If you haven’t been paying attention, you might not realize the market is up 20% (S&P500) since the depths of the Trump tariff turmoil 3 months ago. And select high-growth stocks (arguably “meme” stocks) are up dramatically more (see table below). Some media pundits are arguing we’re in a bubble, while others suggest “this time it’s different.” In this brief report, I argue my case for when this “bubble” will burst and how you might want to play it.

Are we in a Bubble?

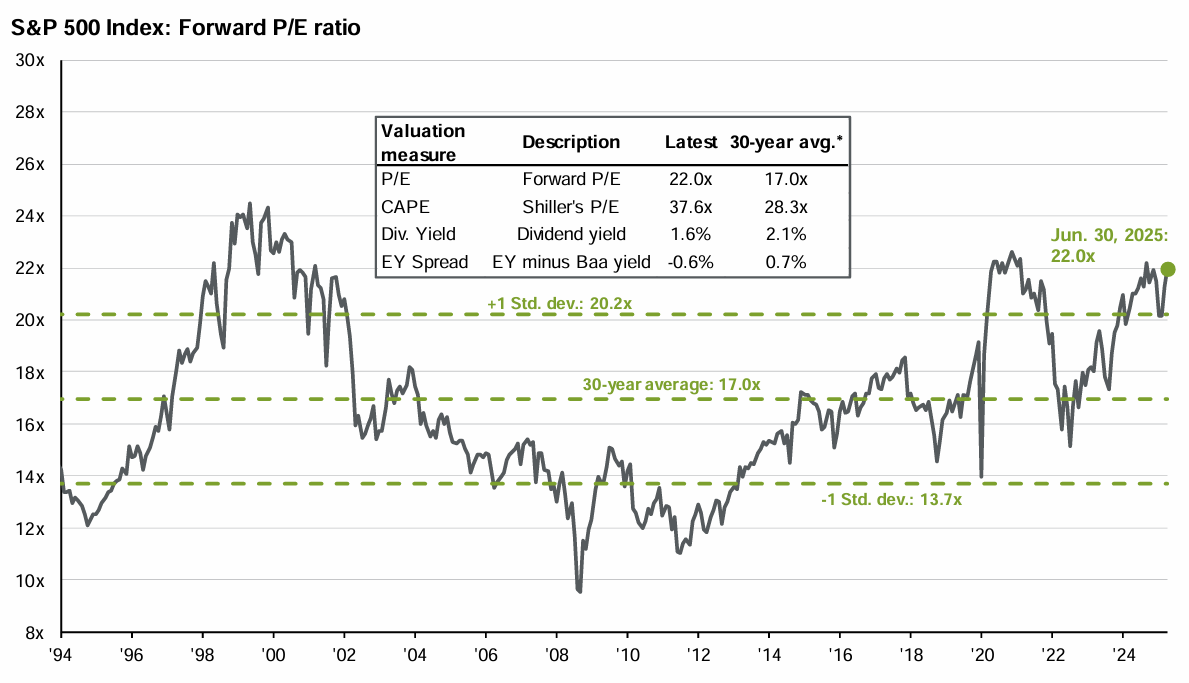

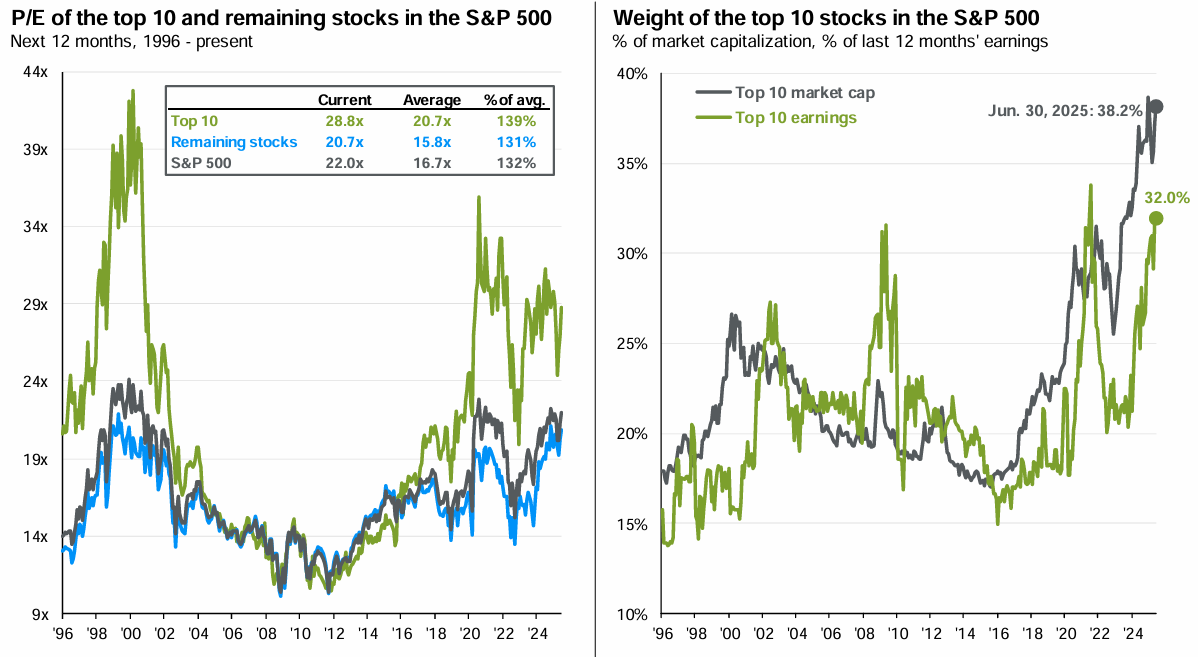

Two of the most common arguments I hear to suggest we’re in a bubble are market valuations (such as price-to-earnings ratios—they’re at historical highs) and the massive size of the top 10 US stocks by market cap (in percentage terms relative to the rest of the market).

