A lot of top growth stocks have sold off hard over the last month, and a select few of them provide extremely attractive entry points right now. In this report we share data on over 100 top growth stocks, briefly review macroeconomic conditions, discuss several massively disruptive secular trends, and then count down our top 10 growth stock rankings. We believe the names on this list have dramatic upside potential in the quarters and years ahead. However, if you are not a growth stock investor, this article is absolutely not for you.

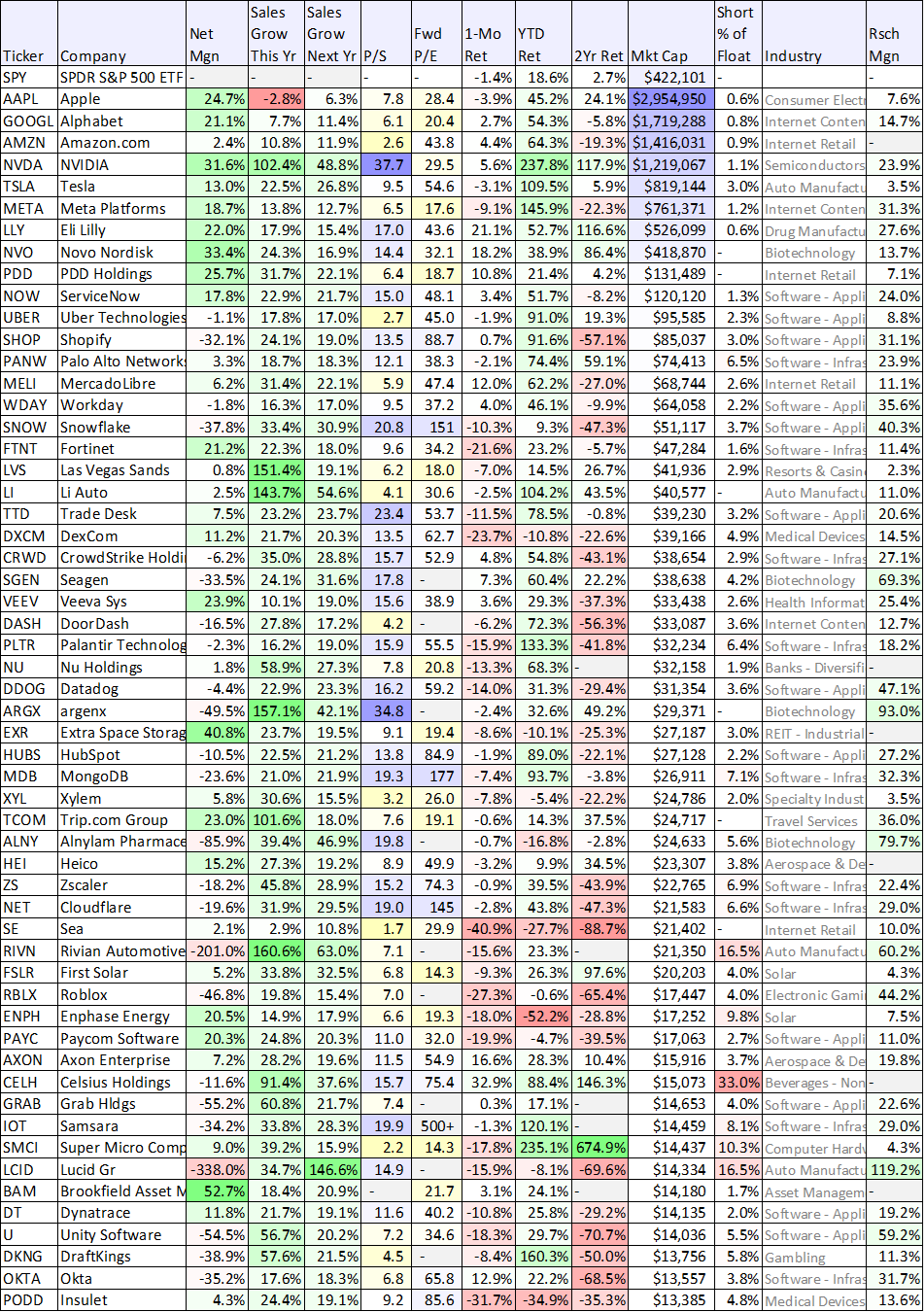

100+ Top Growth Stocks

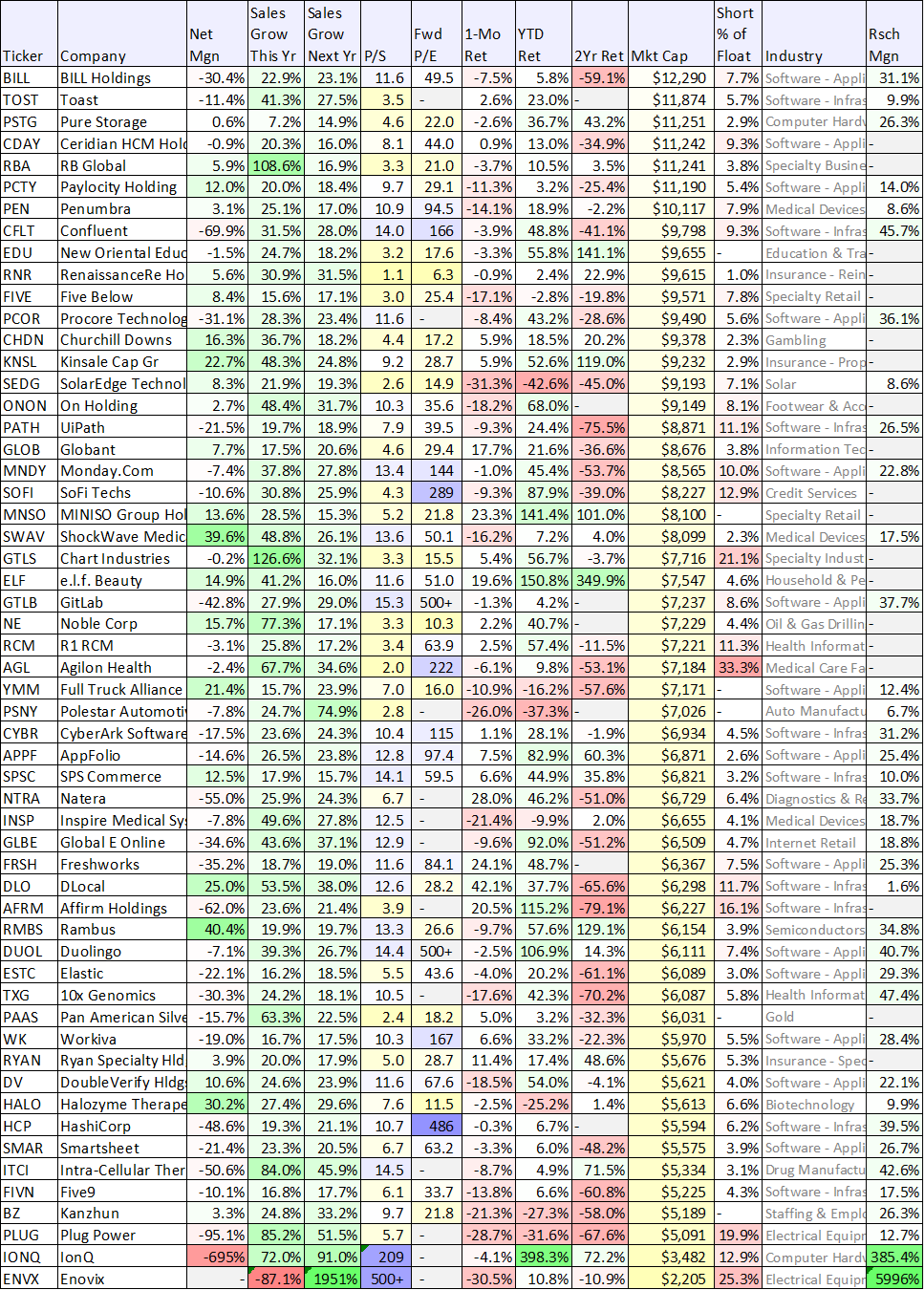

The following table contains data on over 100 top growth stocks (i.e. those with high expected sales growth rates, this year and next). And as you can see, many of them have sold off hard over the last month (as this year’s growth stock rally has pulled back).

Also, many of these names are still down over the last two-years because that’s when the pandemic bubble first started to burst. Not shown, is the 10-year returns (because many of these companies haven’t traded publicly for 10-years yet), but over the last 10 years, many mega-cap names (included near the top of the chart) are up dramatically more than the overall market (as measured by the S&P 500). Rather than chasing mega-caps (many of which are very attractive, but have already experienced tremendous growth), we’re searching for non-mega cap companies with dramatic upside in the years ahead.

data as of August 31, 2023.

