One of my biggest concerns for income-focused investors is opportunity cost. Specifically, they often concentrate their nest eggs in lower-growth sectors of the economy (because that’s where the dividends are) and/or in distressed companies (because that’s where the high-yield/junk bonds are at) and thereby sacrifice total returns. However, the internally-managed BDC I review in this report offers a healthy 9.9% dividend yield by investing in growth-focused sectors and companies (by providing financing to them during their early, pre-IPO, venture capital phase). In this report, I review the business, growth, dividend, valuation and risks, and then conclude with my strong opinion on investing.

Hercules Capital (HTGC):

Hercules Capital is the largest BDC (Business Development Company) focused on providing financing to high-growth venture capital-backed companies. It’s also internally managed, which arguably helps align the interests of shareholders and management. According to the company’s latest investor presentation:

“We focus primarily on pre-IPO and M&A, innovative high-growth venture capital backed companies at their expansion (venture growth) and established stages in a broadly diversified variety of technology, life sciences and sustainable and renewable technology industries”

About BDCs:

Business Development Companies were created by an act of Congress (over 40 years ago) to help smaller businesses grow (by providing them attractive financing, mainly loans). BDCs are not taxed at the corporate level a long as they meet certain diversification and distribution requirements (they’re generally required to pay out +90% of their earnings as dividends).

Healthy Growth:

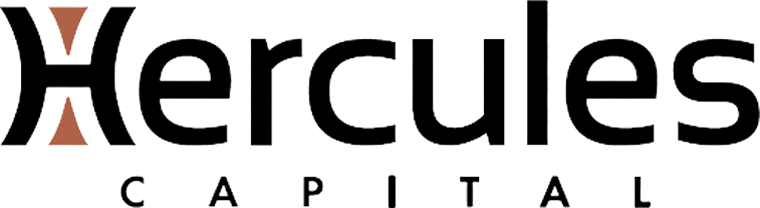

As you can see in the following charts, Hercules has historically maintained a healthy level of growth in investment income and total assets.

