The maritime shipping industry has been decimated in recent years, with commodity prices down and multiple companies filing for bankruptcy. However, one of the shippers in particular has been showing dramatically improving financials, and we believe its high-yield bonds are even more attractive than its stock.

Navios Maritme Holdings (NM)

Navios Maritme Holdings (NM) is a seaborne shipping and logistics company, and it is currently in distress. The shipping industry has been crushed in recent years by lower commodity prices and oversupply of shipping capacity. An increasing number of companies have already filed for bankruptcy, and Navios has been making draconian cuts just to stay afloat. Amidst the distress, the high-yield bond market is providing a glaring clue to investors about the company’s future. Navios is currently on the hook for multiple bond issues with double-digit yields. However, investors should be cautious to select the correct high-yield Navios bonds before even considering an investment.

Navios Has Been Hit Hard by Shipping Industry Woes

Navios is focused on the transport and transshipment of dry bulk commodities, including iron ore, coal and grain, and Navios’ business has been hit hard. For starters, the following chart shows what the global shipping industry slowdown has done to Navios’ stock price.

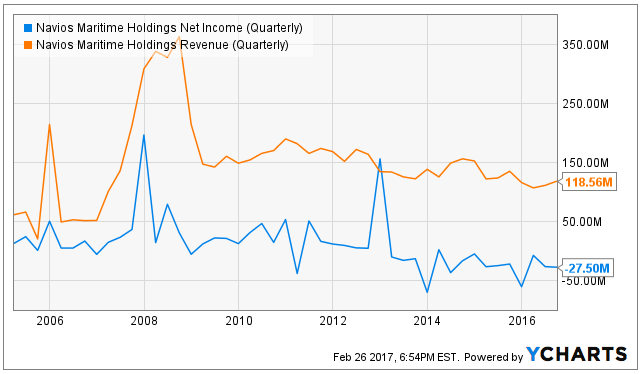

And for added perspective, here is a look at Navios’ historical quarterly revenues and net income.

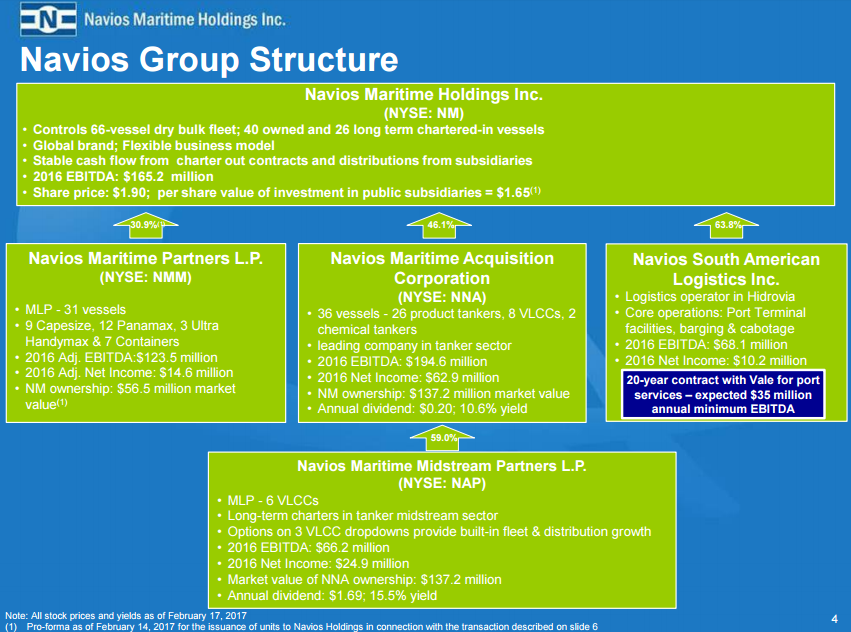

Note that net income has recently been negative. Also, the following graphic provides additional overview information about Navios, and it also provides an indication of the stressed conditions the company currently faces.

For example, as a “company highlight” in the above graphic, Navios lists “Low Cash Flow Breakeven” and “Positioned to Capture Recovery.” Rather than being able to brag about their great profitability (net income has been negative) or a big dividend (it’s been slashed to zero), Navios is forced to list future “what ifs” and non-bottom-line data as a company highlight.

Draconian Cuts

Navios has been making draconian cuts in recent quarters just to stay afloat.

For example, in order to preserve cash, management bought back deepy discounted high dividend paying preferred stock, they bought back deeply discounted bonds (to reduce their interest payments), they were able to renegoatiate reduced bank debt cash requirements, they eliminated the equity dividend (less recently, back in 2015), they reduced their break even charter fleet, they’re leveraging economies of scale with their Navios affiliates, and their big debt maturities don't begin until 2022 (more on these debt maturities later). As a result, the following graphic shows Navios’ improved cash breakeven.