The table is sorted by market cap, and you likely recognize many names you are familiar with (we included the “Super 7” mega-cap stocks at the top of the table, for comparison purposes). One thing you may notice, the Super 7 has very strong net profit margins, but many of the other names on the list do not yet (because they are spending heavily to generate high sales growth at this point in their life cycle as they capitalize on important secular themes—which we will cover later in this report).

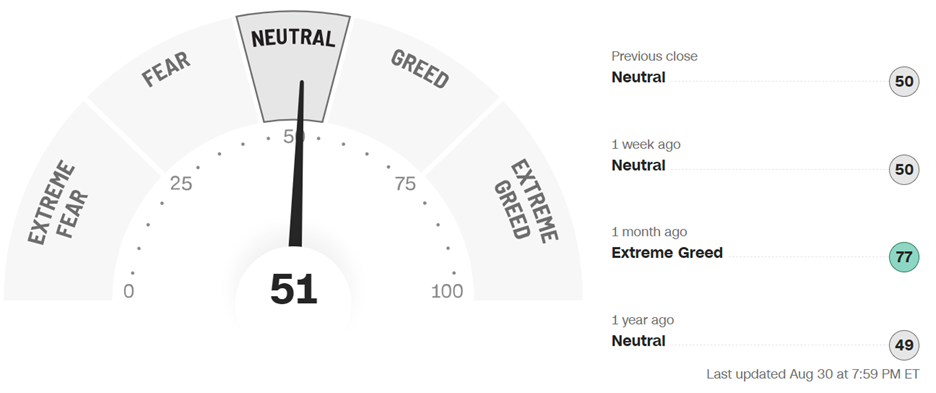

Macro: Market Greed Has Faded

As you can see in the following two “Market Greed” graphics, fear has fear has risen (and greed has faded) over the last month. This is consistent with the market pullback we have seen over the last one-month for many top growth stocks, and it has created some increasingly compelling entry points (as we will cover later in this report). And considering the market was up so strongly through the first 7 months of this year, the pullback in attractive and not surprising.

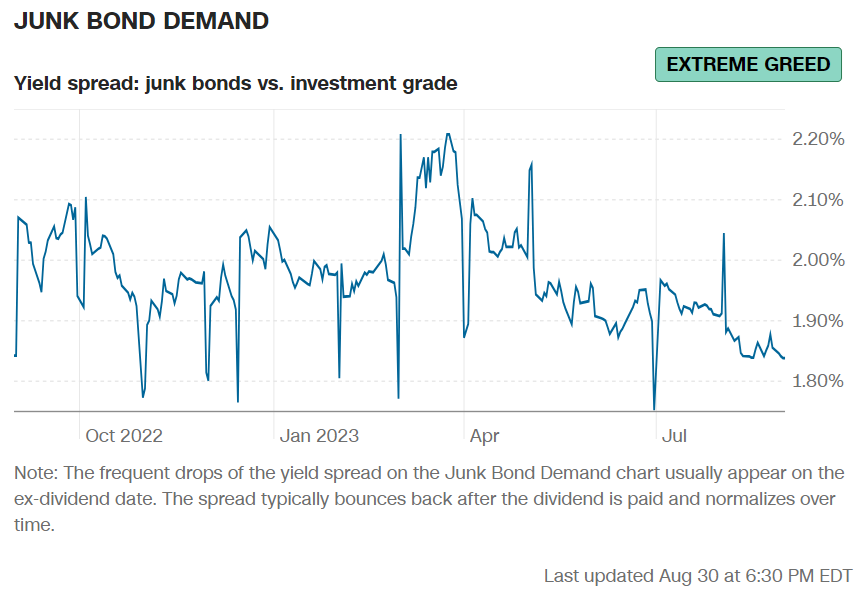

To add more perspective, this next chart shows the yield spread on junk bonds versus investment grade bonds is currently very low. This is an indication that the market is not panicking, and currently has some stability. Widening yield spreads can be an indication of high volatility and danger for investors. The chart is labeled “extreme greed,” suggesting the bond market may be too calm and comfortable, but we view it as a sign of current stability.

