S&P futures are hovering around flat to slightly negative so far this morning, as we head into a day where the upcoming release of last week’s fed meeting minutes may already be outdated. Both treasuries and commodity prices have been trending lower, a sign that the fed’s inflation fight may be less dire than last week’s minutes convey. Markets tend to recover long before recessions end. This report shares data on past recessions, chip stock valuations (e.g. Nvidia, AMD, Micron and Intel) and an update on the market’s technical position.

Energy Stocks: Ugly 1-Month, Still Up Big YTD

Positve Signals: Growth Stocks Up, Commodities Down

BH THINKER: The Worst First Half for Stocks in 50 Years

Meta Platforms: Fervently Hated, Money-Printing Value Stock

Other than a Super Bowl watch party, most people hate commercials and advertisements of any kind. They are disruptive, often offensive and increasingly violate privacy. Nonetheless, Meta Platforms (formerly Facebook) continues to print and store massive piles of money it derives from advertising across its platforms, including Facebook, Instagram, Messenger, WhatsApp and others. And despite the fact that growth in traditional markets may be slowing, and its pivot to the Metaverse is wildly unproven, the low valuation (of this once growth now value stock) is hard to ignore. This report reviews the business, valuation, risks and concludes with our opinion on investing.

10-Day Market Reversal

Lead of Value Over Growth

10-Year Treasury vs Growth Stocks

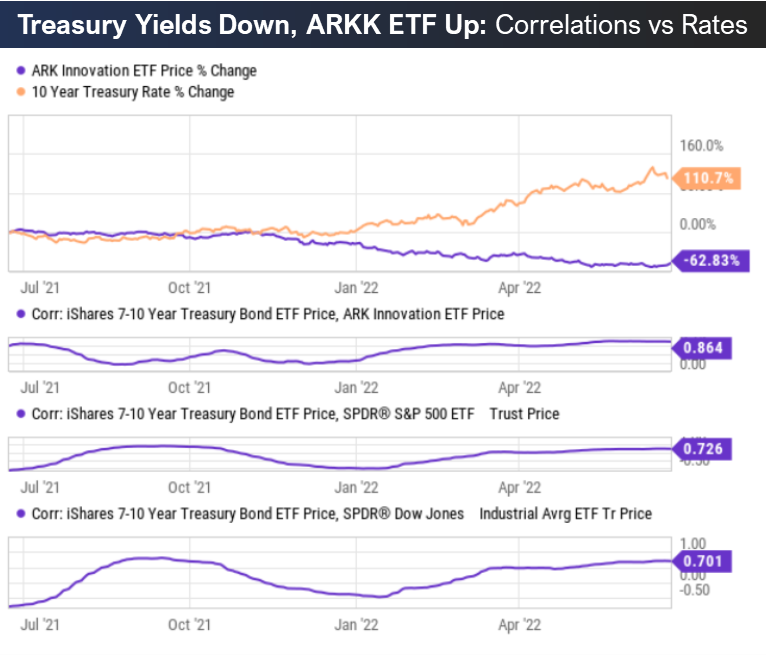

As you can see in the following chart, there has been a high correlation between high-growth stocks (as measured by the Ark Innovation ETF (ARKK)) and the 10-year treasury rate. More so than for the S&P 500 or the Dow.

The reason is because as the fed raises rates to fight inflation, they slow down the economy as a side affect, and the most growth-oriented names are the most negatively affected.

Considering we just had the largest drop in 10-year treasury rates this week since Covid, it was off-to-the-races for ARKK and high-growth stocks in general.

Honeywell: Growth-Value Debate, Big Dividend Growth

In the “olden days,” it was widely accepted that value stocks outperform growth stocks over the long-term. But as central bankers have gotten increasingly involved in the last few batches of market cycles, growth stocks (supported by easy money) have been dominating—until this year. And if the US Fed’s now increasing interest rate trajectory is any indication, value stocks may again return to extended periods of outperformance. Shares of diversified industrial company, Honeywell (HON), fall into the value stock category, and may be worth considering. This report reviews Honeywell’s business, its valuation and risks, and then concludes with our opinion on investing.

Top Sales Growth: 20 Worst Performers

Shopify: Meme Stock, New Market Paradigm

We first purchased Shopify at ~$143 per share in August of 2018. It now trades at ~$333 per share. Not a bad return—until you realize the shares have fallen over 80% in the last 6 months! This report compares Shopify’s business fundamentals (including its business strategy, ongoing revenue growth and margins) to its current valuation, and then examines the question of whether Shopify CEO, Tobias Lütke, continues to imprudently push an easy-money, high-growth business strategy in an increasingly sober new market paradigm—now characterized by higher costs of capital and a starkly less friendly meme stock environment (yes—Shopify is a meme stock). We conclude with our opinion on who might want to invest—or if it’s simply time to sell and move on.

Top 10 Big Dividends: REITs, BDCs, Bond CEFs, Energy and More (4-10% Yields)

When it comes to income investing, investors have a lot of choices. And considering the current macroeconomic environment (inflation, the fed, market declines, recession risks) many investors are left flummoxed concerning their next move. In this report, we share our top 10 big-dividend opportunities, including two ideas from each of the following five categories: REITs, BDCs, Bond CEFs, dividend-growth stocks and energy investments. The yields range from 4% to over 9%, and we share some high-level macroeconomic perspective before we get into the countdown.

The Big-Dividend Report

Verizon: 5.2% Yield, 4 Risks Worth Considering

The share price of steady dividend-growth stock, Verizon, is still down more than 11% following its latest earnings release. And the 5.2% dividend yield is increasingly tempting for many income-focused investors (especially in our current volatile market). But the outsized dividend doesn’t come without risks. In this report, we review Verizon’s business, its dividend safety, the current valuation and four big risks the company currently faces. We conclude with our opinion on who might want to consider investing.

Chip Stocks: Price-to-Sales Ratios Decline

Roku: Despite Massive Sell Off, False Headwinds Still Exist

Roku (ROKU) shares are down 85%. And while some investors celebrate the bursting of what they believe was an obvious pandemic bubble stock, things could still get worse. For example, the Fed’s hawkishness is driving us into recession, Roku’s earnings are again negative and the shares remain highly shorted right along with many other now infamous “high-growth” stocks. In this report, we review Roku’s business, its growth opportunities, its valuation, the multitude of headwinds that many investors are now increasingly aware of (such as supply chain issues, competitive threats, slowing growth), and then conclude with our opinion on investing.

Looming Recession?

STAG's 4.4% Yield: 3 Big Risks Drive Price Lower

If you are an income-focused investor, you probably like investing in REITs for their often big, steady, dividend payments. However, you may have noticed that following years of strong outperformance, the industrial REIT sector (including monthly-dividend payor, STAG Industrial (STAG)) has recently sold off hard. This report reviews STAG’s business, including information on the 3 big risk factors contributing to its relatively lower valuation multiple—as compared to industry peers (especially following the recent big Industrial REIT sector sell off), and then concludes with our opinion on investing.