Full-stack AI infrastructure and cloud/GPU cluster company, Nebius (NBIS), just blew its own doors off (shares up dramatically) by announcing a new 5-year $17.4+ billion deal with Microsoft (MSFT) to provide dedicated access to its new data center in New Jersey. The deal, and the current valuation, are a stark reminder to investors that old-school valuation metrics (such as price-to-earnings ratio) make little sense when dealing with disruptive growth, and “forward vision” matters more (if you can get it right). After reviewing Nebius in detail (business, growth, valuation and risks), this report shares 5 additional top AI stocks as a roadmap and attempt at forward vision for the AI megatrend through year end.

About Nebius

Nebius is in the right place at the right time (i.e. the cloud-AI megatrend). According to its own website “Nebius is a technology company building full-stack infrastructure to service the high-growth global AI industry. Headquartered in Amsterdam and listed on Nasdaq, Nebius has a global footprint with R&D hubs across Europe, North America and Israel.”

More specifically, “Nebius’s AI-native cloud platform has been built for intensive AI workloads. With a full stack of purposefully designed and tuned proprietary software and hardware designed in-house, Nebius gives AI builders the compute, storage, managed services and tools they need to build, tune and run their models and applications.”

Nebius is basically a massive AI megatrend enabler and beneficiary. The company gets early access to Nvidia GPUs (such as Blackwell Ultra, last quarter) and in turns offers customers early access for their AI workloads.

Growth

As I wrote about Nebius a little over a week ago:

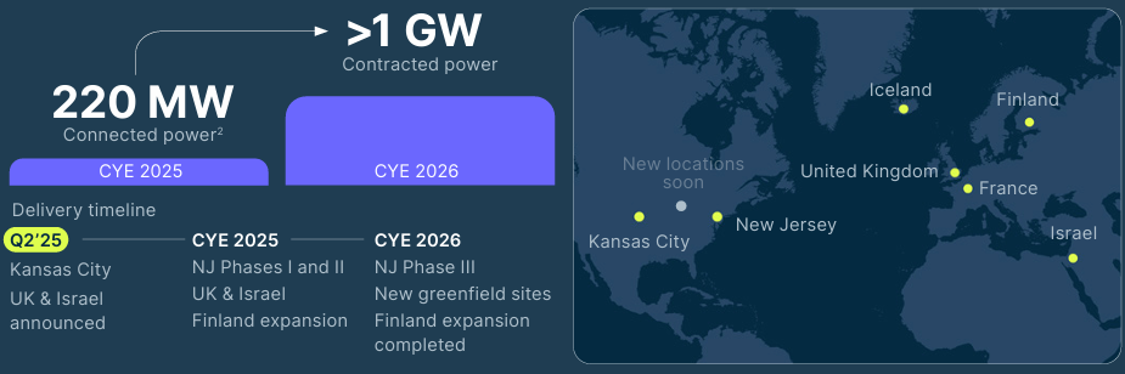

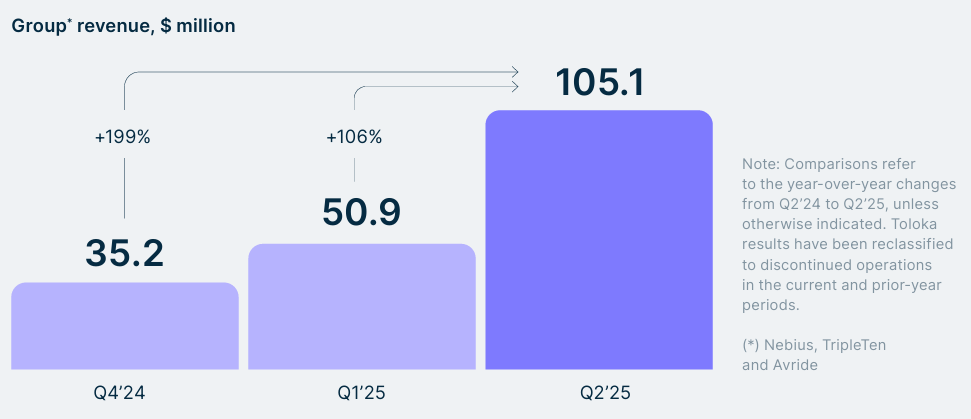

“It’s highly attractive with a staggering 383% current-year sales growth and over 100% projected for next year, plus a focus on global AI builders. Nebius's 625% Q2 revenue growth and plans for over 1GW power capacity by 2026 highlight its ability to outperform traditional cloud giants through AI-specific vertical integration. Trading at a trailing P/S of 65x, Nebius appears expensive but justified by its explosive growth trajectory in the AI sector.”