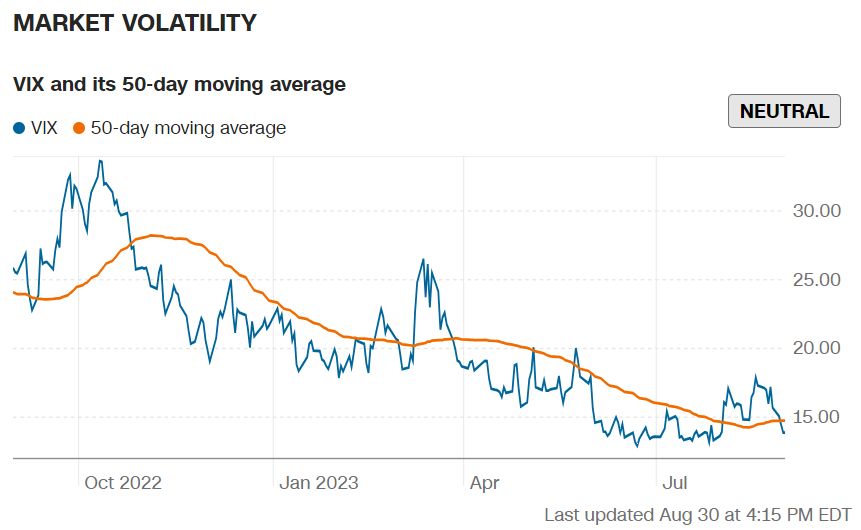

Further, the market “fear index” (the VIX) is currently low by historical standards, also suggesting the market is fairly calm and stable right now.

Big Disruptive Secular Trends

Before getting into our top 10 rankings and countdown, it’s worth considering a few major market secular trends because they are a big part of the thesis behind most of the names on our top 10 list.

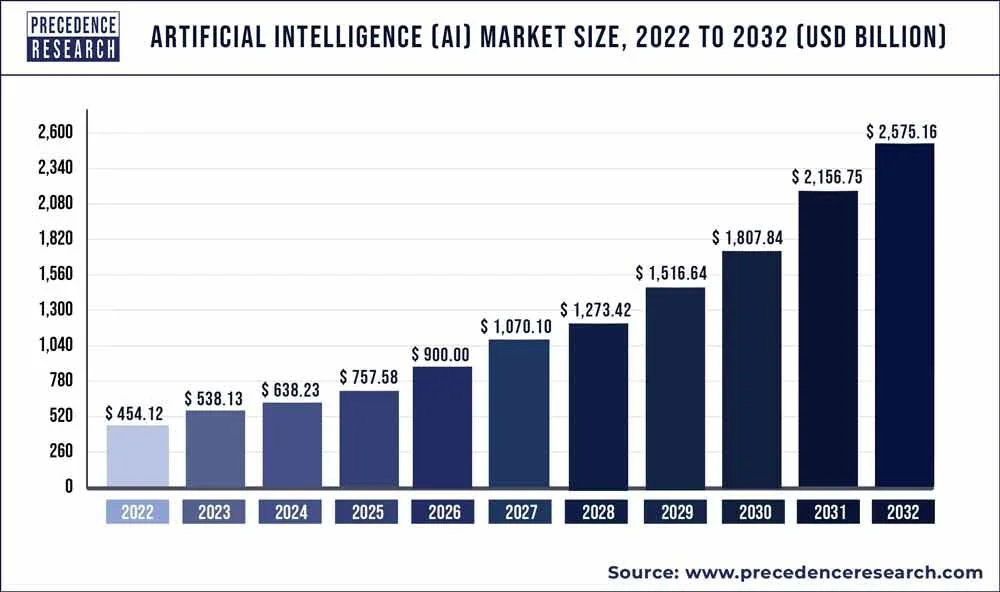

1. Artificial Intelligence: Unless you’ve been living under a rock, you’ve likely heard of the massive market disruption being caused by artificial intelligence this year. Artificial intelligence is basically “a machine’s ability to perform the cognitive functions we usually associate with human minds.” And generative AI is “describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, simulations, and videos.” AI has been a big part of the reason certain stock prices have shot up this year (such as Nvidia (NVDA) in our earlier table). And you can see in the following graphic just how big the AI market is expected to grow in the years ahead.

2. Fintech: “Fintech” (or financial technology) is another secular trend with the ability to massively disrupt markets. The space is wide ranging, but a major component is online payment processing companies with the ability to efficiently (and very profitably) process large amounts of financial transactions online and thereby eliminating the need for physical currencies. The opportunities in this space are very large and potentially extremely lucrative.

3. The Great Cloud Migration: In case you’ve been living under a rock, the world has been moving to digitize practically everything and then store it in the cloud. This not only makes things dramatically more efficient for organizations, but it also unlocks new highly valuable insights that become apparent from having such easy access to extensive data. As such, there is massive explosive demand for companies that can support the great cloud migration, especially considering it is still in its early innings and has many years of high growth for many years into the future. There are lots of attractive opportunities in this space if you know where and how to look.

