Following an ugly 2022, the market has been strong so far this year (the S&P 500 is up 15%), but the recovery has not been spread equally among all stocks. In this report, we focus on powerful growth stocks, sharing data that makes a compelling case for more gains ahead for certain names in particular. After sharing stock-specific data (on profit margins, expected revenue growth, short interest and more) we consider current macroeconomic conditions (market fear is currently low), a few massively-disruptive secular trends (such as alternative energy, the great cloud migration and busted pandemic-era IPOs) and then count down our top 10 growth stock rankings. We believe the names on the list have massive upside potential in the quarters and years ahead. However, if you are not a growth stock investor, this article is absolutely not for you.

50 Top Growth Stocks

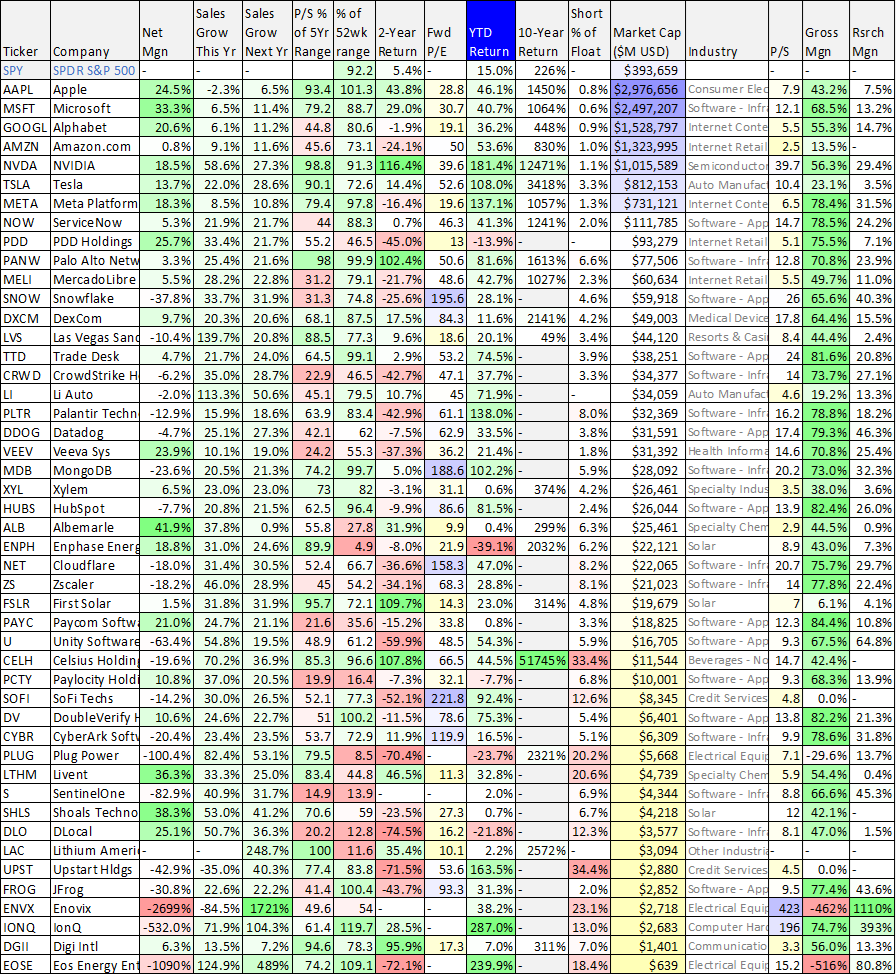

To give you an idea of what’s been happening with top growth stocks (i.e. those with the highest expected revenue growth rates) you can see performance data (and a lot more) in the following table. Importantly, you’ll notice the huge gains for mega-cap stocks so far this year (this has driven the major indexes higher), but also the mixed performance results for other stocks that also continue to post strong fundamental results, and arguably have a lot more upside considering their relatively smaller size (and the disruptive mega trends that support them, as we will discuss momentarily).