And those growth figures and valuation metrics just got thrown out the window again, after Monday’s big deal announcement with Microsoft. And importantly, that’s the whole point; growth estimates and valuation metrics make little sense when you are dealing with disruptive growth (such as the massive cloud-AI megatrend).

And according to Nebius founder and CEO, Arkady Volozh, regarding the new deal with Microsoft:

“The economics of the deal are attractive in their own right, but, significantly, the deal will also help us to accelerate the growth of our AI cloud business even further in 2026 and beyond.”

Valuation

For perspective, here is a look at how Nebius compares to the other top AI stocks to be considered in this report, and as you can see, they all have high revenue growth, high (expensive) valuation metrics, and dramatic (volatile) recent share price performance.

For example, at 71x earnings, Nebius looks very pricey, but it has impressive margins, and incredible growth. You can also see how it compare to other top AI stocks in the table (we will reference data in this table later this report).

The Big Risk: Nebius is the AI “Capex Fall Guy”

The biggest risk for Nebius (aside from its nosebleed valuation metrics) is simply that it is the AI “capex fall guy” for the Microsoft’s of the world. Specifically, companies like Microsoft, Meta, Alphabet and Amazon (hyper scalers) could easily afford to build out all this data center infrastructure on their own (or they could just buy the “Nebius’ of the world), but they don’t want to because they know there is a huge risk of over overbuilding. Specifically, the hyperscalers don’t want the capex on their own financial statements because at some point in the future (maybe sooner, maybe later), AI data center capital expenditures will slow, and Nebius (not Microsoft) will be left holding the bag.

Visual Capitalist

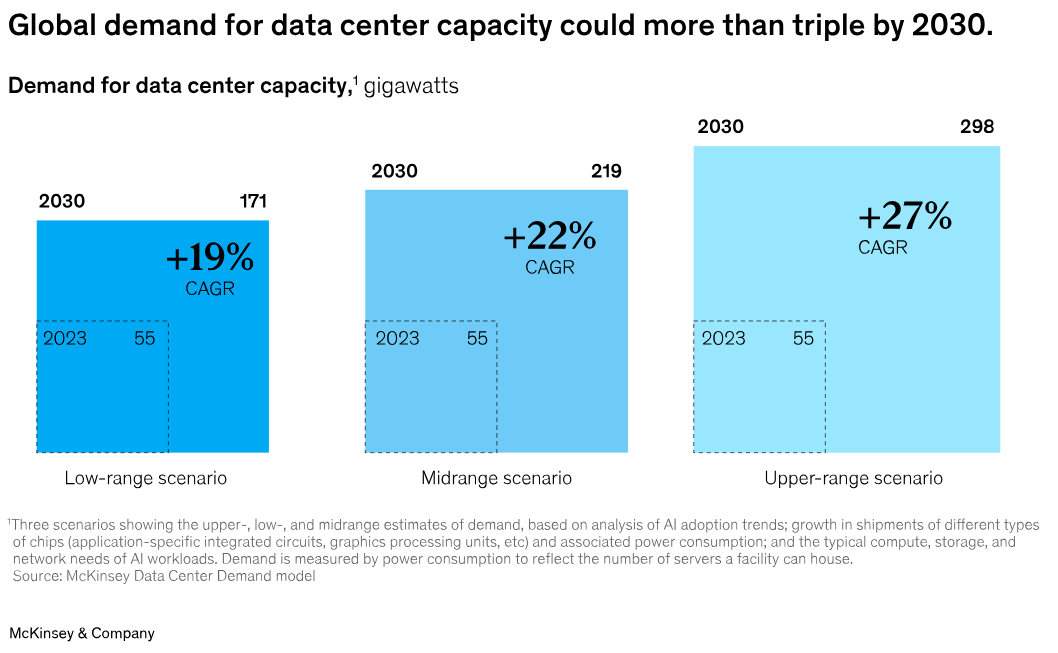

Nebius will have to deal will all these data centers when they become obsolete (new disruptive technologies will emerge) and/or they overbuild when the megatrend slows. Nebius is in a great position right now (right place, right time), but when it falls—it’s going to fall hard.

5 Top AI Stocks Roadmap

For more perspective on the AI megatrend, let’s consider a few more top ideas at different “phases” in the megatrend.

