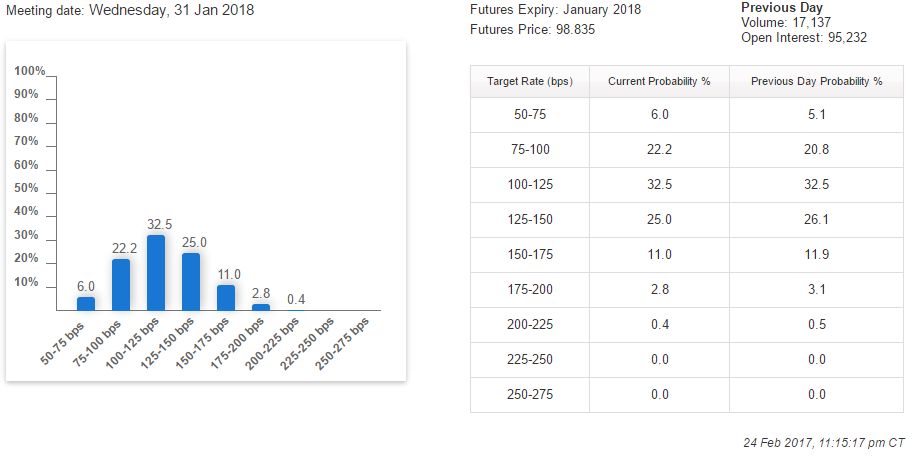

The third investment theme and opportunity is the Financial Sector. As the chart shows, this sector has performed extremely well over the last year, mainly due to the newly elected “Pro-Business” US President and expectations of increasing interest rates (higher rates help many financial companies earn more profits via a wider net interest margin). Remember this is the sector that performed horribly leading into the financial crisis. And Financials performed especially poorly coming out of the financial crisis because interest rates were set artificially low, and because the previous administration attacked the sector with justice department lawsuits and extreme regulations. And even though this sector has performed very well over the last few months (due to increasing interest rate expectations and the new administration) the sector has been severely beaten up since 2008-2012, and still has a long way to increase, in our view. The following chart shows the market is expecting more interest rate increases over the next year.

All of our current holdings, including our multiple financial stocks, are available here…