Macro: The Market Seems Greedy

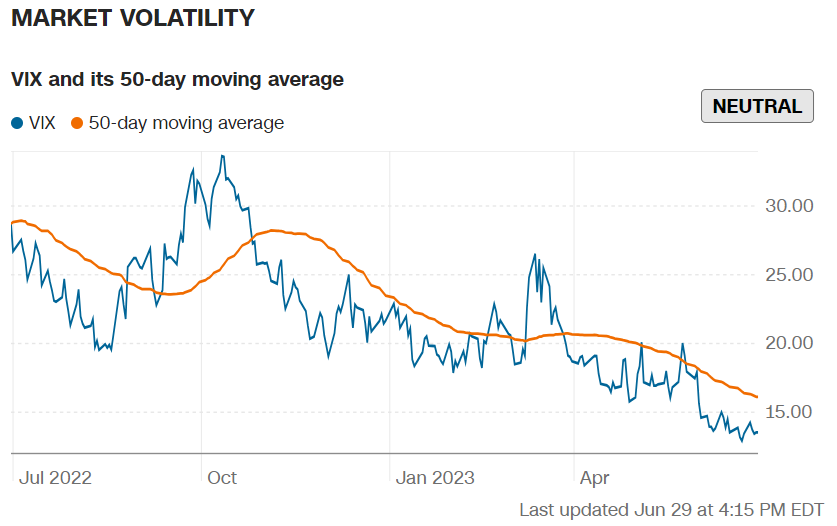

Considering the major market indexes are up significantly this year, many investors feel the market is starting to get greedy (and therefore “must” be due for a selloff). Afterall, plenty of economists are still predicting a recession, and broad market indicators, such as the market greed index (including credit spreads and volatility) suggest the market may be a little too confident right now.

For example, credit spreads are really low, perhaps an ominous signal that the market is too confident.

And the market “fear index” (the VIX) is currently low by historical standards, suggesting (to some) that the market could be a little “too sure” of itself right now.

Big Disruptive Secular Trends

Before getting into our top 10 rankings and countdown, it’s worth first considering a few major market secular trends because they are a big part of the thesis behind most of the names on our top 10 list.

Alternative Energy: Energy is expensive, yet vital to the modern world, and there is always high demand to do things better, smarter and more profitably. As such, the “alternative energy” names in our top 10 list range from solar energy conversion companies, to more highly efficient batteries for electronic devices and the rare earth elements required for batteries in electric vehicles. The demand for energy is practically insatiable, and the names in our top 10 have the potential to provide major disruptive growth supported by explosive demand for “alternative energy.”

The Great Cloud Migration: In case you’ve been living under a rock, the world has been moving to digitize practically everything and then store it in the cloud. This not only makes things dramatically more efficient for organizations, but it also unlocks new highly valuable insights that become apparent from having such easy access to extensive data. As such, there is massive explosive demand for companies that can support the great cloud migration, especially considering it is still in its early innings and has many years of high growth for many years into the future. There are lots of attractive opportunities in this space if you know where and how to look.

Busted “Pandemic-Era” IPOs: This is more of a category than a secular trend, but it is important because the “busted IPO” space is ripe with attractively priced growth stocks (now that the pandemic bubble has burst, yet many of the companies who benefited continue to strengthen their fundamentals). IPO stands for “initial public offering,” and many companies chose to offer their shares publicly for the fist time during the pandemic because market valuations were so high then that they could raise a ton of capital by selling their shares. However, many of those share prices came crashing down, and select “busted IPO” stocks now present extremely attractive investment opportunities.

Our Top 10 Growth Stocks:

So with that backdrop in mind, let’s get into our rankings, starting with #10 and counting down to our top ideas. All of the names on the list benefit from at least one of the secular trends described above, they are all attractive fundamentally (including the metrics included in our earlier table) and they all have powerful price appreciation potential in the quarters and years ahead, despite the current macroeconomic conditions (and perhaps even supported by them).

