A lot of investors believe the bond CEF (closed-end fund) I review in this report is “second rate” compared to PIMCO bond CEFs, but with an impressive BIG (temporary) price decline (and now discount) versus NAV and a 10.9% distribution yield (paid monthly), it’s worth considering (and the management company has massive resources too). In this report, I review the opportunity, including how it generates that big monthly yield, what are the big risks, and then I conclude with my strong opinion on investing.

BlackRock Multi-Sector Income Trust (BIT) Yield: 10.9%

A lot of people immediately roll their eyes at the notion of investing in a BlackRock fund because: (a) it’s not PIMCO (i.e. the preeminent bond fund manager) and (b) BlackRock has a reputation for being big into “socially responsible” investing (something some people view as political). But make no mistake, BlackRock is a first-rate investment management company with deep resources to support its investment strategies.

Objective of BIT:

According to BlackRock’s website, the:

“primary investment objective [of BIT] is to seek high current income, with a secondary objective of capital appreciation. The Trust seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its assets in loan and debt instruments and other investments with similar economic characteristics. The Trust may invest directly in such securities or synthetically through the use of derivatives.”

And BIT has largely delivered on this objective over time (since its inception), as you can see in the historical distribution in the chart below (i.e. it’s never been reduced, only increased).

However, like a lot of bond CEFs, it has struggled in recent years with the capital appreciation “secondary objective” (as the fed’s interest rate moves have wreaked havoc on bonds). And you can see a particularly large price decline (versus NAV) in the following BIT price chart.

Big Discount to NAV

As you may be aware, CEFs can trade at wide discounts or premiums to NAV (all esle equal, I’d always rather buy an attractive CEF at a discount). Currently, BIT’s discount is approximately 6.0% (which is much larger than usual).

Interest Rate Risk

The reason for the big new discount to NAV on BIT appears to be tied largely to its shorter duration (or interest rate risk) versus many other big-yield bond CEFs. For example, BIT’s effective duration (i.e. its interest rate risk) is only around 2.3 years, whereas other popular funds (such as BTZ, PDI, PDO and PAXS) tend to have durations closer to 4-5 years.