Phase 0: Nvidia (NVDA)

Nvidia is ground zero for the AI and cloud computing megatrend. Its GPUs dominate the AI megatrend so much that the federal government considers them a national security risk, and has limited their export to foreign countries. Nvidia has performed extremely well, but it is still reasonably valued. For example, its price-to-earnings to (forward) growth (PEG) ratio is still below one (as per the earlier table), impressive! And it is also a huge part of the S&P 500 and the economy. I am long Nvidia in a healthy amount.

Phase 1: Microsoft (MSFT), AI Hyper Scalers

The big Nebius deal is with Microsoft a massive company that uses massive amounts of Nvidia chips. Like other hyperscalers (such as Meta (META), Amazon (AMZN) and Alphabet (GOOGL)), Microsoft has been a huge beneficiary of AI so far, and it will continue to be for years as innovation-forward leader, Satya Nadella, continues to lead one of the most healthy growth-and-value companies in the history of the world. It has incredible margins (per the earlier table) and is 25% undervalued currently (as per Wall Street analyst estimates). I am long Microsoft and have no intention of selling (ever) unless something dramatic changes.

Phase 2: Core Weave (CRWV), AI Cloud Infrastructure

Like Nebius, Core Weave is another AI cloud infrastructure play with a unique Nvidia partnership (early access to the latest Blackwell chips to be used in their AI-focused and highly-efficient data centers, at scale). Core Weave faces the same big risks as Nebius (it’s another capex fall guy for the hyper scalers with an extremely high valuation—although at 13x forward sales it’s still not nearly as expensive as Nebius). And for the time being it continues to be in the right place at the right time, and the shares have big upside from here (especially following a recent sell off versus recent all-time highs—analysts think the shares are currently 36% undervalued, as per the earlier valuation table).

Phase 3: Vertiv Holdings (VRT), AI Components

There are a lot of data center “nuts and bolts” companies benefiting from the megatrend, and Vertiv Holdings is one of them. Vertiv provides critical power, cooling, and IT infrastructure solutions for data centers supporting AI operations. And with 25% current year sales growth and 26.2% upside to consensus targets, it’s a solid pick as AI expansion drives demand for efficient thermal management. Vertiv's innovations in liquid- and air-cooling strategies are crucial for handling AI rack densities and addressing the industry's shift toward complex cooling solutions. Trading at a price/sales of 5.2x, Vertiv's valuation reflects strong growth prospects and is very compelling given its forward PEG ratio of 0.7x (attractive!).

Phase 4: Bloom Energy (BE) AI Energy

AI data center demand for energy is mind blowing (it’s enormous) and efficiency will become increasingly important. Bloom Energy manufactures solid oxide fuel cells for distributed power generation, including for AI data centers seeking reliable energy. Its 19% sales growth next year and its focus on alternative power solutions offer exposure to the AI ecosystem. Bloom Energy's partnerships with Oracle (ORCL), Equinix (EQIX), and AEP (AEP) for SOFC deployments address AI data centers' need for on-site, low-carbon power, with projections of 38% on-site generation by 2030. Bloom’s price/sales of 7.5x is actually quite reasonable as compared to the market opportunity for clean energy adoption.

Phase 5: AppLovin Corp (APP), The AI Apps are Coming

As the chips have arrived, and the hyper scalers continue to build out the infrastructure, enormous wave after wave of applications using AI will continue to emerge and benefit users and their stocks’ share prices. For example, AppLovin is focused on AI-powered mobile app advertising and marketing through its Axon AI model, and it is experiencing dramatic revenue growth so far (with impressive gross an net margins). And despite strong price gains, the shares are still highly rated by Wall Street and have an impressive 5-year earnings er share growth estimate (20%). And keep your eyes open because additional opportunities and solutions are coming and they will be impressive.

World Economic Forum, Aug 2025

The Bottom Line

The AI megatrend is still just getting started and it has massive room to run, especially through year-end as momentum remains strong.

However, if you are thinking about going “all in” on AI… don’t. That’s my advice. It’s a hugely valuable part of the economy, but it’s not the only hugely valuable part of the economy. Sure, you can find hordes of young people with little to lose recommending something absurd like investing almost entirely in AI (with a healthy dose of bitcoin on the side). But the right way to approach AI, is to own a small handful of top ideas within the constructs or a more broadly-diversified goal-focused portfolio, if (and only if) it is consistent with your goals.

Personally, I am overweight top AI stocks (as compared to the S&P 500) in my own disciplined growth portfolio. However, at the end of the day, you need to do what is right for you. Prudently-diversified, goal-focused, long-term investing continues to be a winning strategy.