Note, the focus on cash at this point (instead of Net Income) is because the company is just trying to keep the lights on (growing long-term net income is secondary at this point). And as a result of all these initiatives, Navios still hasn’t been able to bring projected 2017 costs below revenues as shown in the following graphic.

Based on Navios’ current cash liquidity available, the company should be fine (able to remain a going concern) through2017 and 2018. However, it is the significant debt maturities in 2019 and especially 2022 and beyond that will create serious challenges for the company, as shown in the following chart.

Starting in 2019, Navios will need to find new sources of cash flow (e.g. refinance its debt, or benefit from an industry turnaround) or it will simply not have enough cash to pay it’s bills. We have described “possible outcomes” for Navios in and after 2019 in a later section of this report, but it’s first worth considering what the bond market is currently telling us about Navios.

What the Bond Market is Telling Us

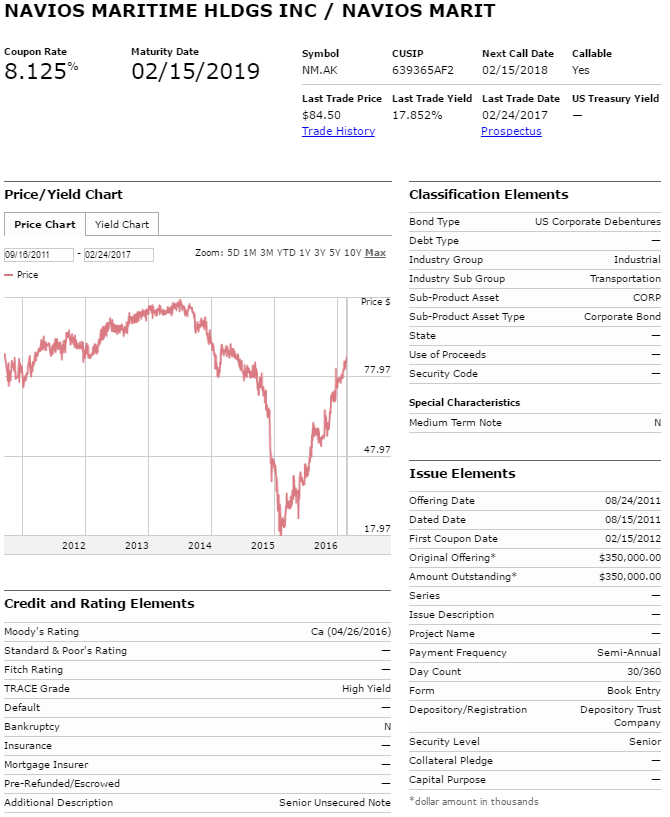

The following graph shows what the debt market thinks about Navios.

Specifically, the above chart shows Navios’ bond price has been going almost straight up in recent months, indicating the market’s dramatically increased confidence in the company’s ability to continue operating. Said differently, in early 2015 the market believed there was a high probability Navios’ would file bankruptcy (the bonds were trading at about 18 cents on the dollar), but the price has since recovered to 84.5 cents on the dollar indicating the market has much more confidence in Navios ability to meet its debt obligations and remain a going concern.

All Navios Bonds Are Not Created Equal

Extremely important to note, not all Navios bonds are created equally. For example, in addition to the 2019 bonds shown in our previous chart, Navios is also on the hook for some 2021 bonds through its sister company, Navios Maritime Acquisition (NYSE:NNA) as shown in the following graphic.

For reference, Navios operates via the following group structure...

And according to SEC filings Navios Maritime Holdings is on the hook for the bonds...

The Company [NM] and its wholly owned subsidiary, Navios Acquisition Finance (US) Inc. ("Navios Acquisition Finance" and together with the Company, the "2021 Co-Issuers") issued $610,000 in first priority ship mortgage notes (the "Existing Notes") due on November 15, 2021 at a fixed rate of 8.125%.

The 2021 Notes are fully and unconditionally guaranteed on a joint and several basis by all of Navios Acquisition's subsidiaries with the exception of Navios Acquisition Finance (a co-issuer of the 2021 Notes).

And even though the 2021 bonds offer the same coupon rate and mature at a later date, they still trade at a higher price (they are 92.5 cents on the dollar, as shown in our earlier chart). There are two reasons for the higher price on the later maturity bonds. First, they offer some recourse. Specifically, these bonds are secured by some "first mortgage notes" whereas the earlier bonds (2019's) are simply debenture bonds meaning they are not secured by any specific company assets. So basically, if Navios goes bankrupt, the 2019 bondholder may theoretically get nothing, whereas the 2021 bondholders at least have a claim to some of the ships (it will take a while to recover this value, but eventually they'll get something more than the 2019 bonds in a bankruptcy situation). And secondly, NNA is still profitable unlike NM, which creates the impression that NNA is a safer investment than NM (in reality, there is only some truth to this, we will cover later why NNA has been "backstopping" NM).