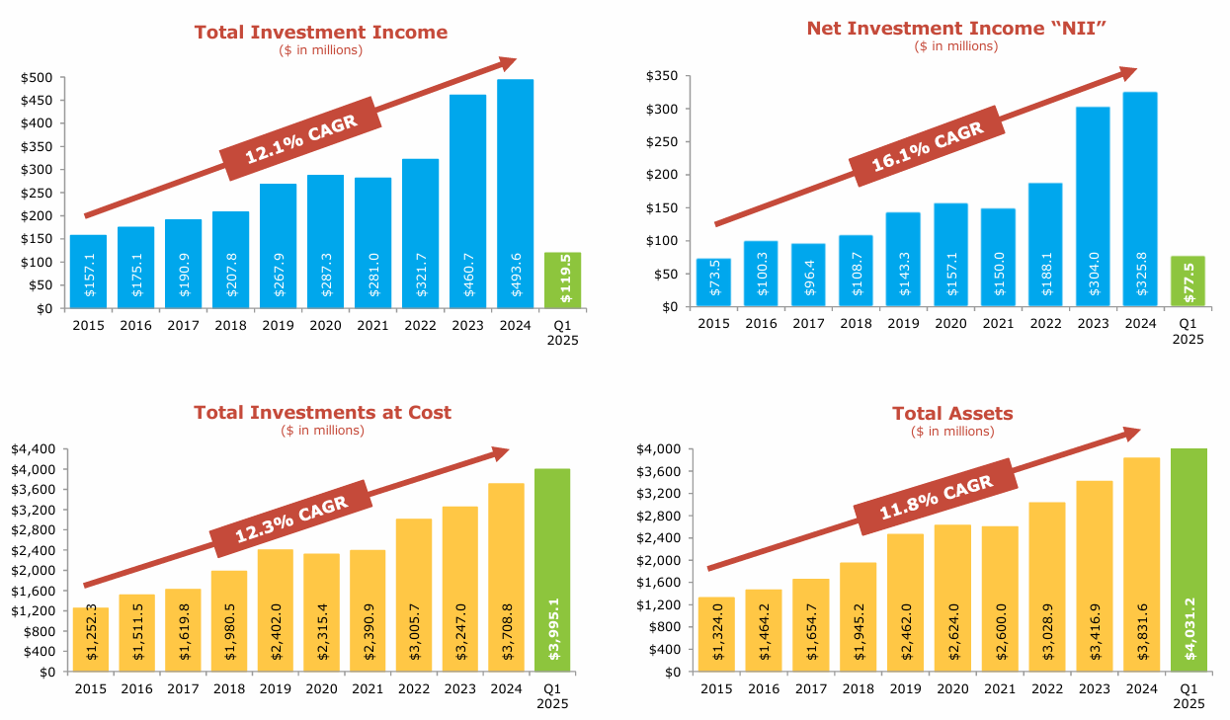

Part of the reason for Hercules’ success is its focus on newer/disruptive growth industries of the economy. Specifically, as other BDCs compete over old economy business with slow growth, Hercules is the leading BDC in growth areas. For example, here is a look at Hercules returns versus other leading (but differentiated) BDCs.

And you can dig deeper into how Hercules is differentiated in the following graphic (including its focus on first lien debt (safer) floating rate loans with interest rate floors (more potential upside) and its investment grade credit rating (a good thing).

Strong Dividend: 9.9% Yield

And one of the biggest reasons people invest in Hercules is the big dividend (current yield is 9.9%) as you can see in the following chart.

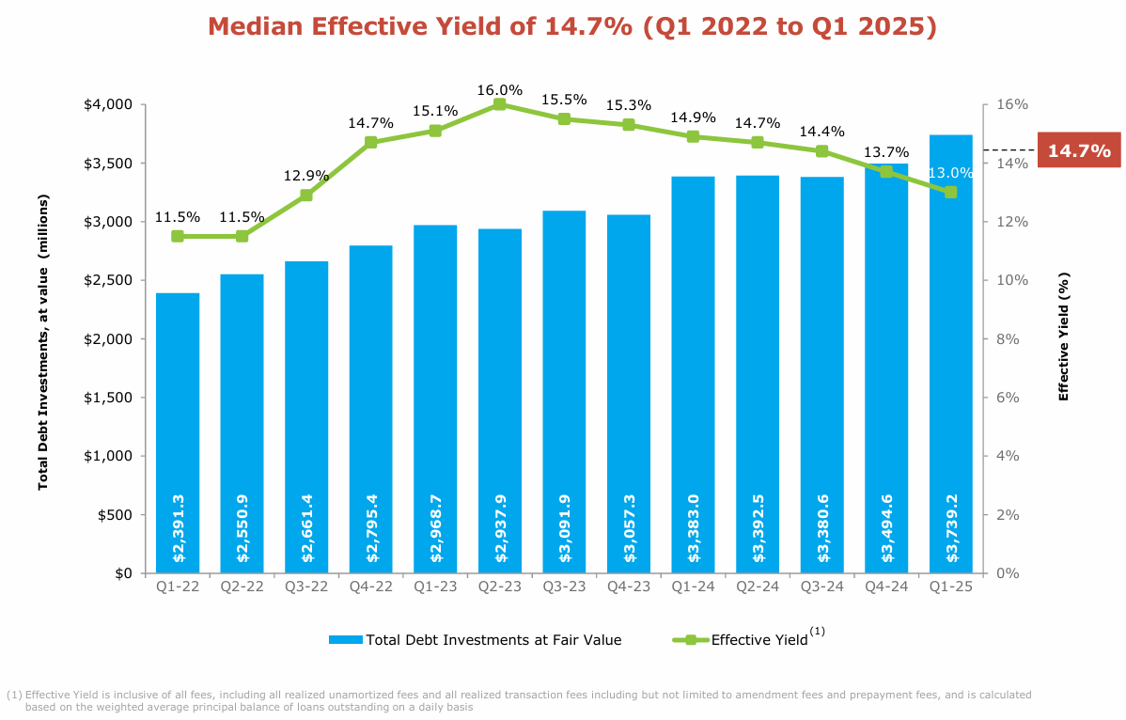

Hercules basically support this yield by lending out its own assets (money) at a high rate, and then also borrowing money (at a low rate) so they can lend out even more at a higher rate. For some perspective, you can see the company’s effective yield on its outstanding loans (i.e. it is double-digit and thereby supporting its own strong dividend payments to investors owning Hercules shares).