10. Enovix (ENVX)

This is the most speculative idea in the top 10, and potentially the most lucrative (if things continue to progress for the company). Enovix is a manufacturer of advanced lithium-ion batteries. And this “early-stage public company” (it’s a “busted pandemic IPO stock) is well-positioned to benefit from growing demand, including mobile, Internet of Things (IoT) and electric vehicles. What sets Enovix apart (versus the competition) is its energy density advantage (achieved through design and architecture choices) and silicon anode technology (learn more in our full report linked below). Importantly, Enovix also addresses key safety concerns.

We ranked Enovix in last month’s top 10 growth stock report, and since then the shares have climbed more than 40% (in large part due to an encouraging battery cell order from the US Army). Here (below) is our full report, whereby we review the business model, market opportunity, financials, valuation and risks. If you can handle this stock’s very high risk-reward profile, the shares are absolutely worth considering. We are long Enovix.

*Honorable Mention:

Celsius Holdings (CELH)

We’re including Celsius as an honorable mention on this month’s top 10 list (it was also an honorable mention last month) because the shares continue to present massive disruptive growth potential. And while the high short interest and massive price gains over the last month frighten a lot of investors (shares are up 20% over the last month, and short interest was recently 24%), this company keeps posting massive revenue growth.

Celsius (an $11.5B market cap stock in our table) is basically an energy drink company (offering a variety of flavors with proprietary clinically-proven formulas), and its revenues have been growing at an absolutely incredible pace. The driving force behind its recent rapid revenue growth is its relatively new (within the last year) distribution deal with Pepsi. According to CEO John Fieldly in the company’s latest earnings press release):

“During the first quarter of 2023, Celsius delivered an all-time quarterly record revenue of $260 million in sales and over $34 million in net income, driven by expanded availability and increased consumer awareness. In addition, we continue to further transition into PepsiCo’s best in class distribution system.”

Distribution is a huge deal, and if you’ve been in a US grocery or convenience store lately, you’ve probably come across a Celsius display, such as the ones below.

Celsius has plans to keep growing. Its corporate mission is:

To become the global leader of a branded portfolio which is proprietary, clinically-proven or patented in its category, and offers significant health benefits).

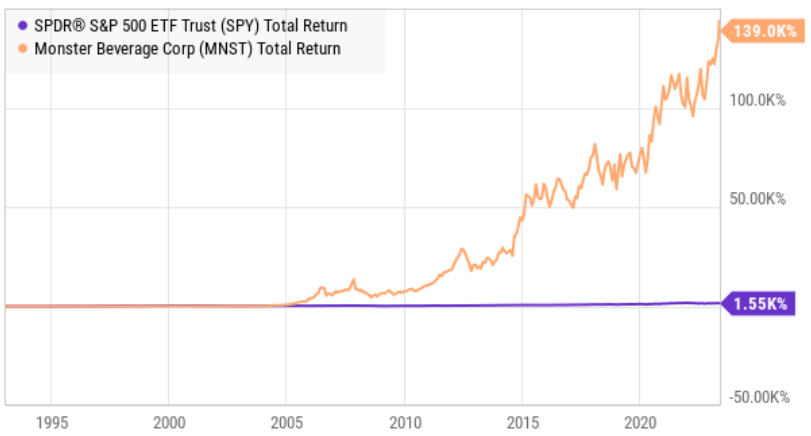

And as compared to competitor Monster Beverage (distributed by Coca-Cola), Celsius continues to have significant room for growth in terms of revenue and market cap.

And if Monster’s historical price returns trajectory (following its Coke deal) is any guide (see below), Celsius is still just getting started.