Our Top 10 Growth Stocks:

So with that backdrop in mind, let’s get into our rankings, starting with #10 and counting down to our top ideas. All of the names on the list benefit from at least one of the secular trends described above, they are all attractive fundamentally (including the metrics included in our earlier table) and they all have powerful price appreciation potential (especially after the stock market softness over the last month) in the quarters and years ahead.

10. Enovix (ENVX)

This is the most speculative idea in the top 10, and potentially the most lucrative (if things continue to progress for the company). Enovix shares are very volatile, and the share price has recently pulled back signficantly over the last month (it’s the last row in our earlier 100+ stock table).

Enovix is a manufacturer of advanced lithium-ion batteries. And this early-stage public company is well-positioned to benefit from growing demand, including mobile, Internet of Things (related to the great cloud migration) and electric vehicles. What sets Enovix apart (versus the competition) is its energy density advantage (achieved through design and architecture choices) and silicon anode technology (learn more in our full report linked below). Importantly, Enovix also addresses key safety concerns.

Enovix continues to position itself for wide scale production (for example, its recent manufacturing agreement in Malaysia), and it is also lining up battery cell orders (for example, this one from the US Army). Here (below) is our full report, whereby we review the business model, market opportunity, financials, valuation and risks. If you can handle this stock’s very high risk-reward profile, the shares are absolutely worth considering, especially after the recent pullback. We are long Enovix.

*Honorable Mention: IonQ Inc. (IONQ):

IonQ harnesses the power of atomic ions found in nature to develop quantum computing systems that are widely regarded as surpassing traditional computer technologies in both quality and scalability. Founded in 2015 and first trading publicly in late 2021, the company is relatively small, but growing rapidly and supported by very large long-term secular disruption opportunities.

We’re including IonQ as an “honorable mention” because we don’t yet own shares (as the technology’s uses are still nascent) however the upside is potentially enormous if this superior technology becomes more viable and catches on (which it appears on track to eventually do so). IonQ investors include Google Ventures and Amazon Web Services.

IonQ shares are tempting as the price has pulled back over the last month. You can read our new full report on IonQ here:

9. SoFi Technologies: (SOFI):

SoFi is a “fintech” company. More specifically, it is an online financial services company and bank that targets younger high-income customers. And SoFi has a lot of good things going for it. For starters, the recent end (this month) to the federal student loan forbearance program means more business for SoFi as federal loans are again refinanced (now that there is a need again) through SoFi’s private loans business. However, while student loans had slowed in recent years, SoFi’s personal loans business continues to accelerate (and is now much larger than student loans). Furthermore, the company picked up a bank charter recently, and is now benefiting from higher interest rates (i.e. higher net interest margins as rates rise).

SoFi shares are down nearly 10% over the last month, but the business continues to get better (it’s on track for GAAP profitability in Q4), and you can read our latest new SoFi report using the link below.

8. Palantir (PLTR)

Palantir is basically a software company, and it is positioned to benefit dramatically in the years ahead from the massive secular growth in Artificial Intelligence (“AI”) and Machine Learning (“ML”) (especially thanks to the company’s leading solutions, innovation, sticky customer base and very strong balance sheet).

Palantir’s recently announced quarterly earnings, whereby it raised forward guidance and announced a $1 billion share repurchase plan (both good things). However, it is growth in demand for the company’s Artificial Intelligence platform that is most interesting. Here is what CEO Alex Karp had to say about AI.

Shares of Panatir have been volatile since its pandemic-era IPO, but the business has continued to grow and expand. The shares are down more that 15% over the last month, and this is creating an increasingly compelling entry point. In the following report, we review the business, the growth, the opportunity, the valuation and the risks. We are currently long shares of Palantir with no intention of selling.

7. Super Micro Computer: (SMCI):

If you like to invest in powerful secular growth opportunities, Super Micro Computer (SMCI) has likely caught your eye. This developer and manufacturer of high-performance servers and storage systems is benefitting dramatically from explosive secular growth in artificial intelligence (“AI”) and high-powered computing (including its special relationship with Nvidia). The total addressable market opportunity is enormous. We recently wrote this one up in detail (see link below), and the shares have pulled back more than 17% over the last month (making for a significantly better entry point). We recently purchased shares of SMCI (on the pullback). Here is our full report:

*Honorable Mention: Celsius Holdings (CELH)

We’re including Celsius as an honorable mention (again) on this month’s top 10 list because the shares continue to present massive disruptive growth potential. And while the high short interest and massive price gains over the last month frighten a lot of investors (shares are up 32% over the last month, and short interest was recently 30%), this company keeps posting massive revenue growth.