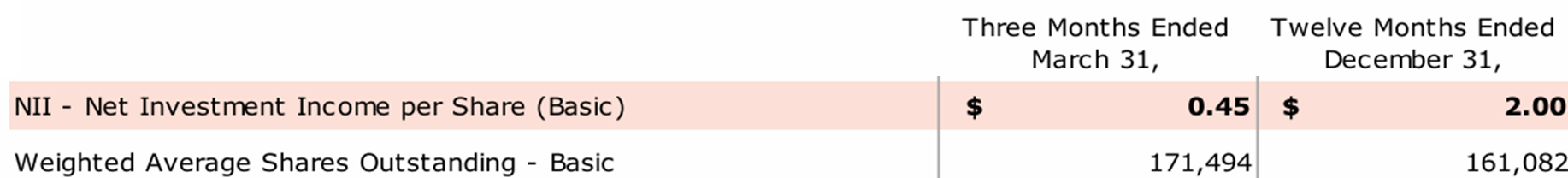

And from a financial statement standpoint, Hercules’ net investment income per share has consistently exceeded its dividend payout (a good thing). For example, last quarter’s $0.45 net investment income exceeds the ordinary dividend amount of $0.40 (see graphic below), plus Hercules sometimes pays a special (extra) dividend too (as you can see in the light gray versus dark gray in our earlier dividend graphic).

Current Valuation:

