We've all been the target of anger, but few as much as Tesla (TSLA) CEO, Elon Musk, after he purchased Twitter and joined forces with Trump. However, an examination of his body of work at Tesla reveals he brilliantly created the modern electric vehicle ("EV") industry in anticipation of renewable energy becoming a significantly larger portion of the US electric grid (see chart below) and thereby enabling EVs to ultimately be powered more by clean energy and less by the dirty fossil fuels that dominated the grid and powered EVs when that industry began. It was a brilliant innovation that improved quality of life in the US, and he seems, presciently, about to do it again. This report is about the existential total addressable market opportunity Full Self-Driving (“FSD”) technology creates for Tesla, including competitive advantages, valuation, risks and concluding with my strong opinion on investing.

The Importance of Innovation:

Before getting into the details, and to briefly provide some high-level perspective, Warren Buffett is rumored to have once said about investing:

“First come the innovators, who see opportunities that others don’t. Then come the imitators, who copy what the innovators have done. And then come the idiots, whose avarice undoes the very innovations they are trying to use to get rich.”

Musk innovated the modern EV industry, many other companies around the globe are now imitating it, and as the market gets saturated, a new batch of third "i's" will continue to try to compete. Meanwhile, Musk has set his eyes on a new innovation; another very large market opportunity where his business can scale wide and far, quickly.

Understanding Full Self-Driving (“FSD”)

Autopilot and FSD are Tesla’s driver-assistance technologies. They currently operate in “supervised mode” (which requires driver oversight); however Tesla’s goal is “unsupervised mode” (i.e. where the vehicles drive themselves entirely). This technology and goal has the potential to unlock a massive robotaxi network opportunity (and potentially transform the entire transportation industry as we know it). And Tesla expects a small fleet (10 to 20) of its full self-driving vehicles to begin hitting the roads in Austin, Texas within the next few days.

Estimated Total Addressable Market (“TAM”) for FSD

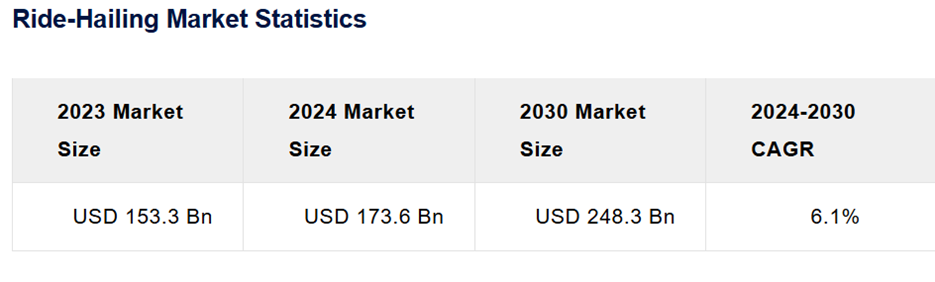

The TAM for FSD is massive, considering the global transportation market’s size (think taxis, busses, trains and more) and FSD’s potential to disrupt it. For example, the ride-hailing market alone (think Uber) is projected to reach nearly $250 billion by 2030, with autonomous vehicles potentially capturing a significant share (due to lower operating costs). And if Tesla deploys a robotaxi network, some estimates suggest a TAM of $1–2 trillion globally for autonomous ride-hailing by 2040 (due to reduced labor costs and increased vehicle utilization).

Tesla’s existing fleet of over 5 million vehicles (already equipped with FSD capacity via software update), combined with its ability to scale production (faster and more efficiently than competitors—more on this in a moment), positions Tesla to potentially dominate this massive market opportunity. Further, potential FSD subscriptions and licensing to other manufacturers could add billions in recurring revenue (at a $99–$199 monthly subscription rate).

Tesla’s Competitive Edge Over Uber

Tesla has a big advantage over Uber (the current dominant ride hailing service) in the increasingly imminent autonomous market. Specifically, Uber relies on human drivers (who account for ~70% of ride costs), while Tesla’s FSD may eliminate driver costs entirely.

Further, Tesla’s vertically integrated approach (Tesla controls hardware, software, and data collection) gives it a dramatic advantage. For example, its vehicles generate real-time driving data and thereby update and refine FSD’s training models faster than competitors. On the other hand, Uber’s autonomous efforts (such as its partnership with Waymo) depend on third-party technologies, thereby limiting control and scalability (whereas Tesla’s fleet is already FSD-capable via software updates). Moreover, Tesla’s brand loyalty (arguably) and EV expertise enhance its competitive advantage.

Tesla’s Competitive Edge Over Waymo

Tesla FSD also competes with Alphabet’s (GOOGL) Waymo. However, Tesla’s massive fleet (over 5 million FSD-capable vehicles, generating real-time data) gives it a huge advantage over Waymo (with only around 700 vehicles, operating in limited cities, and relying on costly “lidar” sensors). Estimates have FSD’s technology as potentially $10,000–$15,000 less expensive, per vehicle, versus Waymo’s $100,000+ retrofit efforts. Tesla CEO, Elon Musk, recently acknowledged this differentiator saying:

"The car is very expensive, made in low volume. Teslas are probably cost 25% or 20% of what a Waymo costs and made in very high volume."

Tesla’s fleet size is a huge advantage, and its data and cost structure are hard to match. However Waymo’s has some advantages, such as regulatory approvals and operational robotaxis giving it a head start, but again Waymo is dramatically limited by scale as compared to FSD.

Valuing Tesla’s Potential:

Tesla appears extremely expensive on traditional valuation metrics. For example, with a current 125x forward price-to-earnings ratio, the stock appears most obviously overvalued to many investors. However, at this point, Tesla’s valuation hinges on the success of FSD in disrupting the transportation market, which will potentially unlock massive growth, cash flows and profits.