Another difference between the 2019 and 2021 bonds is the "bite size" and the ability to locate them. The 2019 bonds are available to retail investors potentially in denominations as small as $10,000 (or smaller), whereas the 2021 bonds may only be available to accredited investors and available in larger denominations. If you are a qualified institutional investors, you should be able to work with your broker to locate the bonds, but if you're a retail investor you may be limited to only investing in the 2019 bonds. And this is fine because we actually like the 2019 bonds better...

Which Bonds We Like

We prefer the 2019 unsecured bonds more than the 2021 secured bonds for four reasons. First, NM has less debt maturing in 2019 than in 2021/22 (see our earlier debt maturity chart), and this makes it much easier for the company to remain a going concern at least through the 2019 bond maturities and up until the 2021/2022 larger maturities.

Second, Navios has shown it is fighting hard to stay in business, and we believe the company has now realigned its balance sheet to provide the financial wherewithal to stay afloat at least long enough to pay the 2019 bonds (remember all of the draconian cuts we described earlier- this makes it feasible for Navios to pay the 2019 bonds).

Third, NM's related entities (as shown in the earlier "Navios Group Structure" graphic) have already shown they're willing to help NM. For example, about a year ago, NNA (one of the profitable entities) made a $50 million loan (at a below market rate) to NM to help NM meet liquidity needs. The loan appeared to hurt NNA shareholders in the short run (because they have debt with outside entities at a much higher rate), however, it makes clear that the various "Navios Group Structure" entities have a vested interest in supporting each other, and they're willing to do it. The reason is because if NM files bankruptcy, then NM creditors have a claim to NM's near 50% ownership in NNA, and unpaid NM creditors could create big headaches for NNA management (technically, NM and NNA have the same CEO- the whole "related entity" thing). For this reason, there is a strong reason for the two strongest Navios entities (NNA and NAP) to support NM (i.e. keep it from defaulting) because it's in their best interest to deal with NM instead of angry investors, lawyers, and regulators if NM were default (as a side note, there's less vested interest in supporting NMM because the related entity ownership structure has less wide-reaching impacts on the profitable NNA and NAP entities if NMM goes bankrupt (see earlier group structure chart), and this is a big part of the reason NMM has already been selling off assets and has very low cash on hand, whereas NM has a lot of cash on hand and has been restructuring financings instead of wide-scale asset sales).

And fourth, we like the higher yield on the 2019 bonds. It seems many investors would prefer the later maturity bonds because they offer some asset backed recourse, however they don't offer as much yield and we are honestly more comfortable that the 2019 bonds won't default (i.e. NM is likely to "tough it out" through 2019 in hopes that the dry bulk market will rebound, whereas it will be enormously much more challenging to tough it out through the 2021/22 maturities because they are so much larger.

Possible Outcomes

Worth considering, there a variety of possible outcomes under which Navios is likely able to pay off the 2019 bonds. For example, the company's recent balance sheet improvements (the draconian cuts) have demonstrated Navios' willingness and ability to remain a going concern. This makes it easier for Navios to refinance the 2019 bonds if need be. Specifically, if Navios does not have the cash on hand to pay off the bonds when they mature in 2019, it is now more likely that Navios will be able to refinance the debt by offering newer bonds with a later maturity date. And in this case, the 2019 bondholders will get paid.

Another situation under which Navios is able to pay off the bonds when they mature in 2019 is simply if business improves and they have the cash on hand. As we described earlier, Navios has positioned itself well to benefit from an improvement in the shipping industry. Specifically, Navios' cost structure is low, and its competition is disappearing (filing for bankruptcy) all of which positions Navios to profit if/when the industry turns around.

Support from related entities (NNA and NAP) is another way NM could meet liquidity needs and pay off the 2019 bonds. NM is close to paying it off on their own, and Navios related entities have already shown an ability and willingness to support NM financially.

An acquisition is another way in which Navios could pay off its 2019 bonds. Specifically, with the industry depressed, and Navios stock price so low, a well-financed competitor could easily step in and purchase Navios, believing it will eventually deliver profits when the industry turns around. If Navios were to be acquired, the acquirer would be on the hook for paying off the bonds.