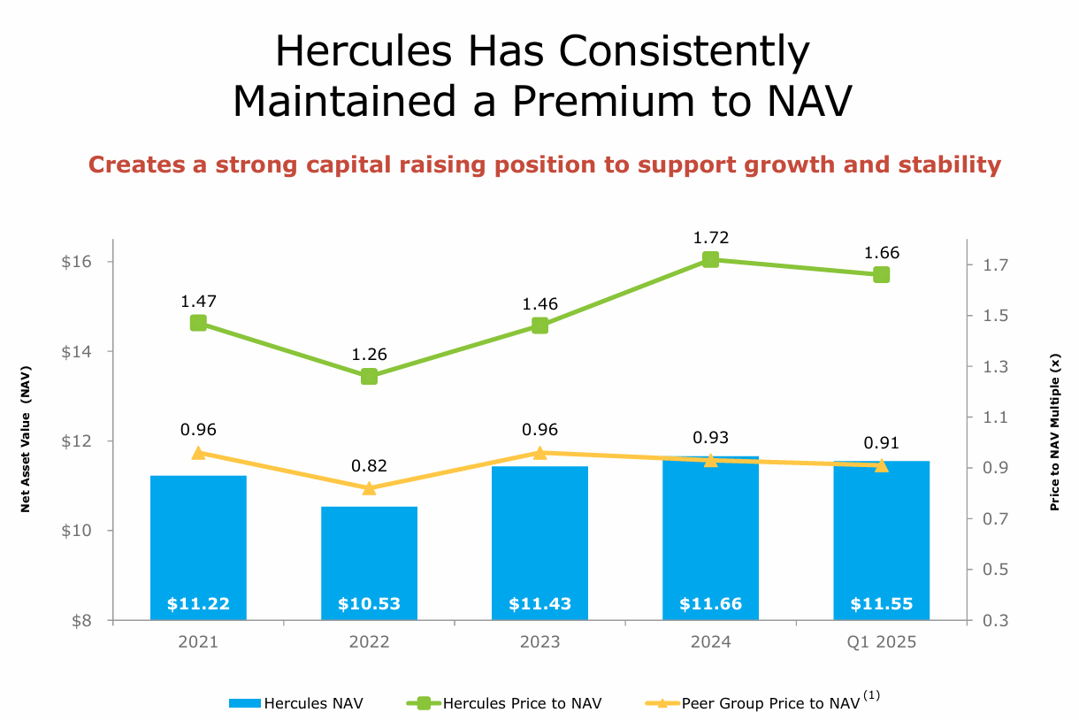

Price-to-book (P/B) value (also known as price-to-net-asset-value (“NAV”)) is a basic BDC valuation metric, and as you can see in the chart below, Hercules is expensive as compared to peers.

However, while some investors decry this as a bad thing, it actually allows Hercules to issue additional shares at a premium price thereby creating an attractive capital raising situation and thus supporting growth (recall Hercules continues to growth faster, and return more, than BDC peers as we saw earlier).

Risks:

Hercules does face a variety of risks that investors need to consider. In particular:

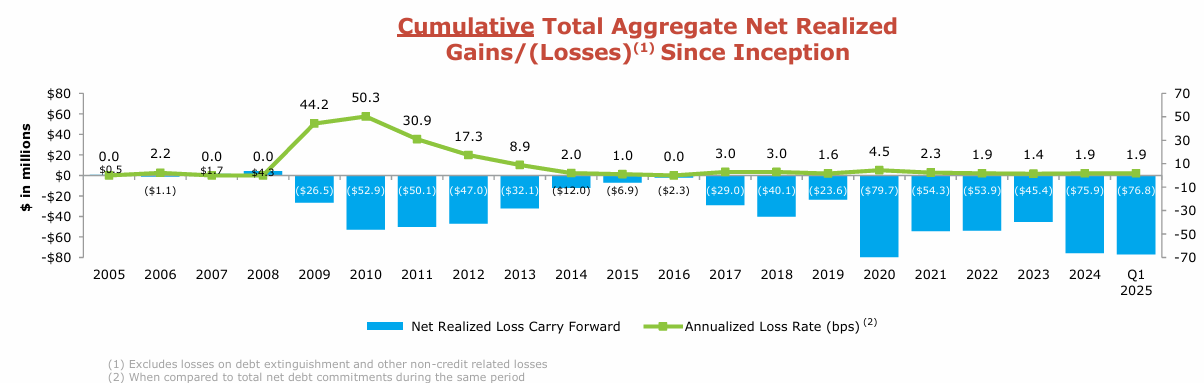

Market Cyle Volatility: The growth companies Hercules invests in can be particularly volatile as we move throughout the market cycle (i.e. when times are good, things can be really good, but when times are bad—things can turn south quickly). For example, you can see how bad things got for Hercules during the great financial crisis in 2009 in the following chart.

Specifically, the green line shows over 50% of 2010 loans reported losses. And Hercules shares reported extraordinary price declines in 2008-2009. However, Hercules did continue to pay a big dividend throughout the entire period (although it was slightly reduced during the period as you can see in the earlier dividend chart).