Celsius (an $15.1B market cap stock in our table) is basically an energy drink company (offering a variety of flavors with proprietary clinically-proven formulas), and its revenues have been growing at an absolutely incredible pace. The driving force behind its recent rapid revenue growth is its relatively new (within the last year) distribution deal with Pepsi. According to CEO John Fieldly in the company’s latest earnings press release):

“During the first quarter of 2023, Celsius delivered an all-time quarterly record revenue of $260 million in sales and over $34 million in net income, driven by expanded availability and increased consumer awareness. In addition, we continue to further transition into PepsiCo’s best in class distribution system.”

Distribution is a huge deal, and if you’ve been in a US grocery or convenience store lately, you’ve probably come across a Celsius display, such as the ones below.

Celsius has plans to keep growing. Its corporate mission is:

To become the global leader of a branded portfolio which is proprietary, clinically-proven or patented in its category, and offers significant health benefits).

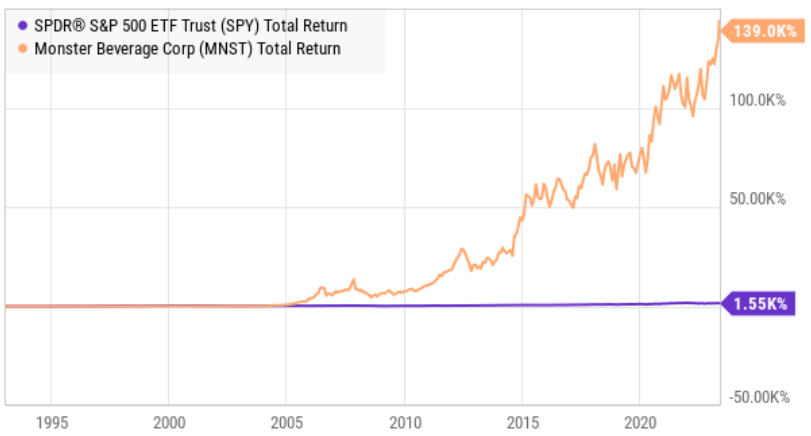

And as compared to competitor Monster Beverage (distributed by Coca-Cola), Celsius continues to have significant room for growth in terms of revenue and market cap.

And if Monster’s historical price returns trajectory (following its Coke deal) is any guide (see below), Celsius is still just getting started.

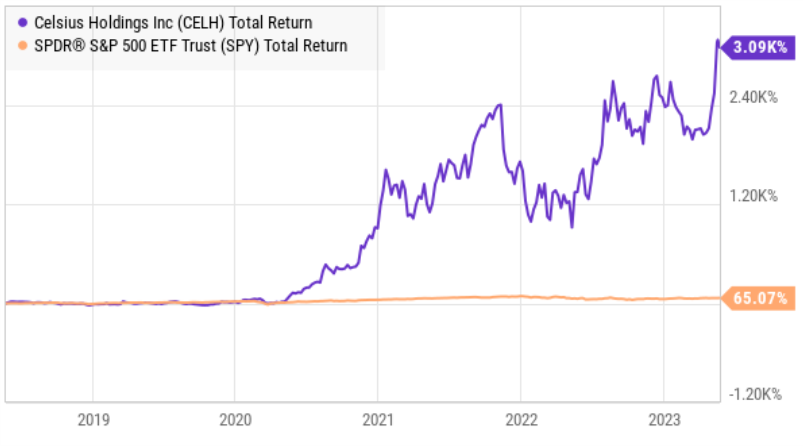

For reference, here is a look at Celsius’ recent price returns (below). The shares started to take off during the pandemic as lockdowns forced sales outside of mainly fitness clubs and into the mainstream (and now the Pepsi deal is taking the sales to new levels).

We’ve owned the shares since they traded in the $60’s (the current price is near $200), and we’d have ranked it in this report if it weren’t for the recent steep share price surge. There are a lot of people betting against Celsius at this point (short interest was recently over 33%!), but that can actually work in favor of investors as a potential short squeeze could quickly drive these shares even dramatically higher.

If you are curious, you can access our initial 2021 Celsius report (to see how we were thinking about it during the pandemic and before the Pepsi deal) using the following link.

6. Datadog (DDOG)

Datadog is a very high growth “observability and security” platform for cloud applications, and it is a huge beneficiary of “the great cloud migration.” Specifically, Datadog’s highly-regarded solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience. And the shares are down 14% over the last month, creating a more attractive entry point considering the business keeps growing and the market opportunity is massive.

