In the market battle of bulls versus bears, fear-and-greed continues to create attractive high-income opportunities (yields of 7-10%+) in specific corners of the market, including business development companies (BDCs), stock-and-bond closed-end funds (CEFs), dividend stocks and more. This report reviews the critical costs and benefits of investing in each of these groups and then counts down (ranks) my top 10 specific big-yield investment opportunities right now (selected from across the groups) as fear is currently creating some very attractive opportunities. Enjoy!

BH20 Growth Stocks: ONDAS Sits Atop (Autonomous Drones)

Top 10 Big-Yield CEFs: This PIMCO Fund Stands Out

If you like big steady income (to offset the short-term uncertainty of long-term stock-market investments), closed-end funds (“CEFs”) currently offer a widely-diverse set (ranging from varied stock and bond strategies) of big-yield opportunities (9%+ yields, often paid monthly) to choose from (ranging from those benefiting from market over-reactions to Fed interest rate signaling as well as otherwise-steady utility sector opportunities being whipsawed by AI’s startling demand for energy). This report shares 10 top big-yield opportunities (including a variety of relevant quantitative data and important qualitative commentary) and dives a bit deeper into one contrarian PIMCO bond CEF that is particularly compelling right now. Enjoy!

BH Sentiment Index: Fear Spikes, Value Salivates, Fast-Paced Growth Takes Cover!

"Market Fear" is currently strong, as the BH Market Sentiment Index has fallen from 83 ("extreme greed") just 3 weeks ago to now 20 (teetering on "extreme fear"). The reason is multifaceted, but the market has posted significant gains in recent months (since "Liberation Day") and investors are increasingly concerned about an "AI Bubble," as well as an increasingly hawkish fed (creeping inflation fears) and unsettled trade agreements with South Korea (we import a lot of steel, semiconductors and cars (Kia, Genesis, Hyundai)).

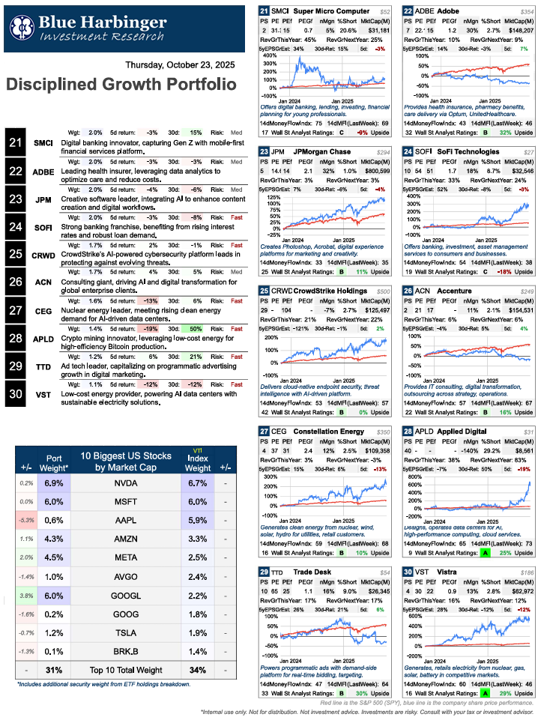

The Disciplined Growth Portfolio: Moderate, Yet Aggressive

This report shares the latest update on the BH Disciplined Growth Portfolio (38 current positions, not at all equally weighted), including several small new trades as well as a continued focus on powerful long-term growth opportunities. After this week’s stellar Nvidia earnings, a lot of investors are left wondering “what unexpected, good news can possibly remain for this already unprecedented AI growth story?” And the answer, of course, is building a prudently concentrated long-term growth portfolio that will benefit from AI (including AI hyper-scalers and “picks-and-shovels” companies”) but also healthy growth businesses benefiting from opportunities beyond just AI. Enjoy!

BH20 Growth Stocks: Aggressive Longs → Now Aggressive Shorts

The rats are abandoning ship as the top performing AI and growth stocks this year are quickly becoming top short candidates (look out below!). Specifically, the hard selloff in speculative AI stocks (over the last 2 weeks—see table) is not something I am buying as the BH Sentiment Index has fallen sharply (Now 38 out of 100—Fear!)—and it’s not the type of fear I am buying. Previous top ranked growth stocks (e.g. IREN and Bloom Energy) are crashing.

BH Fear & Greed Index: Speculative Stocks Are at Risk

Market "Greed" is tumbling, with the BH Sentiment Index falling from 83 two weeks ago, to 50 last week, and now only 38 (Fear). This is an increasingly attractive time to buy quality stocks that have sold off (be contrarian), however speculative growth stocks (e.g. the "AI/Growth Bubble") is at risk of falling further…

BH High Income Portfolio: 9.5% Yield, Lots of Opportunities

The drumbeat of “AI/Growth Stock Bubble” marches on, yet high-income investors continue to sleep well at night. If you are a member of this distinguished income-focused group (or even just a casual small-time allocator), BDCs, stock & bond CEFs and dividend stocks continue to offer attractive opportunities. This report shares the latest update on the BH High Income Portfolio (25 positions, 9.5% aggregate yield) and one 13.7% yield BDC in the portfolio that I am watching closely. Enjoy!

Main Street Capital: What Bubble?