And to put the importance of FSD in perspective, CEO Elon Musk recently said:

“If we don’t solve full self-driving, Tesla’s value is basically zero.”

It seems clear that FSD is an existential opportunity for Tesla investors, but nonetheless it can also make sense to consider the company’s valuation using a sum-of-the parts approach, considering FSD, plus automotive and plus energy storage. For example, here are some very high-level “back-of-the-envelope” calculations:

Energy Storage Business: With $10.1B in 2024 revenue (10% of Tesla’s total revenue), up 67% from 2023, and with a gross margin of around 24.6%, we could assign a 10x price-to-sales multiple (this assumes many years of high growth) to value Tesla’s energy business at $101B. Obviously, this estimate includes lot of big assumptions and “what-ifs,” as well as a high-degree of uncertainty.

Auto Business: Tesla’s auto segment (electric vehicles, leasing, and regulatory credits) generated $85.1B in 2024 revenue (85% of Tesla’s total revenue, up only 1% from 2023, and with a gross margin of around 17%), we could assign a 5x price-to-sales multiple (this assumes the company returns to growth as Musk refocuses on the business) to assign a value of $425.5B for Tesla’s auto business. Obviosuly, this includes a lot of assumptions (especially considering increasing competition from EV imitators and new competition).

FSD Business: Considering Tesla’s current market cap is around $1.2T, and we’ve estimated the other two main segments to be worth ~$526.5B ($425.5B + $101B), that means FSD must be worth at least $673.5B (1.2T - 526.5B) for the shares to be fairly valued. That is a huge (673.5 unicorns) valuation for a business segment that is not even a real business yet (it’s just an idea in “research & development”). However, considering our TAM estimates earlier, it’s not unreasonable to believe the FSD segment can be worth dramatically more than $673.5B if it is successful in the FSD robotaxi market.

For example, Tesla shares currently trade at ~$360, but Wall Street firms like Wedbush say it’s worth $390 (with a bull case of $650, citing optimism about FSD) and ARK Invest previously saying it’s worth $2,600 per share by 2029 (estimating ~90% of Tesla’s enterprise value and earnings in 2029 will come from robotaxis). However, the average Wall Street price target is more bearish, recently at only $292 from the 36 firms covering it.

Clearly there is a lot of uncertainty and “what-ifs” involved in Tesla’s valuation, but if it is successful with FSD and the robotaxi industry then the shares are worth dramatically more than the current price. Said differently, Tesla is a highly speculative investment that is absolutely not for everyone,

Risks:

Obviously, Tesla shares face huge risks (most of them surrounding FSD execution risk) that investors need to consider. For example:

FSD Trust: Fully self-driving vehicles are pretty scary if you ask me. And it seems Tesla will need to achieve nearly perfect reliability to gain consumer trust. Any FSD accidents could quickly destroy investor confidence. However, this was the case when Tesla EV’s first entered the market, and several highly-publicized car fires damaged the share price, but only temporarily. Tesla overcame those challenges.

FSD Adoption: Robotaxis require consumer buy-in. And cultural resistance still exists, despite the fact that FSD robotaxis will likely be significantly cheaper than Uber (potentially $0.50/mile vs. $2/mile), easier (and more cost effective) than car ownership, and “greener” (due to EVs being powered by increasingly cleaner energy grids).

Loss of Freedom: To some people, a car represents freedom. However, considering the extent to which FSD “stalks your every move” (it records everything) you are giving up some freedom. Not to mention, you’re also giving up control to a robot technology (i.e. “robo” taxi), and you’re still limited by EVs needing to be “plugged in” somewhere (instead of just fueling up and going). Nonetheless, compared to busses, trains, motor scooters and more, FSD robotaxis will be a big step up for many.

Regulatory Hurdles: FSD needs regulatory approval, akin to Tesla’s reliance on EV credits in its early days. Musk’s relationship with President Trump could expedite federal support, but local regulations vary, and FSD deployment could face significant delays.

The Woke Mob: As mentioned, Musk is basically hated by a large percent of the US population because of his political alignment (he has shown support for the current White House administration as per his previous leadership of so-called DOGE). Groups that once praised Musk for improving the environment by advancing the EV industry now reject anything he does. “DOGE is just becoming the whipping boy for everything” said Musk in a recent interview as he announced he would be scaling back his work leading DOGE (to focus more on his businesses) following big profit losses for Tesla.

Buffett’s Wisdom on Politics and Investing: Legendary investor, Warren Buffett, cautions against mixing politics with investments. For example, he once stated on CNBC:

“If you mix your politics with your investment decisions, you’re making a big mistake.”

Whether you agree or disagree with Buffett and/or Musk, Tesla’s stock has absolutely faced huge volatility and financial pressure due to politics. However, despite near-term pressures, if Tesla is successful with FSD then its long-term fundamental attractiveness can drive the share price dramatically higher.

The Bottom Line:

If you think Elon Musk is a horrible person and you want him to fail into oblivion, I personally encourage you to succeed in that mission, legally and with civility. But regardless of your opinion, he is an exceptional example of following your dreams, to build something great, despite adversity and in the face of naysayers telling you it's not possible.

There is a good chance Musk will do it again with FSD as he has presciently positioned himself for success in a large market opportunity that is about to materialize (and improve millions of lives) much quicker than many people envision. However, the risks are very real, and investors may want to consider owning shares as only one part of a prudently-concentrated portfolio of high-growth disruptive opportunities.

At the end of the day, you need to do what is right for you (that’s how markets work). But if FSD succeeds, Musk may be about to “better the US again.”