As members know, we purchased shares of Datadog in March (in the $60’s), and it is increasingly attractive following its latest earnings release, whereby it beat revenue and earnings estimates and also raised forward guidance (the shares now trade around $97). Growing revenues at a very impressive rate (and with gross margins near 80%, and an impressive land-and-expand track record), yet still trading at only 16.2 times forward sales, Datadog continues to present a highly attractive long-term buying opportunity. You can access our full Datadog report using the link below. We are currently long Datadog.

*Honorable Mention: Sea Limited (SE):

Sea Limited is a digital commerce company (based out of Singapore) that soared during the pandemic, but has since fallen hard, especially after its most recent quarterly earnings announcement. However, the company is growing rapidly (14% forward revenue growth expectation), it’s finally GAAP profitable, and it trades at less than 20x forward earnings and around 1.6x sales. It also has mounds of cash on the balance sheet to support continued growth. And it is benefiting from the massive fintech secular trend.

We recently initiated a small position in Sea Limited in our Disciplined Growth portfolio on the recent very steep post-earnings price decline. We’ll have more to say about this one soon, but for now we are including it as an “honorable mention.” Long SE.

*Honorable Mention: Confluent (CFLT):

We don’t yet own shares of Confluent (that’s why we’re including it only as an honorable mention), but the company is very interesting from a growth standpoint (that’s also why were including it as an honorable mention).

Confluent is on a mission to “set data in motion.” It provides a data platform which is designed to help businesses manage and process data in real-time from various sources. Traditional database technologies typically focus on storing and retrieving data that is at rest, meaning data that has been persisted to disk or stored in databases. In contrast, Confluent's platform is built around Apache Kafka, an open-source distributed streaming platform, which enables the processing of data in motion or data streams.

Confluent has plans to integrate its platform with popular AI systems, further expanding its product offerings and strengthening its position in the industry. In the following report (link below), we analyze Confluent’s business model, its market opportunity, financials, valuation, risks, and then conclude with our opinion on investing.

5. Fortinet (FTNT):

Shares of this cybersecurity company fell sharply over the last month as quarterly earnings were healthy, but the company cut its forward guidance estimates based on a weak economy. However, among cybersecurity companies, Fortinet is well-positioned to thrive even during a macro slowdown because of its large size and 21% net margins (while a lot of other cybersecurity stocks aren’t yet profitable).

Furthermore, Fortinet is still growing rapidly, with revenue expected to grow at around 20% this year and next. Further still, the shares trade at under 10x sales (lower than industry peers with similar growth and less profits) and 34x earnings (not bad considering the growth and profits). Cybersecurity is not a luxury item (it’s a necessity) and the total addressable market is massive and continues to grow as the digital revolution and great cloud migration continues. You can read our previous Fortinet notes and report using the link below. We are currently long shares of Fortinet in our Disciplined Growth Portfolio.

*Honorable Mention: Veeva Systems (VEEV)

Given the challenging macroeconomic backdrop (high inflation, recession fears looming), if you had to list the top characteristics you’d like to see in a stock market investment right now, it might include things like: high profit margins, no debt, tons of cash and a sticky client base that is economically non-cyclical. Veeva Systems is a healthcare stock with all of those things, plus a very high revenue growth rate, a large total addressable market opportunity, a wide economic moat and basically no competition

Veeva was ranked in the last two Top 10 reports, but the shares have since posted very strong gains, and we’re including it only as an honorable mention in this report. The shares do still have dramatically more upside potential ahead (and they still trade below all-time highs). This is an extremely attractive long-term growth stock, and you can read our previous report using the link below. We are currently (and still) very long Veeva.

4. Paylocity (PCTY)

Paylocity provides cloud-based human capital management and payroll software solutions. Revenues are growing at 20 per year (and this is especially impressive considering the company is very profitable with a 12% net margin), but still spending heavily on growth (the company’s research margin was recently 14%). Further, the shares are down 11% over the last month, and up only 3% this year. It trades at under 30x earnings and under 10x sales, both impressive for such a profitable company that continues to grow rapidly and has a large total addressable market opportunity.

Paylocity is a cloud-based Software-as-a-Service company, that got its start in payroll for small businesses, but has expanded to more HR functions and continues to attract mid and larger companies too. Paylocity is special because of its sticky customer base (once a company sets up payroll, they tend to leave it in place).

Paylocity shares have been weak because the economy has been weak, but as the economy picks up again, Paylocity’s growth will continue to accelerate and the valuation can go much higher.