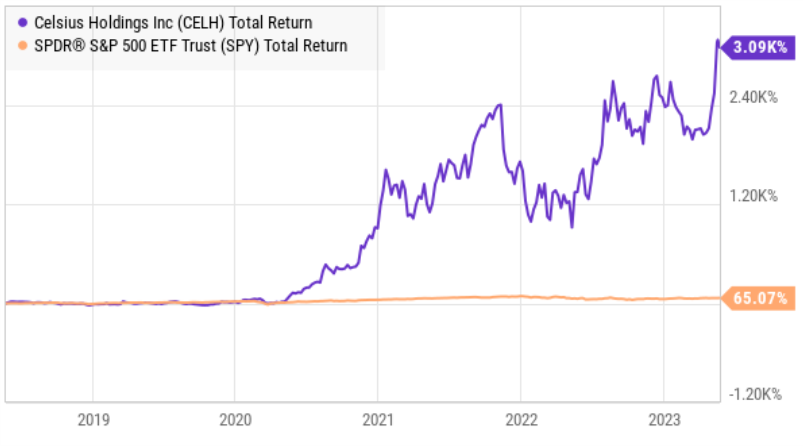

For reference, here is a look at Celsius’ recent price returns (below). The shares started to take off during the pandemic as lockdowns forced sales outside of mainly fitness clubs and into the mainstream (and now the Pepsi deal is taking the sales to new levels).

We’ve owned the shares since they traded in the $60’s (the current price is above $150), and we’d have ranked it higher on this list if it weren’t for the recent steep share price surge (the market cap is now 14.7x TTM sales—a lot for a “consumer staples” stock). There are a lot of poeple betting agains Celsius at this point (short interest waas recently over 33%!), but that can actually work in favor of investors as a potential short squeeze could quickly drive these shares even dramatically higher.

If you are curious, you can access our initial 2021 Celsius report (to see how we were thinking about it during the pandemic and before the Pepsi deal) using the following link.

9. Paycom (PAYC)

As you can see in our earlier table, Paycom is an $18.8 billion market cap stock that screens extremely well in terms of profit margin and expected revenue growth, yet the share price performance has been lackluster this year and over the last two years.

Paycom is a software-as-a-Service ("SaaS") company that provides cloud-based human capital management ("HCM") solutions for small to mid-sized companies in the United States. And there are a few things that make Paycom particularly attractive (in addition to its high profits and high revenue growth). For starters, software is a high-margin business to begin with, and in Paycom's case they provide software for payroll solutions—an area that is even more sticky (once a company sets up payroll, they're not likely to switch it).

Also, Paycom serves small and mid-sized companies which are much easier to gain as customers than large companies (which are historically served by Automatic Data Processing (ADP). However, as small and mid-size companies grow they become large companies. And in addition to that growth, Paycom offers a variety of additional services ("land and expand") that further fuels its high growth rate.

At a time when some investors believe the market is headed for recession, Paycom is a business that is worth considering for its disruptive growth (it benefits from “the great cloud migration”), sticky customer base and very strong profits. We really like Paycom a lot here, however it is the only stock in our top 10 list that we don’t currently own (because we own a stock in a similar industry that we like even more and that is ranked in an even better spot on this top 10 list). We recently shared more insights on Paycom, and you can access that report using the following link.

8. Palantir (PLTR)

Palantir is basically a software company, and it is positioned to benefit dramatically in the years ahead from the massive secular growth in Artificial Intelligence (“AI”) and Machine Learning (“ML”) (especially thanks to the company’s leading solutions, innovation, sticky customer base and very strong balance sheet).

Palantir is a “busted pandemic-era IPO.” Specifically, the stock was loved (during the pandemic bubble) then hated (when the bubble burst), but the business has only been getting stronger and the shares are still inexpensive relative to where we expect them to be in five years and beyond. In the following report, we review the business, the growth, the opportunity, the valuation and the risks. We are currently long these shares with no intention of selling.

7. Datadog (DDOG)

Datadog is a very high growth “observability and security” platform for cloud applications, and it is a huge beneficiary of “the great cloud migration.” Specifically, Datadog’s highly-regarded solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience.

