Trinity Capital looks good for its big well-covered distribution, early growth-stage investments (RocketLab, for instance), internal management team, investment grade credit rating and reasonable valuation. Of course there are risks (industry concentration, interest rates, and an increasingly competitive BDC space) but within the constructs of a prudently-concentrated high-income portfolio, it’s absolutely worth considering.

Trinity Capital (TRIN)

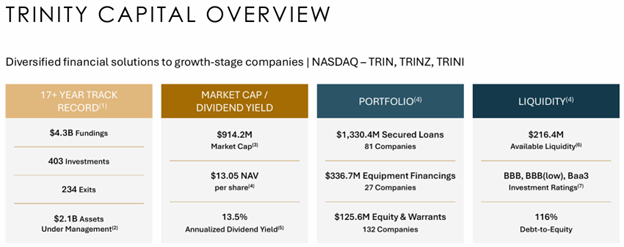

Trinity is an internally managed Business Development Company (BDC), offering investors a compelling opportunity to access private credit markets with a high distribution yield (currently 14.2%). And with over 17 years of experience, Trinity provides diversified capital solutions to growth-stage companies across technology, healthcare, and clean energy sectors.

And despite macroeconomic risks (more on this later) Trinity’s diversified private-credit portfolio and strategic management structure make it an attractive income opportunity for investors.

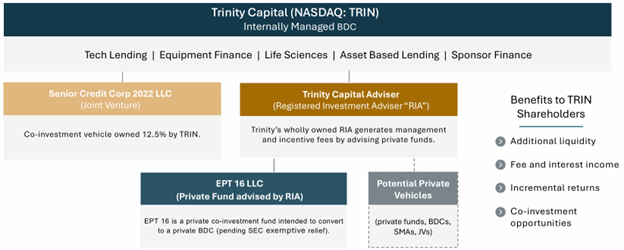

Internally-Managed BDC Differentiation

As a Business Development Company (a publicly-traded entity regulated under the Investment Company Act of 1940), Trinity is designed to provide capital to private or small-to-mid-sized companies through loans, equity investments, or other financial instruments. BDCs must distribute at least 90% of their taxable income as dividends, offering investors high yields but exposing them to credit and market risks.

Trinity Capital, headquartered in Phoenix, Arizona, operates as an internally managed BDC, distinguishing itself from competitors like Hercules Capital or FS KKR Capital, which are externally managed and incur higher management fees. Trinity’s internal management aligns shareholder and management interests, reducing costs.

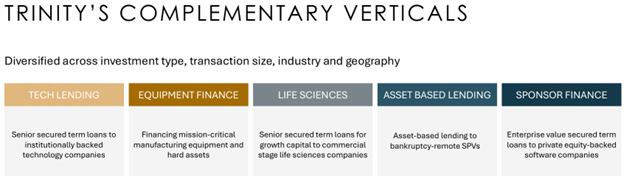

Noteworthy, Trinity’s five business verticals (i.e. Tech Lending, Life Sciences, Equipment Financing, Asset-Based Lending, and Sponsor Finance) enable it to invest across 20+ industries, with no single credit exposure exceeding 5% of its debt investments. As of March 31, 2025, its $1.8 billion portfolio includes $1.33 billion in secured loans (81 companies), $336.7 million in equipment financings (27 companies), and $125.6 million in equity and warrants (132 companies).

This diversification, coupled with a 17-year track record of $4.3 billion in fundings and 234 exits, sets Trinity apart. Its focus on growth-stage, institutionally backed companies in innovative sectors like SaaS, biotech, and clean energy further differentiates it from BDCs targeting more mature or distressed firms.

Dividend Safety

As mentioned, and as you can see in the graphic below, Trinity has a strong dividend history.

For some perspective, Trinity is able to pay such as large dividend by lending (investing) it’s own capital (and money it borrows at a low rate) to borrowers at a high rate. It is this interest-rate spread, combined with leverage (borrowed money) that allows Trinity to support such a large distribution yield, as you can see in the chart below.

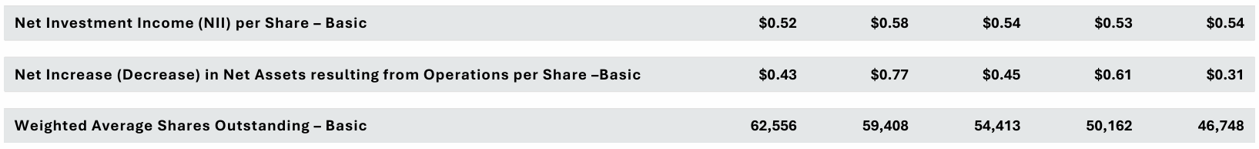

Additionally, the distribution is well covered, as you can see in the following table, the company’s $0.51 quarterly dividend is exceeded by its Net Investment Income (NII) per share (a good thing).

