This report shares updated data on all 40 positions in the Disciplined Growth Portfolio, and highlights notable risks and opportunities. Notably, we’re seeing some big cracks in the AI dam, and thereby new opportunities that are worth considering as you manage your own investments.

The Disciplined Growth Portfolio

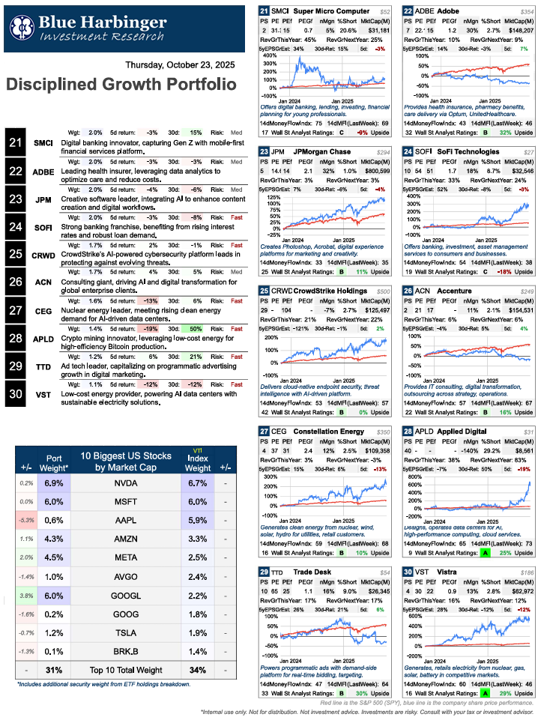

For starters, here is the complete Disciplined Growth Portfolio.

fsdaadsf

asdf