For example, you can see in the following chart (as of June 30th) forward P/E ratios on the S&P 500 are well aboe the 30-year average (and they’ve only gotten higher as stocks are up so far this month—and quarterly earnings season is only just about to ramp into full force).

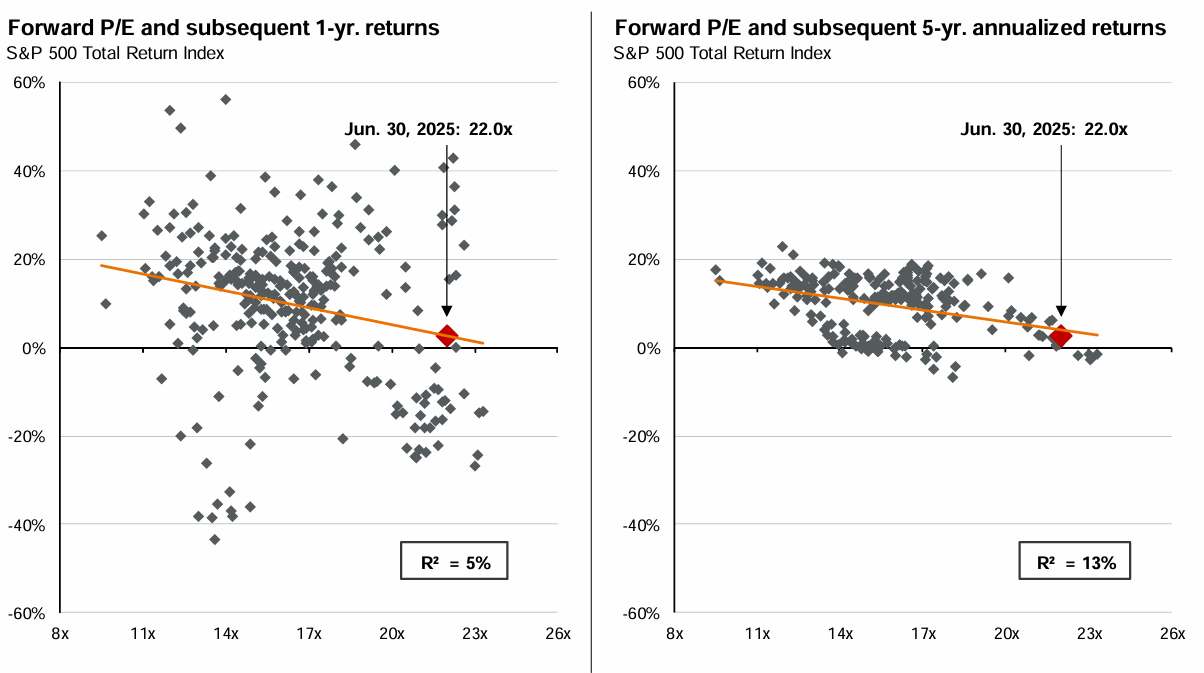

And then of course subsequent stock market returns are lower when the P/E ratio is higher, as you can see in this next chart.

And then here is a look at just how big the top 10 US stocks (by market cap) are related to the rest of the S&P 500 (i.e. they’re really big right now, and their P/E ratios are really high). For reference, you can see the 7 biggest (of the top 10) in my earlier table (i.e. see the Mag 7 in purple at the bottom).

So by traditonal, high-level metrics, the stock market is a little “frothy” right now, to put it mildly (more on this in the conclusion).

How should you play the current “Frothy” market conditions?

The “boring” answer is that you should play the market according to your own personal goals. If you cannot handle another 20% or 30% or more pullback and market correction—then for goodness sake don’t put everything you own in the stock market!

But if you have a longer-term horizon (7-10 years or more) then stay invested. Don’t try to time the market’s short-term moves. You WILL get it wrong (despite armies of idiot media pundits and sales people that will tell you otherwise—hint: they just want your money).

How am I playing the current “Frothy” market conditions?

I am NOT being overly aggressive right now, but I am sticking to my long-term goal-focused strategies.

For example, my Disciplined Growth Portfolio is still overweight megatrend themes I like (such as AI, the cloud and related businesses), but I am not being overly aggressive (I still have exposure to other market sectors and business strategies) and I am absolutely NOT going all in on meme stocks right now.

And in my “High Income NOW” strategy, I am not being overly risky compared to usual, but I am still staying exposed to a prudently-concentrated portfolio of high-income opportunities. I know that both strategies seem very different, but they are both still affected by the same market volatility and economic conditions.

And I also know that all investment decisions should be driven by your own personal situation and goals.

The Bottom Line

Yes, we’re in a bubble. It’s driven by inflation, fiscal and monetary policies and high-valuations (particularly by social media exuberance for meme stocks, and frankly little kids (obnoxious 20 and 30 year olds) that live their entire lives online).

But that does NOT mean it will burst tomorrow, next month or even next year. In my opinion, now is NOT the time to bet your livelihood on meme stocks, but it is time understand your personal situation and stick to a prudent strategy.

I am long the market, for the long term.