We have owned shares of Paylocity since 2015 when they were trading below $30 (they currently trade at over $200), but the shares continue to have significantly more upside ahead. You can access our previous Paylocity reports here:

3. Enphase (ENPH):

Enphase shares are down more than 18% over the last month (after a disappointing earnings announcement) and down more than 50% this year. However, the company is not as bad as these numbers suggest, and in fact it is hugely profitable (20% net profit margin), growing rapidly (mid-teens revenue growth rate expectations) and trading at only 6x sales and under 20x forward earnings.

Enphase is a leading manufacturer of semiconductor-based microinverters (used in solar energy panels), as well as batteries, EV chargers, and other storage solutions. And the shares are down because these markets have been weak (from a macroeconomic standpoint). However, the long-term demand and secular trend remains intact, and these shares are quite attractive for long-term investors at the current price.

More specifically, Enphase is well positioned given the strong investment activity in the clean energy space globally as well as its innovative microinverter technology. Enphase is actively diversifying its product offerings and expanding into new markets, while also focusing on continuous technological advancements to maintain a strong presence in the industry.

In the following report, we analyze the Enphase business model, its market opportunity, financials, valuations, risks, and finally, conclude with our opinion on why it currently presents such an attractive investment opportunity. We are long Enphase in our Disciplined Growth Portfolio.

*Honorable Mention: Shoals Technologies (SHLS)

Shoals is an industrial sector business that continues to grow rapidly as it benefits from the solar energy secular trend. Specifically, it provides electrical balance of system solutions (for solar, battery energy and EV charging applications) to mainly engineering and construction firms. And its valuation is increasingly attractive, especially considering the competitive advantages of this highly profitable $4B+ market cap company. Despite the business strength (it recently beat earnings expectations again), the shares are down 20% over the last month, and down 15% this year (despite the fact that it’s very profitable with a 37.5% net profit margin and sales are expected to continue growing at a rapid pace).

In the following report, we review all the details, and then conclude with our opinion on investing in this rapidly growing business. We are long Shoals.

2. Albemarle (ALB)

Albemarle shares are down a few percentage points over the last month, but the business remains very strong and positioned to benefit from the massive secular trend towards electric vehicles. Specifically, Albemarle is a materials company that mines mainly lithium which is used in electric vehicle batteries. The shares remain well below their late-2022 peak of over $334 (they currently trade at around $200) but the fundamentals continue to improve.

For some perspective, we recently wrote up lithium company (and Albemarle competitor), Lithium Americas (LAC) here, but prefer (and own) shares of Albemarle instead. Both companies are benefiting the the massive secular growth trend in electric vehicles (because their EV batteries are lithium-based), but we prefer Albemarle because it is less risky (it is a more established company that is already very profitable), but still has a ton of upside (as the demand for lithium will continue to grow dramatically.

Albemarle stands out for its amazing net margins (over 40%), incredible growth trajectory, and because the shares are still down dramatically (but we expect them to recover, especially as lithium prices are expected to recover). In the following note, we consider the company’s latest strategic effort, its valuation and our opinion on investing (i.e. we own shares).

1. PureStorage (PSTG)

PureStorage is a lessor known beneficiary of the AI secular trend. The shares are hovering around flat over the last month, but the business continues to grow rapidly. PureStorage announced earnings on August 30th, whereby they easily beat expectations (for the second quarter in a row) and raised guidance based on demand related to AI.

Pure Storage provides high-capacity storage for data centers using software & hardware technologies that are extremely well rated by customers. For example, it has won awards in AI and Cloud-Native Software (AIRI//S, Pure's next-gen AI-ready infrastructure, was recognized by AI Breakthrough Awards as the Best AI Solution for Big Data).

Per CEO Charles Giancarlo on the most recent quarterly call:

As we discussed last quarter, Generative AI and ChatGPT have brought artificial intelligence to the top of mind for all customers. And AI creates two sets of opportunities for Pure. First, we can supply products for AI training environments, such as the creation of large language models or LLMs short. And second, we can support enterprises to prepare their data architecture for AI inference, meaning the use of LLM's on their own data.

PureStorage is profitable, currently trading at only 4.6x sales (and 20x forward earnings) and has a long runway for high growth based on the AI secular trend. We currently own shares of PureStorage and you can read our previous notes and reports using the following link.

The Bottom Line:

Growth stock investing is not for everyone because the volatility can be high. However, if you have a long-term horizon, growth investing can be extremely lucrative. Many top growth stocks have pulled back over the last month, and some of them (such as those described in this report) are extremely attractive.

The long-term viability of a business is much more important than any short-term price pullback. However, the recent pullbacks do add some additional margin of safety. We believe the top names listed in this report are all attractive long-term growth businesses, and they will likely be trading significantly higher in the quarters and years ahead.