As members know, we purchased shares of Datadog in March (in the $60’s), and it is increasingly attractive following its latest earnings release, whereby it beat revenue and earnings estimates and also raised forward guidance (the shares now trade around $100). Growing revenues at a very impressive rate (and with gross margins near 80%, and an impressive land-and-expand track record), yet still trading at only 14.8 times forward sales, Datadog continues to present a highly attractive long-term buying opportunity. You can access our full Datadog report using the link below. We are currently long Datadog.

6. Google (GOOGL)

Before rolling your eyes at a mega-cap stock being included in a top 10 growth stock list, just know that Google is an incredible juggernaut of a company with virtually insurmountable competitive advantages and that basically prints money.

Specifically, as you can see in our earlier table, Google has huge net profit margins (even after factoring in its large research budget), very high revenue growth (especially considering it is already such a massive business) and it basically owns a huge swath of the internet and the global economy (thereby giving it extreme competitive advantages, including its incredible network effects and enormous economies of scale). Importantly, Google will continue to benefit from the great cloud migration secular trend which is still just barely getting started (Google is the #3 cloud provider behind only Microsoft and Amazon Web services).

And despite Google’s impressive year-to-date price gains, the shares are still trading significantly below all time highs while the company’s earnings and revenue growth just continue to steadily march higher. Trading at a stellar forward (non-GAAP) PEG ratio (price/earnings to growth) of 1.39x, Google is a strong long-term buy. We are long Google.

Honorable Mention:

SoFi Technologies (SOFI)

SoFi made our top 10 list last month, and we’re including it again this month, but only as an “honorable mention” because the price gains have been so strong over the last month (it’s up nearly 50%) following an announcement from the Biden Administration that they’d be ending the federal student loan forbearance that has been nagging SoFi’s private student loan business.

SoFi is an online financial services company and bank that targets younger high-income customers. It generates the majority of its revenues from loan origination, and it had been facing heavy fear and selling pressure from the government’s student loan forbearance program that was making SoFi’s private loans extremely unattractive, relatively speaking (there as no forbearance on private loans).

Furthermore, SoFi has recovered from fear related to recent bank failures (which had been keeping much of the entire banking industries stock prices lower), despite SoFi’s continuing rapid growth.

Rising interest rates have been a significant driver of revenue growth recently as the shares head toward GAAP profitability this year. And despite the recent strong share price gains, the company’s long-term upside remains great as the total addressable market opportunity is quite large. You can access our recent SoFi report below. We are currently long Datadog.

5. Veeva Systems (VEEV)

Given the challenging macroeconomic backdrop (high inflation, recession fears looming), if you had to list the top characteristics you’d like to see in a stock market investment right now, it might include things like: high profit margins, no debt, tons of cash and a sticky client base that is economically non-cyclical. Veeva Systems is a healthcare stock with all of those things, plus a very high revenue growth rate, a large total addressable market opportunity, a wide economic moat and basically no competition

Veeva was ranked even higher in our previous report, and the shares have gained over 20% in the last month, but still have dramatically more upside ahead considering they basically are their own industry and still trade significantly below their all time highs. This is an extremely attractive long-term growth stock, and you can read our previous report using the link below. We are currently long Veeva.

4. Paylocity (PCTY)

We alluded to Paylocity earlier in this report when we discussed Paycom. And we’ve ranked Paylocity even higher (than Paycom) because of its attractive valuation.

For starters, Paylocity provides cloud-based human capital management and payroll software solutions. Revenues are growing at 20-30% per year (and this is especially impressive considering the company is very profitable with 10% net margins), but still spending heavily on growth (the company’s research margin was recently 13.9%). This combination makes the shares even more attractive than Paycom.

Similar to Paycom, a few things that make Paylocity special (aside from its high revenue growth and high profits) are its sticky customer base (once a company sets up its payroll processing, they are unlikely to switch). Paylocity’s original strategy (in an industry once-dominated by entrenched behemoth ADP) was to work with small businesses that were largely ignored by ADP (the industry leader that focuses on very large businesses). However, Paylocity did so with more flexible cloud-based solutions that are now greatly preferred in many instances, and the company continues to make progress with larger companies too (especially as it grows its offerings to the benefit of its “land and expand strategy”).