Investors love to look at Main Street Capital’s relatively high price-to-book value and immediately declare it an overvalued bubble of a Business Development Company (“BDC”). But what many investors don’t realize is it’s a fundamentally different type of BDC with its steady net asset value (“NAV”) gains (while peers stay relatively flat—or worse). So while some thumb their nose at Main Street’s mere 5.3% dividend yield (puny in the BDC space), they fail to recognize the steady dividend growth, plus the powerful supplemental dividends, as well as the many other attractive qualities that set it apart (i.e. low debt, strong liquidity, above-average pipeline, healthy portfolio, efficient operations and macro resilience). This report reviews all of that (and the big risks) and then concludes with my strong opinion on investing.

BH20 Growth Stocks: AI Smackdown Shopping List

The leading AI hyperscalers (basically the Mag7) just sold off hard, and some (but not all) of the leading AI “picks and shovels” stocks sold off with them. One name in particular stands out as increasingly attractive as I will briefly review from this week’s BH20 Growth Stocks report (incuded). Enjoy!

BH Market Sentiment Index: Greed Just Faded Fast!

10 Contrarian GARP Stocks to Buck the AI Bubble

If you are concerned about inappropriately high valuations for top growth stocks currently benefiting from recent AI hype (increasingly being described as an “AI bubble”), here are 10 top contrarian growth stocks with less ties to AI, but that still have healthy growth trajectories, much more reasonable valuations (e.g. low price/earnings to growth (PEG) ratios) and a lot of upside as per Wall Street analysts estimates. I currently own several of these names in my prudently concentrated/diversified, long-term, BH Disciplined Growth Portfolio. Enjoy!

BH20 Growth Stocks: Hyperscaler Spending Good Sign for AI "Picks-and-Shovels" Companies

There is a new #1 in town, as Bitcoin-turned-AI-HPC-cloud company, Iren (IREN), has been dethroned by this accelerating fuel cell provider for AI datacenters. Massive runway for fast-paced growth, especially if this market stays healthy—which it may with stong AI momentum signs from megacap hyperscalers this past week. So much concentrated data and compelling opportunities in this market if you know where to look (such as this report). Enjoy!

BH Fear & Greed Index: Despite Naysayers, Momentum Still Dominates

BH Fear & Greed Index: Markets regained momentum, confidence and "greed" over the last week as stocks remained near flat but regained their footing as money flowed in (MFI over 50 again for SPY), the VIX (market fear index) calmed down, credit spreads came down/ remain low, and treasury yields remained mostly neutral. Nvidia…

Top 10 BDCs: Ares Stands Out (Big Yield and Risks)

As the largest publicly-traded Business Development Company (“BDC”), Ares Capital (ARCC) is not only well-positioned to defend its big dividend (current yield is 9.3%) with spillover capital, but it’s also well-positioned with multiple levers for growth (e.g. conservative balance sheet leverage, fees and plenty of deal flow). And despite the big risks (such as falling rates, spread compression and “hidden” liabilities), the latest earnings announcement suggests it continues to present an attractive valuation for long-term income focused investors. This report shares data on 10 top big-yield BDCs, then reviews the details on Ares and concludes with a strong opinion on investing.

BH20 Growth Stocks: Massive Earnings Week Ahead

This upcoming week is the “Super Bowl” of earnings with 5 stocks (Meta, Microsoft, Alphabet, Amazon and Apple—commanding rougly 25% of the S&P 500’s total market cap) all announcing mid week. And with the market on eggshells lately (e.g. tariff concerns and arguably “frothy” valuations, especially for AI) this week could set the direction for stocks for weeks (perhaps until Nvidia announces on 11/19). What’s more, this week could slow the rapid price gains for the stocks listed in this week’s “BH20 Fast-Paced Growth Stocks" Ranking, or it could catapult these names even dramatically higher in a hurry. Enjoy the data—these stocks are special!

The Disciplined Growth Portfolio: More Wins, More Upside Ahead

Disciplined Growth Portfolio: New Cracks in the AI Dam, New Opportunities

This report shares updated data on all 40 positions in the Disciplined Growth Portfolio, and highlights notable risks and opportunities. Notably, we’re seeing some big cracks in the AI dam, and thereby new opportunities that are worth considering as you manage your own investments.

The Disciplined Growth Portfolio

For starters, here is the complete Disciplined Growth Portfolio.

fsdaadsf

asdf

High Income Portfolio: New Risks, New Opportunities

This report shares recent data on all 25 positions in the 9.8% aggregate yield “High Income Portfolio,” and highlights notable risks and investment opportunities as you manage your own income-focused portfolio. Notably, we’ve seen some share price movements (as the market continues to digest tariffs, interest rate dynamics and the ebbs and flows between value and growth) that are worth considering as you manage your own investments.

BH20 Growth Stocks: MP Materials to Benefit from Tariff Turmoil

Market jitters continue as China-tariff risks, plus the AI “bubble,” keep investors up at night. Nonetheless, “high-performance-computing” datacenter stocks and trade war beneficiaries (such as MP Materials) continue to soar higher (despite very high short interest) and with no end in sight for this powerful megatrend rally. This report shares the latest “BH20 Top Growth Stocks” with a special discussion of MP Materials.