Veeva Software (VEEV) is dominating in a large TAM industry (life sciences) with its software-as-a-Service solutions benefiting from high margins and AI momentum. This report takes a closer look at the business (post this quarter’s powerful earnings report), competitive moat, AI opportunities, growth, valuation and risks, and then concludes with my strong opinion on investing.

About Veeva

Founded in 2007 by a former Salesforce (CRM) executive (Peter Gassner), Veeva provides cloud-based Software-as-a-Service (“SaaS”) solutions for life sciences companies (from small biotech startups to global pharmaceutical giants, such as Johnson & Johnson and Gilead Sciences). The company has two reportable segments, including:

Subscription Services: this segment accounts for 80% of revenues and includes recurring revenue from cloud-based software subscriptions, namely Veeva Commercial Cloud (encompasses Veeva CRM and related applications for sales, marketing, and customer engagement in the life sciences industry), Veeva Development Cloud (includes Veeva Vault, a suite of applications for clinical, regulatory, quality, and safety processes, such as clinical trial management and regulatory submissions), and Veeva Data Cloud (includes solutions like Veeva Link and Veeva Compass for real-time data analytics and insights).

Professional Services and Other: This segment accounts for roughly 20% of revenue and includes implementation, consulting, training, and support services to help clients deploy and optimize Veeva’s software solutions.

Worth mentioning, a key strength of Veeva’s business model is its attractive recurring revenues, driven primarily by a subscription-based and licensing framework. In fiscal year 2024, subscription services generated $1.9 billion in revenue with an 85% gross margin (impressive!).

Veeva’s Moat

Veeva’s competitive moat is driven by high customer switching costs and significant regulatory expertise. Specifically, the life sciences industry operates under strict regulatory rules, and Veeva’s solutions are designed for compliance and efficiency. Once Veeva is integrated into a client’s workflow, it generally becomes mission-critical and is thereby costly and risky to switch.

Additionally, Veeva’s wide customer base and data integrations create an ecosystem that makes it difficult for competitors to enter.

Veeva AI

With the ongoing proliferation of AI, Veeva is increasingly in the right place at the right time considering its massive collection of life sciences industry data. In April, the company announced the upcoming release of Veeva AI (scheduled for December) a suite of artificial intelligence tools/features designed to enhance productivity and efficiency (by using AI to automate tasks, generate insights, and assist users with various workflows). It uses AI Agents and AI Shortcuts to achieve these goals.

Veeva also has its AI partner platform, which provides Veeva Vault software and Veeva Vault Direct Data API access, training and support (to select partners). Veeva is a goldmine of data for AI training.

Veeva’s Growth

Veeva’s revenue continues to grow rapidly and with a large market opportunity ahead. Not only did the company recently beat Q1 revenue estimates (Veeva reported $759 million, up 16.7% year-over-year) but also raised guidance.

And Veeva’s core life sciences business is estimated to have a $20 billion total addressable market (“TAM”), and in an industry where Veeva already dominates (with around 80% market share for CRM in pharmaceutical sales, for example).

Also, new client wins continue to support Veeva’s 2030 revenue target of $6 billion.

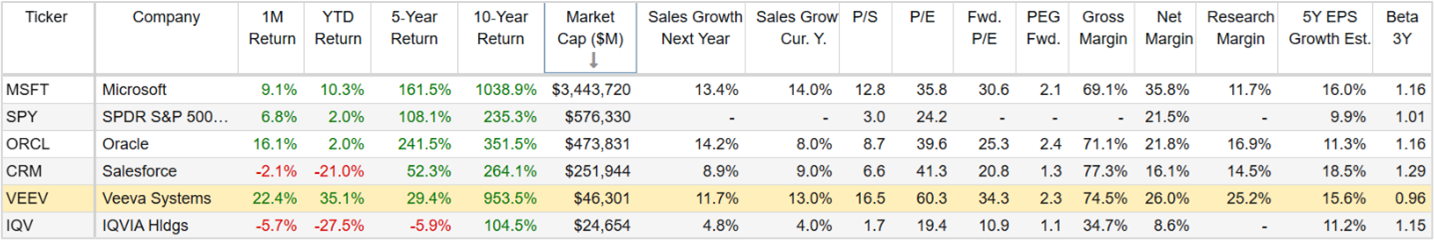

Also impressive, Veeva’s business leads itself to very high margins (see table above), including gross, net and research (i.e. they’re very profitable even after spending heavily on R&D).

Valuation

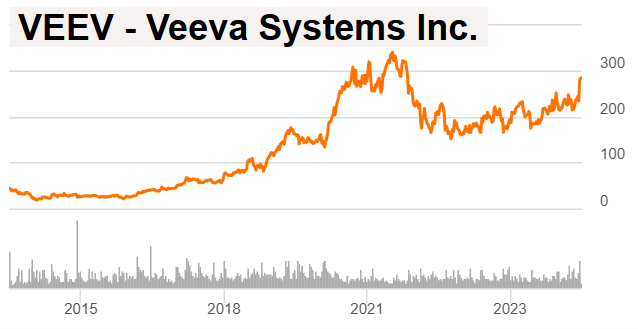

Veeva’s shares are still below their post pandemic highs, even though they’ve been gaining upward momentum, especially this year.

However, despite very high (attractive) estimated revenue growth and earnings per share growth (see table above) traditional valuation metrics (e.g. PE ratio) make the shares appear somewhat expensive. But considering the company’s dominant position in the large and growing life sciences TAM, combined with rapidly increasing AI efficiencies, these shares can easily continue to exceed expectations in the quarters and years ahead (and said high valuation metrics may be under appreciating long-term growth).

Risks

Competition, regulation and other macroeconomic headwinds all create risks for Veeva. For example, Veeva faces competitive pressures from IQVIA, Oracle, and Salesforce. However, given the company’s specialized life sciences focus (and already dominant industry position) it has a healthy head start (and moat, as discussed).

The current White House administration also creates a heightened sense of uncertainty on the regulatory front, as Veeva noted in the Q&A of its most recent quarterly call.

Further still, macroeconomic headwinds (such as higher interest rates and venture capital uncertainty) can also delay or prevent new projects from some customers.

Conclusion

Veeva is a high-quality SaaS company with a robust moat, impressive margins, and strong AI-driven momentum. Its subscription-based model fortifies its healthy recurring revenues, and its industry-specific platform creates high switching costs and barriers to entry. Veeva’s latest earnings beat, guidance raise and client wins underscore the attractiveness of the business. Leading blue-chip growth stocks (like Veeva) will rarely be cheap, and the company’s valuation metrics appear full. However, considering the large TAM, high growth and AI tailwinds, the shares remain attractive for long-term growth investors. Long Veeva.