The shares have sold off this year (as the economy has hit a soft spot, particularly with many client companies in the technology sector laying off employees) thereby making for a more attractive entry point. Especially considering Paylocity has exceeded earnings expectations and raised guidance during both 2023 quarterly earnings releases so far. And here are a few interesting things Paylocity CEO Steve Beauchamp had to say in the company’s most recent release:

"Our overall momentum continued in the [most recent] quarter, with… recurring & other revenue growth of 28% and total revenue growth of 38%, as our differentiated value proposition of providing the most modern software in the industry continues to resonate in the marketplace. We continued to build upon our unique value proposition with the recent release of AI Assist, the HCM industry’s first integration of generative AI. Leveraging an integration with Open AI – the developer of ChatGPT – AI Assist is designed to help our clients more easily and effectively communicate and engage with their employees. Additionally, our commitment to product development continues to be recognized, with Paylocity recently placing #1 overall in G2’s Best HR Products list and ranking inside of G2’s Top 25 Global Software companies. Similarly, the strong culture at Paylocity was recognized externally as we received Forbes’s 2023 Best Employers for Diversity award for the second consecutive year.”

We have owned shares since 2015 when they were trading below $30 (they currently trade at near $180), but the shares continue to have significantly more upside ahead (they trade at only 8.5 times forward sales and are well below their 52-week high). You can access our previous Paylocity reports here:

3. Shoals Technologies (SHLS)

Shoals is an industrial sector business that continues to grow rapidly as it benefits from the solar energy secular trend. Specifically, it provides electrical balance of system solutions (for solar, battery energy and EV charging applications) to mainly engineering and construction firms. And its valuation is increasingly attractive, especially considering the competitive advantages of this highly profitable $4B+ market cap company. In the following report, we review all the details, and then conclude with our opinion on investing in this rapidly growing business. We are long Shoals.

2. Albemarle (ALB)

We recently wrote up lithium company, Lithium Americas (LAC) here, but prefer (and own) shares of Albemarle instead. Both companies are benefiting the the massive secular growth trend in electric vehicles (because their EV batteries are lithium-based), but we prefer Albemarle because it is less risky (it is a more established company that is already very profitable), but still has a ton of upside (as the demand for lithium will continue to grow dramatically.

Both stocks (ALB and LAC) are included in our earlier table, but Albemarle stands out for its amazing net margins, incredible growth, and because the shares are still down dramatically (but we expect them to recover, especially as lithium prices are expected to recover). In the following note, we consider the company’s latest strategic effort, its valuation and our opinion on investing (i.e. we own shares).

1. Enphase (ENPH)

Enphase is a leading manufacturer of semiconductor-based microinverters, as well as batteries, EV chargers, and other storage solutions. The company is well positioned given the strong investment activity in the clean energy space globally as well as its innovative microinverter technology. Enphase is actively diversifying its product offerings and expanding into new markets, while also focusing on continuous technological advancements to maintain a strong presence in the industry.

Despite this company’s very strong financials and growth trajectory, the shares are down significantly and have a relatively high level of short interest. We view the short interest as noise and we expect it to give the shares an extra boost as short sellers will be forced to close their positions as the share price climbs higher.

In the following report, we analyze the Enphase business model, its market opportunity, financials, valuations, risks, and finally, conclude with our opinion on why it currently presents such an attractive investment opportunity. We are long Enphase in our Disciplined Growth Portfolio.

The Bottom Line:

If you have what it takes (and if it is consistent with your goals) the market continues to present a variety of very attractive long-term growth opportunities, such as the ones described in this article. Just know that short- and mid-term price volatility can be the price you pay for powerful long-term price returns and compounding. We believe the names in this report are fundamentally attractive businesses, financially attractive businesses, supported by extremely attractive secular trends and will likely be trading dramatically higher in the quarters and years ahead.