Finally, if Navios does file for bankruptcy protection, it may not happen until after the 2019 bonds have matured and been paid off. As we described earlier, the much larger debt maturities don't come until 2021/22, and Navios has already shown it is fighting like mad (and now has much more financial wherewithal to stay afloat) for the time being. Even if market conditions (and Navios' profitability) haven't improved by the 2019 maturities, the company will likely kick the can down the road a couple more years (at least until the 2021/22 maturities) in hopes that the market will turn around, and Navios will again become profitable. And if Navios does file for bankruptcy after the 2019 bonds have been paid off but before the 2021/22 debt come due, we don't want our capital tied up for months and years (in the 2021 bonds or the stock) as the bankruptcy courts work out the details in deciding just how much of our money (how many cents on the dollar) we will get paid back based on the liquidation value of the company's assets (i.e. mainly its ships).

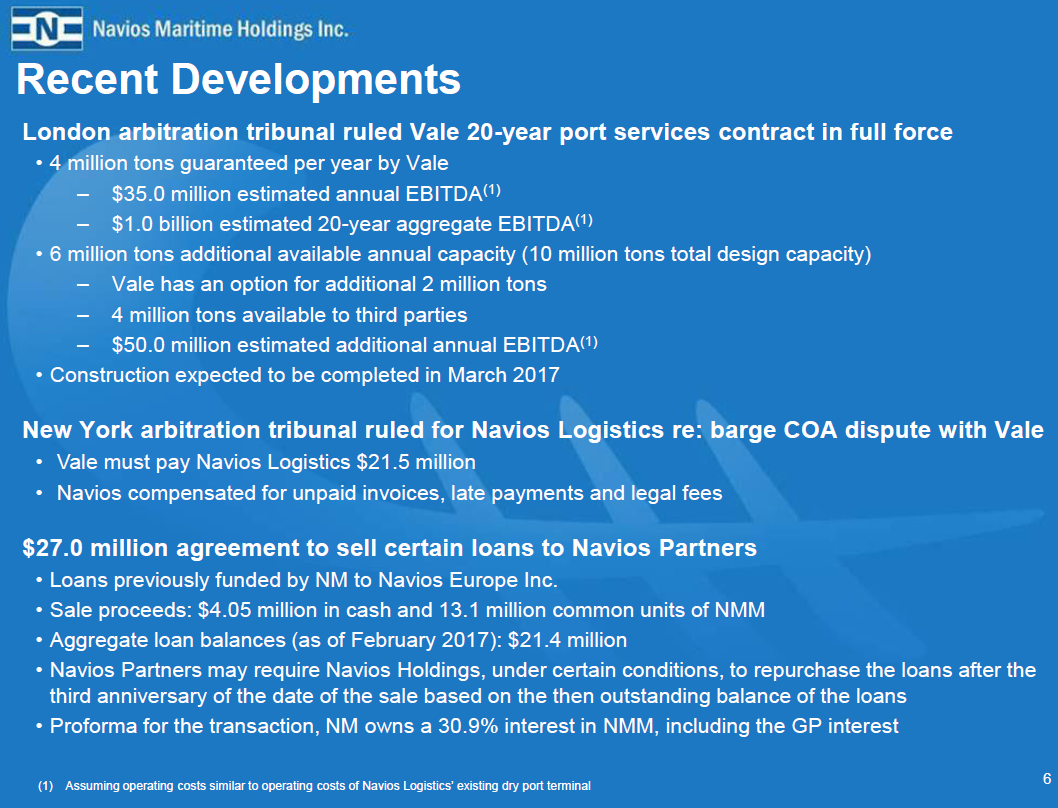

And of course there is the risk that Navios files for bankruptcy prior to paying off the 2019 bonds, in which case investors may have only a very small amount of their original loan capital returned. However, based on current market developments (i.e. the draconian cuts as well as the sharply climbing bonds prices) we think the 2019 bonds are very likely "money good." And for your consideration, here are some highlights of recent positive developments (within the last several months) that will help Navios' financial wherewithal continue to strengthen.

Conclusion

In summary, the glaring clue is that the bonds (2019's) are going almost straight up signaling the growing confidence investors have that the company will NOT default (i.e. the 2019's are "money good"). And the company's recent actions to preserve liquidity (i.e. the draconian cuts) back up the narrative that the company (Navios) also believes they can meet their 2019 debt obligations. Further, profitable Navios related entities (NNA and NAP) have a vested interest in not letting NM default because of the ownership structure. On the other hand, even though the 2021 bonds have some recourse (they're secured by ship mortgages) they're still riskier in our view because there is so much more debt to payoff in 2021/22. Based on the company's recent actions, it seems they're much more likely to meet the 2019 obligation and then wait and see if the market has recovered by 2021/22 before attempting to pay off that debt if they are even able. With an 8.125% coupon payment, and nearly an 18% yield to maturity, we like the 2019 bonds.