Share Repurchase and Capital Raise

Also important, Trintiy has a share repurchase program, which they are not using at the moment because they are raising capital now to meet growth opportunities (also a good thing). But for a little perspective, Trinity has a share repurchase program announced back on November 7, 2024, whereby they are authorized to buyback of up to $25 million of its own common stock.

Also noteworthy, insider buying activity, such as director Ronald E. Estes purchasing 700 shares on June 11, 2025, and CEO Kyle Steven Brown acquiring 3,513 shares, signals optimism about the BDC’s future performance.

Valuation

While one of the smaller BDCs, Trintiy trades at an attractive price to book value (a basic BDC valuation metric) relative to its own history.

And this is despite some volatility in non-accruals (defaults/workouts).

Also worth repeating, Trinity maintains an investment grade credit rating (a good thing).

Furthermore, here is a look at how Trinity (recently trading at a price-to-NAV ratio near 1.1x) compares to peers like Hercules Capital (1.6x) and Main Street Capital (1.9x) (i.e. favorably).

Risks

Of course Trinity poses risks that investors need to consider. For example…

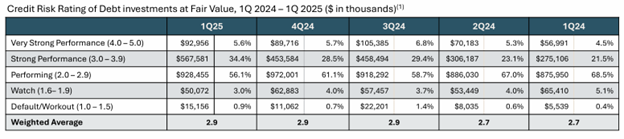

Credit Risk monitoring is critical, as portfolio companies may default in a high-rate or recessionary environment. However, as we saw in our early table, non-accruals are fairly consistent with history (a good sign).

Concentration in growth-stage firms, while diversified, is another risk for Trinity. It exposes the BDC to more volatility. Although, Trinty is more diversified (across multiple sectors) as compared to many of its BDC peers).

Leverage, with a debt-to-equity ratio of 1.2x (see table above) increases risks, but also is prudently managed (e.g. investment grade credit rating).

The BDC Industry: Additionally, market sentiment toward BDCs can be volatile, potentially affecting share price stability. Not to mention increasing competition in the BDC space for a limited number of deals. Although Trinity’s niche focus (growth stage) and small size gives it an advantage and nimbleness too.

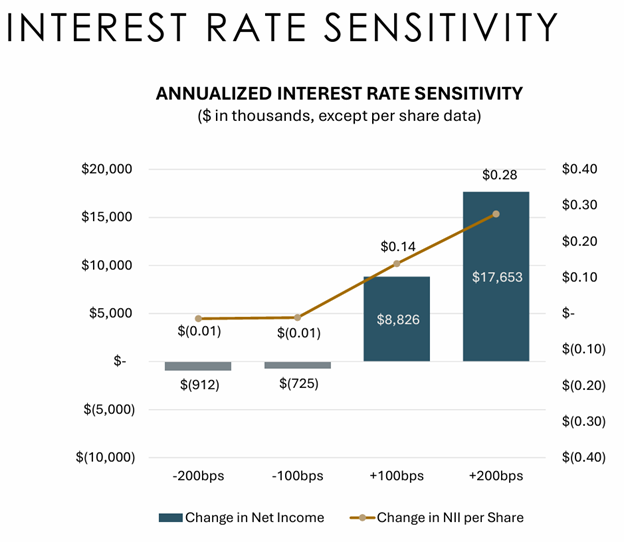

Interest-Rate Sensitivity is another risk. Specifically, Trinity’s loan portfolio consists of more (~76%) floating-rate loans (debt investments) than its own floating-rate borrowings (leverage), thereby creating a unique interest rate risk profile as shown in the following graphic.

The Bottom Line:

Trinity Capital offers a compelling investment case for income-focused investors, with its 14.3% yield, diversified portfolio, and consistent dividend growth. Its internal management, five verticals, and focus on growth-stage companies differentiate it from other BDCs, while its strong liquidity and investment-grade ratings support future growth. Despite risks from macroeconomic uncertainties, credit exposure, and leverage, Trinity’s strategic positioning and robust fundamentals make its big distribution yield attractive. If you are an income-focused investor, Trinity Capital is absolutely worth considering. I own shares.