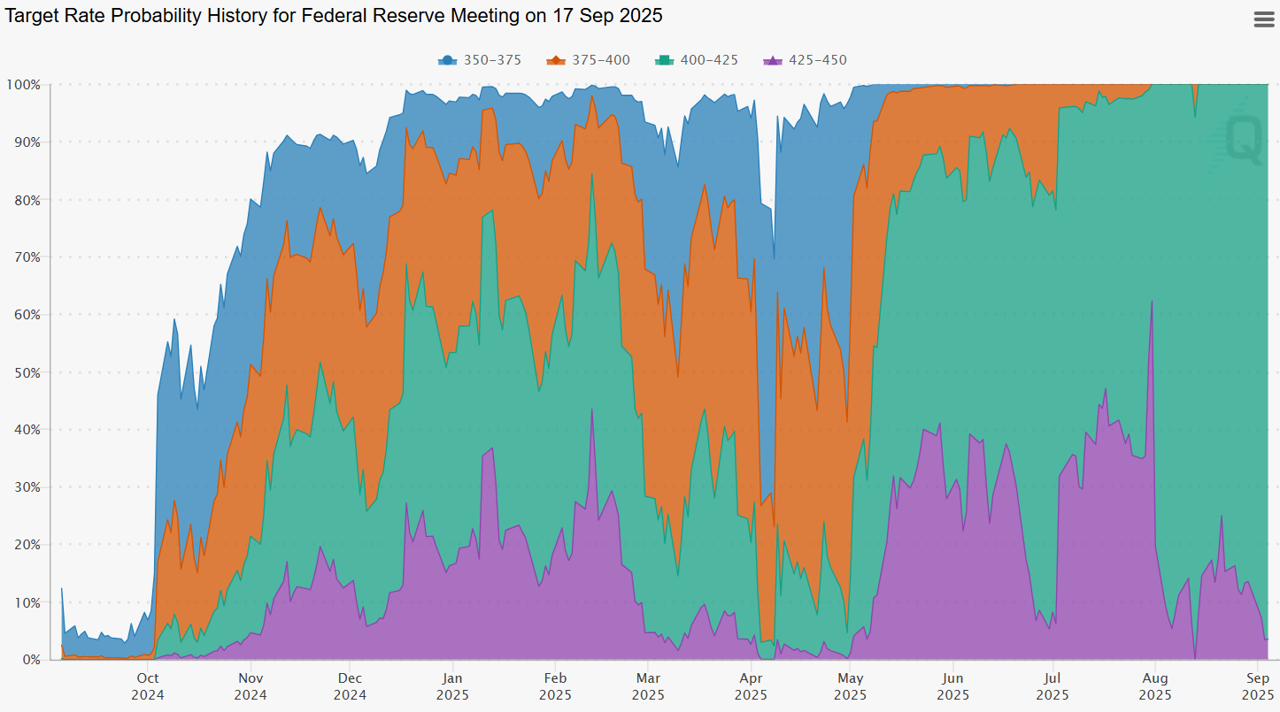

The reason this matters is because when interest rates go down, bond prices go up (all else equal). And the fed is now increasingly likely to cut interest rates as much as 50bps at the upcoming September 17th fed meeting (as you can see in the following chart), will will be “less positive” for BIT versus other popular bond CEFs because it has a lower duration.

And accordingly, it appears there has been a recent flight out of BIT and into other popular bond CEFs, and the selling pressure on BIT is causing it to trade at a discount (and the buying pressure on other bond CEFs with longer durations is causing them to trade at larger premiums).

However, the thing is, the actual bond markets are fairly efficient, meaning the NAV of these funds is fairly correct based on all the available information, and the market price of BIT appears fairly inefficient (as the recent increase in discount versus NAV appears emotionally driven by selling pressure).

In a nutshell, the market price of BIT right now appears fairly attractive (i.e. “buy low”). That’s not to say the discount cannot get bigger—it can, and the discount may not recover back to NAV. But all else equal, I prefer to buy attractive CEFs at a discount (because it gives you exposure to all the underlying bonds at a discount—i.e. on sale).

Other Risks

There is obviously a lot more going on here than just interest rates (i.e. all else is NOT equal from fund to fund). Let’s consider some of the risks below:

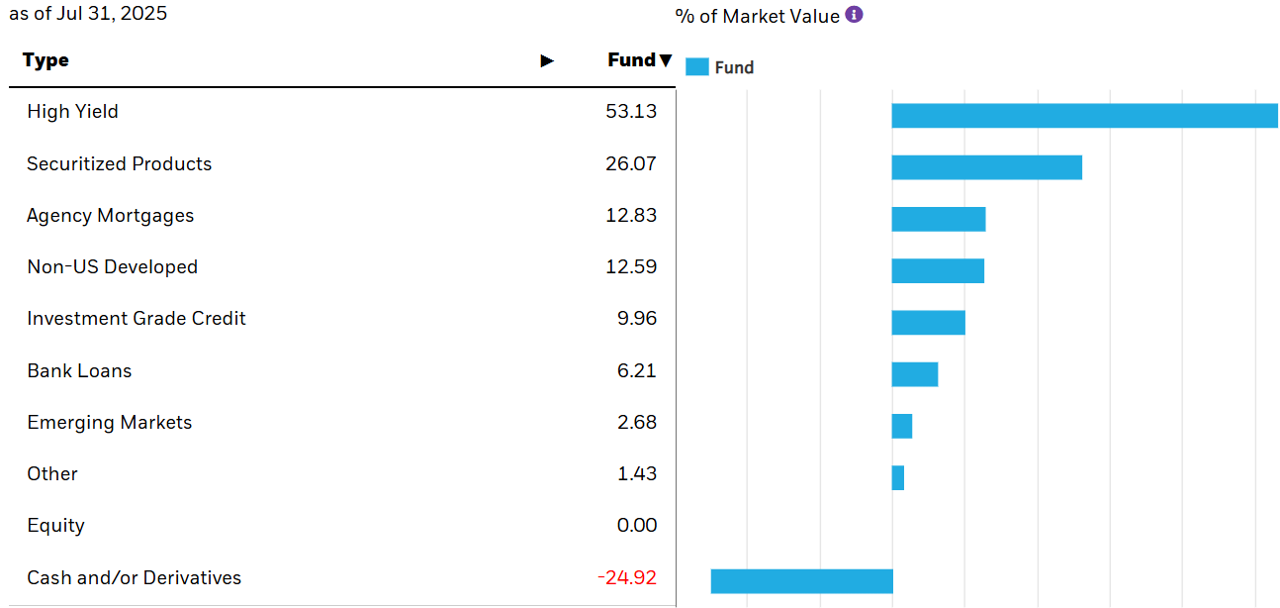

Leverage: BIT currently uses about 37% leverage (or borrowed money) which can maginify income and returns in the good times, but also increase risks in the bad times. The leverage is also one of the big ways BIT helps support its big distribution yield, considering its underlying holdings only yield aroud 7.04%.