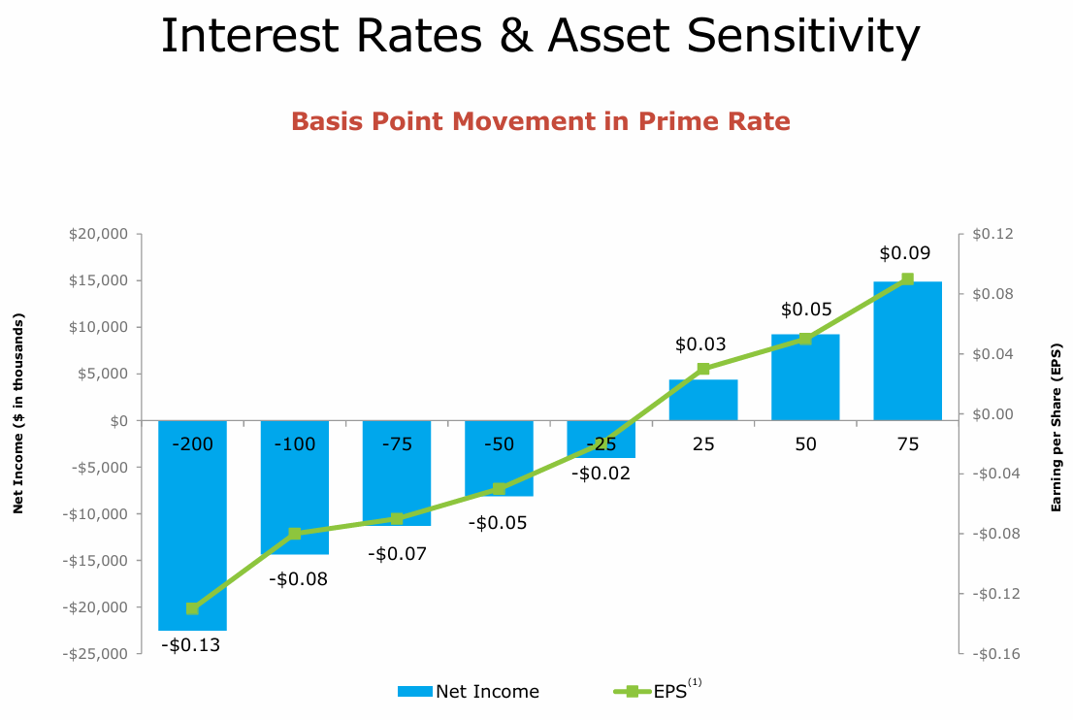

Interest Rate Risk is another exposure investors need to consider. As you can see in the following chart, Hercules’ net income and earnings per share will decline sharply if rates are cut (remember, nearly 100% of the loans Hercules makes are floating rate, not fixed).

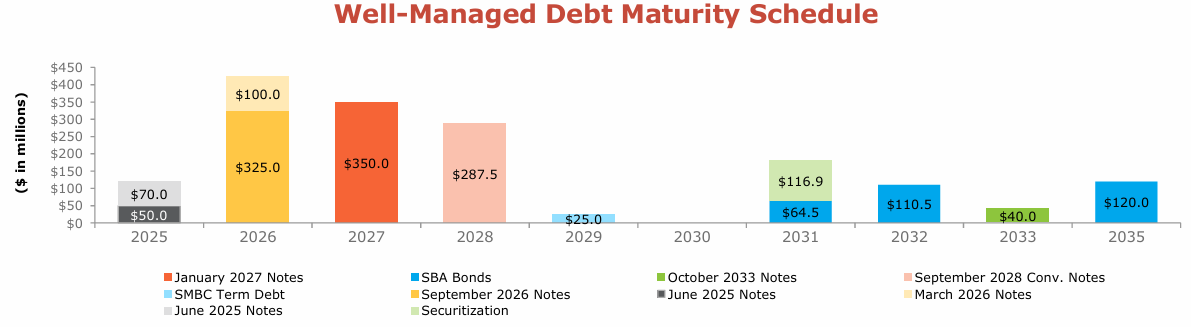

Debt Maturities are another risk as Hercules has significant maturities (that will most likely need to be refinanced) in 2026-2028.

So depending on where interest rates are at that time, Hercules’ interest expense could increase (or decrease) significantly. Recall also, Hercules has the luxury of an investment grade credit rating (which means they can borrow at lower rates than many other BDCs).

The Bottom Line:

Hercules offers a big, healthy, dividend yield, plus more long-term price appreciation potential than many other BDCs (because of its leadership position in the niche BDC disruptive-growth space). It’s not particularly cheap (or expensive) right now, and it has risks (as discussed). However, given the ongoing high-growth trajectory (especially as compared to other BDCs concentrated in lower growth sectors), Hercules is a standout. Hercules is absolutely worth considering for a spot in your prudently-diversified, income-focused portfolio.

* I am Long Hercules.