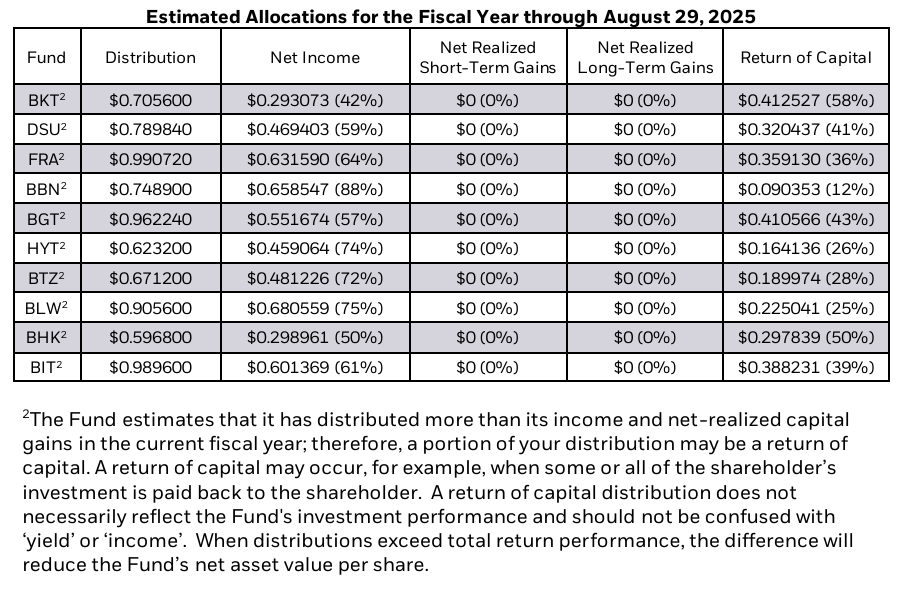

Return of Capital (ROC) is another big risk factor. Like many other popular bond CEFs in recent years, BIT has sourced a significant portion of the distribution from ROC. In order of preference, CEFs can source the distribution from income (i.e. interest payments on the holdings/bonds), capital gains (long-term and/or short-term) and then ROC. Here is a look at how BIT has supported the distribution this fisal year (which ends in October):

Credit Risk (or basically the likeliness of the underlying bonds defaulting) is another risk. And BIT has a bit more high-yield bond risk (i.e. lower credit ratings) that some other funds (such as BTZ, another popular BlackRock fund).

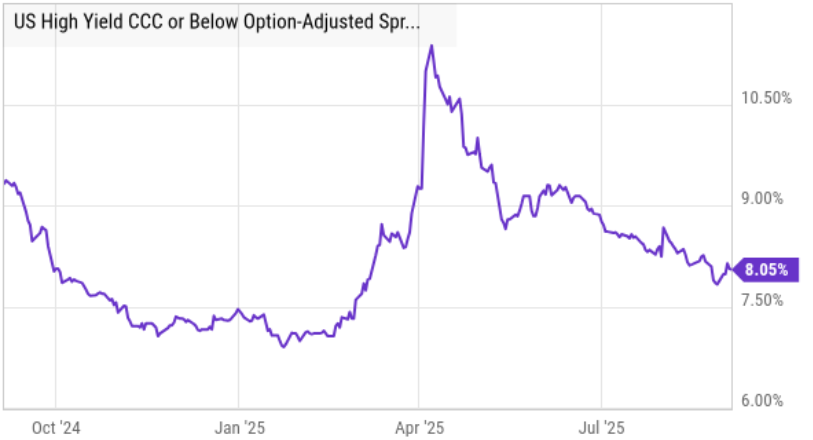

As long as credit spreads remain fairly low, then the higher credit risk is not a problem for BIT, but if the market gets shakey then the NAV of BIT can fall. Here is a look at current credit spreads (on CCC rated bonds, for example) versus how wide they got when Trump’s “liberation day” had markets on uncertain ground.

Distribution Cut Risk: Using a lot of ROC for an extended period of time is not sustainable because it erodes the NAV (or earnings power) of the fund. BIT is not alone in this challenge (as mentioned), but if the fed does follow through on interest rate cuts then that will help BIT some (and other bond funds, with higher durations, even more). However, even if the distribution is “right-sized” a bit, it will still likely be quite large.

The Bottom Line

BIT is an attractive, well-managed, big-yield CEF currently trading at an attractive discount (and that discount may prove to be only temporary). BIT is absolutely worth considering for a spot in your prudently diversified long-term income-focused investment portfolio. I own it in mine (i.e. the Blue Harbinger “High Income NOW” portfolio.